“Lift Industry Report 2021” covering information, data and considerations about the lift and escalator industry was published by the Ministry of Industry and Technology.

The Ministry published the data of 2021 under the title of “Lift Industry Report 2021” again, with a revision it made in the title of last year’s “Lift Industry Report 2021,” which consisted of 2020 data.

Although the turnover of Turkish lift industry is lower than other sectors in general, it constitutes an important field of activity in terms of the country’s industry, economy and employment thanks to its function and being widely preferred as the most common means of transport.

With new technologies developing across the world, the Turkish lift industry has also entered into a great period of change and reached significant market shares in world trade.

The Turkish lift industry should directly be considered with urbanization, and the construction sector that have been developing in connection with it. Considering that the urbanization process will continue and new earthquake-resistant buildings will be constructed instead of existing buildings in Türkiye, the lift industry will inevitably grow in parallel with activities of the construction sector. Ongoing Turkish investments in the Middle East, the Balkans and African countries have been continuing to affect the lift industry positively. Problems experienced in the Middle East in recent years have led to a market shrinkage in the lift industry.

However, despite the presence of multinational companies with over 100 years of experience and background and the national lift industry being in its early stages, it is inevitable for the success and workload coming from Türkiye’s location to grow equally. The most important reason for this development is that lift component manufacturers have achieved production efficiency. In addition, innovation and R&D activities in need of development have great importance for the future perspective of the sector.

Number of Lifts Installed in Türkiye Exceeded 700,000

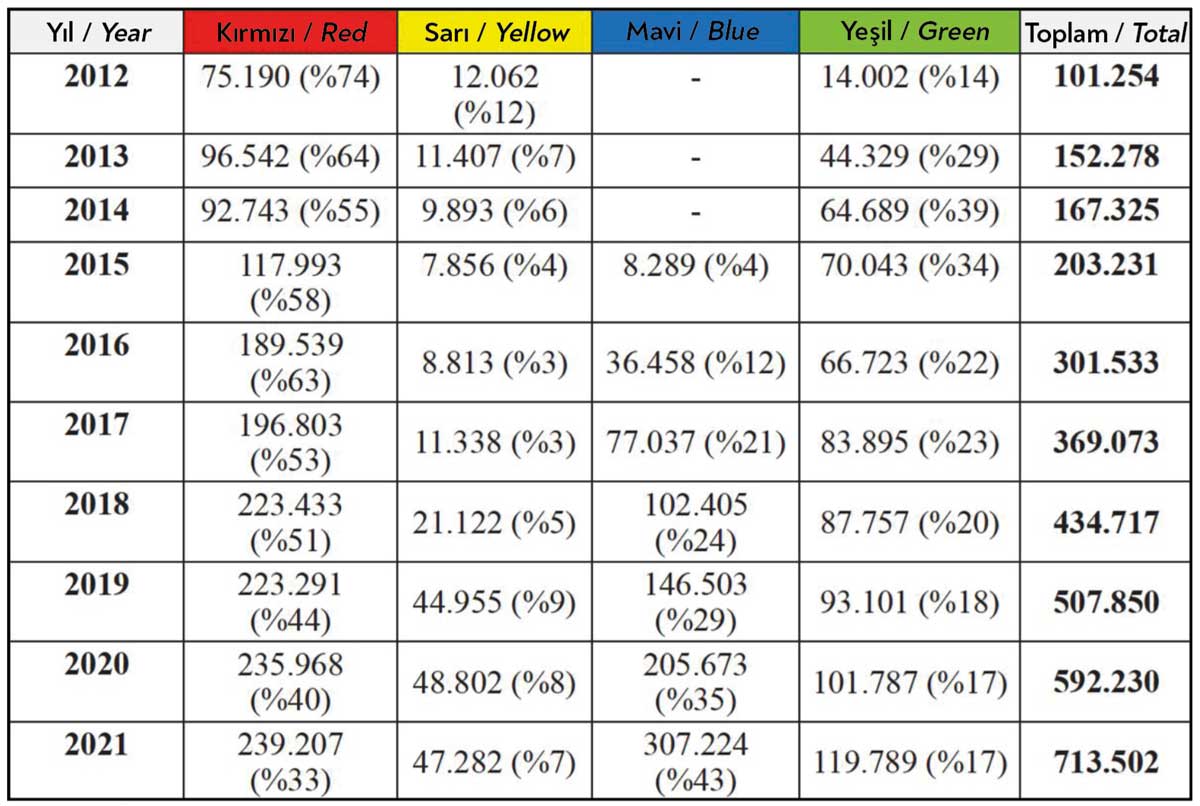

According to the report, periodic controls of 713,502 lift units in total were carried out in 2021. In consequence of these controls, 239,207 lifts (33%) received red labels, 47,282 lifts (7%) received yellowl labels, 307,224 lifts (43%) received blue labels and 119,789 lifts (17%) received green labels.

Based on the results of periodic lift controls, which first started in 2012 according to the table, it is seen that there has been a tenfold increase in the number of lifts controlled within the past 10 years.

Component and Package Lift Exports Increasingly Continue

In recent years, works of Turkish companies have started to be seen in segments such as installation and complete (package) lift sales abroad. Moreover, there has been a significant increase in the number of companies that carry out lift installation works in Turkic republics, the Middle East and EU countries. The development of foreign trade with African countries especially leads Turkish lift companies to increase their investments in these countries.

Countries that import lift components from Türkiye include EU countries, Middle East countries and Turkic republics. Moreover, the fact that components are exported everywhere from the Middle East to South America shows that competitive power has increased remarkably. However, it is observed that component exports have been focused on products originating from the Far East.

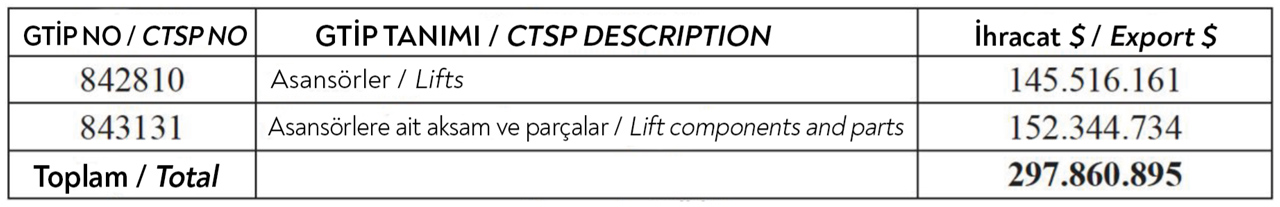

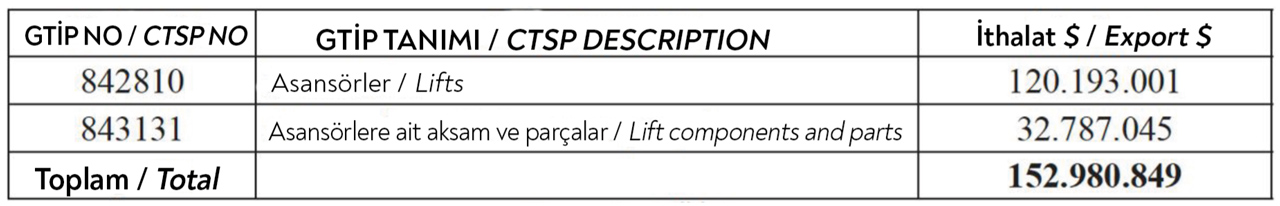

According to import and export figures for 2021, total foreign trade volume in 2021 was at the level of $451 million. Considering the field of activity of the Turkish lift industry, it is estimated to have a turnover of around $2-3 billion across annual number of lift installations according to buildings constructed in 2021, certification services, periodic control services, component production and maintenance services.

For years, the strongest segment of the lift industry has been lift components and parts manufacturing, achieving an export surplus in foreign trade. This segment stands at a significant point in balancing lift exports and imports, which is supported by foreign trade figures for 2021. The foreign trade surplus of $145 million in this segment can be accepted as the most important indicator of this situation.

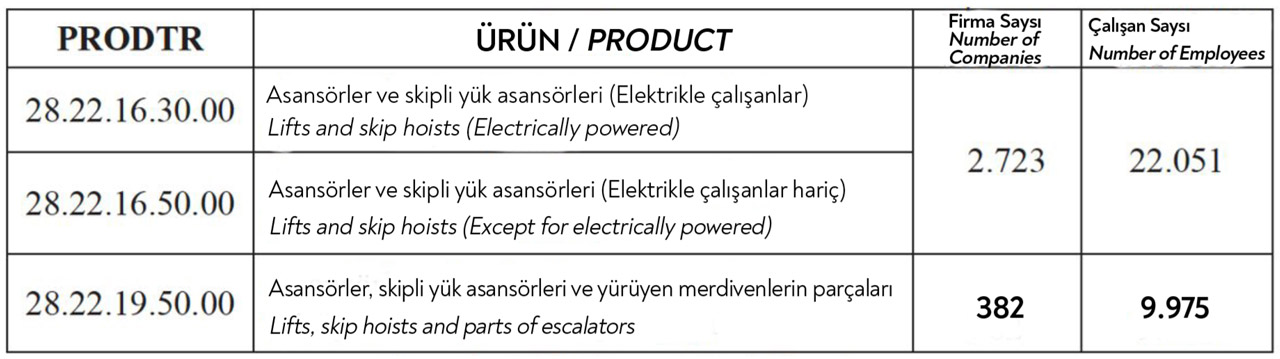

Number of Companies with SCC Decreased While Number of Component Manufacturer Companies Reached 382 with a Record Increase

Another attention-grabbing topic in the report is that the number of companies with Service Competence Certificates (SCC) granted by the Turkish Standards Institution for maintenance services decreased from 3,072 to 3,061, while the number of component manufacturer companies rose from 285 to 382 with an increase of 34%.

According to data from annual operating statements (2021) submitted by lift installers and component manufacturers to the Ministry of Industry and Technology, the number of employees in the sector reached 32,026. Moreover, it is estimated that approximately 40,000 people work in this segment, including activities such as certification and periodic control.

More than 800,000 lifts have been installed and commissioned in Türkiye. The majority of these lifts, including the existing and newly installed ones, are still being used.

Considering new lift installations as part of the activities of the lift industry, the number of lifts -which had a tendency to increase in 2013, 2014, 2015, 2016, 2017 and 2018- declined in 2019 and 2020 due to the setbacks in the construction sector because of the pandemic and economic problems, and started to increase again in 2021.

Get more of Elevator World. Sign up for our free e-newsletter.