Ropeless Revolution

Feb 1, 2024

Silicon Valley-based Hyprlift, Inc. expects to disrupt and transform the elevator industry.

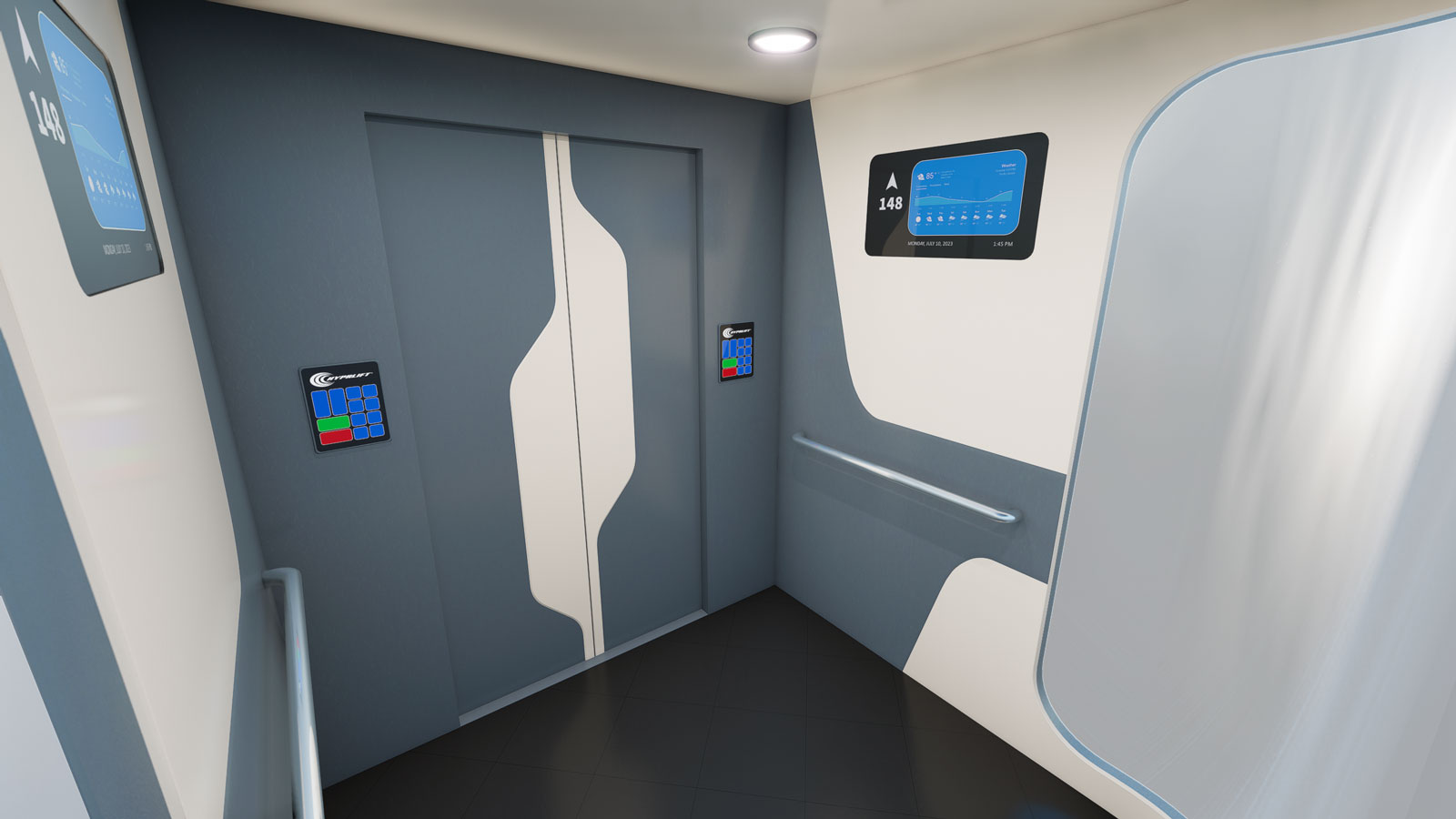

Seeking to revolutionize the industry he has been a part of for three decades, serial entrepreneur James Hutchinson conceptualized the Hyprlift self-propelled elevator cab and founded Hyprlift, Inc. in April 2019. Hyprlift’s “next-generation” elevator utilizes an onboard dynamic-tractive drive that engages with the shaft’s guiderails, propelling the cab at high speeds without the use of ropes. “Hyprlift cabs are not bound to a single shaft, but will have the ability to transfer horizontally from shaft-to-shaft, allowing cabs to navigate autonomously throughout the building,” Hutchinson said.

Serving as its CEO, Hutchinson bootstrapped the startup (originally based in Honolulu, Hawaii) for its first two years using funds generated by his other businesses. Initial endeavors included filing U.S. and international patents and hiring the engineers who would become instrumental in helping the company secure grant funding.

Hyprlift’s go-to-market strategy targets skyscraper-class buildings in NYC’s modernization market and Dubai’s new construction market.

In July 2021, Hyprlift was awarded the Small Business Innovation Research (SBIR) Phase I grant from the National Science Foundation (NSF) to take its cab concept — initially just a mathematical model — and build a working proof-of-concept prototype. With the project successfully completed, Hutchinson relocated the company to Santa Clara, California, in February 2022.

In Silicon Valley, Hyprlift would have better access to private funding and technical talent for its expanding team. Comprised of a core group of engineers and a well-credentialed board of advisors (including Randy Wilcox, former president of Otis Elevator Co., and James Fortune, principal partner at FS2 Elevator Consulting), the team has more than 200 years of combined vertical-transportation industry experience.

Two years after receiving the initial SBIR grant, Hyprlift earned the NSF’s Phase II award, a US$1 million federal grant to design and build its elevator from concept (ELEVATOR WORLD, November 2023). Currently, the company is constructing a full-scale Hyprlift demonstrator cab at its R&D facility. The team plans to have the completed cab running in a test tower before the end of 2024. “This is when we get to take the Hyprlift cab out for a spin and really see what it can do,” Hutchinson said. In December 2023, Hyprlift closed its first private funding round for an undisclosed amount. The largest investment came from India’s Johnson Lifts Pvt. Ltd., representing one part of a broader strategic partnership agreement between the two companies.

Hyprlift’s go-to-market strategy targets skyscraper-class buildings in NYC’s modernization market and Dubai’s new construction market. The company’s value proposition centers around reducing the number of shafts needed, increasing a building’s leasable space. Results of a case study conducted by Hyprlift using the One World Trade Center (OWTC) in NYC indicate that the number of shafts used by existing traditional elevators could be cut almost in half with the Hyprlift system.

The Hyprlift demonstrator cab will be used to work toward regulatory certification. Hutchinson acknowledges that it is difficult to say how long the certification process will take, but demand from building developers would expedite it. He notes that elevator OEMs are unlikely to embrace ropeless technology until they are forced to by market demand, as they are heavily vested in their legacy products. While developers will ultimately determine when the system is brought to market, Hutchinson and the team believe its efficiency impacts will be compelling: “We expect Hyprlift to radically disrupt and revolutionize the elevator industry.”

OWTC Case Study

A computer-simulated elevator traffic analysis of the OWTC was conducted to compare the performance of Hyprlift to a traditional elevator system. By omitting cables, Hyprlift allows multiple cabs to travel within the same shaft. Therefore, fewer shafts are needed to meet the building’s vertical-transport demands. The OWTC study indicates 30 shafts are needed (29 fewer than traditional systems), freeing up approximately 70,600 ft2 of internal floor space. This 33% increase in now-lettable space translates into nearly US$6 million of additional revenue per year for the building operator.

Get more of Elevator World. Sign up for our free e-newsletter.