Europe, Germany and Switzerland

Jun 5, 2023

In-depth discussions provide insight on the respective economies and the impacts on the elevator industry.

Traditionally, every year a report on the elevator and escalator markets in Europe’s German-speaking countries is compiled. This year, the focus is on Germany and Switzerland. Big industry associations — the German Mechanical Engineering Industry Association (Verband Deutscher Maschinen und Anlagenbau [VDMA]) in Germany and Verband Schweizerischer Aufzugsunternehmen (VSA) in Switzerland — supplied their insights and statistics. During video calls with your author, both managing directors described the current industry situation in their respective countries, thus guaranteeing a solid background and understanding of the markets and their trends.

Elevators in Europe, a Multi-Million Unit Market

According to the European Lift Association (ELA), nearly 6.5 million elevators existed in Europe in 2021. Germany takes third place with approximately 815,000 after Spain, in first place with slightly more and Italy in second place with slightly less than 1 million elevators. New elevators in this period were estimated at roughly 140,000, with Germany on top with approximately 24,390, followed by Türkiye (approximately 16,500) and France (approximately 14,800).

More data for the global market (including Europe and Germany) can be found in the regular survey from ELEVATOR WORLD, the German elevator association VFA Interlift e.V. and fair organizer AFAG Messen und Ausstellungen GmbH in association with Credit Suisse. The last period covered was the fourth quarter of 2022. Under the heading “Global Elevator Industry Survey Reflects Improved Outlook,” the report on results can be found at Elevator World.

In the Euro zone, the inflation rate fell from 8.5% to 6.9% in March 2023. In Germany, it fell from 8.7% in February to 7.4% in March. In Switzerland, the rate decreased to 2.9% in March from 3.4% in February.[1]

“Regard Building Services Technologies, Including the Elevator, as a Complete Ecosystem…”

Your author (USB) spoke with Dr. Peter Hug (PH), managing director, Lifts and Escalators, VDMA, Frankfurt/Main, Germany, who had just returned from a longish business trip to Singapore, about the German and European elevator markets, their status, perspectives.

USB: Mr. Hug, could you please provide some information about your personal and professional background?

PH: I am an economist and studied economics and business informatics approximately 30 years ago. I have been working for the industrial association VDMA since 1993. I became an information technology (IT) specialist over the years through my practical work. I started in the field of construction machinery, followed by mining machinery and agricultural technology. Today, my three main areas of expertise are, since 2009, building automation, also since 2009, cleaning machines and, since 2020, elevators and escalators. Digitalization in the building sector got off to an early start with, among other things, BACnet, a standard that has since become established. Today, we are talking about BIM (Building Information Modeling) and CAFM (Computer-Aided Facility Management).

When I find some time in the evenings or on weekends, I listen to and play electric guitar. Jimi Hendrix is one of my favorites because he was kind of a novelty in the music business. I originally came across him because I found a poster of his so cool.

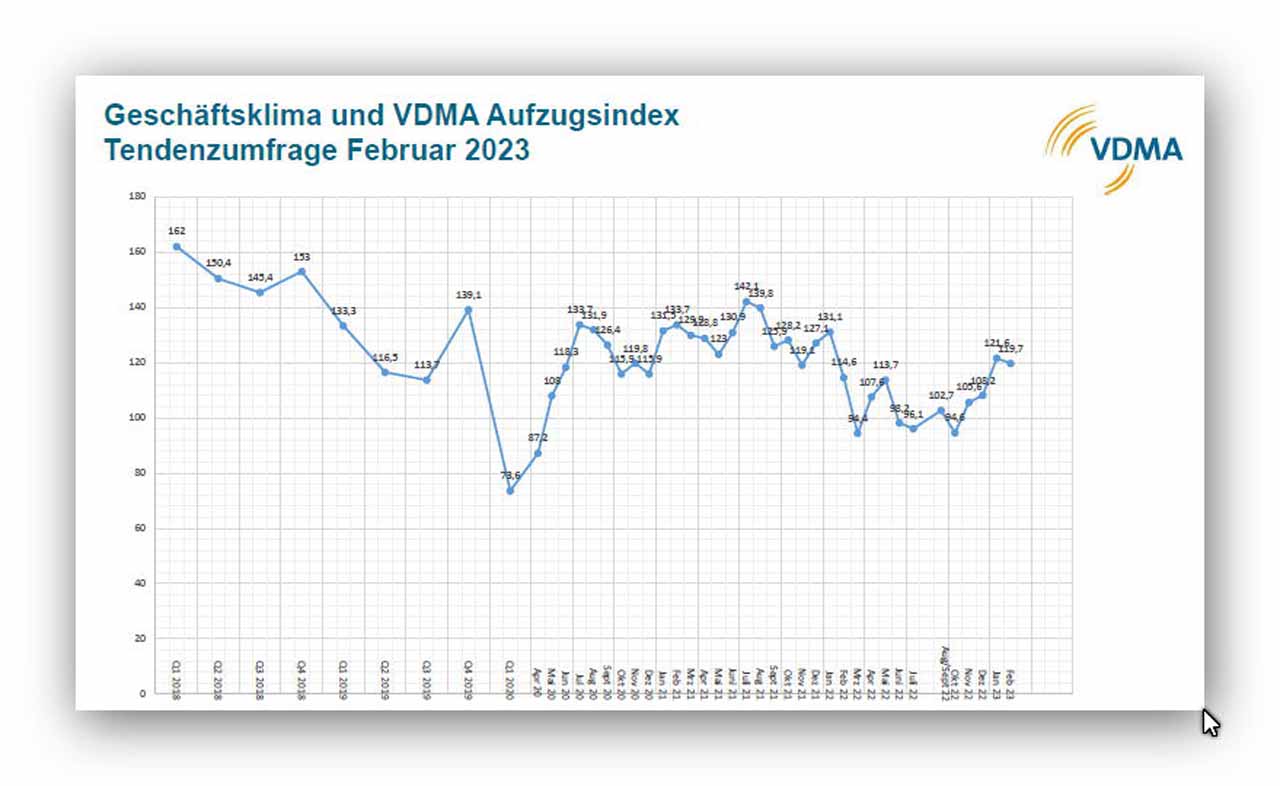

USB: Today, we are talking about markets in Germany and Europe with a focus on elevators and escalators, which partially depends on the construction industry. The main indicator in Germany is the quarterly VDMA Lift Index.[2] In February 2023, it went slightly down. How do you explain this development?

PH: During the pandemic, the index dropped sharply. Since then, we have also been recording it monthly — no longer just quarterly — to be informed faster and be able to react, if necessary. The Lift Index recovered quickly after the March 2020 slump and reached pre-crisis levels. One month with a small downward movement, last seen in February 2023, is not yet a trend. The construction industry — and with it the elevator industry — has held strong, even in [coronavirus] times. Another slump in the Lift Index came with the start of the Ukraine war, followed by more difficult conditions such as supply chain bottlenecks and rising interest rates, which is why the index was in the negative range more often than not from March 2022 to October 2022.

Building interest rates are currently rising from 1% to up to 4%, but have not yet reached the level of 9% seen in the 1980s and 7% in the 1990s. In addition, there are massive price increases for building materials, which have caused a sharp rise in construction prices. Take Frankfurt and the surrounding area, for example. There, construction prices are now at the level of the city of Frankfurt six to eight years ago. This applies to new construction projects, which are now largely equipped with elevators, but also to existing buildings.

The 400,000 apartments promised by the Ministry of Construction for 2022 have not been accomplished. In 2023, this development will continue. I anticipate even fewer completed buildings in 2024. Housing starts will be put on hold, as announced, for example, by major real estate companies such as Vonovia.

The construction industry — and therefore the elevator industry — will also recover. Interest rates and the supply situation will stabilize by mid to late 2023. Prices were excessive in some cases, especially for pre-owned buildings. With interest rates at extremely low levels, buildings could be financed comfortably. If interest rates continue to rise, market prices will fall. The historically high prices and historically low interest rates cannot be maintained in this way.

USB: Do you also have information on this development from around Europe?

PH: We didn’t have a real estate “bubble” in the German market, so none can or will burst. In Europe, the situation is different. In Scandinavia, for example, especially in Sweden, but also in Spain, mortgage rates are variable. There, construction volumes and — as a result — elevator orders are already plummeting. In the last real estate crisis in the U.S. years ago, the trigger was the overnight increase in variable mortgage rates. In Germany, the whole thing will be more moderate because of long terms with fixed interest rates. Due to longer planning phases, signs of a decline are there already, but until significant numbers of debt reschedulings exist, the decline will remain moderate.

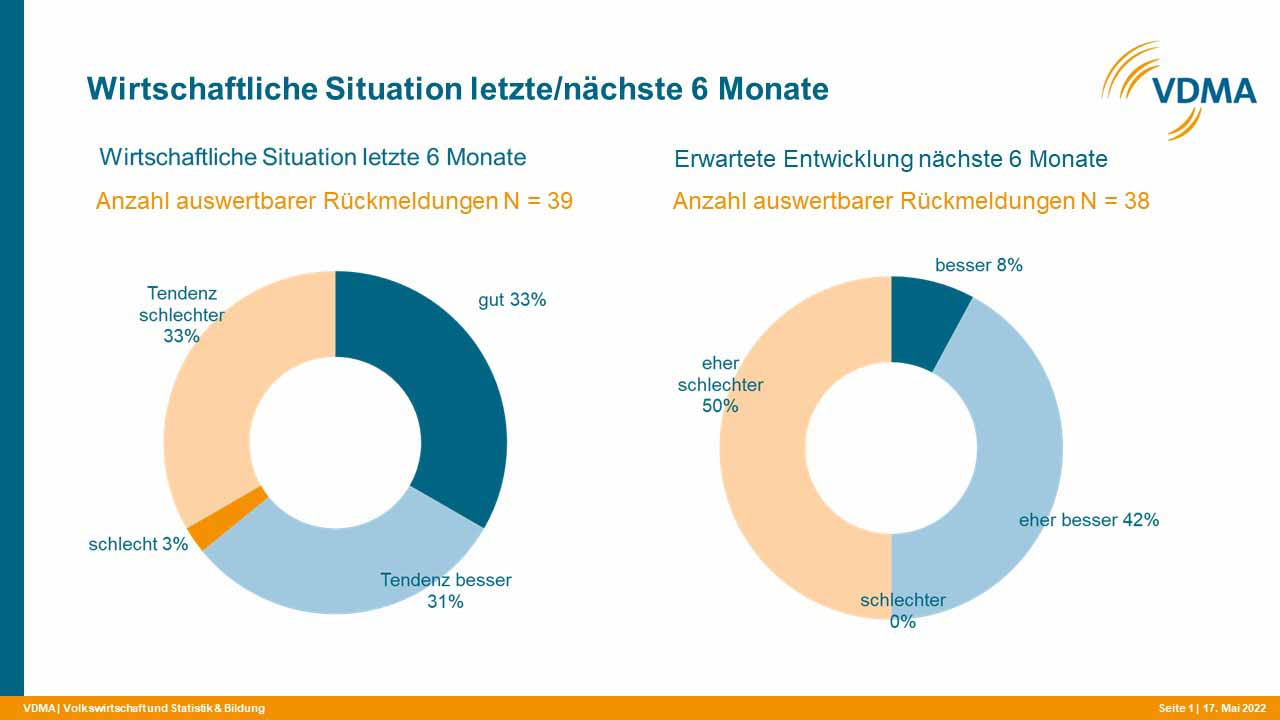

USB: Within the framework of the Lift Index, you also ask companies their opinion on their actual and future business expectations. These numbers also went down slightly in the last quarter. Why?

PH: I have talked to my member companies in the elevator industry. The problem is that building technology, including building automation and elevators, is the last thing to be installed in a building. That’s why everything that can be saved, such as sensors, is often cut back. Elevators fare somewhat better because the shaft is already considered in the planning phase due to space requirements. Nevertheless, it takes a long time from order to delivery. Although many elevators are still being completed, delivered and installed, the number of incoming orders is declining.

The elevator industry, like other industries, will look to exports and diversification. If that is not enough, production will be adjusted to the market and capacities will be reduced. Fewer material purchases will also have an impact. This means companies will survive the lean period quite well. Many would rather give up margins than let valuable, skilled workers go.

To sum it up: In the short term, the market will remain stable. In the medium to long term, it will settle at a lower level in Germany.

“The construction industry — and with it the elevator industry — has held strong, even in [coronavirus] times.”

— VDMA Lifts and Escalators MD Dr. Peter Hug

USB: What would have to change to overcome the slump in the construction industry in Germany?

PH: There are proven measures from the past. For example, the allocation of building land by local authorities is still experiencing a bottleneck that slows down construction activity. Secondly, mortgage interest should once again be deductible from income tax. This would help many young families in mid-career to achieve home ownership. Thirdly, the land purchase tax could be suspended, at least for the first purchase of owner-occupied real estate. Germany is the country with the lowest home ownership rate in the European Union (EU), which does not at all keep with the myth of a rich country. These measures would suit Germany well and could help dispel the shock of the interest rate hikes.

USB: Do the same tendencies and reasons apply to Europe?

PH: Europe shows mixed markets. In Scandinavia, residential construction is in decline. Denmark and Norway will build at least 11-12% less in m2 in 2023. Sweden will also still be negative in this period. Other countries have been positive in the past, such as Ireland with a significant plus in 2022, a slight plus in 2023 and a significant plus again in 2024. Everything revolves around the availability of building materials and building prices. Even if Germany puts away the higher interest rates and energy prices, as well as the Ukraine war with +/- zero, other markets react differently.

If we look at non-residential buildings such as office buildings or large department stores, the bankruptcy of Galeria Karstadt should be a warning. Internet commerce has changed this business. And office space requirements have been reduced in the wake of the coronavirus. We now have a large proportion of home offices, e.g., around 50% at VDMA in Frankfurt, like our member companies. Where once three to four desks were needed, today there are only two. That is the same all over Europe, even worldwide.

USB: You also regularly publish statistics about the production situation in the mechanical engineering sector in Germany. What are the actual numbers? What are the tendencies?

PH: The mechanical engineering sector in Germany is developing in a way similar to the construction and elevator industries. In 2022, the sector grew by 0.8% to 1%. For 2023, we expect a real decline of 2%. This figure was calculated based on the order intake.

USB: What is the economic situation in Germany generally? We heard about an inflation rate of 7.9% in 2022, the highest number of bankruptcies ever in 2022 and an expected gross domestic product (GDP) growth of only 0.3% in 2023.

PH: The International Monetary Fund has put the overall economic trend in Germany for 2023 at minus 0.1%. German economic research institutes have settled at plus 0.3%. These figures are significantly lower than those for the elevator industry because they include a hodgepodge of different industries. In industries where development slows down between order and delivery, elevators or construction sites on the scale of cement plants with two-year delivery times feel the overall economic trends later than, for example, cleaning machines with only two weeks between order and delivery.

USB: And in Europe? The 2022 graph from Eurostat shows Germany in second to last place with only 1% growth.

PH: Germany is no longer an economic locomotive in Europe. In terms of GDP, we are not quite in last place. Denmark, the U.K. and Sweden are in the red, while Ireland is up 4%. Eastern Europe is also growing at between 0.5% and 1.7%. Here, too, the reasons are energy prices and the shortage of skilled workers, mainly due to demographic developments.

Exchange rates have a major influence. After the decoupling of the U.S. and China, the question arises as to where the EU and its industries fit in. Despite intensive efforts to the contrary, geostrategic dependencies exist. The mechanical engineering industry is 85% dependent on exports and is, thus, highly dependent on global markets. Demand depends on developments in other countries.

In his book, Das Märchen vom reichen Land (The Fairy Tale of the Rich Country), Daniel Stelter asked whether Germans even perceive themselves as being at the bottom of the economic league. Germany is a rich country, but has a comparatively poor population. In Asia and the U.S., for example, incomes and living conditions develop much more dynamically, especially depending on the qualifications of sought-after employees. As a result, every year about 50,000 academics leave Germany for foreign countries. There, they hope for better working and living conditions. They no longer contribute to value creation in Germany, and they don’t come back. So, Stelter’s — and my — answer is, yes, Germans are definitely aware of this uncomely development. This is reflected in a similarly uncomely manner in the Sunday question, “Who would you vote for if there were a general election next Sunday?”

“In the short term, the market will remain stable. In the medium to long term, it will settle at a lower level in Germany.”

— Hug

USB: Let’s take a more detailed look at three influences on the economy, which you mentioned already. Let’s start with the embargo on Russia following the attack on Ukraine.

PH: The mechanical engineering sector is underperforming compared to the growth of the German economy as a whole because markets have collapsed. Exports to Russia, for example, have fallen since 2019/2020 to virtually zero today. International competition has also become stronger. China, for example, now makes a lot on its own.

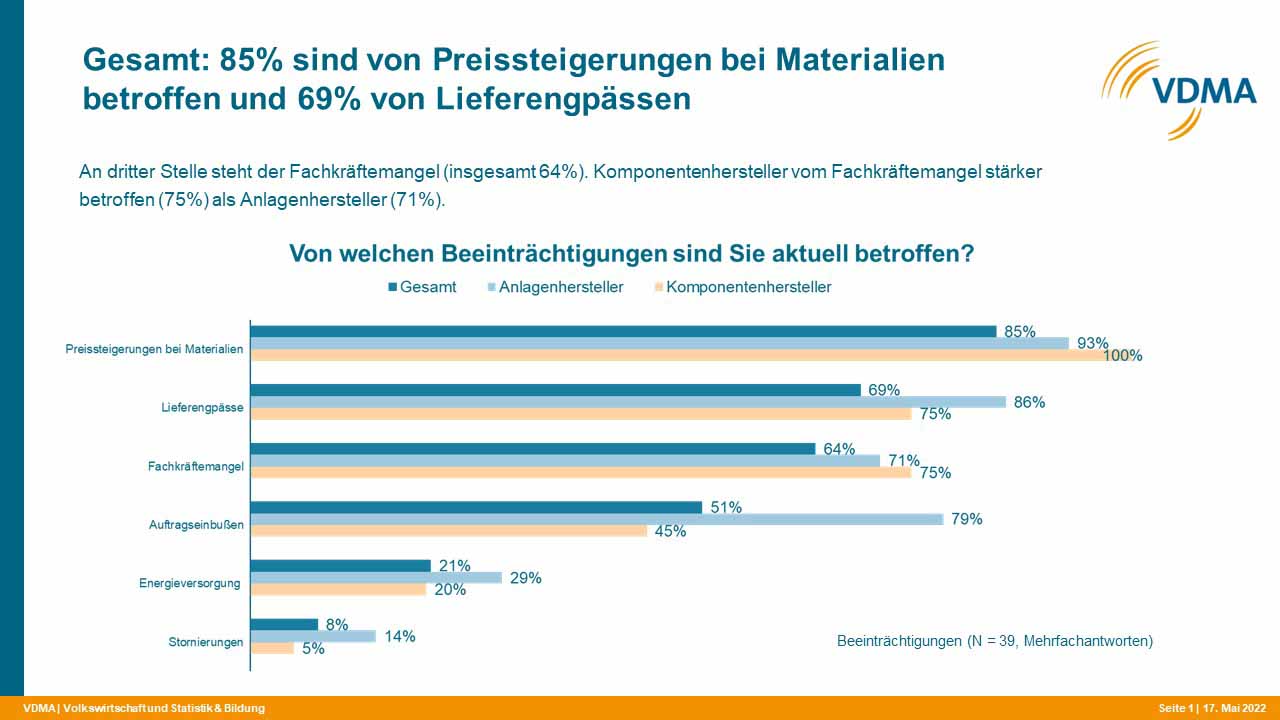

USB: A huge influence is the rising cost of materials and energy, as well as of components, if you even get them in the needed quality and quantity. What is the situation? What do you expect?

PH: An important linked question is where which products are manufactured. For example, the German chemical company BASF continues to invest heavily in China. The production of ammonia, for example, is uneconomical given high German energy prices. In general, production — including machinery and components — is increasingly being relocated abroad. This is particularly true for energy-intensive industries. This development is not new. Already in 2019/2020, German gas prices were 20% higher than in the U.S. This represents an enormous stumbling block for economic development here and now.

Due to the coronavirus and partially interrupted supply chains, however, there was and still is a countermovement to bring production back to Germany. However, as supply chains and prices, except for semiconductors, slowly return to normal according to our surveys, this development is leveling off. However, we cannot yet declare the “all-clear.”

USB: The last — but not least — topic in this regard is the need for qualified personnel. In general, what is the situation?

PH: In the past, there were 15 to 30 applicants for a job, all of whom were suitable for the position. Today, with luck and effort, just one person can be found within a reasonable amount of time.

USB: To stay on the topic of personnel, what can we do to attract more staff to our small-but-fine industry?

PH: The elevator industry has realized the problem, and we have discussed it at VDMA. Especially in elevator technology, you often find lateral entrants. Young people do not know about the elevator industry, and therefore have little interest. Everyone uses elevators but is not aware of the industry. Therefore, we will launch a campaign to make the industry more attractive. We will present ourselves as attractive, secure employers with long-term business models. The campaign will focus on social media, which is not so expensive yet has a broad impact.

The ideas were presented at the VDMA annual meeting of the members. Initial reactions were positive. Over Easter, the query ran as to who would participate. There is a choice of different forms of participation in the campaign for all VDMA member companies. Job seekers are informed about the industry and actively approached. We want to make the industry known as such, because we are, of course, in competition with other industries. The launch will still take place in 2023.

USB: What about the inclusion of more women in the elevator industry?

PH: VDMA is also active here. With the Impuls Foundation, we conducted a study that confirms women have enormous potential. But, it’s hard to get women interested in technical fields of study and careers. My son graduated in 2022 with a degree in electrical engineering — along with 60 men and two women. Is it just a lack of attractive presentation? We regret this development. That there are possible solutions is shown by our part-time degree course in building automation initiated by VDMA in which women are enthusiastically involved, but still too few. At the International Sanitary and Heating Fair, there used to be a student day where we deliberately always had a woman onstage to talk enthusiastically about her professional life. It’s again time for more visible female role models.

USB: Are there any other topics you would like to mention concerning markets?

PH: It is still important to me to make clear that today building services technologies, including elevators, must be regarded as a complete ecosystem. The elevator is an elementary part of the building that can no longer be considered in isolation. The reason is digitalization, which is also becoming increasingly integrated in buildings. Service robots must also be able to use elevators without any problems. Integration is possible via common interfaces; standalone solutions have had their day. Other players from service companies, robotics, building services and IT are already filling emerging niches and seeking opportunities in the changing market. I include connectivity to access controls from the security technology sector, for example. The business models of the “Big 4” and others are already changing.

USB: Thank you, Dr. Hug, for your insights and information.

About VDMA

With more than 3,600 members, VDMA is the largest network organization and an important voice for the machinery and equipment manufacturing industry in Germany and Europe. The association represents the common economic, technical and scientific interests of this unique and diverse industry.

One of their assembled 35 trade associations, VDMA Lifts and Escalators represents the interests of the German elevator industry. It stands for nearly 90 member companies from the lift, escalator and component sectors, which, with a turnover of more than EUR2 billion, accounts for around 90% of the lift and escalator market in Germany. The main objective of their work is to represent members’ interests politically. They participate nationally and internationally in the drafting of standards and guidelines. They provide member companies with concentrated expertise on technical regulations, the economic situation and training to promote their economic development.

Highs and Lows — “Similarities and Distinctions”

The second in-depth focus of this report on the economic situation of the elevator industry, the construction industry and the economy as a whole is Switzerland. Silvia Glaus-Zinder, managing director of Verband Schweizerischer Aufzugsunternehmen (VSA) (Association of Swiss Elevator Companies; aufzuege.ch), took a great deal of time to explain the background to your author orally and provide up-to-date Swiss economic data. In doing so, she emphasized that the integration of the Swiss elevator industry into surrounding countries (Germany, Italy and France) is no issue in Switzerland itself. There are similarities and distinctions.

The main focus in the Swiss elevator industry is currently barrier-free construction, firefighters’ elevators and noise abatement. The pandemic is no longer an issue, but interrupted or sluggish supply chains still are. There is also a shortage of components in Switzerland due to the Ukraine war, which is causing a major problem.

There is a shortage of components in Switzerland due to the Ukraine war, which is causing a major problem.

Also, as a consequence of the war, in the fall/winter the proclamation of a so-called power shortage situation was threatened. This would result in elevators no longer being used already as a first step. VSA and its members have been actively lobbying to make the case that elevators are extremely energy efficient and recuperate energy, for example. “When users are not allowed to use elevators, it creates serious havoc,” is our statement. While federal agencies intended to remove elevators from the relevant papers, escalators should continue to be included, which would make train stations, airports and shopping malls usable. However, the campaign of the Federal Office of National Economic Supply (Bundesamt für wirtschaftliche Landesversorgung BWL) to conserve electricity, now at least, forgo restrictions and bans on operations related to elevators and escalators.[3]

Elevator Market

Currently around 250,000 elevators are in operation in Switzerland. Since 2005, new elevators placed on the market must be reported by law, along with all elevators placed on the market since 2001. As of December 31, 2022, 6,847 new elevators placed on the market (including 1,839 replacements) were reported to the central elevator register of the Federal Elevator Inspectorate (Eidgenössischen Inspektorates EIA), a significantly lower number than in 2021, with 8,065, or even in 2020, with 8,777. This was even the lowest number since 2012. The three cantons with the largest numbers in this regard in 2022 are Zurich with 1,091, Vaud with 648 and Bern with 694.[4]

Construction Economy 2022/2023

The Swiss Association of Master Builders (Schweizerischer Baumeisterverband) provides economic data and quarterly surveys on the Swiss construction industry. For 2022, it attests to a “stable high level of construction activity.”[5] As in 2021, turnover and construction activity were around CHF23 billion, with construction material prices significantly risen. Profit margins were correspondingly very low at 2-3%, as higher prices were only partially passed on. As in 2021, order intake was well above CHF23 billion. Commercial business construction and residential construction declined, although a housing shortage is now becoming apparent. Public sector construction, on the other hand, increased. In 2022, only 38,000 new apartments were approved — the lowest figure in 20 years. Skilled workers also remain a scarce commodity.

Together with Credit Suisse, the Swiss Contractors’ Association publishes the Construction Index four times a year.[6] It forecasts the development of turnover in the main construction sector. For 2023, turnover is expected to be 1.0% below that of 2022. In Q1 2023, the Construction Index fell for the first time in the last 12 months. Main construction turnovers are expected to be down 2.4% from the previous quarter, driven by commercial and residential construction. Negative influences include:

- Rising financing costs

- The economic slowdown

- Fewer planned new residences and office space

Most regions in Switzerland are reporting below-average investment volumes, but there are signs of construction prices normalizing.

On the positive side, there is a high level of existing order backlogs and new orders. Most regions in Switzerland are reporting below-average investment volumes, but there are signs of construction prices normalizing.

Economic Situation

The Swiss economy grew by 2.1% in 2022 (real GDP), despite the Ukraine war and rising energy prices. Adjusted GDP was plus 0.2% in the 3rd quarter of 2022 and +/- 0.0% in the 4th quarter of 2022.

The Federal Government Experts Group for Economic Forecasts expects the Swiss economy to grow at a significantly below-average rate of 1.1% in 2023 and 1.5% in 2024. The energy situation in Europe has eased, but inflationary pressure remains high internationally.[7]

Regulatory Affairs

The most important elevator standards are listed on the VSA website, aufzuege.ch. The quarterly report on the current status of important standards for elevators and escalators can also be found there. The contact person for elevators and escalators at VSA is Giuseppe Martino, head of the Standards Department and member of the Executive Board at the Swiss Society of Engineers and Architects. He is also chairman of the Swiss Supervision Committee for European Standardization with 10 persons, located at VSA.

VSA recently received many inquiries about shaft smoke extraction. Therefore, current laws and standards were supplemented in 2022 together with the Swiss Engineering Association (SIA) by the VSA leaflet “Testing Certificate Ventilation (Prüfbestätigung Be- und Entlüftung)” in German and French. The topic is discriminated, and interfaces are pointed out.

The topic of occupational safety based on relevant laws has also always been very high on the agenda. VSA is in constant conversation with other Swiss associations. As early as 2018, VSA published a brochure titled “Sicher Arbeiten an Aufzügen – Persönliche Schutzausrüstung (PSA) Dabei? Und überprüft?” (“Working Safely on Elevators – Personal Protective Equipment Included? And Checked?”) VSA has also explained the Safety Norm for Existing Lifts (SNEL) in accordance with SIA 270.080 in a brochure based on documents from the ELA.

The Construction Work Ordinance (Bauarbeitenverordnung) was revised, effective January 1, 2022. It applies to the entire construction industry in Switzerland with its 70,000 companies. Among other things, modified requirements apply to work on ladders, roof edges, scaffolding and pits/shafts. The Swiss Accident Insurance Fund (Schweizerische Unfallversicherungsanstalt Suva) lists the three main changes as:

- Written documentation of the safety and health protection concept

- Measures to protect employees in the sun, during heat and cold

- Sufficiently illuminated workplaces and routeways

Special Features

A special feature of Switzerland is that it has four official languages: French, Italian, German and Rhaeto-Romanic. Glaus-Zinder speaks all official languages, plus English and Spanish, a consequence of Switzerland’s role as a European hub and the European elevator business. In the association, too, many brochures are written in three languages (excluding Rhaeto-Romanic). As an example, Glaus-Zinder uses the now-fourth edition of the “VSA Guide to Lift Retrofits” of May 2022, which can be downloaded free of charge from the website, as can all other VSA papers mentioned above.

Finally, another special feature of Switzerland are the many elevators in mountainous locations and on mountaintops. As a traditional example, Glaus-Zinder mentions the Hammetschwandlift, which provides access to the Bürgenstock.[9] Today, this elevator would no longer be buildable in the same way. At that time, pioneering elevator work was done. Today, this elevator is visited by many locals and international guests. Another “highlight” in this respect is the new elevator in Zermatt in the valley station of the 3S-Railway, as well as the modernization performed on the Testa Grigia on the Kleinmatterhorn.

About VSA

The Association of Swiss Elevator Companies (Verband Schweizerischer Aufzugsunternehmen [VSA]) is the leading industry association of elevator companies in Switzerland. It is a member of the European umbrella organization ELA. It provides operators and users with independent information on the installation, modernization and maintenance of escalators and elevators. VSA and its members are committed to safety and quality in the elevator industry and to occupational safety. The 11 members of VSA cover 90% of the Swiss market. New members include TK Aufzüge (elevators) and Ascensori (elevators) Falconi, a small to medium-sized enterprise from Ticino, Switzerland. VSA member Ascenseurs Menétrey (elevators) in Romont, Switzerland, received the 2021 Innovation Award from the Canton of Fribourg for the development of a new cabin.

References

[1] Swiss Federal Office for Statistics (Schweizer Bundesamt für Statistik)

[2] vdma.org/viewer/-/v2article/render/77037089

[3] bwl.admin.ch/bwl/de/home.html

[4] svti.ch/eidg-inspektorat-fuer-aufzuege/wissen-veranstaltungen/statistik-gemeldeter-aufzuege

[5] baumeister.swiss/stabil-hohe-bautaetigkeit-im-2022-zusaetzlicher-druck-auf-die-tiefen-margen-2

[6] baumeister.swiss/baumeister-5-0/konjunktur-statistiken/bauindex

[7] State Secretariate for Economic Affairs [Staatssekretariat für Wirtschaft SECO], Directorate for Economic Policy, Business Cycle; seco.admin.ch/seco/de/home/wirtschaftslage—wirtschaftspolitik/Wirtschaftslage.html

[8] felstechnik.ch/felssplitter/felssicherung/neue-fundamente-fuer-den-hammetschwand-lift

[9] celtic-lift.ch

Get more of Elevator World. Sign up for our free e-newsletter.