Latest market statistics give Italian VT industry reason for cautious optimism. [1]

Two years ago, your author wondered if the Italian lift industry would see the light at the end of the tunnel.[1] The answer is given by AssoAscensori President Robert Zappa. He recently said, “Following the drop caused by the crisis, the Italian market is back to growth.” Let us step back in time for a moment.

Historical Trends

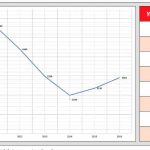

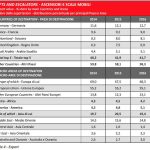

Elevatori has reported on historical trends. If we look at the 1997-2006 pre-crisis period, we see the Italian lift industry growing in terms of number of new lifts per year, on average, by 5.2%. The sector was in excellent shape. It had average growth far above that of the Italian gross domestic product in the same timeframe. In 2006, the total turnover of the national lift industry was worth EUR2.6 billion (US$3 billion), 32% from export. Then, the situation changed. In 2008-2009, the crisis arrived, hitting the sector with an 18- to 24-month delay. For the first time since World War II, the Italian lift industry experienced a decrease. The total turnover of the Italian vertical-transportation (VT) industry dropped from EUR2.6 million (US$3 million) in 2009 to EUR2.2 million (US$2.5 million) in 2014.[2] In the pre-crisis era (2008), some 18,000 to 20,000 new lifts were installed in Italy. This dropped to 10,267 in 2012, 8,275 in 2013, 7,564 in 2014 and 7,579 in 2015.[3] In the same period, the industry in Germany, Spain and the U.K. grew. France showed a slight decrease (Table 1).

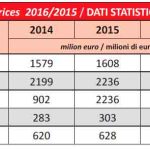

At current values, total turnover has been declining. As shown in Table 2, in 2009, it was EUR2.605 million (US$3 million); 2010, EUR2.474 million (US$2.8 million); 2011, EUR2.562 million (US$2.98 million); 2012, EUR2.440 million (US$2.84 million); 2013, EUR2.298 million (US$2.67 million); and, in 2014, EUR2.199 million (US$2.56 million). The Italian industry saw the light at the end of the tunnel in 2015, however, with a slight recovery to EUR2.236 million (US$2.6 million).

The Rapporto ANIE/AssoAscensori 2014 wrote:

“Following a difficult 2012, in 2013, the Italian lift and escalator industry showed a further decrease of total turnover: -6.2% at current values from -4.4% in 2012. Future trends remain uncertain, depending on the real recovery of international market investments. Exports might take advantage of the internationalization strategy adopted by companies toward new markets.”

New Scenario

The scenario has changed slightly since then. The latest Federazione ANIE[4] report states the Italian technology industry is leading the recovery. The 2016 data recorded a 4.2% increase in total turnover for the electronics sector and substantial stability (-0.7%) for the electrotechnics sector, which includes lifts and escalators.

Both industries show positive trends and diversified growth in 2017 for the first quarter. The new trends have been confirmed by data provided by the National Institute for Statistics, the main supplier of statistical information in Italy. According to the institute, between January and March 2017, internal market orders for both the electronics and electrotechnics industries had a 9.1% increase, compared to Q1 2016. Export didn’t perform as well: +3.7% (versus Q1 2016).

The ANIE Report has a positive outlook for the future in all market sectors of the federation’s member companies, including building construction, infrastructure and energy. The report observes:

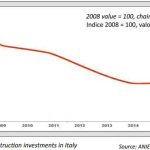

“We had a decade of deep weakness. Since 2008, building construction investment dropped by 30%. In 2016, turnover grew by nearly 2%. Now, in 2017, we see the first trend change in all building construction-related technologies.”

Such a changed scenario has a direct impact on the national lift and escalator industry.

Back to Growth

According to AssoAscensori, in 2016, total turnover grew by 2.5% compared to the previous year. Nevertheless, the report still takes a thoughtful approach, observing, “Even if we had a slight improvement in 2015, we should look at the more recent growth signals with caution, as we had a long phase of market weakness.”

Looking at the international market (+2.9% in 2016/2015 versus +1.8% in 2015/2014), “the positive datum might show a stabilization of the industry, even if market levels are significantly lower than the pre-crisis period.”

In the 2009/2015 period, the internal market, representing products sold only in Italy, constantly decreased, going from EUR2.090 billion (US$2.43 billion) in 2009 to EUR1.608 billion (US$1.87 billion) in 2015. The decrease curve has become steepest since 2011.

The 2016 datum finally shows a slight recovery of +2.9%, to EUR1.655 billion (US$1.92 billion). “The whole contraction mostly derived from the new installation market,” AssoAscensori observes, continuing:

“Yearly sales are now one-third of what they were in 2008. Such a trend is strictly linked to building construction dynamics. Following a very difficult decade, in the last two years, we have had fluctuating recovery signals. The extraordinary maintenance sector confirmed a more stable [ability to] withstand [market fluctuations] and represents nearly 40% of total building construction improvements.”

Export: +2.8%

In 2016, Italian lift exports kept growing (+2.8% versus +3.1% in 2015/2014), reaching turnover of EUR957 million (US$111.4 million). They were at EUR931 million (US$108.3 million) in 2015 and EUR902 million (US$105 million) in 2014. This mostly derives from the stability of the core European markets, which represent more than 68% of total exports (Table 4). However, demand from non-European markets showed a deeper weakness.

According to AssoAscensori, such trends are in line with the evolution of the global building construction industry. Following the expansion of the previous five years, an adjustment phase followed in 2016. The association observes:

“The most critical aspect, among others, is the slowdown of the most important emerging countries, China in particular, even if the country still maintains the highest investment values at the global level.”

On the contrary, new growth opportunities in non-European countries were offered by specific markets in Asia and the Americas.

Building Construction Market

The AssoAscensori report closes with an analysis of the European building construction market (Table 6). It states:

“In 2016, the recovery of the losses suffered during the crisis continued. Positive investment trends were recorded in most European countries, even at different development paces. Some markets, such as Ireland and Sweden, were really dynamic. Others, such as Germany and Spain, had a less dynamic positive trend. Recovery signals arrived from Greece, which, in the past, showed a persistent weakness. Some countries in eastern Europe, such as Hungary and the Czech Republic, are in countertendency, even if, in the past, they had interesting growth levels.”

The expected growth of building construction investment in Europe might have a positive effect on the Italian lift industry in 2017, even if we are in the presence of some major variables.

Two years ago, we wondered if the Italian VT industry would see the light at the end of the tunnel. Well, it seems we are out of the tunnel — maybe just barely out, but out, nonetheless.

- Table 1

- Table 2

- Table 3

- Table 4

- Table 5

- Table 6

References

[1] Liberali, Fabio, “Growth Is Back!” Elevatori, November-December 2017.

[2] AssoAscensori, various reports

[3] European Lift Association/AssoAscensori, various reports

[4] Federazine ANIE is made up of 14 industrial associations, representing

more than 1,300 companies and approximately 468,000 employees with total

aggregated turnover of EUR74 billion (US$8.6 billion).

Get more of Elevator World. Sign up for our free e-newsletter.