In this comprehensive article, we delve deeper into the Turkish elevator market, examining key insights, emerging opportunities, and strategies for success.

With a predominant focus on new installations (NI), the Turkish elevator market demonstrates a unique preference for cost-effective solutions. While modernization sales remain modest at 2-3% of total sales, the affordability of new installations compared to European counterparts drives decision-making processes. The inclination towards new lifts over modernization is particularly evident when the cost of replacing aging lifts is comparable to that of modernization, leading owners, and users to opt for the former.

Despite recent declines in construction activity, the potential for new elevator installations in Turkey remains substantial, with an estimated capacity for 30,000 NI lifts per year. Although the market experienced a peak of 50,000 new installations annually, primarily between 2016 and 2018, recent seismic events in southern Turkey have spurred a resurgence in construction activity. The resulting demand for infrastructure improvements has fuelled optimism for increased elevator and door business, particularly in the affected regions.

With an average building height of 8 floors, Turkey’s architectural landscape has witnessed a surge in larger-scale projects such as hospitals, shopping malls, and metro systems. This trend has translated into heightened demand for larger-sized elevators and advanced door solutions, including Big Vision doors. Fermator and Fupa Lift have been pivotal in meeting this demand, offering innovative door solutions tailored to the specific requirements of the Turkish market.

The Turkish elevator market is characterized by a diverse array of component manufacturers, many of whom export their products globally while maintaining a significant presence in the domestic market.

Fermator’s solutions:

In response to the demands of our era, Fermator has prioritized its expansion in the Middle East with the establishment of Fermator Middle East, alongside its official partner in Turkey, Fupa Lift. This significant investment initiative involves the establishment of new production facilities, a long-anticipated endeavor aimed at delivering enhanced and expedited services to the elevator industry.

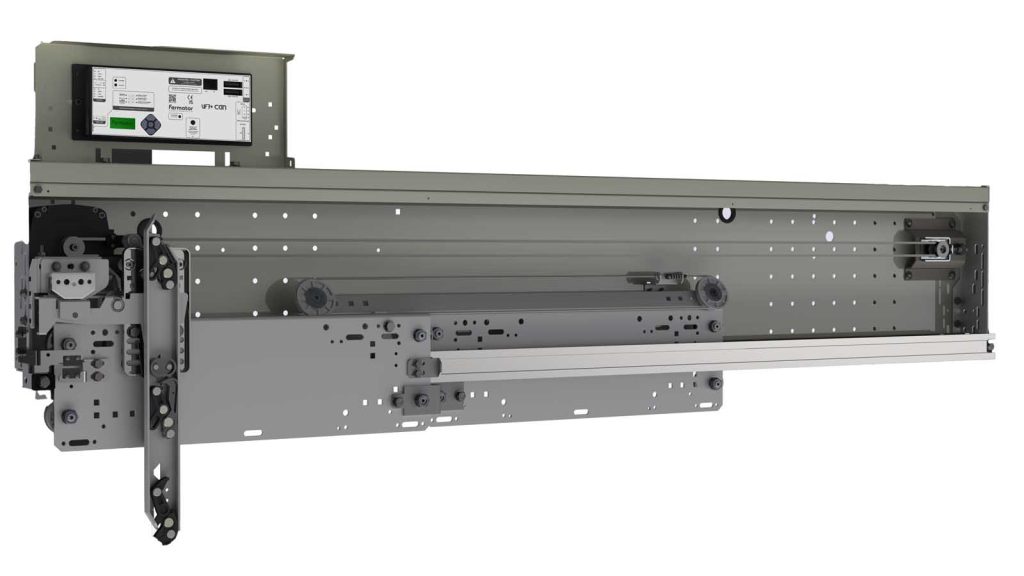

Fupa Lift new facilities, under Fermator license, production of high-quality doors in Spain quality, production of upper segment cabin and suspension, machine chassis and complete package elevator systems. Spanning 12,000 square meters of enclosed area, these modern facilities boast 10,000 square meters dedicated to production.

With the aim of offering the best solutions for any new installation project, Fermator presents its top-selling products tailored for the Turkish market:

Elite MR: The Elite MR model for cabin and landing doors is designed specifically for new residential elevator installations. Renowned for its flexibility, modularity, and ease of installation, this door system provides a comprehensive solution to various residential sector needs. Notable features: Reliable, customizable, and adaptable for new residential lift projects, offers a wide range of options and certifications, low energy consumption. Lift application; door cycles per year is up to 800.000, traffic peak of the door is up to 240 cycles per hour, and traffic lift speed is up to 2,5 m/s.

50/11 MEGA: The 50/11 MEGA model for cabin and landing elevator doors is engineered to meet the demands of both residential and commercial segments, focusing on accommodating large moving masses efficiently and safely. This model stands out for its robustness and state-of-the-art features, striking a balance between functionality and aesthetics in residential and low commercial buildings. Ideal for buildings with heavy loads or large dimensions. Notable features: durable, robust, and strongly structured, ideal for high-traffic performance in residential buildings, recommended for large dimensions or heavy loads. Lift application; Door cycles per year: up to 800.000, traffic peak of the door is up to 240 cycles per hour and traffic lift speed is up to 3,5 m/s.

As Turkey enters a new phase of construction and development, the elevator market presents compelling opportunities for growth and innovation.

Get more of Elevator World. Sign up for our free e-newsletter.