Small Player Finds Opportunity in East Africa

Oct 1, 2017

Big elevator companies dominate market, but niche focus means business for Kenya’s RentState.

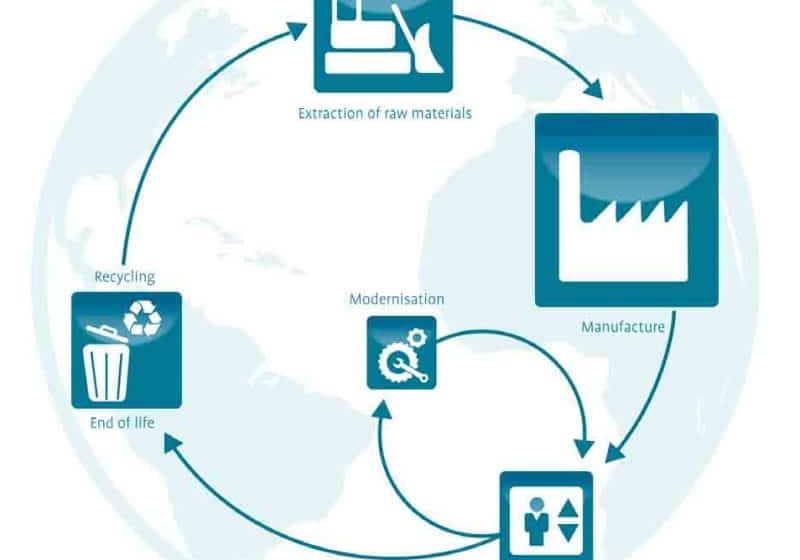

Small and medium-sized elevator companies in Kenya are shifting their focus to more creative solutions for the modernization and maintenance sectors to survive in a market otherwise dominated by major OEMs.

Small elevator companies across East Africa are also reaping rewards in the highly competitive but declining Chinese elevator market, as some East Asian medium-sized elevator manufacturers are now looking for partnerships to supply their products in the emerging Kenyan market.

“Although the Kenyan market is dominated by products from the large global elevator manufacturers, there is a place for small and medium-sized competitors,” says Akash Gandhi, director of business operations at RentState Ltd., a Nairobi-based elevator startup that is also East Africa’s sole agent for China’s Shenyang AMTE Industries LLC’s Intentec brand of vertical-transportation (VT) products.

Recent changes to government policy toward real-estate development could be a boon to small elevator companies in Kenya. The government has introduced incentives that reduce the corporate tax rate for investors who enter the housing sector and build at least 400 units annually.

The country’s National Treasury Cabinet secretary, Henry Rotich, said the incentive is meant to provide decent, low-cost housing to meet a fast-growing demand in Kenya’s urban areas, which are currently running about 200,000 units short of the 250,000 needed each year. National Housing Corp., a government agency that promotes housing, recently completed 240 new residential units in the capital of Nairobi and towns of Kisumu and Kisii.

RentState is one of the small companies that has found a niche in providing specialized service in small quantities but of high quality that has ensured steady growth of its client base.

“Some of the property developers probably require a single elevator unit delivered in a timely manner, and small and medium-sized elevator companies do best in such situations,” said Gandhi, who added:

“The idea to start RentState was born out of many discussions with building-construction consultants who expressed concern on the lack of information on VT, which results in poor workmanship on projects or delay in completing them.”

Gandhi said there is a growing trend in the East Africa market in which property owners acquire old buildings with no provision for VT systems, but want them installed. According to Gandhi:

“We help the client to understand the building’s traffic needs by analyzing issues such as the height of the building, the population at the building, number of elevators required, ideal carrying capacity, how best the elevators can be arranged and even how long one has to wait before the elevator arrives.

“Elevator buyers are getting more and more sensitive on the quality of products they get, because this will impact their overall costs in terms of repairs and replacement. RentState’s other strength has been the quick delivery times of products ordered by our clients, which is a minimum of 35 days after the product arrives at the port of Mombasa.”

RentState, which was incorporated in 2014 and started operations a year later, benefits from its partnership with Shenyang AMTE Industries in terms of training the company’s engineers.

“Our engineers are trained at the company’s manufacturing factory in Shenyang, China, which has made it easier for us to ensure quality of our installations and maintenance,” said Gandhi.

Since 2015, RentState has installed elevators and escalators in a variety of facilities, including Nairobi West Hospital and Light Academy, both in Nairobi.

“We have also supplied products at special requests by clients who, for example, want dumbwaiters or special products for the disabled, to enable them to access buildings,” Gandhi said. “Some of these clients do not place big orders for elevators, but maybe they just need one unit, and this is an opportunity for small elevator companies to expand in the market.”

Although maintenance is often the largest profit-making segment for small elevator companies, Gandhi says this segment is still in the hands of the majors in East Africa, where the contract trend has been to manufacture, deliver, install and work with the client throughout the elevators’ lifecycles.

However, according to Gandhi, RentState is moving forward with confidence that the East Africa elevator market is set to grow with diverse investment opportunities for both the market leaders and emerging smaller competitors. “As a small company that is eager to expand its footprint in the region, we have put emphasis on safeguarding the interests of clients by demonstrating how a property developer can get the best option when it comes to VT,” he said. “RentState has also developed a system of working with property owners to ensure the best service delivery on the elevators that the company has installed.”

RentState has an updated checklist book for all routine maintenance tasks. “We always ask the property manager to sign the checklist, just to be sure all the necessary maintenance has been done and a copy filed for follow-up in case of any problem,” Gandhi said.

In addition, RentState has an arrangement with Shenyang AMTE Industries for an engineer from the company’s factory for an annual inspection of all the installed equipment within East Africa. “We also deliver spare parts to our clients within 96 hr., and in fact, the period could be faster were it not for the customs clearance requirements that take long,” said Gandhi.

One of the challenges facing small elevator companies in the East African market is pricing. “The East Africa market is still price sensitive,” said Gandhi. “Some clients do not have the necessary information and would opt for cheap products that turn out to be expensive later because of the long downtimes of their equipment and costs of the frequent repairs.”

There are other property developers who opt to import their new equipment directly, with no regard to safety features, no standards regulating the property and no consideration for longevity, said Gandhi. “At RentState, we are aware that clients tend to be brand-conscious, and we, of course, want to create our own brand in terms of the quality of service we offer them.” Gandhi added that most of the contracts RentState has secured are through referrals from previous projects.

Get more of Elevator World. Sign up for our free e-newsletter.