Bharat Bijlee

Sep 1, 2020

Nakul Mehta (NM), vice chairman and managing director, shares insights with your author (SSP) on the motor manufacturer’s emphasis on sustainability, advanced technology and recent developments.

SSP:How is technology transforming the vertical-transportation (VT) industry in India? What has been Bharat Bijlee, Ltd.’s contribution in this regard?

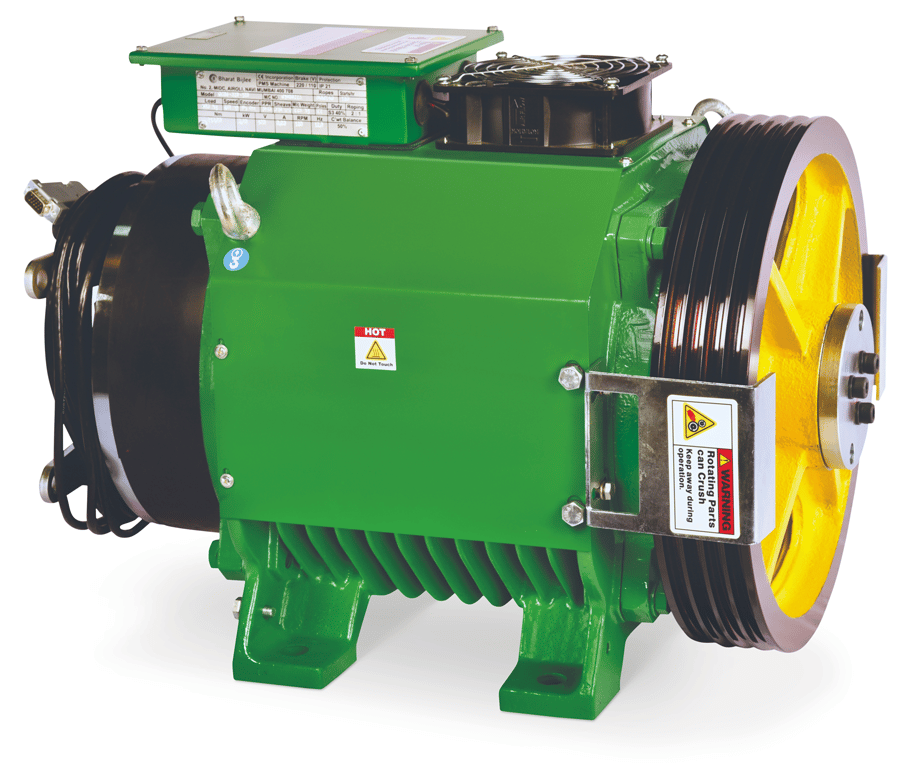

NM: Although elevators are relatively long-lifecycle products, the industry has been both an innovator and early adopter of new technologies in the last 20 years. This has impacted not just the domain of product design, but also the equally important aspects of early-stage specification, installation and service. Important trends today are digitalization and energy efficiency. These are driven by the need to maximize efficiency and traffic management at the lowest cost and to maximize equipment uptime using connectivity and real-time analytics. Our contribution to the industry is as a manufacturer of synchronous gearless machines across a wide range of applications and specifications. Permanent-magnet motor technology enables lower energy consumption, space savings and freedom from environmental concerns caused by oil leaks and spills. This is a relatively new product line for us, and we are excited about being part of the VT industry.

An interesting trend likely to gain enough traction to transform the industry is digitalization. Using IIoT, personalized mobile apps and artificial intelligence, it is possible to create a digital ecosystem that connects a building’s owner and facility manager, the OEM’s call center and service technicians, and even the passenger in real time.

SSP:What is the significance/unique selling proposition of your brand and its offerings for the VT industry?

NM: We have been manufacturers of rotating machines since 1946. From 1973 to 2004, we manufactured and installed elevators under the Olympus brand and had over 12,000 installations across the country. This legacy left us with an understanding of the nuances of the complex VT business and its fast-changing technologies. By 2007, the building industry was increasingly aware of the advantages of machine-room-less (MRL) elevators and gearless machines, new technologies gaining rapid acceptance in other parts of the world. That year, we identified gearless synchronous elevator machines as a new line of business, leveraging our understanding of elevator applications with over six decades in the manufacture of electric motors. In 2008, in partnership with Permagsa of Spain, we became perhaps the earliest manufacturers of permanent-magnet gearless elevator machines in India. We understand that some customers need guidance in product selection, commissioning and troubleshooting, and we can help with personalized support and technical documentation. We also provide field service support across the country, which is monitored and measured by our central ServiceLINE™ team.

SSP:Which are the key markets to which you cater? Which are the key offerings showcased recently, like the GreenStar range of gearless machines?

NM: With our own sales force, we are active in about eight cities in India, which we plan to expand to 15 cities. We also have a reasonable proportion of export sales with regular supplies to customers in Spain, Germany, Portugal and Russia. Our GreenStar synchronous gearless machines are used in passenger, goods and home elevators. They are compact, reliable and relatively maintenance-free. Over the years, several variants have been developed for different applications, loads and rated speeds, most recently the GreenStar BELT for elevators with flat-belt suspension. These machines can accommodate multiple encoder options and operate with the customer’s preferred drive.

SSP: What are the recent developments at Bharat Bijlee?

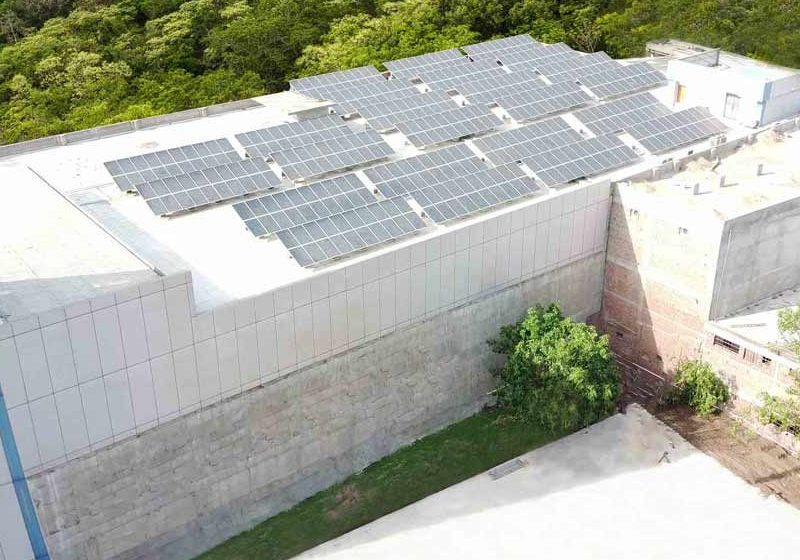

NM: In 2018, we set up an entirely new Indian Green Building Council-certified Green plant for gearless machines. This year, we had planned to augment the facility to double the production capacity. However, that is a decision that will have to be reviewed over the next few months.

SSP: What are your development/growth plans and vision for the future?

NM: Technology is changing faster than ever before, and our goal is to continuously innovate to stay abreast of the curve. Product improvement and development is a continuous process. Our quality processes and systems are customer-centric and closely integrated with operations and suppliers, and this is a focus area for ongoing improvement. We are evaluating smart technologies for Industrial Internet of Things (IIoT)-based condition monitoring; the question is only whether there is a clear value proposition for the customer. We already have a reasonable export footprint, and we will look to expand this. There is a growing awareness that India’s share of the global market for elevator components is minuscule and that there is an opportunity here for the industry.

Ideally, all states should follow a new central lift act with uniform safety standards, and perhaps this will happen in due course.

SSP: How would you compare the VT industry in India with that in other countries?

NM: Generalized statements about the Indian elevator market are difficult to formulate. India is like a continent. Even in this age of increasing homogeneity, the cultural, economic and demographic diversities in this country are immense. Essentially, there is no “single” Indian elevator market. Every state and city has its unique characteristics. Most global elevator OEMs are established here and have offerings that cater to multiple market segments. This means that a certain minimum benchmark for product performance and service has been set. At the same time, the highly segmented market means that there is space for smaller regional manufacturers; many have grown to a reasonable size, improving continuously and even competing with multinational corporations. A lot of newer technologies from specialist component manufacturers are now available to everyone, which levels the field in some ways. The industry has matured, expanded and become more sophisticated, but gaps remain that are now being addressed by enlightened members of the industry and its stakeholders. Most important is safety and all the elements of making VT safe. Equally important is a realization that elevators are the lifeline of a building and that cost cannot be a dominant criterion in selection. There is also a growing awareness that effective elevatoring — the number, capacity, speed and layout of VT equipment — is unique to each building and must be an essential part of project planning at its initial stages.

SSP: To what extent do you see the market for VT in India evolving and developing further?

NM: Urbanization is the biggest macro driver for the VT industry. Alongside the infrastructural and sustainability challenges this poses, it is argued that well-regulated urbanization is a positive force, with cities becoming engines of development and economic growth. Continuing urbanization in India, together with high land costs, will drive the vertical growth of cities, not only in metros, but increasingly in tier-2 and -3 cities.

Typically, construction growth is closely linked to the growth of the economy and to perceived optimism about its immediate outlook. Recent economic headwinds and discrete events like demonetization and the implementation of RERA and GST have had an adverse impact on the real estate sector and, hence, the VT industry. Construction as a share of gross domestic product shrank significantly during the last five years. Even so, the elevator market grew at a compound annual growth rate of around 9% between 2011 and 2020.

Saving energy in real estate and construction is a growing priority, with green buildings being designed to consume less energy. Elevators can account for up to 7% of the total energy load in an office building, and there is a trend toward green elevators, as well. This encompasses not only energy consumption, but also materials, control protocols, lighting and ventilation. Green elevator technology also extends beyond the equipment itself and includes factors that can lower the carbon footprint across an elevator’s lifecycle: for example, the energy efficiency of manufacturing facilities, through to remote service monitoring where digitalization again plays a role. Our contribution to this is through our high-efficiency gearless machines, the option of flat-belt suspension and regenerative drive systems.

SSP:What trends have been witnessed in different elevator segments in India? Which segments do you see driving growth?

NM: Low- and mid-rise residential buildings continue to account for a major share of the elevator market, with growing adoption of MRL products. Home lifts are an interesting new segment. High-rise, high-end commercial and residential properties tend to follow business cycles, and it is likely that activity in this segment could be muted in the immediate future. The infrastructure sector will be an important driver of demand, along with government initiatives such as the Smart Cities Mission. An interesting trend likely to gain enough traction to transform the industry is digitalization. Using IIoT, personalized mobile apps and artificial intelligence, it is possible to create a digital ecosystem that connects a building’s owner and facility manager, the OEM’s call center and service technicians, and even the passenger in real time. This can result in dramatic improvements in equipment reliability, uptime, waiting times and passenger safety. Interestingly, digitalization need not be the exclusive purview of large OEMs, as the technology is now becoming available from independent system specialists.

SSP: In light of the COVID-19 situation and emphasis on high rises in major metros, what are your expectations for the VT industry during 2020 and beyond?

NM: The Indian elevator market in 1996 was just 7,000 units annually. Since then, it has grown to about 75,000 units per year with an installed base of 600,000 units, making it the second-largest VT market in the world. The aftermath of the pandemic will affect the new-installation business badly — as it will other sectors of the economy due to disrupted supply chains and cash cycles, labor shortages and muted demand. According to some estimates, it could take as long as four years for elevator demand just to return to 2019 levels. In a broader context, many of the changes we have witnessed during the pandemic are likely to be permanent. We have all already begun to redefine the way we work, conduct our business and interact with colleagues and customers. We will see a more digitalized future with new benchmarks for business processes and productivity.

SSP: How important is it to have uniform regulation of VT with specified norms applicable across India?

NM: It is vital, because only uniform regulation can ensure uniform safety levels in VT systems across India. Apart from the performance parameters of the equipment and the effectiveness of the elevator solution for a particular building, there is a critical aspect of human safety. An elevator is not just an agglomeration of component systems; it comes into existence only when it is installed in a hoistway. So, while design integrity and quality of the equipment is important, how the elevator is installed and maintained is equally important. Conformity with relevant standards in letter and spirit is crucial, and the ongoing initiative to harmonize Indian Standards with international standards is a welcome step. Similarly, the applicable section of the National Building Code (NBC) of India 2016 (which includes “Minimum Technical & Safety Requirements”) comprehensively details how an elevator should interface with different kinds of buildings. It covers the entire elevator lifecycle and is intended as a model for adoption by all stakeholders, including inspecting authorities. The sheer breadth of its scope makes it a uniquely comprehensive document. What is important now is for individual state and city building bylaws to place substantive emphasis on compliance with relevant provisions of the NBC. All states could follow the example of those that have already modified technical schedules of their lift acts and rules to call upon the relevant Indian Standards. Ideally, all states should follow a new central lift act with uniform safety standards, and perhaps this will happen in due course. Together, these initiatives can make a significant difference to VT safety and performance.

About Bharat Bijlee

Established in 1946, Bharat Bijlee has two business segments: Power Systems that comprises its transformers and projects businesses and Industrial Systems that comprises electric motors, drives and industrial automation and magnet-technology machines divisions. The company caters to a spectrum of applications, industries and the builders of the nation’s infrastructure: power, refineries, steel, cement, railways, machinery, construction and textiles. Headquartered in Mumbai, it has a sales and service network across India and also serves international markets. The company’s manufacturing facilities are in Navi Mumbai on more than 170,000 m2. It has modern plants for its product lines that have been certified with ISO 9001:2015 and 14001:2015 and OHSAS 18001:2007 standards.

Get more of Elevator World. Sign up for our free e-newsletter.