Indonesia Rising

Oct 1, 2015

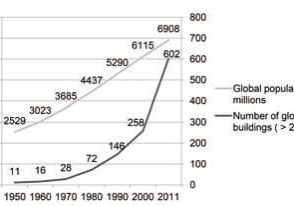

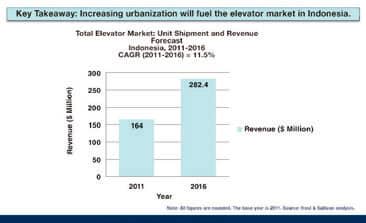

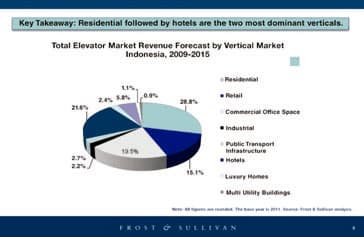

Underlying megatrends such as urbanization and population growth are driving business for vertical-transportation companies in the world’s largest island nation.

When Jakarta, Indonesia, hosted the 1974 Conference on Tall Buildings and Urban Habitat, there were very few tall buildings in the capital city. Clearly, though, Indonesia had high ambitions—ambitions that today are coming to fruition as numerous tall and supertall buildings are under construction or proposed in the capital. Conference host the Council on Tall Buildings and Urban Habitat (CTBUH) returned to Jakarta in summer 2013, but this time to stay: on July 5 of that year, the organization launched its Indonesian chapter on the site of the proposed 638-m-tall Signature Tower, which, if built, will be the tallest building in the county and the fifth tallest in the world.

Throughout Indonesia, airports are being built or expanded, and hotels are multiplying at a rapid pace as the nation becomes even more popular as a tourist destination and the political landscape and regional policies evolve to pave the way for development.

Indonesia, the world’s largest nation comprised entirely of islands, offers both challenges and opportunities, according to those who do business there. Among the challenges: a relatively new and still-stabilizing democracy, air-travel safety issues, the potential for natural disasters such as earthquakes and volcanic eruptions, lack of a skilled workforce and dependency on foreign capital/fluctuating exchange rates.

Rewards, however, can be great, as evidenced by the nearly 40 200-m-or-taller buildings that are proposed, under construction or recently completed,[1] the elevator contracts being awarded, and the announcements of new business partnerships and branch offices. In terms of vertical transportation, new midsize to tall buildings are generating business for everyone from OEMs to smaller, domestic outfits. Almost without exception, Jakarta is where the majority of significant buildings are taking shape, but the city is by no means the only place in Indonesia experiencing growth, observes Sapta Goenata, founder of PT Koppelindo Elevators, based in Jakarta.

Koppelindo recently installed units in Indonesia’s second-largest city, Surabaya (population: approximately 2.76 million[2]), a major shopping destination with numerous malls;[3] Bekasi City (population: approximately 2.3 million[2]), which boasts malls and manufacturing plants such as Honda, Samsung and Converse;[4] the industrial and manufacturing hub of Tangerang, home to more than 1,000 factories;[5] and popular tourist and shopping destination Bandung.[6] The first part of 2015 was busiest for Koppelindo, with the latter half of the year seeing business contract, Goenata observes.

Over the longer term, prospects are solid, says Mitsubishi Electric spokesperson Katsunobu Moroi. He expects national, annual demand to grow from its current 2,500 units to approximately 3,500 units in five years, and reach 5,000 units in 10 years. The biggest growth will be in the low- to mid-rise market with activity occurring not only in Jakarta but in other Indonesian cities such as Subayara, Medan, Balikpapan and Makassar.

Despite the shadow cast by recent passenger-jet accidents in the region, the Association of Southeast Asian Nations (ASEAN) Open Skies Policy, which went into effect on January 1, is laying the groundwork for increased construction, Goenata states. The policy is designed to enhance regional trade by allowing airlines of ASEAN members—Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam—“to fly freely throughout the region via the liberalization of air services under a single, unified air-transport market.”[7] Goenata observes:

“Compared to before the policy went into effect, it is now easy to take a flight from Jakarta to another island. As a result, road infrastructure is being built, and investors from both the region and overseas are building hotels, offices and apartments on other Indonesian islands such as Papua, Sulaiwesi and Sumatra.”

The diversity of the Indonesian market is reflected in the 2014 Schindler Group Review. Contracts awarded to the company, all in Jakarta, include:

- St. Regis hotel and office buildings, 42 elevators and six escalators

- Sudiman Central Business District office building, 29 elevators and six escalators

- Soekarno-Hatta International Airport Terminal 3, 38 elevators

- Rudo Delta Mas office buildings, 50 elevators

- Thamrin Nine Tower 1 (the country’s current tallest building), 32 elevators and 34 escalators (ELEVATOR WORLD, March 2015)

ThyssenKrupp, meanwhile, has very deep roots in Indonesia. It has supplied the nation with steel rail since the late 1800s. Vertical transportation is a rather recent development, however, with ThyssenKrupp opening an Elevator Technology Sales and Service office in Jakarta in 2005. Today, that office has more than 160 employees, and they stay busy. Like its independent counterparts, ThyssenKrupp’s business is bolstered by an array of midsize and tall projects in Jakarta and beyond.

In 2015, ThyssenKrupp supplied 22 units to the Arcade office towers in Jakarta, ranging from nine to 14 stories. Outside of Jakarta in Bumi Serpong Damai, it provided 12 units to the 28-story Casa De Parco apartment towers.

Tourism, Changing Politics Drive Business

Indonesia is a major tourist destination, and the hospitality sector is a big driver of business. Property consultant Colliers International projects 6,251 new hotel rooms to come on-line in the Jakarta market over the next three years, creating demand for vertical transportation. Among companies keeping Indonesia’s tourists moving vertically is Sigma Elevator & Escalator, which in 2015 supplied equipment to 15 hotel properties, not only in Jakarta, but across Indonesia.[8]

Goenata is encouraged by the July 2014 election of President Joko Widodo—the first Indonesian president who is not a product of the nation’s political elite or military[9]—and believes prosperity will continue if Widodo gets reelected. Widodo has emphasized maritime and other infrastructure development and increased electric power capacity. To that end, he did away with gasoline price subsidies shortly after taking office in an effort to free up funding to build infrastructure.[10]

Michiel De Moel, former regional managing director for KONE’s Southeast Asia office who has since formed a Singapore-based consultancy with KONE’s former head of technology Johannes de Jong (p. 30), observes Jakarta is similar to other large and developing cities in the region in that it has a weak infrastructure (compared with established world cities), unskilled workforce, dependency on foreign capital and fluctuating exchange rates. He opines: “This makes the planning, design and development of tall buildings a challenge, potentially causing delays or changes in plans.” Indeed, Pertamina Energy delayed construction of its 99-story, 530-m-tall tower in Jakarta earlier this year.[11]

The Pertamina tower reflects Indonesia’s progressive attitude about design and energy efficiency. The Skidmore Owings & Merrill (SOM) design resembles a giant, elongated razor clam with a top that forms a funnel to generate wind energy—one of an array of features that make the design “a model of sustainability and efficiency,” according to SOM (EW, February 2014).

Technology for Earthquake Protection, Efficiency

The largest cities in Indonesia are earthquake prone, so de Jong advises that elevator systems incorporate the strongest earthquake protections possible from EN 81–77 and ASME A17.1. He says these

measures include:

- Rails able to withstand high acceleration

- Guards to hold ropes in place

- Earthquake sensors to stop elevators when the initial, non-destructive seismic waves hit

- Protection wires near brackets and sills to prevent ropes from getting stuck behind these items

- Counterweight derailment wires that stop an elevator when the counterweight derails in an earthquake

Because earthquake-protection equipment adds cost, it is not always implemented, de Jong notes. Many Indonesian towers are being built without clear vertical-transportation specifications, he states. Add that to what Frost & Sullivan calls “an extremely price-sensitive market. . . that has restricted the entry of certain participants that offer premium products and value-added services,”[12] and earthquake-protection equipment for elevators is often nonexistent.

Still, De Moel observes Indonesian customers are “clearly interested in new technologies, especially when there is an economic benefit and/or when the technology will help them improve the reputation, brand or value of their building or company.” Destination-dispatch solutions are popular; several of the Schindler installations mentioned above implement its PORT technology.

De Jong adds that it is only a matter of time before Indonesian customers demand the latest technologies, such as UltraRope (EW, August 2013). Observing there are several supertalls such as Signature Tower in the works, he notes, “There are many buildings in Indonesia that could benefit from an UltraRope modernization or from using UltraRope in a new installation.”

Challenges aside, the consensus is that Indonesia is a good place to do business. De Moel states Indonesian people are generally fun to work with, family oriented, modest and polite. Recruiting and training staff can be a tough task when a company is in growth mode, but if it’s done right, the rewards will be high business growth, satisfied customers and happy employees, De Moel observes. “When you have been able to establish relationships and show you really care, both customers and employees alike will support you and the business,” he adds. That will be important as Indonesia comes into its own as a tall-building capital.

Upon launch of its Indonesian chapter, CTBUH observed:

“Indonesia has been growing rapidly since Asia’s last financial crisis in the late 1990s. Driven by the increase in property values and land prices, the number of tall buildings in Jakarta’s Sudirman central business district has skyrocketed. Numerous 30–60 story developments are being constructed alongside several supertalls.”

All of those in the elevator industry hope the current upward trend in Indonesia continues indefinitely.

If it’s built, Signature Tower will be the fifth-tallest building in the world.

The Swiss Belinn Manyar Hotel in Surabaya

Schindler provided the vertical-transportation system for the St. Regis hotel in Jakarta, set to open in 2016.

Schindler provided 38 elevators to the new Terminal 3 of the Soekarno-Hatta International Airport in Jakarta.

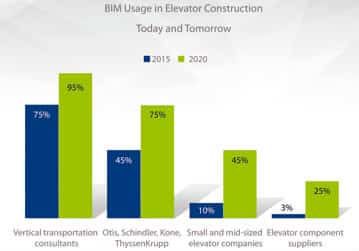

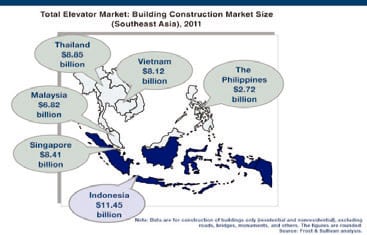

Building Construction Market

Elevator Market Revenue Forecast

Elevator Market Split by Verticals

References

[1] The Skyscraper Center, The Global Tall Building Database of the CTBUH, “Indonesia Buildings.”

[2] World Population Review, “2015 Indonesia Population,” worldpopulationreview.com.

[3] wikipedia.org/wiki/Surabaya

[4] wikipedia.org/wiki/Bekasi

[5] wikipedia.org/wiki/Tangerang

[6] wikipedia.org/wiki/Bandung

[7] ASEAN Briefing, Business Intelligence from Dezan Shira & Associates,”Open Skies Policy to be Implemented in 2015,” January 2, 2015.

[8] PT. Jaya Kencana, Mechanical & Electrical Engineers, jayakencana.com/portfolio/10/1/sigma-lift-and-escalator/hotel.

[9] wikipedia.org/wiki/Joko_Widodo

[10] The Wall Street Journal, “Indonesia Scraps Gasoline Subsidies,” (Sentana, I Made), December 31, 2014.

[11] Detik Finance, “Oil Price Drops, Pertamina Delays High Tower Project,” (Dhany, Rista Rama), February 17, 2015.

[12] Frost & Sullivan, “Elevator Market in Indonesia Rides High on Urbanization, Finds Frost & Sullivan,” www.frost.com, November 28, 2012.

Get more of Elevator World. Sign up for our free e-newsletter.