Ministry of Industry and Technology has published ‘Elevator Sector Report 2020,’ which includes information, data and considerations about the elevator and escalator industry.

Along with developing new technologies in the world, the Turkish elevator industry has entered a great transformation process and achieved an important market share in world trade. Considering that urbanization process in Turkey will continue and new earthquake-resistant buildings will be constructed in place of old buildings, the report predicts growth in the elevator industry will continue in line with construction activities. Additionally, Turkish investments in the Middle East, the Balkans and, recently, in African countries have positive impacts on the elevator industry.

Because of recent problems in the Middle East, unavoidable market shrinkage has been experienced in the elevator industry. It is seen that the competitive power of national companies weakened as the multinational companies, which dominate the market, moved their production facilities to Asian countries that offer low-cost labor. The report states this situation is an important risk both for the end users and the development of the national elevator industry.

Despite the existence of multinational companies with more than 100 years of experience and background in the industry, Turkey’s position brings an inevitable success and growth in business volume. One of the important reasons for this growth is that elevator component manufacturers have achieved efficiency in production. Additionally, innovative R&D activities play an important role in the future perspective of the industry.

Within the scope of the Technology Oriented Industry Action Program, elevator companies have made applications, with the first call made for high-tech industries.

The report included, as in every year, TUIK and Ministry data under the titles of “General Situation of the Industry” and “Last Semiannual Assessment of the Industry.”

General Situation of the Industry

The report states, with the inclusion of the technical legislation of the European Union into Turkish Legislation and the acceptance of international standards as the “Turkish Standard,” harmonized standards within the EN 81 family have provided an important advantage in terms of competitive power and access to new markets.

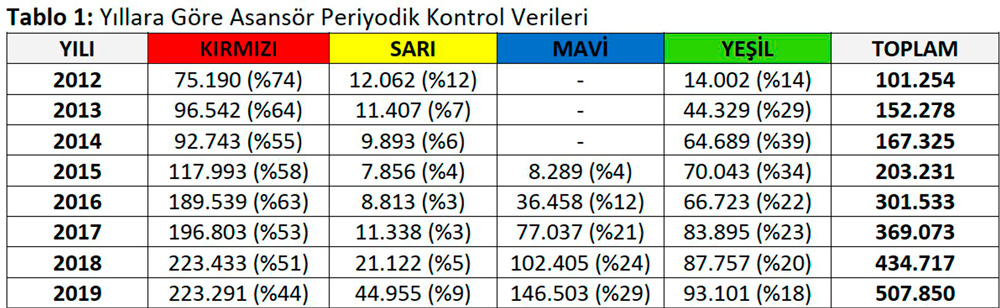

The table that takes place in the section where periodical elevator control data is shared is shown below, noting the number of elevators inspected between the years 2012 and 2019, and based on the label colors they received. As seen in the table, there is a significant increase in the number of elevators that are inspected and that have received the green level.

Increase in Complete Elevator Sales

In recent years, Turkish companies have also been involved in areas like installation and complete elevator sales abroad. Additionally, the number of our elevator installation companies that operate in Turkic Republics, Middle East and EU countries have increased considerably. The growth of foreign trade with African countries has enabled Turkish elevator companies to increase their investments in these countries.

The countries importing elevator components from Turkey were primarily EU countries, Middle East countries and Turkic Republics. Additionally, component export from Middle East to South America indicates that the competitive power is significant. However, component import is centered on Far East-based components.

Component Production

Elevator safety components manufactured in the domestic market are cabins, machine-motor group, full and semi-automatic cabins and landing doors, ropes, control cards, control boards, guide rails, indicator devices, landing and cabin operating panels, overload systems, cabin and counterweight suspensions, hydraulic cylinders, gearless machines, photocells, speed control devices, control systems, shoes, sensors, rail brackets, balance chains, switches, VVVF invertors, rope fixtures, pulleys, systems (machine-room-less systems), overspeed governors, safety gear (brake blocks), hydraulic and spring buffers, door locking devices and unintended car movement protection devices. However, the supply of rupture valves, hydraulic power units and hydraulic pressure control units, which are obligatory for hydraulic elevators, is import dependent.

In general, considering the component manufacturing in the Turkish elevator industry, we are dependent on foreign sources for the installation of hydraulic elevators, but not dependent on external sources for the installation of electric-driven elevators. In terms of hydraulic elevator manufacturing, hydraulic power units are important production elements. 90% of hydraulic power units are imported to our country as packaged units.

Elevator components are manufactured mostly in Istanbul, Kocaeli and Bursa in Marmara Region, İzmir in Aegean Region, Ankara, Konya and Kayseri in Central Anatolia Region, Antalya in Mediterranean Region, and Malatya in Eastern Anatolia Region.

Authorized Type-A Inspection Bodies

Periodical inspection of elevators is carried out by Type-A Inspection Bodies that sign protocols with relevant institutions, after being authorized by the Ministry of Industry and Technology within the scope of the Elevator Periodic Control Directive.

The rules and procedures regarding authorization of Type-A Inspection Bodies by the Ministry of Industry and Technology have been determined by the Elevator Periodic Control Directive published in the Official Gazette, dated May 4, 2018, with the number 30411, and 38 Type-A Inspection Bodies have been authorized and released to the public by the Ministry of Industry and Technology.

For information about Type-A inspection bodies authorized by the Ministry of Industry and Technology for the periodical controls of elevators, please visit https://www.sanayi.gov.tr/sanayi-faaliyetleri/yetkilendirilen-kurum-kuruluslar/01060420321

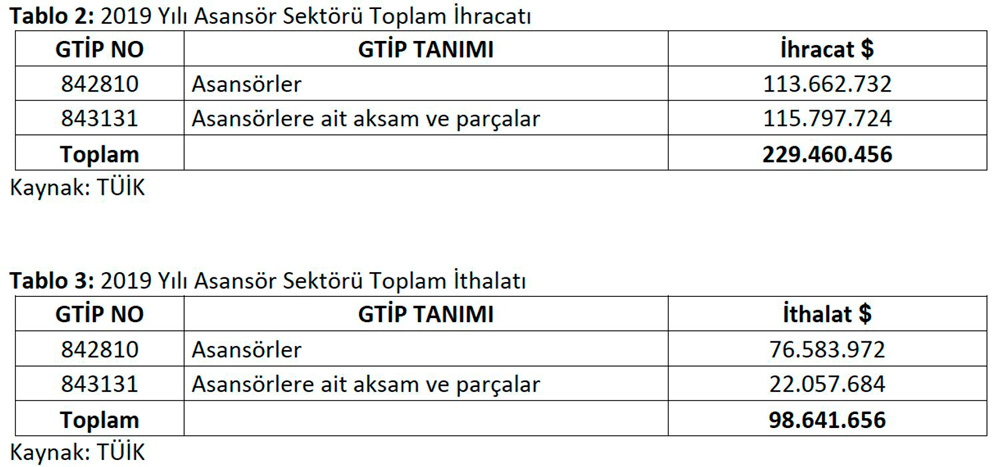

Turnover of the Sector

In terms of export and import figures in 2019, foreign trade volume for 2019 was $328 million in total. Considering the scope of the Turkish elevator industry, the industry has a turnover of approximately $1 billion to $1.5 billion in terms of annual installation numbers based on the constructions that are built, certification services, periodic control services, component production, and maintenance and service activities.

With one-to-one adaptation of EU legislation, Turkey has been an important market for the elevator industry in Europe, and has maintained its foreign trade volume in recent years. In foreign trade, the biggest field of activity that had foreign trade surpluses has been the production of elevator components and parts for many years. This field of activity balances elevator export and import figures while foreign trade figures in 2019 support this argument. The foreign trade surplus of $94 million in this field can be considered as the most important indicator of this situation.

Assessment

Table 3: Total Import Volume of the Elevator Industry in 2019

At the end of the report, it is stated that there is a shrinkage both in domestic and foreign markets, and has reflected on both new installation activities and component manufacturers. However, with the introduction of innovative hygienic products related to elevators, new products entered the market.

Until 2020, approximately more than 600.000 elevators have been installed and put into service in Turkey, and the majority of these old and new elevators are still used.

Considering the 2,749 installers and component manufacturers registered in the industry registry system, it is emphasized that maintaining collaboration within the Turkish elevator industry is inevitable, while it is hard to turn the mitotic division experienced in the industry into an advantage.

For the full report, you may visit https://www.sanayi.gov. tr/assets/pdf/plan-program/AsansorSektoruRaporu(2020).pdf or scan the QR code here.

Get more of Elevator World. Sign up for our free e-newsletter.