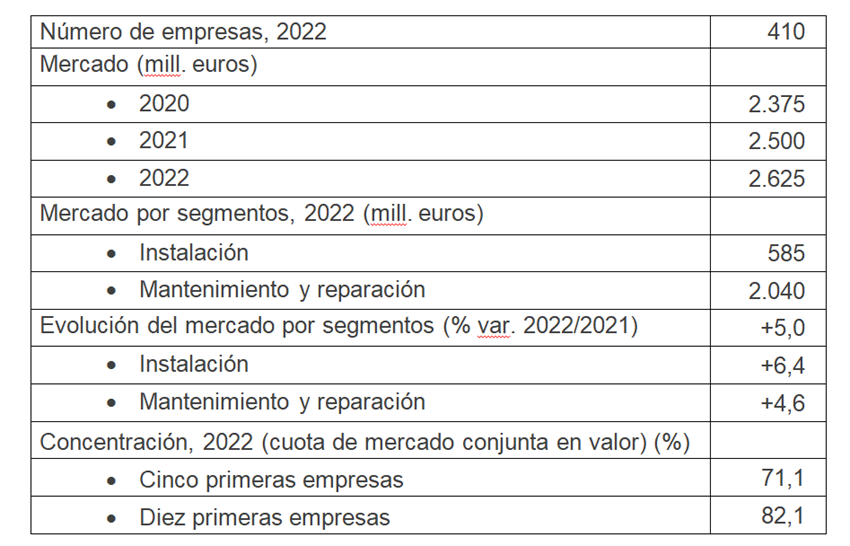

The elevator market in Spain registers a new increase in its value, exceeding 2.6 billion euros.

The turnover of Spanish companies belonging to the vertical-transportation industry amounted to EUR2.625 billion in 2022, which represents a growth of 5% compared to the previous year. This is confirmed by the latest report prepared by the Informa DBK Sector Observatory (subsidiary of Cesce).

This amount corresponds to the activities derived from the installation, maintenance and repair of lifting devices. Thus, the segment that obtained the highest turnover in Spain was the installation of new equipment, which registered growth of 6.4%, reaching revenues of EUR585 million.

Maintenance and repair services also increased to reach a 4.6% increase compared to the previous year, which was quantified at EUR2.04 billion. Both activities hold just over three quarters of the global market in Spain, according to said report.

Thus, the segment that obtained the highest turnover in Spain was the installation of new equipment, which registered growth of 6.4%, reaching revenues of EUR585 million.

Regarding the value of exports from the Spanish market in 2022, a total of EUR700 million was recorded, which represented an increase of 24.7%, thus exceeding the historical maximum of 2018. By country, France was positioned as the main destination followed by the U.K., Germany, Morocco and Portugal. Imports managed to reach EUR92 million, a very similar variation rate.

For its part, the Spanish Elevator Business Federation (FEEDA) also maintains the growth recorded for the Spanish elevator industry and comments on it showing “a growth that continues to rise compared to the last study in 2021.” FEEDA points to an increase of 5.29% in its analysis of global activity. By segment, it points out that growth in new construction was 11.02%, in post-sale 3.96% and in export, much lower, 7.81%.

The DBK Sector Observatory predicts that the Spanish elevator market will close this year with an increase of close to 5% to begin in 2024 with a certain “moderate slowdown.” Thus, the report points out, “This evolution would give rise to a figure of about EUR2.85 billion in the last year.” Regarding equipment installation activities, it points to an annual increase of 5-6% for the period 2023-2024, and for the maintenance and repair market it shows an annual growth of around 4%.

New Construction and Rehabilitation of Elevators

One of the factors that contributes to the good prospects for the end of 2023 in the elevator sector corresponds to the recent approval of a public call for subsidies for this year intended for accessibility, conservation, energy efficiency and health actions in existing buildings of use, such as residential housing, which are included in the “Plan Rehabilita Madrid 2023.”

According to this Plan, which is included in the Official Gazette of the Madrid City Council, three lines of action are established with respect to elevators. In its first point referring to “Accessible Line,” it points out that the installation of new elevators must include the works that are justified for this, including the demolition and new construction of stairs. Likewise, other devices must be installed to improve accessibility or the performance of other works such as ramps, expansion of elevator cabins and an increase in the number of stops or lifting platforms.

In a second point, “Line Conserves” refers to correct communication in elevators, platforms or similar for the replacement of parts or renewal of equipment. And finally, there is “Green Line,” in which it is recommended to improve the energy efficiency of elevator and lighting installations, such as replacing lamps and luminaires with other energy-efficient LEDs, as well as installation of ignition control systems and regulation of the level of lighting and use of natural light.

A Small Business Sector

Regarding the composition of the Spanish market, DBK reports that it continues to show “a preponderance of small companies,” which are those focused on elevator maintenance and repair services. It points out, however, the trend of “a progressive concentration of supply” continues, in which company acquisition and absorption operations stand out.

The top five companies held 71% of the market in 2022, while the top 10 accounted for 82% of the total.

Get more of Elevator World. Sign up for our free e-newsletter.