Where Are All the Startups?

Dec 1, 2023

Israel’s elevator conundrum

Editor’s note: This article was written prior to Hamas’ attack on Israel.

Known as the “Start-up Nation,” Israel has been at the forefront of technological advancement, boasting a vibrant entrepreneurial environment with innovations cutting across numerous fields such as construction, computers, material science and energy conservation. Yet, a perplexing gap emerges in the elevator sector. While the Israeli real estate market booms, driving up elevator demand, the development of elevator technology by startups is curiously absent. Why?

Israel: A Start-Up Giant in a Petite Frame

Despite its modest size, Israel is often at the forefront of the world’s attention when it comes to innovation. To put things into perspective, Israel’s landmass is about 8,019 mi2, making it only slightly larger than New Jersey. Yet, within this compact space lives a population of fewer than 10 million people, fiercely driving a vibrant startup culture. This is especially noteworthy when considering that some global cities with comparable or larger populations don’t come close to matching Israel’s entrepreneurial output.

Given these dimensions, 130,000 elevators might seem significant in a local context, but on the global scale, it’s a rather modest figure. However, the number isn’t as telling as the story behind it. The real tale is about a nation — small in size but grand in ambition — with an intrinsic ability to disrupt industries and set global trends. But, as with all stories, there are areas of intrigue and mystery, like the curious absence of elevator tech startups in the “Start-up Nation.”

The Israeli Real Estate and Elevator Market: A Snapshot

The growth of Israel’s real estate market directly correlates with the increasing demand for elevators. In 2022, Israel had a whopping 130,000 operational elevators, with approximately 5,000 new ones added annually — a steady market growth of almost 4%. Interestingly, many of these elevators have surpassed their average life expectancy of 25 years, with many operational ones older than 40 years. Between 2015 and 2020, more than 55,000 new apartments sprung up yearly in Israel. In 2020 alone, more than 15,000 of these were located in high-rise buildings.

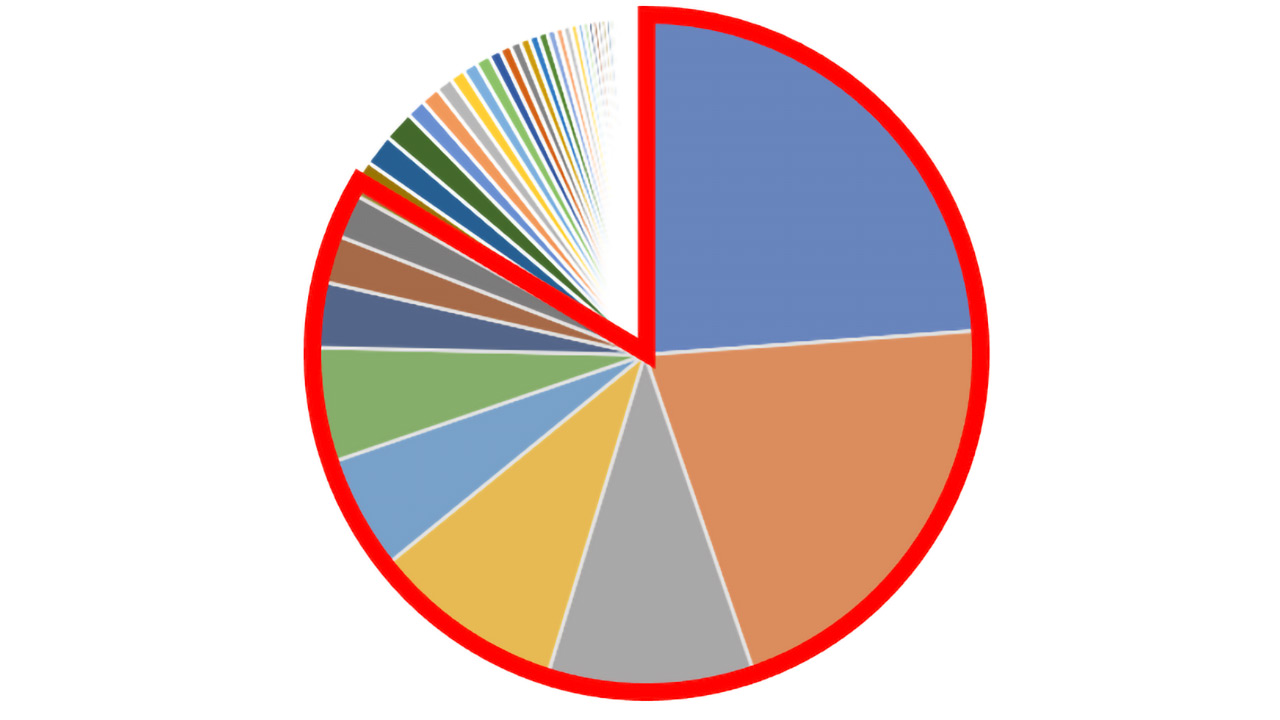

Despite these promising numbers, the elevator service sector in Israel remains surprisingly consolidated. Out of the 80 elevator service companies, fewer than half hold licenses to install new elevators. Dominating the scene are international juggernauts: KONE, TK Elevator, Schindler, Mitsubishi Electric and Otis. The market further extends to Orona, Hyundai, Wittur, Sicor and SJEC, alongside brands from Türkiye, Spain and beyond.

This regulatory maze, combined with the market stranglehold by international entities that don’t manufacture within Israel, pushes potential elevator tech startups to look toward European markets for their initial ventures.

Digging into market segmentation, an intriguing disparity arises: Twenty percent of large corporate entities wield control over 80% of the market. Conversely, the remaining 80% of businesses scramble for the leftover 20% — a setting hardly conducive for nimble, innovative startups.

In-House R&D Versus Startups

Israel’s thriving startup culture, renowned for pushing technological boundaries, has been conspicuously absent in the elevator sector. A closer look reveals a primary culprit: high entry barriers. Most elevator brands have proprietary control boards, blocking external connectivity without the manufacturer’s consent.

Adding to the challenge is the labyrinth of regulations. Acquiring approval from regulators to interface with an elevator or introduce novel elevator types is near-impossible without prior acceptance in major markets like Europe. This regulatory maze, combined with the market stranglehold by international entities that don’t manufacture within Israel, pushes potential elevator tech startups to look toward European markets for their initial ventures.

A Glimmer of Innovation

In this scenario, Exypnos emerges as a beacon of hope. This Israel-based startup focuses on elevating the user experience in elevators with cutting-edge AI-integrated products. Its offerings range from smart screens that replace traditional elevator buttons, allowing for easy software integration, to video chats with emergency services and AI-driven passenger assistance.

At the heart of Exypnos’ innovation is Anodo, a solution that integrates AI to optimize the elevator experience. Beyond a mere digital interface, Anodo harmonizes cabin design, touch displays and communication solutions. These AI-enhanced features help ensure a seamless elevator journey, whether retrofitting an existing system or implementing a new one.

These advancements, though currently only available B2B (i.e., selling only to elevator companies, not directly to customers), are commendable in an industry dominated by giants.

Toward a B2C Future?

The overarching question remains: Is there a future for business-to-customer (B2C) elevator startups? Amid the layers of bureaucracy, could there be a niche for “plug and play” elevator add-ons catering directly to consumers, thus bypassing the reigning corporate giants?

Israel’s reputation as a hotbed for innovation suggests that, where there’s a will, there’s a way. It may just be a matter of time before an ingenious entrepreneur cracks the code, offering consumer-focused solutions in this seemingly impenetrable industry.

References

[1] Israeli Ministry of Labor: gov.il/he/departments/labor

[2] Rips Elevators Group: Rips-Group.co.il

[3] Exypnos – Creative Solutions LTD: lift.exypnos.co.il

Get more of Elevator World. Sign up for our free e-newsletter.