by Julio Gil and Pedro Fernández

This paper was presented at the 2023 International Elevator & Escalator Symposium in Edinburgh, Scotland.

Abstract

We are currently experiencing the consolidation of already known technologies, such as:

- IoT [1]

- CAN-BUS

- USB

- Ethernet

- Bluetooth

- WiFi

- LiFi [2]

- NB-OIT [3]/Zigbee

- 5G

- AI: Machine Learning, Deep Learning, Cognitive Learning

- Computer Vision

- Augmented Reality

- Services on Cloud

- Edge Computing [4]

- Virtualization

- Blockchain [5]

- Digital Twins [6]

These types of technologies are now available to small and medium-sized companies, and they are slowly making their way into the elevator sector, characterized by its traditional positioning.

At present, maintenance companies are beginning to connect elevators and collect data, but their use is limited and has little effect on maintenance processes.

In the future, these technologies are expected to change both maintenance itself (AI, mixed reality, artificial vision, etc.), as well as the relationship with the client (cognitive learning, machine learning), from contracting services (blockchain) to elevator design (cloud services, SaaS (software as a service) and manufacturing (digital twins). The tendency is to involve the customer in the lift’s lifecycle.

The main applications of IoT in elevators are:

- Predictive maintenance

- Remote monitoring

- Fault diagnosis and prediction

- Advanced reporting

- Connectivity management

- Energy management

- Smart advertising

- Traffic management

- Elevator access control

- Elevator safety

- Smart contracts

In the elevation sector, there are different technical challenges to be solved: The existing fleet of lifts, new sensors, data manager, Internet of Things (IoT) connectivity and IoT platform.

Nowadays, these are different technologies with few technological companies having technical capacity on all of them, so real technical value is integration of all of them.

We are working to create an ecosystem with all these technical elements, with different technologies and partners to add value to this ecosystem.

1. A Brief History

The elevator has been a product that has evolved slowly with respect to digital technology. Perhaps we can find an explanation in its mechanical origins while the technological revolution has been mainly electronic and digital.

This reluctance to change has been mainly observed in installation and maintenance companies, with manufacturers, including multinational companies, pushing these technologies forward.

Since the 21st century, this perspective is changing but slowly, with the introduction of more and more electronic and digital components, as well as the incorporation of more reliable, affordable and faster communication systems.

One point to highlight is the evolution of microcontrollers. We have transitioned from 8-bit devices with very limited memory (such as the PIC® family from Microchip) that were expensive to 32/64-bit devices with high performance, extensive processing and storage capabilities (such as the Renesas RX family, Texas 28xx family, ARM, etc.) at very affordable prices (below one euro). What used to have 256 bytes of RAM for our algorithms, now provides us with megabytes.

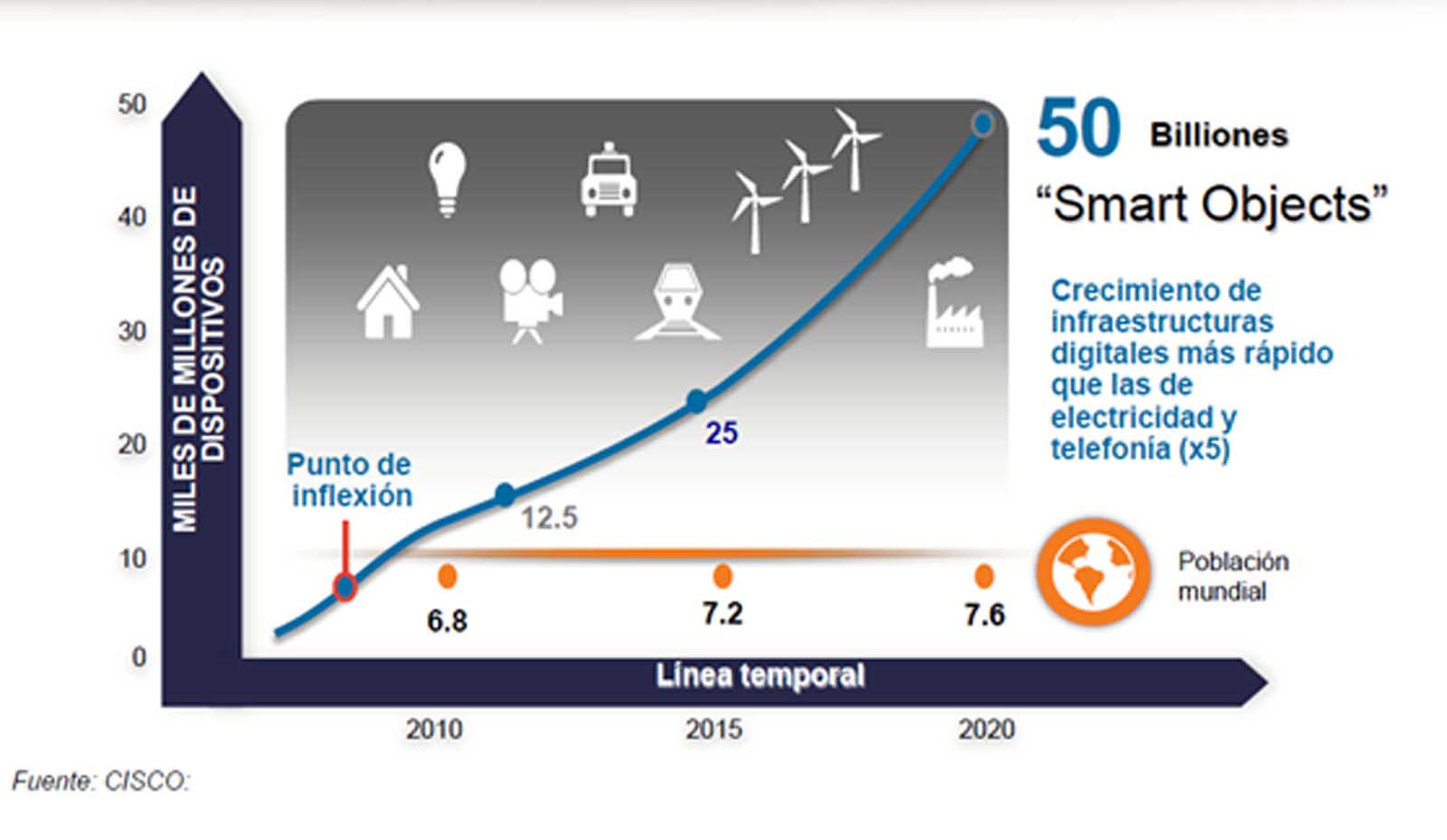

Lastly, the rapid growth of communications (GSM, 3G, 4G, 5G) and the consolidation of the IoT in the market have accelerated the transformation of the sector in recent years.

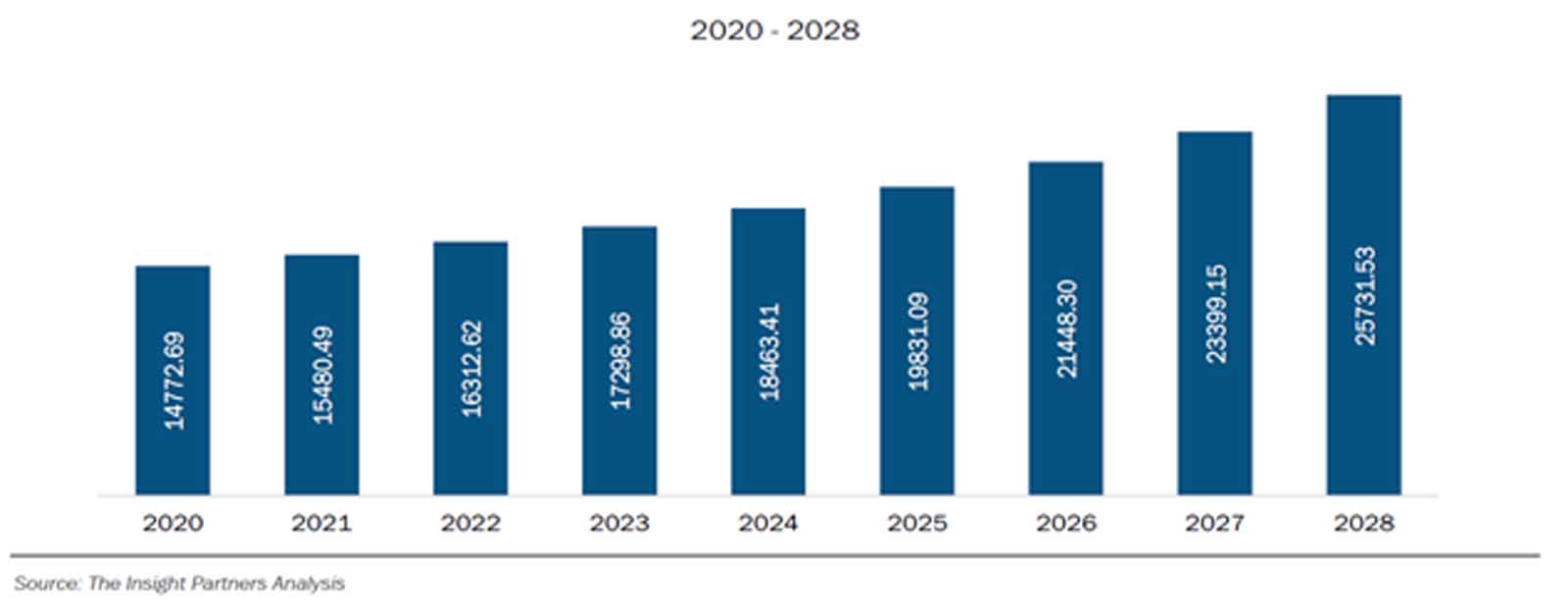

Currently, according to The Insight Partners, the global elevator market generates US$25,731.53 million in hardware revenue, where US$7,651.43 million is attributed to microcontrollers and US$6,604.88 million to IC connectivity. There is consistent growth expected for the coming years.

Below is a table (Figure 2) with the hardware revenue and forecast for the year 2028.

This has allowed for the introduction of more complex and disruptive algorithms, such as frequency variation or traffic control algorithms, which have set companies apart from their competitors.

2. Digital Technologies

The technological evolution we have undergone in recent years has changed the way we relate to the world around us. Consequently, it is also changing the way we want to communicate with elevators.

Technologies such as:

- IoT

- USB

- CAN-BUS

- Bluetooth

- Ethernet

- WiFi

- LiFi

- NB-OIT/Zigbee

- 5G

- AI: Machine Learning, Deep Learning, Cognitive Learning

- Computer Vision

- Augmented Reality

- Services on Cloud

- Edge Computing

- Virtualization

- Blockchain

- Digital Twins

These technologies are gradually making their way into the elevator industry, with some already well-established and others emerging. They are changing both the product and the processes of manufacturing and maintenance.

Among the highlighted technologies:

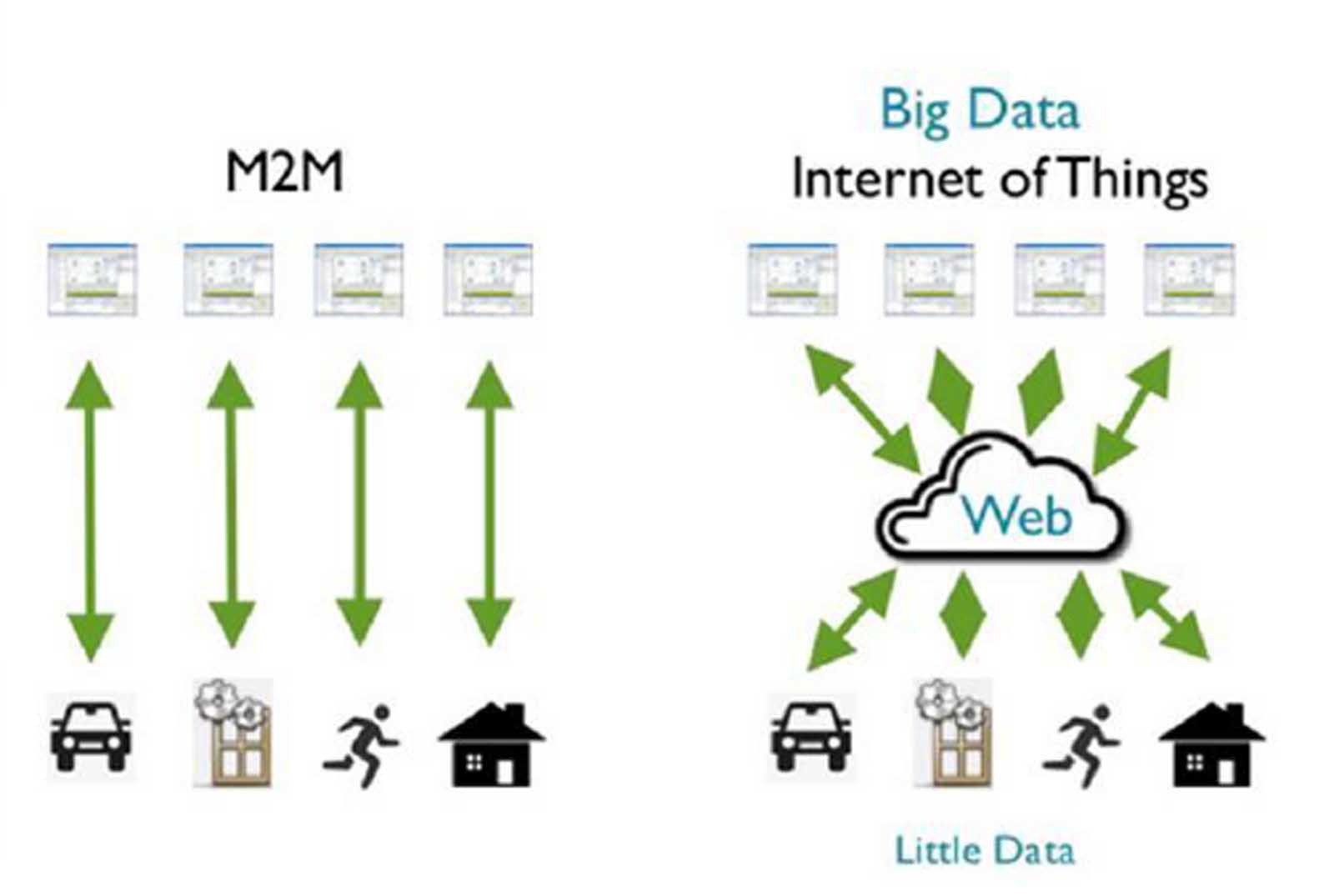

- IoT. Already well-integrated in the elevator sector, improving production processes. Currently being incorporated into elevators themselves, providing analytical problem reports through data, enabling predictive maintenance.

- CAN-BUS. This technology has established itself as the communication standard bus for elevator control systems. Its reliability and low cost have led to its widespread adoption in the industry, driven in part by its use in the automotive sector. This technology has replaced the traditional RS-485 and RS-422 communication protocols.

- Ethernet. This technology, while widely recognized, has been mostly excluded from use in the elevator industry due to its high cost, both in terms of electronics and the required cabling. It is primarily reserved for very specific applications, such as video cameras.

- WiFi/5G. These technologies allow continuous connectivity for elevators throughout their lifecycle, providing valuable data. They currently form the basis of IoT and will enable the implementation of digital twins in the future. While they have become standard for external connectivity, they are generally not used for internal elevator connections due to cost and latency issues.

- NB-IoT/Zigbee. These technologies are relatively new in the elevator sector but have not become dominant, primarily due to network coverage limitations, latency issues and battery life concerns in the elevator architecture.

- Bluetooth. Bluetooth technology has been excluded from elevator use primarily due to cost and latency problems. However, it is widely used for maintenance tool connections via smartphones.

- USB. Similar to Bluetooth, USB is not used within the elevator for communication due to distance limitations. However, it is extensively used for external tool connections, replacing the traditional RS-232.

- Augmented Reality. Augmented reality, still relatively unknown in the elevator sector, has the potential to disrupt how maintenance and manufacturing are carried out. It is currently used for personnel training but has the potential to facilitate on-site troubleshooting and eliminate documentation.

- Computer Vision. As a sensor in elevators, computer vision allows for real-time monitoring, including the ability to detect the number and characteristics of waiting passengers (e.g., elderly, children, individuals with reduced mobility). When combined with AI techniques, it enhances safety (detecting fainting episodes, vandalism, theft, etc.) and optimizes traffic management.

- AI. While holding great potential for maintenance optimization and breakdown reduction, AI technology is still in the evaluation phase. Harnessing its potential is a challenge for companies.

- Blockchain. Blockchain technology, seemingly distant from elevators, can revolutionize maintenance contracts and the relationships between companies and subcontractors. The ability to record the elevator’s state over time in an immutable ledger can form the basis for Smart Contracts, where billing depends on the quality of operations and maintenance can be ensured.

3. Digital Technologies in Manufacturing Companies

The implementation of new digital technologies in factories has not followed a parallel path to the adoption of Industry 4.0, except in multinational companies. Elevator manufacturing plants have traditionally had a more workshop-oriented profile than an assembly line profile, making it challenging for them to transition. This challenge is not only due to economic factors; it’s also cultural, and it requires a transformation of the workers and executives.

Currently, there is a shift in this mindset, with more emphasis placed on the value of data. However, even though data is being recognized as valuable, comprehensive Industry 4.0-type solutions are still relatively distant in this sector. Changes in this industry are more focused on machinery and tool improvements, including robotics, numerical calculations and verification tools.

Regarding design, there has been a significant change, especially in the use of electronic design tools (such as Altium and Mentor Graphics), mechanical design (SOLIDWORKS), 3D printers for prototyping and simulators. These advancements have allowed for cost reduction in design, improved reliability and reduced time to market. Companies have often collaborated with technology centers and universities to facilitate this transition.

4. Digital Technologies in Maintenance Companies

The digitalization of maintenance operations has experienced slow but steady growth in maintenance companies: from specific ERP systems, typically through SaaS services, to the use of mobile phones, which are transformed into smartphones or tablets.

Sometimes, informal tools are used, such as instant messaging (WhatsApp, Telegram, etc.), both in their interactions with customers and with their technicians.

Focusing on the customer relationship, most companies offer web portals where customers can access relevant elevator information. The elimination of paper is nearly achieved, and customers also have mobile apps to request services and view reports of breakdowns. It’s worth noting that COVID-19 has been a driving force in this regard.

Regarding call centers, there is a trend toward automating communication through mobile apps or phone bots.

From the technician’s perspective, paper reports have disappeared, and all management is done through smartphones. Geolocation is being used to schedule real-time routes, and operations are starting to be planned based on existing inventory and the technicians’ knowledge of a specific device.

The use of augmented reality headsets like HoloLens is a clear example of this technology’s use in elevator maintenance. Companies like TK Elevator and MP Lifts are using them to assist in remote problem resolution.

There is still a long way to go, primarily in integrating the potential of IoT into maintenance protocols, as well as using AI for predictive maintenance.

5. Digital Technologies in Product and Service

In the traditional vision, the elevator is located within the building but doesn’t interact with it. Its sole purpose is to transport people. Digital technologies are changing this traditional perspective to a more open one where the elevator is considered a part of the Smart City, offering users additional services such as advertising, weather information, news, promotions and more.

The control systems emerging in the market or those expected in the coming years will be inherently digital and clearly IoT.

This transformation affects two aspects: the traditional one where the elevator is seen as a part of the building, and a new dimension where the elevator as ecosystems becomes a service. At this point, platforms and mobile applications come into play, which we will describe later.

Elevator as Part of the Building

To provide these new features, elevator sensor technology is also evolving. Existing sensor data, such as weight sensors, photocells, door sensors, etc., are being leveraged, while new sensors like video cameras and accelerometers are being incorporated.

At the current stage, there is a tendency to use existing sensors and avoid implementing new ones, unless their utility is clear, for three main reasons:

- Limitation of the volume of information that can be transmitted

- The cost of sensors

- The absence of a clear relationship between the information to be transmitted and its utility as a service

Therefore, the current trend is to send the minimum necessary information, which clearly has an associated service.

Currently, elevator manufacturers and maintenance companies are defining these sensors without a clear criterion.

All of the above will create new business opportunities.

Elevator as a Service (EaaS)

The elevator is becoming integrated within the building ecosystem, offering its connectivity to other elements (e.g., boilers, garage doors) and services to the community (e.g., access control for cleaning personnel, community meeting minutes, etc.).

This integration creates new features and improves existing ones, benefiting both the maintenance provider and the user (e.g., fault diagnosis, energy efficiency, mobile apps).

The main services that these digital technologies offer to maintenance providers include:

- Predictive maintenance: Using IoT sensors to monitor elevator components and predict when maintenance is needed, reducing downtime and repair costs.

- Remote monitoring: Allowing technicians to monitor elevator performance and diagnose issues remotely, reducing the need for on-site visits.

- Fault diagnosis and prediction: Using machine learning algorithms to detect and predict faults before they occur, improving safety and reliability.

- Advanced reporting: Providing detailed reports on elevator performance, usage and maintenance needs to building owners and managers.

- Connectivity management: Ensuring that elevators are connected to the internet and can communicate with other building systems, such as security and HVAC.

- Energy management: Using IoT sensors to optimize elevator energy usage and reduce energy costs.

- Smart advertising: Using elevator screens to display targeted ads based on passenger demographics and behavior.

- Traffic management: Using IoT data to optimize elevator traffic flow and reduce wait times.

- Elevator access control: Using IoT technology to restrict elevator access to authorized personnel only.

- Elevator safety: Using IoT sensors to detect and prevent elevator malfunctions, such as door jams or sudden stops.

- Smart contracts

- Asset management. Tracking the condition and usage of elevator components to optimize part replacement and maintenance schedules.

- Remote troubleshooting: Diagnosing and even resolving issues remotely, reducing the need for on-site visits.

These digital technologies not only enhance the maintenance process but also improve the overall user experience and the elevator’s contribution to building efficiency and smart building initiatives.

The main services offered by these digital technologies for the end user include mobile apps aimed at:

- Interacting With the Elevator. Allowing users to make remote elevator calls, for example, calling the elevator to be ready when they arrive on their floor.

- Elevator Status. Providing real-time information about the elevator’s status, such as whether it is operational, undergoing maintenance or experiencing any issues.

- Scheduled Inspections. Offering details about scheduled periodic inspections, enabling users to stay informed about when these will take place and if there are any scheduled service interruptions.

- Previous Incidents and Resolutions. Displaying information about the elevator’s recent breakdowns and the solutions applied, giving users a complete view of the maintenance history.

- Elevator Configuration. Allowing users to customize certain aspects of the elevator, such as the information displayed on the cabin control panel and settings related to the elevator’s behavior.

- Community Services. Offering additional services to residents or building occupants, such as information updates, announcements or access to building amenities.

These mobile apps enhance the user experience and the ability to interact with the elevator efficiently and in a personalized manner.

Further, these new services will create new business opportunities and additional recurring payment lines of business.

6. Technical Challenges

- The existing fleet of lifts. High initial investments needed in elevator modernization and IoT integrations. Due to the enormous legacy of existing elevators, adapting them to achieve levels of connectivity for their management means carrying out total or partial modernization of the elevators.

- Government Support for Smart City[7] development creating normative and standardized IoT connectivity. Today there is no regulation for the standardization of connectivity for elevators or escalators. Neither a standardized type of operations to be carried out through IoT on elevators nor the type of information to be reported by elevators exist. From a technical point of view, there is no regulation for standard protocols for communication with the lift.

- Communication Protocols. The logical and physical communication protocol and even the structure and standardization of information could be regulated.

- Sensors. Combination between standard sensors (independent or not from lift working) and information received from each controller. The integration of standard sensors, whether independent or interconnected with the elevator’s operation, is crucial. These sensors collect relevant data from the lift, providing valuable insights into its performance and maintenance needs. Sensors provide information. The main actuator on the lift is the lift controller.

- Standardization. Information from each lift controller may be collected to provide a comprehensive view of the elevator’s functioning.

- Solving the way this information is captured within the lift, to be transmitted outside and the way to receive information to be “ordered” to the lift.

- Connectivity IoT level. Specially focused on security (to avoid non-controlled traffic of information).

- Platform. Platform to receive/analyze/send information to the lift.

Nowadays, these are different technologies with few technological companies having technical capacity on all of them, so real technical value is integration of all of them.

We are working to create an ecosystem with all these technical elements, with different technologies and partners to add value to this ecosystem.

7. Conclusion

In the current era of communications, computing, data processing capacity and IoT, industry in general and industrial equipment maintenance services are forced to change their operating processes to adopt and take advantage of this technology. All this represents a greater revolution than the one caused by the steam engine in the 19th century. This revolution represents a huge technological leap whose use necessarily involves reinventing business processes and services.

The advent of IoT in the elevator industry represents a transformative opportunity to revolutionize maintenance services, optimize operations and enhance the overall user experience. By addressing the challenges associated with sensors, data capture and transmission, communication security, platform capabilities and value-added services, IoT solutions need to offer a scalable, secure and efficient ecosystem for lifts.

References

[1] IoT: researchgate.net/publication/288855901_Reference_Architectures_for_the_Internet_of_Things; en.wikipedia.org/wiki/Internet_of_things

[2] LiFi: en.wikipedia.org/wiki/Li-Fi

[4] Edge computing: accenture.com/us-en/insights/cloud/edge-computing-index; en.wikipedia.org/wiki/Edge_computing

[5] Blockchain: euromoney.com/learning/blockchain-explained/what-is-blockchain#:~:text=Blockchain%20is%20a%20system%20of,computer%20systems%20on%20the%20blockchain.

[6] Digital Twins: en.wikipedia.org/wiki/Digital_twin

[7] Smart City: twi-global.com/technical-knowledge/faqs/what-is-a-smart-city; en.wikipedia.org/wiki/Smart_city#:~:text=A%20smart%20city%20is%20a,improve%20operations%20across%20the%20city.

[8] Conectivity: geeksforgeeks.org/architecture-of-internet-of-things-iot/

[9] BMS: sciencedirect.com/topics/engineering/building-management-system

[10] HVAC: techtarget.com/searchdatacenter/definition/HVAC; en.wikipedia.org/wiki/Heating,_ventilation,_and_air_conditioning

[11] API REST: ibm.com/topics/rest-apis#:~:text=An%20API%2C%20or%20application%20programming,representational%20state%20transfer%20architectural%20style; en.wikipedia.org/wiki/Representational_state_transfer

[12] SCADA: en.wikipedia.org/wiki/SCADAscada-international.com/what-is-scada/#:~:text =What%20does%20SCADA%20stand%20for,data%20from%20the%20industrial%20equipment

Get more of Elevator World. Sign up for our free e-newsletter.