Advantages of U.S. Customs Duties to the Turkish Lift Industry

May 19, 2025

New customs duties announced by United States (U.S.) President Donald Trump on April 2, 2025, came as a shock in all markets. After Black Monday in the Far East and European stock markets and the first shock was over, the steps to be taken by the European Union (EU), China and Japan, which have intense trade with the U.S., were awaited curiously. Among these countries, China was the first to react mutually.

While I was writing this article, China’s customs duty was initially set at 34%; later, it was set at 84%, but the additional tax rate was increased to 125% as of April 10. There will probably be several changes before you have the opportunity to read this article. Likewise, in the Presidential Order dated April 9, 2025, the implementation of additional taxes determined at rates

Trade volume between Türkiye and the U.S.

Among the countries to which Türkiye exports the most, the United States ranks second, after Germany. The U.S.’s share in Türkiye’s total exports of US$261.8 billion in 2024 was 6.2%. According to product groups in TurkStat data, the largest export items were nuclear reactors, boilers, machines, and parts product group, which amounted to US$2.15 billion, followed by the chemical industry, which amounted to US$1.138 billion.

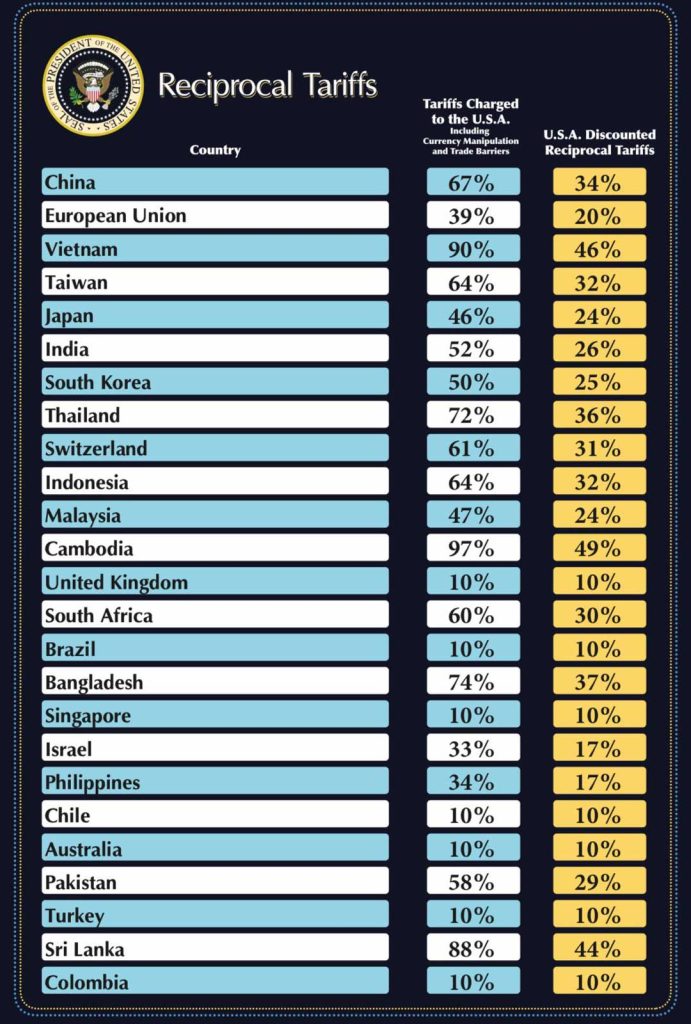

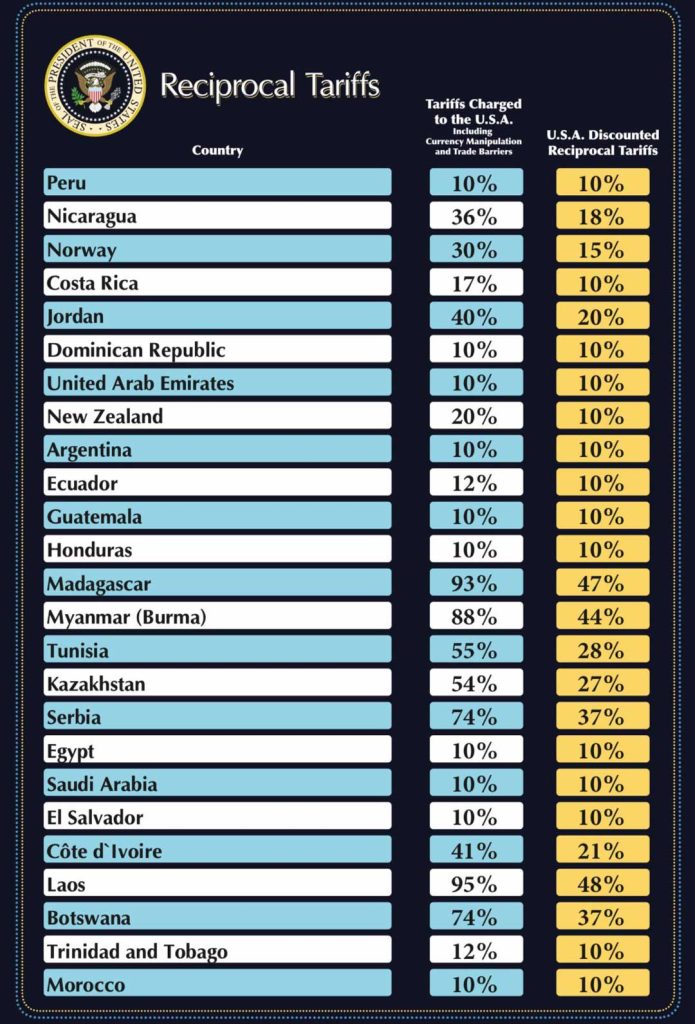

higher than 10% for 56 countries was suspended until July 9, 2025, with a three-month postponement. The additional tax for countries other than China will be 10% during this period. As you can see in the table below, Türkiye is also included in the 10% rate, which is the lowest rate.

| Product group | Export value (dollar) |

| Nuclear reactors, boilers, machines, and parts | 2 billion 150 million |

| Mineral fuels, oils, bituminous materials, mineral waxes | 1 billion 138 million |

| Vehicles and parts other than railway or tramway | 1 billion 42 million |

| Electrical machines, sound equipment, TV equipment, parts thereof | 926 million 723 thousand |

| Carpets and other woven products | 840 million 115 thousand |

| Items made of iron or steel | 691 million 803 thousand |

| Natural pearls, precious stones, precious metals, coins | 677 million 653 thousand |

| Prepared vegetables, fruits, nuts or other plants | 547 million 372 thousand |

| Salt, sulfur, earth and stone, lime and cement | 521 million 220 thousand |

| Materials such as stone, plaster, cement, asbestos, mica, etc. | 519 million 625 thousand |

Additional advantages customs duties will bring to Türkiye

Additional taxes were imposed on electronics, machinery, chemicals, and iron and steel-intensive countries such as China, the European Union and India, which are Türkiye’s competitors in exports to the U.S., as well as textile-intensive countries such as Vietnam and Bangladesh. Treasury and Finance Minister Mehmet Şimşek also made a series of statements on the issue. Şimşek said that Türkiye’s relatively low tax rates provided a competitive advantage in some industries during the customs crisis created by Trump, Şimşek emphasized that the limited trade volume with the U.S. and low oil prices could also positively affect Türkiye.

According to the U.S. government data, the trade volume between Türkiye and the U.S. was US$32 billion last year, and this accounts for approximately 5% of the total goods trade of Türkiye. There is also a trade surplus of US$1.5 billion in favor of Türkiye in this trade. With the additional customs tariffs put in place, this trade surplus in favor of Türkiye is expected to increase even further.

An opportunity for our lift and escalator industry

Although the U.S. ranks second in Türkiye’s exports, its share in the export of lift and escalator industry is at the bottom. We see two problems when we look at the reasons for this. The first one is the standard difference among countries (called codes in the U.S.). Since Türkiye is subject to European Union norms, almost all of the component manufacturers in our country manufacture and certify according to EN standards. The U.S., on the other hand, is subject to the standards of the American Society of Mechanical Engineers (ASME). Thus, ASME compliance and certification are required for many products to be exported from Türkiye to the U.S. Unfortunately, many of the manufacturers have no such certification yet. Another reason is the abundance of price-oriented, low-quality products. The number of lift and component manufacturers in our country is almost higher than in the whole of Europe, but most of these companies manufacture low-quality products that appeal to the domestic and Middle Eastern markets. Yet, there are companies that export sheaves, buttons, casting and machining products from our country to the U.S., albeit in low numbers.

ISO 8100 Standard

As a result of studies conducted by the International Standards Organization (ISO) to ensure the use of a uniform standard across the world, the problem of different standards and codes will be eliminated if ISO 8100, which was published for the first time in 2019 and completed in 2023, is accepted by the U.S. In this regard, EN 81-20 will be replaced by ISO 8100-1 and EN 81-50 will be replaced by ISO 8100-2. The biggest obstacle to the delay in the entry into force of ISO, of which the Turkish Standards Institute is also a stakeholder, is the U.S. and China.

Non-governmental organizations should take a more active role

Our relationship with the U.S. in the lift and escalator industry can, unfortunately, be considered almost non-existent at the level of non-governmental organizations. Unlike other countries, there are a lot of non-governmental organizations in our country just like the inflation in the number of companies. The prominent ones among these need to contact their counterparts in the U.S. and guide and train the manufacturers in our country on this issue. With the disruptions in the supply chain during COVID-19, the search for an alternative to China has peaked with the Trump administration. The lift and escalator industry in our country should take advantage of these consecutive historical opportunities.

Get more of Elevator World. Sign up for our free e-newsletter.