The elevator industry is keeping up with the challenges and reaping the rewards of increased tall-building construction in NYC.

Tall-building construction in New York City (NYC) is at a historic high, and the elevator industry is reaping the rewards. The increased workload is not without its challenges, including having to comply with post-9/11 building and security codes and meeting the demands of ever-more-discerning customers. But, insiders say the industry is embracing the challenges as the wealth is distributed among OEMS, independents, suppliers and consultants. “When there are this many cranes on the horizon in Manhattan, it’s good for all of us,” states Robert Pitney, director of independent elevator company TEI Group, which is experiencing growth in all areas of the company as a result of the building boom.

OEMs are adding staff, too. Schindler’s NYC operation has grown its engineering, project management and field-support departments as it handles projects such as Three and Four World Trade Center (WTC), 7 Bryant Park and residential super-skinny, supertalls 432 Park Avenue and 56 Leonard. Taking shape now, the latter two belong to a new breed of high rises that promises to give the NYC skyline a new look by 2018.

Such buildings make sense in the NYC market, observes Sula Moudakis, Schindler high-rise/new-construction sales director for NYC. “In a competitive real-estate environment like New York’s, where the market values height, supertall, high-end office buildings and ultra-luxury condos with small footprints and less room for elevators are becoming more popular,” she says.

All the glittering new arrivals have forced owners of older properties to renovate in order to, as Pitney states, “compete head to head with them.” It’s a trend from which NYC independents, in particular, are benefitting.

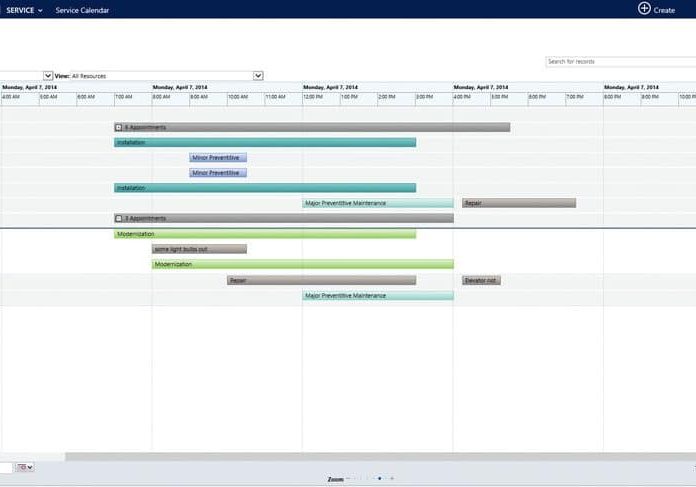

Nouveau Elevator is in the midst of its biggest job to date: the complete renovation of 25 cars and integration of destination-control systems on the elevators at Two Penn Plaza, a 29-story Midtown Manhattan building built in the late 1960s. Nouveau Principal Donald Speranza observes such projects create a cascade of business that flows to suppliers and others. Because of the project, he says, supplier Motion Control Technologies enjoyed one of its biggest orders ever.

It is a similar scenario at Centennial Elevator Industries, which recently wrapped up a couple of noteworthy projects. Working with Van Deusen & Associates, it modernized 11 units in the 21-floor Hippodrome office building at 1120 Sixth Avenue in Midtown, and another 11 units at 285 Madison Avenue, a historic office property that underwent a US$50-million overhaul after it changed hands in the wake of an elevator accident that grabbed headlines in 2011 when a young advertising executive was killed.

Centennial President and Chief Operating Officer Richard T. L’Esperance said the biggest challenge of the heavy workload is being able to meet clients’ demands. “Since we are growing every day, it’s very difficult, but we are managing to get it done,” he states.

D&D Elevator is enjoying a slice of the renovation pie, as well. The company has seen revenue and employment growth of 10-15% each year for the past several years, according to President/CEO Bobby Schaeffer, who expects the trend to continue. “A majority of our work has been in the modernization of aging equipment,” he notes.

Beyond Tall

While it’s true NYC is getting some of its tallest buildings in years, many other types of projects are keeping workers busy. KONE’s new-installation business in NYC, for example, is primarily driven by mid-rise residential construction and retail, according to Patrick O’Connell, director of marketing and communications for KONE Americas.

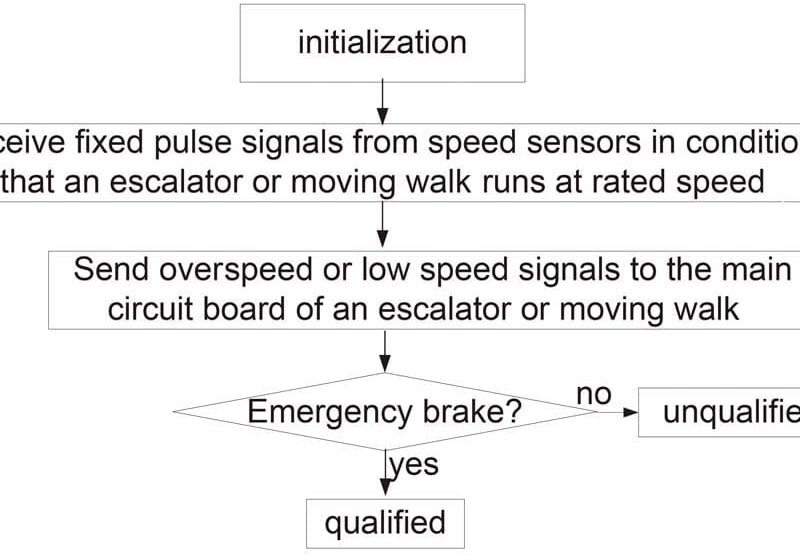

Companies are also winning jobs related to new and upgraded infrastructure, such as in the city’s subway systems. Some of the installations are groundbreaking, such as KONE’s escalators for a new subway station. There, workers installed units with a one-of-a-kind incline with a 90-ft. rise.

Independents are getting in on infrastructure work, as well. Approximately four years ago, Nouveau began to step up its escalator-installation division, particularly related to infrastructure improvements. The effort is paying off in a big way now, according to Speranza, who states:

“We’ve modernized over US$30 million worth of escalators for the [city’s Metropolitan Transport Authority] and have grown into one of the largest escalator companies in [NYC]. We now have over 20 escalator teams doing complete modernizations and installations, not only within the subway system but, [also] across the airports.”

KONE reports the number of employees on its payroll in NYC has increased by nearly 10% over the past year, as it has added people in sales, project management and field resources. Although it has enough people to handle current jobs, other challenges have emerged. O’Connell notes:

“One challenge we’re facing right now is the expansion and growth of non-union general construction and non-union elevator-installation firms, which represents a potential challenge for our union workforce. Competing against companies with lower labor rates means we have to continuously be creative in order to find new efficiencies. It starts with building good products that are engineered to work well and be installed efficiently. Our skilled workforce also recognizes our business challenges and knows working both hard and intelligently are keys to meeting the growing demands of our industry.”

Whether a union or merit shop, a skilled workforce is hard to build, says Schaeffer. Since the inception of third-party witnessing in 2009, many experienced elevator technicians have become licensed inspectors or third-party witnesses, leading to a major technician shortage, he says, adding that action is needed if that is going to change:

“I foresee this problem continuing unless the union shops start to increase their number of candidates participating in apprenticeship training and the local merit shops get serious about delivering their own education programs. Both groups need to do more to deliver continuing-education opportunities to New York-area technicians.”

D&D has in-house education programs, which Schaeffer says are vital to keeping up with growth.

Complexity Adds Challenges

Designing vertical-transportation systems for the new breed of thin supertalls comes with its own set of challenges, Moudakis points out. Their dainty footprints leave little room for elevators. “These matchstick buildings require the unique expertise of the engineering team – such as advanced sway analysis and precision wind and weather adjustments – which is often just as crucial as the technology itself to delivering the best ride quality and performance available,” she opines.

That is good news for consultants such as Lerch Bates Inc., which is handling a heavier workload in NYC these days. Eric Rupe, Lerch Bates vice president, Central and Northeast U.S., says the company expects the current construction activity to continue for another three to five years. “We expect conditions to remain ideal for new construction projects to begin the design stages for at least another [15-33] months, before we see a tapering off to more sustainable levels,” he says.

Syska Hennessy Group, which provides consulting and engineering services, recently oversaw the installation of 20 new elevators, 10 escalators and 14 moving walks that were part of the expansion of LaGuardia Airport. It has had a presence in NYC for more than 60 years, and the most recent years, while the most fruitful, have also been the most challenging, says Associate Partner Michelle Baratta. She points out that after 9/11, building codes changed dramatically, and the industry had to adjust. She observes:

“The elevator industry was required to adapt to these changes in both the design and installation of elevator equipment. Security is now a major concern, as high-end security systems must be integrated with elevator systems. This can be tricky, as it will sometimes involve the integration of up to three disparate systems that are now required to work together, which is not always a smooth transition.”

OEMs are developing new technology with an eye toward urbanization in big cities, such as NYC, where real estate is scarce and valuable. Due to their weight, elevator ropes are one of the main hindrances to going higher, observes O’Connell. That is where KONE hopes its UltraRopeTM, unveiled in 2013, will prove useful, since it is significantly lighter than traditional steel rope and allows for travel of up to 1 km (ELEVATOR WORLD, August 2013).

New technologies, such as UltraRope – on which staggering amounts of time and money were spent – are a clear indicator of how much faith the big OEMs have in the future of tall buildings.

In 2014, ThyssenKrupp Elevator announced MULTI, a ropeless, multiple-car system using maglev technology (EW, February 2015). The company aims to have the prototype operating in its new test tower next year.

ThyssenKrupp Elevator believes NYC is among the growing metropolises worldwide that will benefit from MULTI. As of winter 2015, there had not yet been an announcement of ThyssenKrupp Elevator working with a skyscraper builder in NYC to incorporate the system, but the company certainly hopes that will change in the near future.

The construction activity of NYC, not only in Manhattan but in the other boroughs as well, is great news for the elevator industry. What is going on in America’s largest city has created a mood of optimism among industry professionals. Being busy, they say, is a good problem to have.

NYC Trends: Rope Grippers, Gearless Machines

Stepped-up safety concerns may lead one to believe demand for Hollister-Whitney RopeGrippers® in New York City is at an all-time high, but that isn’t the case. Doug Witham of GAL Manufacturing Corp. says that with the exception of the New York City Housing Authority, most property owners solve elevator-braking requirements by installing two brakes on a single disk in a gearless system. “The current trend is taking out geared machines and replacing them with gearless,” he observes.

So, are Rope Grippers going the way of the dodo bird? “Not in our lifetime,” Witham says, noting that most systems worldwide use suspension ropes, and such systems continue to be the one of choice in developing countries. Business has increased for GAL – which carries an array of products – everywhere in the

U.S., including in NYC. “As of about five months ago, we are back to 2008 numbers. I’ve got to tell you, I never thought I would see that again.”

Get more of Elevator World. Sign up for our free e-newsletter.