Data From Global Elevators & Escalators

Jun 1, 2020

New analyses and benchmarks of the industry with focuses on China

Swiss financial services company Credit Suisse, a long-term commentator on and researcher of the industry, released several reports on the elevator and escalator market in March. All headlined Global Elevators & Escalators, their individual titles are “Looking at What Is Key for 2020 and Beyond,” “China Local Data Insights Into OEMs Relative Positioning Among Top 500 Developers and in Urban Transit,” “Channel Checking With Big4” and “CS China Elevators Pricing Tracker 3M 2020.”

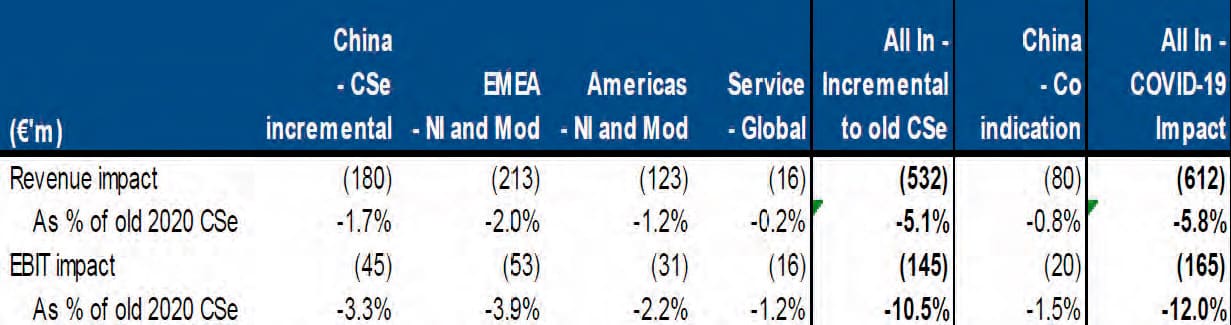

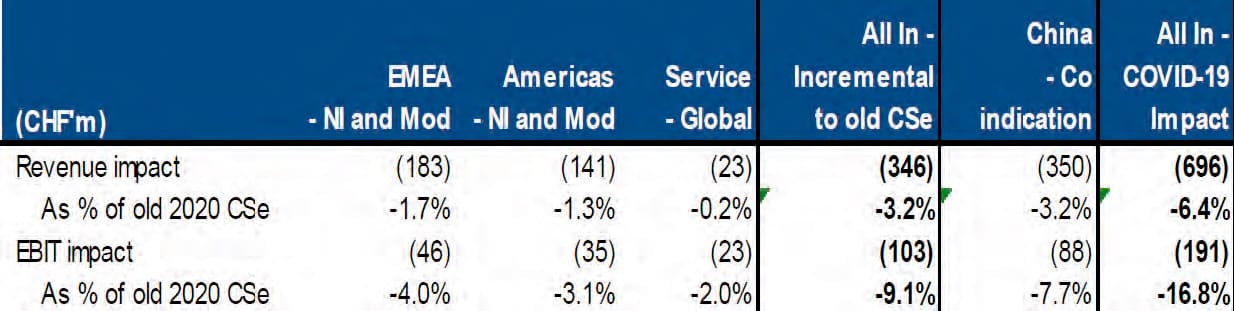

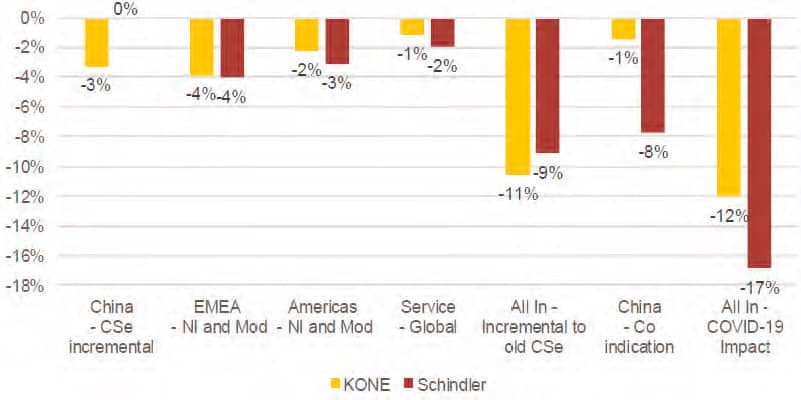

The main report, “Looking at What’s Key for 2020 and Beyond,” addresses the three key debate points for the industry for 2020 and likely midterm. Credit Suisse’s KONE and Schindler forecasts for its assessment of COVID-19’s impact in Asia, Europe and the U.S. have seen 12% and 17% cuts, respectively, for 2020 earnings, but it does not see fundamental investment cases altered by this development. Addressing COVID-19, it notes an impact of -12% on new installations and modernization in China/Asia, Europe and North America and expects an impact on rebates of around 10%. It does not expect service to be substantially affected and expects delayed repair to be completed by the end of the year. While it gives information on other OEMs, it reiterates its “Outperform” rating on KONE and Schindler.

“China Local Data Insights Into OEMs Relative Positioning Among Top 500 Developers and in Urban Transit” analyzes the “top choice” of OEM by top local developers, OEM market share in urban transit in China. The China Property Developer Association’s survey of its top-500 local developers said the “top choice” is Mitsubishi Electric (19%), followed by Hitachi (17%) and KONE (14%). Schindler, while number four at 13%, has gained momentum over the years, as have large local players. Brand recognition for thyssenkrupp, however, has deteriorated recently. In urban transit, a report from RT Rail Transit, Guangzhou Metro’s award of a CNY5.5-billion (US$777-million) contract to Guangri and Hitachi last year gave them the largest market share in the year. However, if this order is excluded, Schindler enjoyed the top spot in both 2018 and 2019. Over that period, KONE improved slightly, while thyssenkrupp was again challenged.

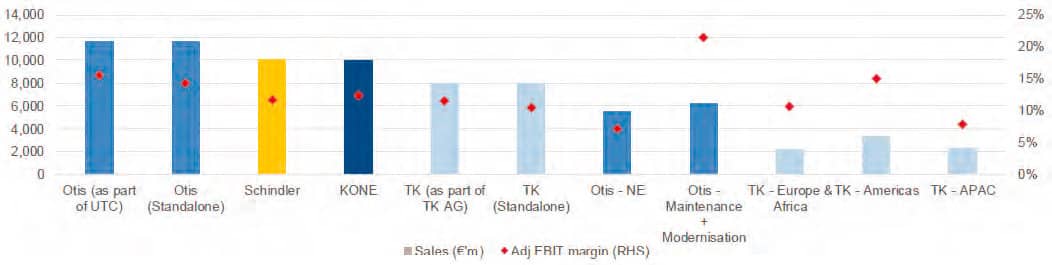

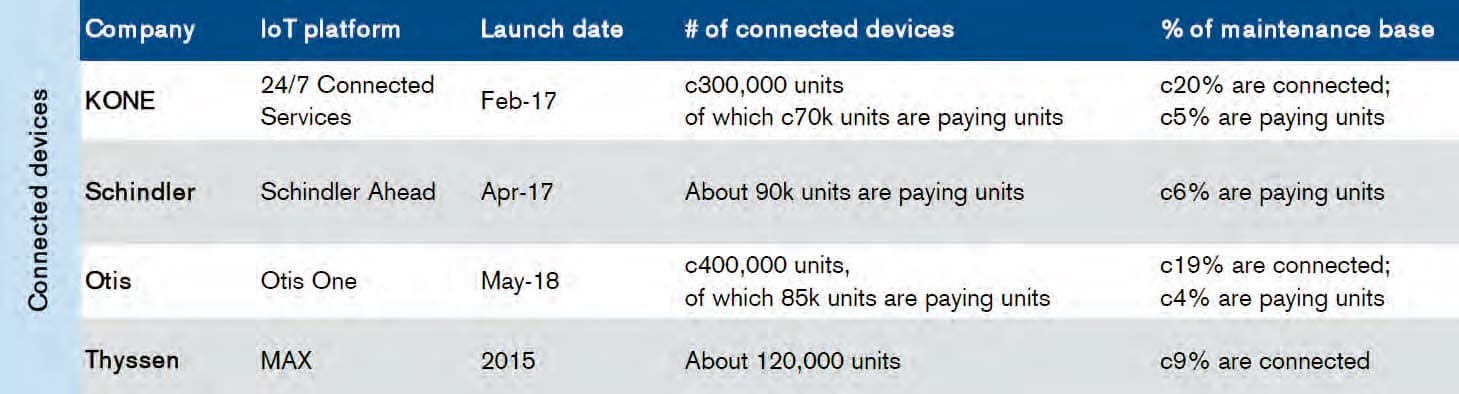

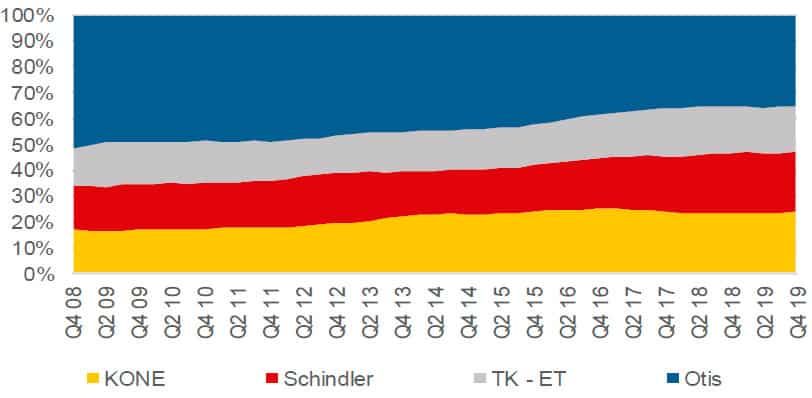

“Channel Checking With Big4” is a look at the major OEMs of Europe (KONE, Schindler, thyssenkrupp and Otis) across China, Europe and the U.S. Although the industry is facing a very testing period with COVID-19, resilience of maintenance is expected, and reassurance is had by the pace of recovery in China.

“CS China Elevators Pricing Tracker 3M 2020” is based on a database of more than 13,000 contract awards in China annually, covering approximately 20% (100,000) market units with direct pricing data on around 15%. The data shows an approximately 60% correlation with the market pricing trend reported by OEMs. The bottom line is that the first quarter showed soft pricing trends amid the pandemic with lower volumes. However, there was a clear improvement in market activity and volumes in March versus February as jobsites were ramped up close to full capacity. Despite a price softness led by social housing, all other end-markets held up. Residential, hospital, school, government and commercial all reported positive developments. Additionally, it is noted that the international price premium versus prices of locals continues.

In looking at maintenance in the overall industry, Credit Suisse says the key point is that standard maintenance should grow for the large players in 2020, as their units under maintenance will increase this year, and maintenance has been qualified as a system-critical service by virtually all countries, with the only sizable market exception being India. The company notes that this differs substantially from some other providers of “building technologies” that see their aftermarket businesses impacted by lockdowns and lower building usage.

The full reports are available to Credit Suisse clients and elevator and escalator market participants. Those interested in receiving it and other industry reports can sign up at bit.ly/2WaiKBp.

Get more of Elevator World. Sign up for our free e-newsletter.