An ensuring compliance has point position in EU lift industry.

by Luca Pezzini

In response to Russia’s recognition of the Donetsk and Luhansk regions of Ukraine on February 22, 2022, and its continuing military aggression against Ukraine, which began the next day, February 23, the European Union (EU) has adopted sanctions severely restricting economic relations with Russia, Russian entities and Russian citizens. A number of packages of regulations implementing the sanction decisions have been unanimously adopted by the European Council and published in the Official Journal. In this article, we provide a short overview of these measures as a guidance for the lift industry and highlight how persons and legal entities under EU jurisdiction can access further support and advice.

Since the military aggression against Ukraine unfolded and intensified, senior Russian military officers accused of war crimes have been named, banks have been excluded from the global SWIFT payment network, and radio communications toward the European Union (whether by cable, satellite or internet) have also been restricted. Coal was also addressed in the last sanctions package, and now a complete import ban has been imposed on all Russian seaborne crude oil and petroleum products, subject to certain transition periods, to allow the sector and global markets to adapt.

A Tougher Regime of EU Sanctions

On May 4, the European Commission presented its sixth sanctions package against Russia. This package also imposes further sanctions against Belarus. Together with the previous five packages, the sanctions are designed to further increase economic pressure on Russia and undermine its ability to wage its war on Ukraine.

Among those sanctioned are top Russian political representatives, oligarchs, military personnel and propagandists. Targeted sanctions now apply to 1,158 individuals, including more than 30 oligarchs; 98 Russian entities and 25 Belarussian entities are also subject to restrictions.

The broader sanctions will also halt public financing and financial assistance for trade with or investment support in Russia, including national export support. In addition, some of the sanctions are designed to impact Russia’s access to advanced technologies.

Targeted Sanctions and Sectoral Financial and Trade Sanctions

The EU has imposed targeted sanctions on persons listed in the EU sanctions list, meaning that, (i), their assets are frozen; and (ii), it is prohibited to make funds or economic resources available, directly or indirectly, to them. More specifically, it is prohibited to make payments to and to provide services (and goods) that could render an economic benefit to a recipient listed in the EU sanctions list. These targeted financial sanctions extend to entities that are not listed in the EU sanctions list but are (i) majority-owned or (ii) controlled by a listed person or entity.

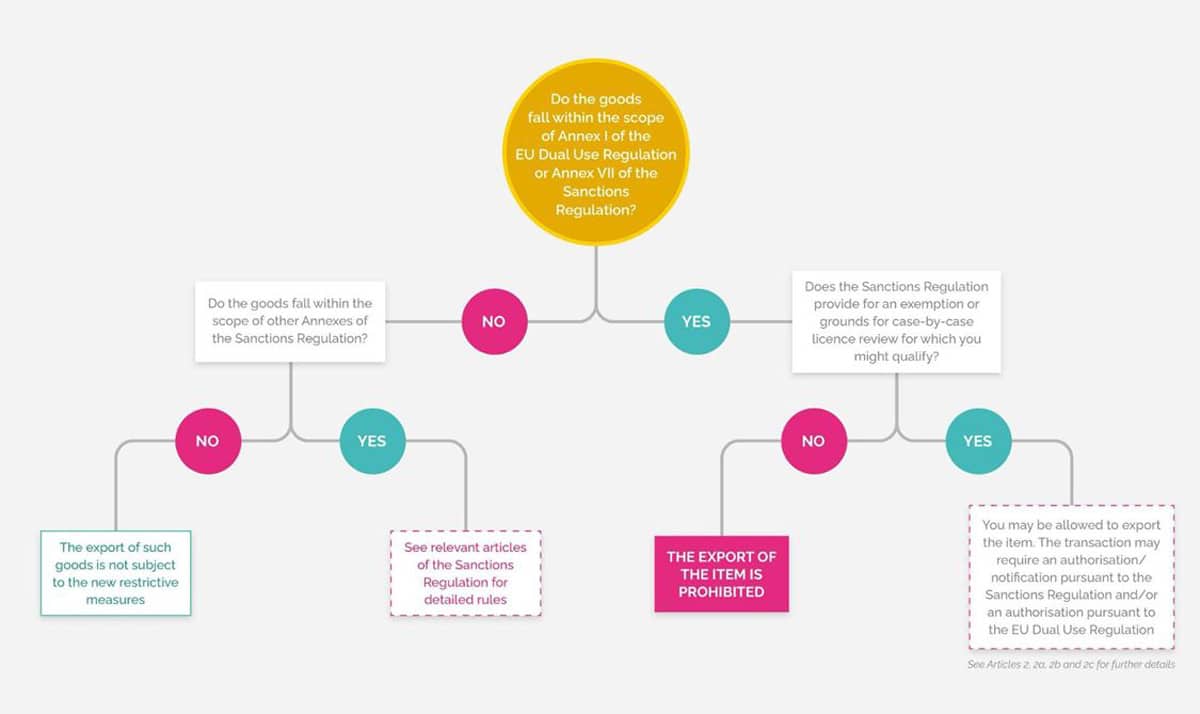

The EU has also imposed sectoral financial and trade sanctions, along with export, sale, supply and transfer prohibitions that cover goods and technology listed in the various Annexes to the applicable regulation. These prohibitions are combined with services prohibitions covering the provision of services relating to the listed goods and technology.

For Russia, these prohibitions would, for instance, apply to goods and services classified as (i) dual-use goods and technology; (ii) goods and technology that might contribute to Russia’s military and technological enhancement, or the development of the defence and security sector; (iii) goods and technology suited for use in oil refining and liquefaction of natural gas; (iv) goods and technology suited for use in the aviation or the space industry; (v) jet fuel and fuel additives; (vi) maritime navigation goods and technology; (vii) iron and steel goods and technology; (viii) goods and technology listed in the CML; or, (ix) goods, which could contribute to the enhancement of Russian industrial capacities.

More information can be found online at ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/faqs-sanctions-russia-export-related-restrictions-russia_en.pdf.

A Regulation (EU) 2021/821 describes dual-use items as:

“Items, including software and technology, which can be used for both civil and military purposes, and includes items which can be used for the design, development, production or use of nuclear, chemical or biological weapons or their means of delivery, including all items which can be used for both non-explosive uses and assisting in any way in the manufacture of nuclear weapons or other nuclear explosive devices.”

Annex 1 of the Regulation lists these items in more detail, including certain types of advanced electronics, semiconductors, drones, software, computers, telecommunications equipment and sensors and lasers.

Other trade restrictive measures have been put in place controlling export and import with Russia and Belarus, including:

- Transactions with an entity established in Russia that is publicly controlled or with over 50% public ownership;

- Importing, purchasing or transferring iron and steel products, as listed in Annex XVII of Regulation (EU) 833/2014 (as amended), from Russia, or goods that generate significant revenue for Russia, as listed in Annex XXI to Regulation 833/2014 (as amended), or coal and other solid fossil fuels, as listed in Annex XXII to Regulation 833/2014 (as amended), if they originate in Russia or are exported from Russia (or, in respect of iron and steel products, are located in Russia);

- Selling, supplying, transferring or exporting machinery, as listed in Annex XIV of Regulation (EC) 765/2006, to any person or entity in Belarus or for use in Belarus.

The EU’s Commitment to Rebuilding Ukraine

While sanctions are being tightened, initial thoughts are already being given to immediate post-war and reconstruction assistance: short-term economic support and suspension, for at least a year, of all duties on Ukrainian exports to the EU.

After the devastation wreaked upon Ukrainian towns and cities, especially in the eastern regions, the Ukrainian GDP is expected to shrink by 30-50% this year alone. The International Monetary Fund estimates that Ukraine already needs EUR5 billion a month simply to run the country, pay pensions, salaries and basic services.

After the war, there will be a huge and costly reconstruction period, which economists estimate could run to several hundred billion euros. Europe is therefore already starting to think about an ambitious recovery package to lay the foundations for long-term sustainable growth, paving the way for Ukraine’s future as part of the EU.

How Can the Lift Industry Ensure Compliance?

The European Lift Association (ELA) stands united in solidarity with Ukraine and supports the EU sanctions against Russia and Belarus.

As an EU-based organization, the ELA also has a compliance responsibility, in particular under the new horizontal services prohibition. ELA also has a due diligence obligation when engaging in its activities to ensure that its operations directly or indirectly (through a member with activities in Russia or Belarus) do not infringe on the EU sanctions regime.

Members of ELA must therefore ensure their own compliance with the sanctions. Full details on the entire package of restrictive sanctions can be found at The European Commission’s trade department.

The European Commission (DG Trade) has also published a guide with a list of frequently asked questions on the restrictive measures it has taken in response to Russia’s actions against Ukraine. Find it online at European Commission: Export-related Restrictions.

Anyone interested in specific answers may find at a dedicated mailbox that has been set up for companies by the European Commission.

Get more of Elevator World. Sign up for our free e-newsletter.