Sales across top seven cities witnessed growth in 2022.

submitted by JLL

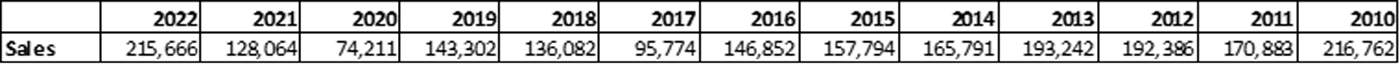

The residential sector witnessed a robust demand revival in 2022, with the year registering a decadal high for in-home sales with 215,000 units across the top seven cities of Mumbai, Delhi National Capital Region (NCR), Bengaluru, Hyderabad, Chennai, Kolkata and Pune, according to JLL’s Residential Market Update — Q4 2022. Sales are similar to 2010 numbers of 216,762 units. Comparing the yearly totals, sales in 2022 increased by 68% year-over-year (YOY), with more than 50,000 units sold in each of the four quarters of the year. The historically high sales numbers are significant, keeping in mind the rise in mortgage rates, property prices and global headwinds during the year. Despite all these challenges, consumer sentiments remained positive, and the residential market has set new benchmarks in 2022 after two COVID-impacted years. Bengaluru, Hyderabad, Mumbai and Pune have achieved the highest sales post-2008, thus witnessing remarkable growth. Delhi NCR and Kolkata have recorded the highest sales post-2014.

Coming Home of Residential Sales

Bengaluru and Mumbai jointly led annual sales in 2022, clocking more than 46,000 units (22% share each), followed by Delhi NCR at 38,000 units (18% share). It is interesting to note that Kolkata, along with the two bigger markets of Mumbai and Bengaluru, witnessed the highest yearly growth in sales.

Bengaluru, Mumbai and Delhi NCR contributed more than 60% of sales in 2022.

| Sales (No of units) | 2021 | 2022 | YOY Growth (%) | % Share in 2022 |

|---|---|---|---|---|

Bengaluru | 27,118 | 46,649 | 72% | 22% |

Chennai | 7,847 | 9,318 | 19% | 4% |

Delhi NCR | 23,109 | 38,356 | 66% | 18% |

Hyderabad | 15,787 | 24,263 | 54% | 11% |

Kolkata | 7,183 | 14,619 | 104% | 7% |

Mumbai | 25,368 | 46,779 | 84% | 22% |

Pune | 21,652 | 35,682 | 65% | 17% |

India | 128,064 | 215,666 | 68% | 100% |

Note: Mumbai includes Mumbai city, Mumbai suburbs, Thane city and Navi Mumbai; data includes only apartments. Rowhouses, villas and plotted developments are excluded from JLL’s analysis. Source: Real Estate Intelligence Service (REIS), JLL Research

As the developers are taking cognizance of the buyers’ preferences and focusing on developing or launching projects that are more relevant and aligned with the evolving customer requirements, the residential market is expected to carry forward the growth momentum witnessed in the past year.

Dr. Samantak Das, chief economist and head of Research & REIS, India, JLL

Quarterly sales numbers (October-December) improved by 16% in Q4 2022 compared to Q4 2021. However, sequentially, they were down by 5%, as there was a cautious approach and delayed decision-making observed in the last month of the year by prospective homebuyers due to global headwinds and uncertainty in economic conditions. It is important to note that sales in the second half of the year (H2 2022) accounted for 51% share of the overall sales in 2022. Siva Krishnan, managing director and head, Residential Services, India, JLL, said:

“The high sales volumes in H2 2022 show that sales were still robust despite the recent challenges underlining the strength of the residential market in India and the increasing importance of home ownership post-pandemic. The Indian residential market is expected to sustain its growth momentum in 2023, while dealing with the challenges of global headwinds and higher interest rates. Moreover, the momentum inhibitor looks to be a temporary one, as India has a resilient domestic economy and robust macroeconomic fundamentals.”

As is the case with yearly sales, Bengaluru and Mumbai are jointly leading the quarterly sales with a 21% share, followed by Pune having an 18% share. Interestingly, Pune, Hyderabad and Delhi NCR have exhibited increased sales volume in the second half of the year driven by quality launches in prime, as well as emerging, growth corridors.

Residential sales marginally down on a quarterly basis

| Sales (No. of units) | Q4 2021 | Q3 2022 | Q4 2022 | QOQ Growth (%) | YOY Growth (%) |

|---|---|---|---|---|---|

Bengaluru | 12,180 | 11,994 | 11,203 | -7% | -8% |

Chennai | 2,696 | 2,128 | 2,222 | 4% | -18% |

Delhi NCR | 8,532 | 10,660 | 8,987 | -16% | 5% |

Hyderabad | 4,503 | 6,990 | 7,824 | 12% | 74% |

Kolkata | 3,311 | 4,367 | 2,499 | -43% | -25% |

Mumbai | 7,012 | 11,487 | 11,479 | 0% | 64% |

Pune | 8,512 | 9,032 | 9,848 | 9% | 16% |

India | 46,746 | 56,658 | 54,062 | -5% | 16% |

Note: Mumbai includes Mumbai city, Mumbai suburbs, Thane city and Navi Mumbai; data includes only apartments. Rowhouses, villas and plotted developments are excluded from JLL’s analysis. Source: Real Estate Intelligence Service (REIS), JLL Research

Premium Segment Gains Momentum

The robust sales witnessed in the residential market are seen across all price segments including the affordable, mid and premium segments. Almost half of the sales witnessed in 2022 came from apartments in the price bracket of up to INR 75 Lakh. The sales momentum also remained strong in the premium segment, as apartments in the INR 1.5-crore-plus price tag had a share of 19% in the overall sales recorded in 2022. There is rising demand for bigger homes with good amenities and support infrastructure. It is interesting to note that the share of the affordable segment in annual sales in 2022 has declined compared to the previous year. The share of apartments priced below INR 50 Lakh in total annual sales has declined from 28% in 2021 to 22% in the current year. On the other hand, the share of the premium segment (priced above INR 1.5 crore) has seen an increase from 10% to 19%.

The affordability synergy that was prevailing six months back has been facing some challenges. There has been a rise in residential prices across the top seven cities of India in the range of 4-11% YOY along with a home loan interest rate that has moved up by around 200 bps in the last seven to eight months. The increase in prices is seen across the spectrum of projects that have high demand and less ready-to-move inventory. New phases of existing projects are also getting launched at higher prices. Dr. Samantak Das, chief economist and head of Research & REIS, India, JLL, said:

“While affordability is likely to be dented, job stability and economic growth will continue to provide the necessary impetus to homebuying activity. Also, it is expected that measures will be taken by various stakeholders to combat inflationary pressures. As the developers are taking cognizance of the buyers’ preferences and focusing on developing or launching projects that are more relevant and aligned with the evolving customer requirements, the residential market is expected to carry forward the growth momentum witnessed in the past year.”

Encouraged by robust sales and strong economic fundamentals, developers launched residential projects across the top seven cities of India. Compared with the previous year, new launches in 2022 witnessed a growth of 81% YOY.

Another 27,000 residential units in the plots and villa categories were sold in 2022 across the top seven cities. Most of the traction was seen in the southern cities of Bengaluru, Chennai and Hyderabad.

| Launches (No of units) | 2021 | 2022 | YOY Growth (%) | % Share in 2022 |

|---|---|---|---|---|

Bengaluru | 22,838 | 48,412 | 112% | 20% |

Chennai | 7,033 | 7,111 | 1% | 3% |

Delhi NCR | 15,482 | 13,554 | -12% | 5% |

Hyderabad | 36,367 | 55,232 | 52% | 22% |

Kolkata | 9,194 | 10,342 | 12% | 4% |

Mumbai | 22,442 | 63,600 | 183% | 26% |

Pune | 23,382 | 49,027 | 110% | 20% |

India | 136,738 | 247,278 | 81% | 100% |

Note: Mumbai includes Mumbai city, Mumbai suburbs, Thane city and Navi Mumbai; data includes only apartments. Rowhouses, villas and plotted developments are excluded from JLL’s analysis. Source: Real Estate Intelligence Service (REIS), JLL Research

New Launches in 2022 on a Surge

Residential launches in 2022, at 247,000 units, are the highest in over a decade and second to the previous high of 281,000 units in 2010. Encouraged by robust sales and strong economic fundamentals, developers launched residential projects across the top seven cities of India. Compared with the previous year, new launches in 2022 witnessed a growth of 81% YOY. Most of the launches were witnessed in Mumbai (26%), followed by Hyderabad (22%). Bengaluru and Pune jointly had a share of 20%. More than 40% of the launches were in the price bracket between 75 Lakh-1.5 Crore. Premium segment apartments in the price bracket of above INR 1.50 crore saw a sizeable 21% share in the year.

Unsold Inventory Increased by 1.8% QOQ in Q4 2022

As of Q4 2022, unsold inventory across the top seven cities increased by 1.8% on a quarter-over-quarter (Q-o-Q) basis, as new launches outpaced sales. Mumbai, Bengaluru and Hyderabad together account for 63% of the unsold stock. An assessment of years to sell (YTS) shows that the expected time to liquidate the stock has declined from 3.1 years in Q3 2022 to 2.9 years in Q4 2022, an indication of robust sales growth.

Outlook

India’s residential market has been on an unprecedented upcycle in 2022 with affordable synergies and the growing importance of home ownership. We have now entered the territory of rising interest rates and global headwinds. As a result, affordability is likely to be impacted further in 2023. Price pressures and moderate-income growth are further likely to create a temporary glitch for affordability, though it should remain attractive and second only to the highest affordability levels seen in 2021. Sales momentum is likely to sustain in 2023 on the expectations of moderating inflation supporting a reversal in repo rate hikes. Moreover, likely measures from stakeholders such as longer loan tenures and attractive pricing deals will keep buyers’ affordability levels within comfort.

Get more of Elevator World. Sign up for our free e-newsletter.