Your author examines the “roller-coaster ride” of the past three years.

by Dominik Sachsenheimer

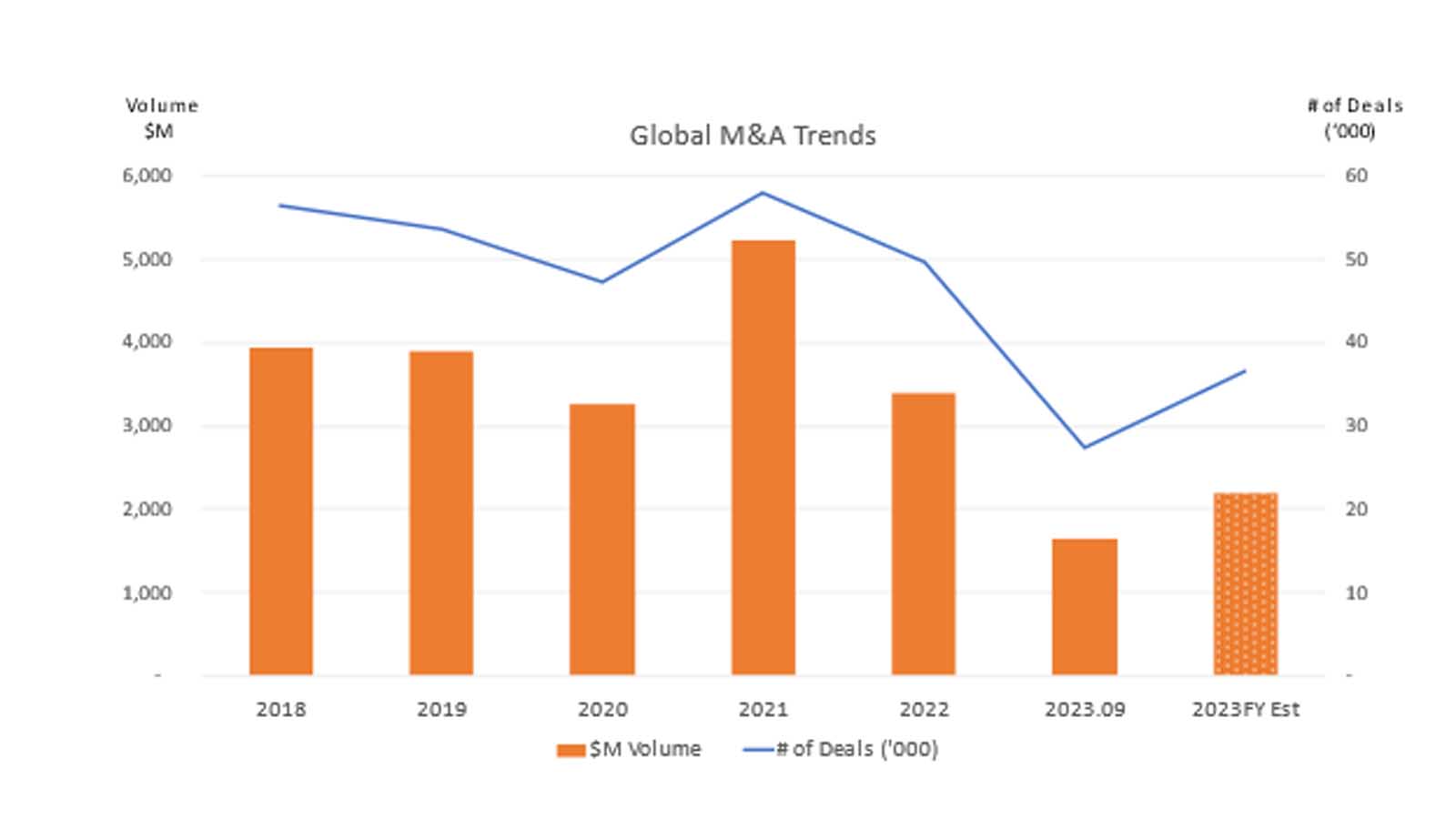

The world of Mergers & Acquisitions (M&A) has experienced a roller coaster ride over the past 36 months. Based on data assembled from the Institute for Mergers, Acquisitions and Alliances, PWC and Bain Capital, the M&A volume worldwide across all industries did not decline during the pandemic, but rather reached an all-time high in 2021 with almost 58,000 transactions closed and valuations totaling more than US$5.2 billion.

Transaction volume declined in 2022, driven mainly by inflation and rising interest rates, as well as geopolitical tensions and increased regulatory oversight. Through September 2023, slightly more than 27,000 transactions across all industries worldwide had closed at approximately US$1.6 billion in valuations. The consensus estimate for the full year 2023 predicts slightly fewer than 37,000 transactions at valuations totaling approximately US$2.2 billion, which constitutes a further significant decline compared to full year 2022 results.

Transactions of commercial elevator service companies in North America were somewhat impacted by these macroeconomic trends, but it is worth analyzing the vertical-transportation industry in more detail. Independent elevator service companies existed for more than a hundred years in the U.S., and for the longest time, the exit strategies for the founders were either to pass on the torch to heirs or employees or sell the company to a competitor. This basic outline has not changed much, but the elevator industry in North America has seen various dramatic shifts on the buyer’s side.

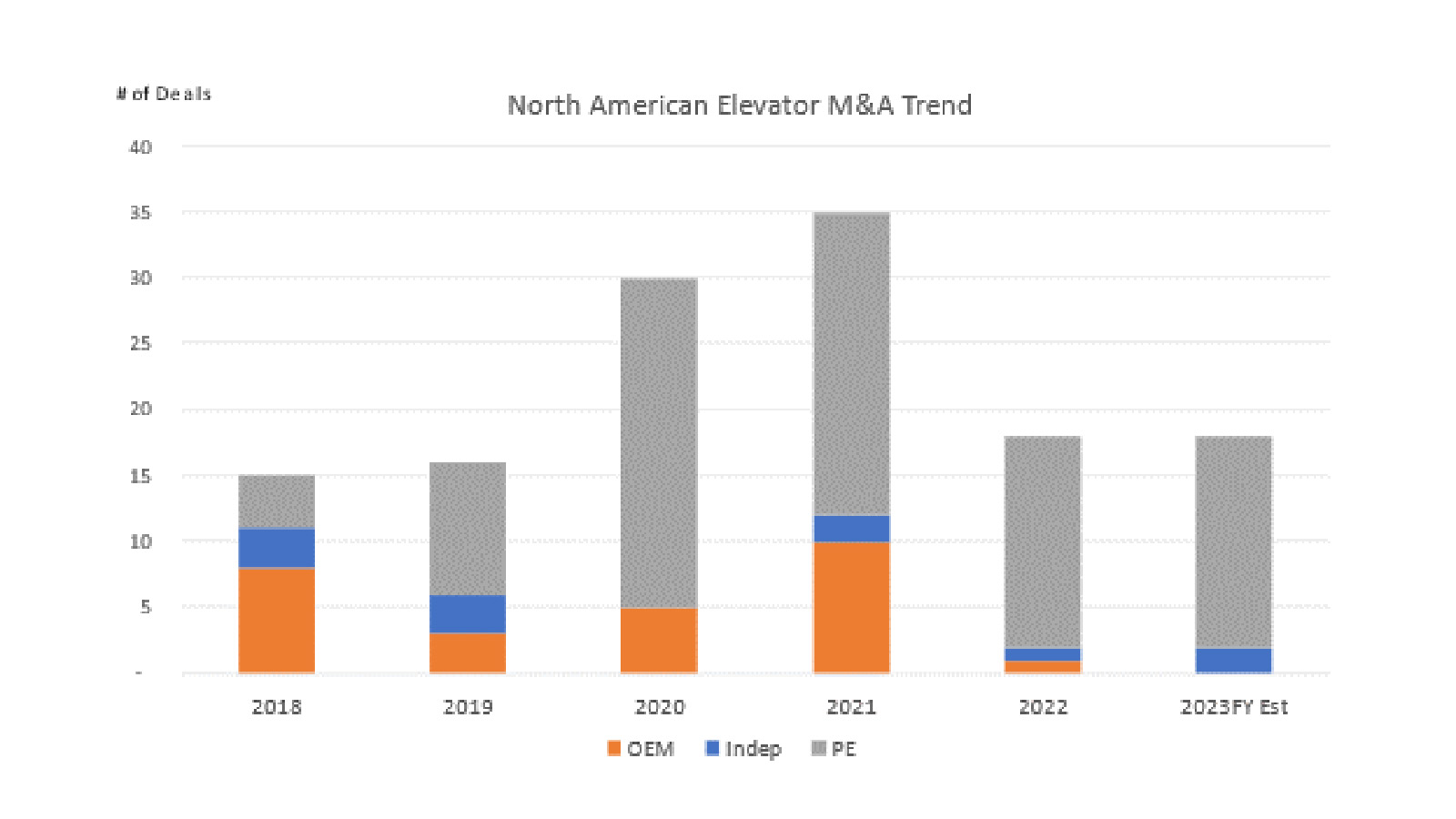

For decades, the most potent and active buyers were OEMs, namely Otis, Schindler, TK Elevator and KONE. The usual volume ranged anywhere between five and 10 transactions per year, with the OEMs leading the charge and a few independents selling to smaller local or regional independent consolidators.

Figure 2 depicts this trend continuing through 2021; approximately five-10 transactions were completed by OEMs and regional consolidators. However, various private equity (PE) investors started buying companies from 2018 on and now account for the majority of transactions, both in terms of the number of deals, as well as annual revenue acquired in these transactions.

As PE investors developed into the leading buyers in the industry, the same macroeconomic concerns discussed above have driven a decline in volume from 2021 to 2022. However, Maven Group estimates a flat trend in 2023, rather than a further decline. OEMs have been largely absent as buyers in North America during the past two years.

The elevator industry remains very attractive for investors for various reasons: Elevator companies provide mission-critical services that are mandated by safety codes. During the pandemic, elevator services were categorized as “essential work,” even in areas that opted for restrictive lockdowns, further emphasizing how resilient the industry remains in times of economic uncertainty. In addition, elevator companies usually work with a broadly diversified customer base generating highly predictable recurring revenue streams, as well as positive cash flow and often double-digit profit margins. Moreover, the general trend of shortening lifespans for most equipment in connection with the sheer age of the installed elevator base in North America all but guarantees decades of consistent, if not increasing, modernization volume. Furthermore, highly skilled technicians in the elevator trade create a high barrier to entry, while the actual requirements for capital expenditures are relatively low compared to other industries. Lastly, the market in North America remains fragmented and, therefore, offers potential for further consolidation.

All that said, average valuations have shifted slightly downward from their peak in 2020 and 2021 to account for the increased cost of money. However, Maven Group continues to observe that highly attractive companies in key markets still demand valuations well above these averages. The scarcity of “perfect sellers” keeps price tags for these sought-after assets at strong levels.

So, what exactly do buyers seek in a seller? In this new environment past the era of “cheap money,” buyers are all the more focusing on partnering with prime companies, which, in turn, means that sellers should enter the process well prepared. Clean records for financials, employee data and customer information help tremendously when it comes to convincing a buyer to offer a good price and a quick timeline to close. A long-drawn-out diligence process revealing inaccuracies in initial valuations often leads to deal fatigue on both sides and sometimes jeopardizes closing altogether. PE buyers look for two types of acquisitions: either a company within the buyer’s geographic footprint that lends itself to an absorption into the existing operations or a company with strong market share in an area that represents a geographic expansion for the buyer. In both scenarios, buyers are looking for additional talent, be it in the field or in the office. Especially when entering a new market, buyers will be more enthusiastic about a transaction if the technical and commercial leadership team that grew their company to a strong market share decides to partner with the buyer to continue the growth trajectory.

When zooming back out to summarize the trends of the past six years, we notice that the commercial elevator service industry in North America now includes two large PE-backed platforms on the non-union side, as well as seven unionized PE-backed conglomerates, along with another handful of platform companies among the elevator part suppliers and manufacturers. We also observe increased PE interest in the residential elevator space, although consolidation efforts have not advanced to the same level as in the commercial area. While the future remains unfeasible to predict, the next few years will be fascinating to observe as more PE investors express interest in entering the elevator industry. Some of the existing investors might not only continue to add more independent companies to their respective portfolios, but also seek larger partners and buyers for their growing platforms.

About Maven Group

Maven Group was founded in 2017 to advise independent elevator companies during the complex M&A process. Maven has consulted on more than 40 closed transactions in the past five years, and the firm’s clients combine for annual revenues of more than US$400 million. To learn more, please visit Maven Elevator website

Also read: A Second Bite of the Apple

Get more of Elevator World. Sign up for our free e-newsletter.