by Kaija Wilkinson

Residential conversions are on the rise, and VT companies are reaping the rewards.

Rick Sayah, vice president and partner at vda, Inc. (VDA), says there’s more than a bit of irony about moving into a former office building to work from home. Yet, that’s what more and more people are doing as offices, left largely empty due to the COVID-19 pandemic and other factors, are converted into residences. It’s a trend Sayah and his colleagues at the East Hanover, New Jersey-based vertical-transportation (VT) consultancy say first emerged in earnest in the mid-2000s and has picked up steam since. David Fried, VDA vice president of sales, was involved in an office-to-residential conversion at 15 Broad Street in the mid-2000s. Formerly known as the Equitable Trust Building, the 43-story Neoclassical tower in the city’s Financial District (FiDi) was originally completed in 1928. Its latest residential conversion was completed in 2007. With high ceilings and an elegant lobby adorned with an elaborate crystal chandelier, the building did “not feel like a conversion” when resident Erin Sykes moved in. “It felt like it was born this way,” she told Bankrate.[1]

In the 1980s, the NYC residential conversion market was focused on industrial buildings (think artist lofts), Sayah says. It wasn’t until NYC tweaked some zoning rules in the 1990s that the city saw true office buildings being considered. Obstacles still remain, however, including FiDi office buildings built after 1977 face zoning rules that make conversion hard. NYC Mayor Eric Adams and New York Gov. Kathy Hochul tried, and failed, to get the 1977 cutoff removed. One investor who owned a 31-story office tower, built in 1983, ended up selling the property when the proposed change died in the state Legislature this past spring.[2]

International Association of Elevator Consultants (IAEC) President Nick Montesano of DTM Drafting & Consulting Services, Inc., says there’s a 28-story 1950s building right around the corner from his office in FiDi that was converted to condos in 1997. Montesano was a mechanic in that building, originally home to the Atlantic Insurance Co., when he met his wife in the 1990s, so it sticks out in his mind. “That one was done well before owners were even thinking about making more residential in downtown New York,” Montesano observes.

Now, the trend is escalating in volume, he says, stating:

“I would say in downtown New York, particularly, there is one owner I’m dealing with who has done about three to four of these over the past five years. Now, in his most recent one, he’s partnered with a major developer. I understand that this partnership and others at that level are looking to do a fair number of these. I’ve been hearing that 20 to 40 properties have been identified to see if they meet the specific criteria needed to convert them from offices to residences.”

Admittedly, some will not meet the criteria. But some will. That means Montesano’s outlook for conversion is pretty bullish. Montesano observes:

“Right now, the apartment cost in New York is higher than it was pre-COVID. It’s pretty amazing to come back that fast and be able to ask and get the rates they can for an apartment. I plan on seeing two or three more office-to-residential conversions come up within the first quarter [of 2024], at least in the [NYC] area.”

Fried, of VDA, says the sheer variety (and subsequent intellectual challenges) of converting Big Apple buildings is part of what makes the VT consulting business interesting. A tremendous number of one-of-a-kind, iconic NYC buildings were constructed during the “Great Depression Years” — the Empire State Building, the Chrysler Building, Rockefeller Center, 70 Pine Street and 20 Exchange Place, to name only a few, Fried observes. A couple of these have been converted.

I’ve been hearing that 20 to 40 properties have been identified to see if they meet the specific criteria needed to convert them from offices to residences.

— IAEC President Nick Montesano, DTM Drafting & Consulting Services

Completed in 1932, 70 Pine Street in NYC’s FiDi was home to the city’s first double-deck elevators; photo courtesy of StreetEasy.

70 Pine Street (built in 1932) and 20 Exchange Place (built in 1931), boasting intricate Art Deco details, saw their futures shift to residential in 2012 and 1997, respectively. Both are in FiDi. Involving changes in ownership and hundreds of millions of dollars in investment, the conversions were quite the undertakings, particularly in terms of code compliance. Sayah, of VDA, says:

“Code issues aren’t strictly related to the elevators. When converting the occupancy of a building, upgrades to accessibility and life safety are required, which affects the sizes of the elevators required. Since these requirements didn’t really exist until the 1960s, older buildings can require more significant overall structural changes.”

Carolyn Flax, VP of real estate consulting firm RCLCO, told Bankrate in August that “there’s a lot of nuance in executing office-to-residential conversions.”[1] An obvious challenge, sheobserved, is retrofitting a former office building to meet residential code. This includes plumbing changes to accommodate requirements for individual bathrooms and kitchens, windows that can open in case of fire and floorplates that minimize travel distance for water lines and air ducts. This makes older buildings, such as the circa-1900s 15 Broad, better candidates for conversion. The new owners of another turn-of-the-century NYC landmark, the Flatiron Building, have said that an at-least partial residential conversion could be in store (ELEVATOR WORLD, August 2023). Sayah says:

“Typically, [converting a historic office building] would involve reusing the existing elevator shafts but installing new elevators, for example taking a three-car group of smaller elevators and making two larger, more modern elevators. In modern office buildings, the cars are more generously sized. Here, the challenge becomes more aesthetic. Large lobbies and oversized elevators begin to feel more sterile and less intimate. There’s also not much utility to be gained from surplus elevators that are no longer required.”

Case Study: Calgary

Unlike NYC, Calgary, Alberta, Canada, is a youngish city (founded in 1875) that owes its growth in large part to the oil and gas industry. On the foothills of the Canadian Rockies, the city has a boom-and-bust economic history, and the latest “busts” left many office buildings with low or zero occupancy. These aren’t the stately Art Deco towers of 1930s NYC; rather, they are typically mid-rise, boxy structures described by one observer as “Mid-Century Meh.”[3] Developers are often able to purchase these properties at very appealing prices. The Astra Group’s Peoplefirst Developments bought Calgary’s Petro Fina Building (a not-unappealing, 11-story structure containing 162,335 ft2 of office space in the city’s downtown commercial core) for a song with conversion in mind.[4]

The Petro Fina Building in Calgary’s downtown core; photo courtesy of Heritage Calgary

The Petro Fina Building is not alone. As of August, Calgary had at least 10 such projects in the pipeline, with the city contributing a total of CAD86 million (US$63.18 million) to leverage nearly CAD190 million (US$139.59 million) in investment.[5]

NYC has also seen several mid-century office buildings converted to residential, as well. At 20 Broad Street, a 23-story former office building originally built in 1956 and converted in 2017, KONE tells EW it provided three KONE MonoSpaceTM 500 elevators, one 3500-lb capacity duplex unit and one 2000-lb capacity duplex unit traveling at 150 ft/min. There is also a new MonoSpace 500 that makes four stops among the building’s top floors. “There were also some elevator modernizations,” Paul Jauregui, KONE marketing manager, New Construction, says. “Eight elevators were modernized using KONE ReVolutionTM, a complete elevator system upgrade that will improve performance of the existing elevator system and is ideal for any low-, mid- or high-rise application.”

Canadian VT consultancy GUNN Consultants is currently handling a single office-to-residential conversion in Calgary, and GUNN President and CEO Eric Peterson says he expects to see more, though he doubts the trend will take hold in other major Canadian cities such as Toronto and Vancouver.

Peterson observes Class B and C office buildings (rather than A) are riper for conversion because they are the ones most likely to remain sparsely populated or vacant since they lack all the bells and whistles of a top office property. And Calgary has a lot of them. Peterson says that it’s likely that VT requirements in office buildings are greater than what they would be for residential so reconfiguring elevators systems is typically a given.

At minimum, Peterson says, a refreshed elevator appearance that involves new cab interiors and fixtures is necessary. As for price tag, that will depend on the type and size of the building and its elevators. “Pricing is likely to be in the CAD200,000 (US$147,874) to CAD300,000 (US$221,811) range per elevator in low-rise buildings, and CAD300,000 (US$221,811) to CAD450,000 (US$332,716) in high-rise applications,” Peterson says.

The Astra Group’s Peoplefirst

Developments bought Calgary’s

Petro Fina Building in the city’s

downtown commercial core for

a song with conversion in mind.

VDA’s Fried and Sayah say price is nearly impossible to predict, as each project is unique. “There’s no rule of thumb here, as individual factors vary widely,” Sayah says. “It could start as a straight modernization, but then you would need to factor in any structural changes, adding landings, extension of travel, etc.” Because residential conversions often include rooftop amenity areas, some modification of the elevator system is necessary even if the core is retained. Fried observes that the number of reusable elevators and the number that need to be removed and replaced would also drive price.

Degrees of Complexity

Palliser One, another office-to-residential conversion in Calgary; image courtesy of Aspen Properties

At 70 Pine Street, the elevator configurations changed significantly, and more than once. Its low-rise double-deck elevators, for instance, the city’s first, were more than what was needed for the building’s office occupancy, so they were converted to single deck in the late 1980s, well before the residential conversion took place. At One Wall Street, NYC’s largest-ever office-to-condo conversion (EW, March 2020), developer Macklowe Properties opted to remove 20 elevators from a perimeter wall and install 25 new ones in the building core to allow for more residences with windows. One Wall Street was ready for move in in August.

Although elevators were only a piece of the US$1.5 billion One Wall Street puzzle, the ripple effect extended far beyond equipment manufacturer Schindler. Suppliers included Mongrain Vertical Transport (four holeless hydraulic elevators) H&B Elevators (passenger elevator entrances), EDI/ECI (hydraulic elevator entrances), The Peelle Co. (two freight elevator cars), Universal Supply, Inc. (construction hoists) and National Elevator Cab & Door Corp. (passenger cab interiors).

Needless to say, consultants are seeing business as a result of growth of this segment, and not just in NYC. Bankrate reported that Philadelphia has seen the most office-to-residential conversions since 2010, followed by Chicago.[1] Washington, D.C., Calgary and Detroit are also seeing some action. Cities including Calgary, D.C. and San Francisco are among those offering financial incentives to developers who take on such projects.

Chicago Landmark Transformed

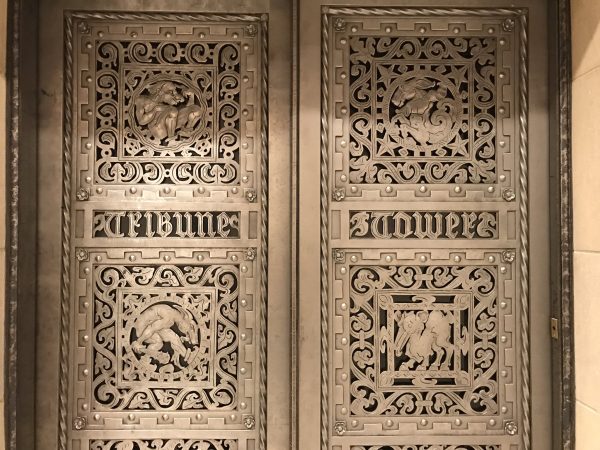

When the Chicago Tribune hosted an international design competition for the Tribune Tower in 1922, it marked a turning point in architectural history.[6] More than 260 entries were received, with a neo-Gothic design by NYC architects John Mead Howells and Raymond Hood deemed the winner and recipient of a US$100,000 cash prize. The Chicago landmark, with its buttresses and intricate ornamentation, was home to the Tribune until 2018, when the newspaper moved out to make way for a condominium conversion by developers CIM Group and Golub & Co.

Conversion architect Solomon Cordwell Buenz (SCB) tells EW Ray Volk of Jenkins & Huntington, Inc. served as VT consultant, with Schindler providing the VT equipment. Existing historic elevator entrances in the lobby, featuring carved screens depicting figures from Aesop’s fables, remain, but the overhaul involved significant new installation and modernization, Schindler tells EW. In addition to modernization of one hydraulic and one geared-service elevator, the project consisted of new:

20 Broad Street in NYC’s FiDi; image courtesy of Visuals

- 10-stop, 5500 passenger elevator (one)

- 30-stop, 7000 service elevator (one)

- 36-stop, 7000 passenger elevator (using existing historic entrance in lobby) (one)

- 26-stop, 7000 passenger elevator (using existing historic entrance in lobby) (one)

- 12-stop 7000 passenger elevator (using existing historic entrance in lobby) (one)

- 15-stop 5500 passenger elevators serving a newly constructed side of the building (two)

- Two- and three-stop 330A hydraulic elevator (one each)

- Four-stop, 330A hydraulic elevator (one)

- Seven-stop, TX-R5 basement geared elevator (one)

When converting the occupancy of a

building, upgrades to accessibility and

life safety are required, which affects

the sizes of the elevators required.

— VDA VP and Partner Rick Sayah

Lobby at 20 Broad Street; image courtesy of Visuals

Because so many developers took the city up on it, Calgary is close to exhausting the CAD153 million (US$112.4 million) set aside for its office-to-residential conversion program.[5] Whether the trend continues apace there will at least partly depend on whether the city is able to get additional provincial and federal government funding. NYC, meanwhile, with its scores of potential conversion candidates and developer interest, looks to remain on an upward conversion trajectory, particularly in certain neighborhoods. Sayah says:

“Lower Manhattan, being the oldest part of the city and lacking the spacious grid layout of Midtown that allows for more consistent office tower footprints and generous lease spans, presents ripe conditions for these conversions. Add to this the stresses on the neighborhood brought about first by 9/11, and later by Superstorm Sandy, and much of the building stock has been through some rough times. The building systems required major overhauls to begin with, allowing for some reimagining of these buildings.”

Elevator doors at Tribune Tower; photo by Andy Richter @actualandyrichter via Twitter

Interior conversion at Tribune Tower in Chicago; image courtesy of Tribune Tower Residences

References

[1] Ostrowski, Jeff, “Will Your Next Home Be a Former Office?” Bankrate, August 17, 2023.

[2] Badger, Emily, “American Cities Have a Conversion Problem, and It’s Not Just Offices,” The New York Times, July 4, 2023.

[3] Gorey, Jon, “Office-to-Residential Conversions Are on the Rise — What Does That Mean for Cities?” Lincoln Institute of Land Policy, May 16, 2023.

[4] Chai, Howard, “How Peoplefirst Developments Decided to Convert Calgary’s Petro Fina Building,” Storeys, May 8, 2023.

[5] Dippel, Scott, “5 More Downtown Office Towers Will Be Converted To Residential Housing,” CBC News, April 20, 2023.

[6] en.wikipedia.org/wiki/Tribune_Tower

Get more of Elevator World. Sign up for our free e-newsletter.