The Indian elevator market is on the path to touching record heights.

by Gopalkrishnan Shanker and R. Eashwar Ramu

India is one of the high-growth economies of the world. While the growth had begun to slow down a bit from 2018, the pandemic and ensuing lockdowns resulted in the economy contracting by 6.6% in FY 2020-21. However, there was smart recovery, and the economy posted an 8.7% growth in fiscal year (FY) 2021-22. For the current year, the official forecasts range from a 6.8% to 7.0% expansion of the economy. India’s gross domestic product (GDP) in FY 2021-22 is placed at INR236.6 trillion (at current prices), i.e., US$3.17 trillion. Going forward, the country seems well set to resume its growth path at the long-term average of 6 to 6.5% per annum.

The building and construction sector is one of the key contributors to the Indian economy and provides employment to more than 40 million people. Contribution of the construction sector to the GDP in India reached a high in 2021-22 and was estimated at INR17.0 trillion (US$228 billion).

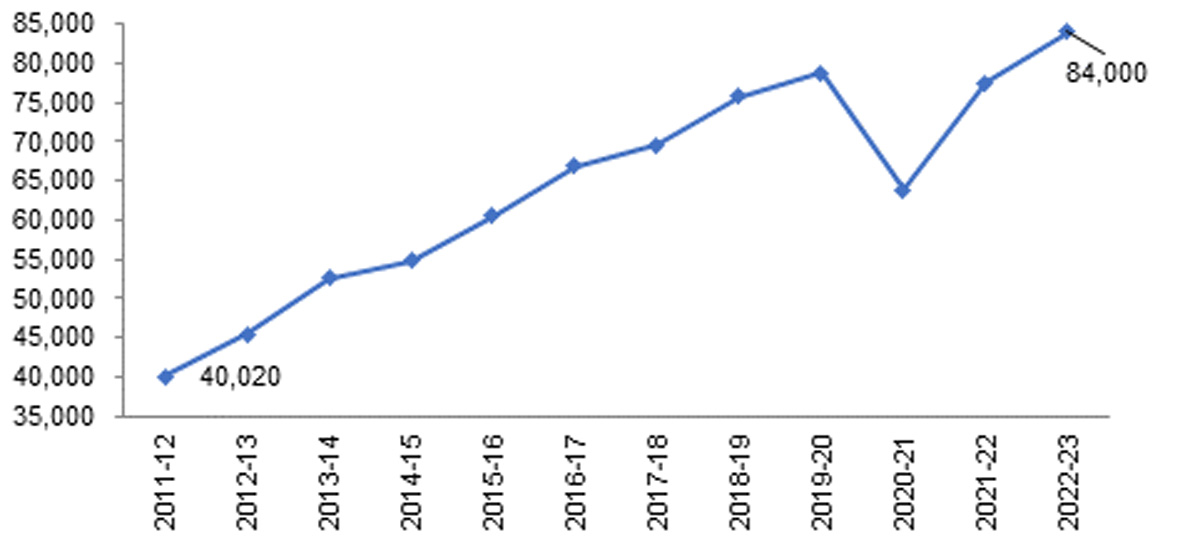

Rapid industrialization and urbanization have led to the vertical growth of cities in the emerging economies, which, in turn, has fueled demand for elevators and escalators. The elevator market in India has grown well over the last three decades since the economic reforms began in 1991-92. The growth of the elevator industry, which had witnessed double-digit numbers, faced a decline, owing to the slowdown of the real estate sector, as well as the introduction of the regulatory reforms of 2016 and 2017. The elevator industry, similar to all other industries, was adversely affected with the onset of the pandemic; the industry weathered the lull and has since bounced back to reach pre-pandemic levels.

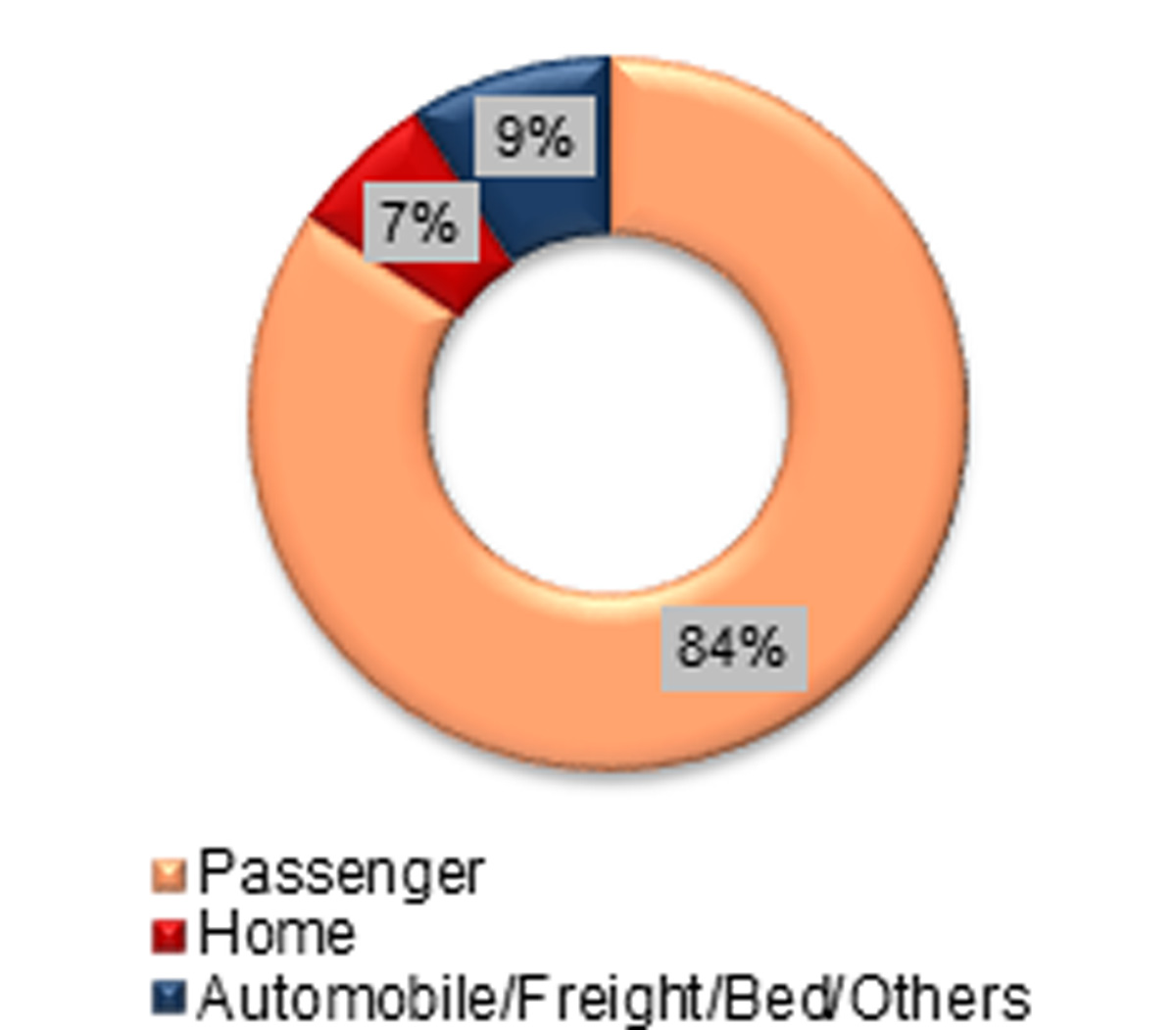

India continues to be one of the leading global markets for elevators with an installed base of more than 700,000 elevators. The market for new installations in India, as measured by the orders booked, is estimated at around 84,000 units for FY 2022-23, of which passenger elevators account for about 84%. An impetus for affordable housing, an increasing number of housing projects and a rising number of hospitals are some of the key demand drivers. Home elevators are witnessing an uptick, with increasing demand for villas and row houses in gated communities and premium/designer apartments.

The Western region is the leading region for elevators; however, the Southern region has been growing at a faster pace in recent years and has outpaced the other regions. Demand for higher-capacity elevators is expanding. The commercial, retail, airport and metro rail station sectors need spacious elevators with capacities upwards of 1000 kg.

Demand for elevators with speeds of 1.5 – 2.0 m/s is expected to grow faster than others, as there is an increasing preference. Owing to the increased impetus given to the affordable housing scheme by the government, elevator manufacturers have product offerings at the lower end of the speed spectrum, as well.

The adoption of machine-room-less (MRL) elevators has accelerated significantly in the last decade. Almost all the manufacturers of elevators have product offerings with MRL technology. MRL technology is now available for even high-rise buildings. Key advantages of MRL elevators include energy efficiency, smoother travel, lower weight, better design and space savings.

The residential segment continues to be the key segment driving demand for elevators in the country. Other key end-user sectors of passenger elevators include commercial, retail, industrial, hotels, hospitals, airports and metro rail stations. The warehousing and data center segments are new additions contributing to the demand for elevators in the country.

Metros such as National Capital Region (NCR), Mumbai, Bengaluru, Hyderabad, Pune, Chennai, Ahmedabad and Kolkata remain the key markets in terms of number of elevator units sold. Urbanization has been rapid in India (noticeably in some of the Tier II cities) in the recent decades. It is quite evident that the vertical growth of cities and towns is gradually taking place in India.

The pattern of growth of the elevator market varies across regions, and preferences are not quite the same across regions. This implies that the Indian market cannot be seen as a single market but as a confluence of multiple markets. The concept of “one size fits all” might not work across the country. In the next five years, the market for passenger elevators is forecast to grow at a compound annual growth rate of around 7–8% per annum. The Government’s focus on infrastructure projects will also drive demand for passenger elevators and escalators in the country.

About MCG

Established in 1985, Madras Consultancy Group (MCG) is a specialist firm in developing B2B marketing strategies. MCG has successfully completed more than 1,200 assignments in the last three decades across diverse sectors, including building materials, engineering, machinery and equipment, metals and mining, packaging, power and infrastructure. Since 1998, MCG has completed a large number of consulting and research studies on elevators and escalators in India, Sri Lanka, Bangladesh and the Gulf Cooperation Council (GCC) region.

Get more of Elevator World. Sign up for our free e-newsletter.