Post-Pandemic Scenarios for the Brazilian VT Market

Oct 5, 2022

SMEs face challenges including standards compliance and materials shortages.

by Fábio E. Beker Aranha

translated by Carmen Maldacena, EW Correspondent

The postponement of the Brazilian equivalent to the European EN-81-20 standard coming into effect and Brazil’s vertical-transportation (VT) sector being concentrated among a few companies are some of the issues that define the present situation.

For most people in Brazil, routines are quite similar to those they experienced before the pandemic. There are few restrictions, and the use of masks is falling. The vaccination rate is significant: More than 80% of the population has received two doses. However, the country still has 100 deaths daily (as of May 2022), a figure that shows people must still be careful.

Postponed Standards

The compulsory compliance of the Brazilian standard ABNT NBR 16858-1, equivalent to the European standard EN81-20 (on the agenda for July 2022) was postponed for 30 months. It will be compulsory by April 2024. This delay does not imply an impediment for adaptation or total compliance by companies that realize the standard can be put into effect at any time during this period.

The postponement was specially asked for by small and medium-sized enterprises (SMEs) because, in Brazil, the standard would be compulsory two years after its publication. In Europe, it had a three-year adaptation period. The two-year terms were useful for the multinational companies because their products and processes were previously adopted in other countries. Furthermore, one must take into account that these two years corresponded to the COVID-19 pandemic, during which companies were greatly affected, and the priority was their survival.

Brazilian VT companies consider it very important to comply with safety standards. In fact, Brazil has been included in the Standard ISO 8100 that will be in force globally as a result of the important work carried out by the World Elevator Escalator Federation.

Absence of Laboratories

To effectively implement the EN81-50-equivalent standard ABNT NBR 16858-2, the Brazilian VT market does not count on test labs or recognized certification bodies to carry out the required checks and balances. The nearest lab is INTI (Instituto Nacional de Tecnología Industrial) in Argentina. For this reason, the disparity between SMEs and multinational companies is even greater because the multinationals have foreign certificates. SMEs would incur extra-high costs to apply for tests and certifications. This situation increases asymmetries in an already too concentrated Brazilian VT market.

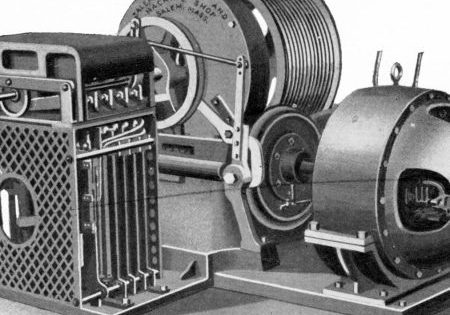

The Brazilian VT market has been concentrated in three multinational OEMs (Otis, Schindler and TK Elevator) for many years.

More Concentration

The Brazilian VT market has been concentrated in three multinational OEMs (Otis, Schindler and TK Elevator) for many years. At present, this situation has become even more pronounced due to the acquisition of Group Elevadores Villarta — one of the largest independent companies in Brazil — by Schindler. The acquisition was approved by CADE (Consejo Administrativo para la Defensa Económica), an organization equivalent to the Federal Trade Commission (FTC) in the U.S. or the Dirección General de Competencia de la Comisión Europea in Europe, in charge of antitrust regulations.

Growth Forecast

In 2022, the growth forecast for the construction sector will be 3% if the Brazilian economy grows 2%, according to a survey by the Brazilian Chamber of the Construction Industry. However, it is expected that 2022 growth will be slower than that of 2021 because of high financing interest rates, falling purchase power and a weakened labor market.

Building costs were constant in 2021. According to FGV (Fundação Getúlio Vargas), elevators were one of the products with a major cost increase of 25%. Elevators for residential buildings represent three quarters of installations, and commercial buildings, one quarter. More than half of individual elevators travel at 1 m/s with a capacity of eight passengers and 12 stops. The social housing segment boasted a higher increase during past years when elevators served lower buildings. Salaries also figure big in construction costs.

The strong increase in 2021 resulted from the economic cycle starting in 2020 being strongly affected by low interest rates. This result relates to the present commercial cycle. In other words, sales in the real estate sector, which has had strong growth during the last two years, will translate into jobs. However, the cycle must be fueled by new businesses. The increase of financing interest rates will have a negative impact on the market, so it may not grow as it did in 2021. The popular housing sector will bear the brunt of the still-high unemployment rate, the great amount of informal workers and depressed income. Meanwhile, public and private investment in infrastructure will become part of improvements brought about by sectorial activity.

Lack of Commodities

In general, the Brazilian VT industry is suffering from lack of commodities in several sectors. The world is going through an unprecedented materials shortage situation. The problem is evident, for example, in the lack of semiconductors. This issue is particularly serious for inverter manufacturers that cannot get electronic components on the global market, and therefore cannot meet demand within normal deadlines.

No matter how good planning may be, factors like the lockdown in China and port congestions, among others widely reported, have had an impact on the global network. Even powerful car manufacturers have completely stopped production due to lack of materials. Deliveries must be scheduled considering the present situation, because suppliers cannot foresee when things will be back to normal. Products that were supplied within 30 days in the past cannot be expected before 120 days or more, with no guarantee of deadline compliance.

Exhibition Postponed

EXPOELEVADOR, the major VT event in the Latin American sector, had to be postponed again until May 9-11, 2023. This change was decided because most exhibitors took into account the difficult economic situation and other uncertainties. For the event to be successful, exhibitors and visitors must feel safe organizing their trips.

Also read: Brazil and Beyond

Get more of Elevator World. Sign up for our free e-newsletter.