A detailed overview of the recent German lift industry

by Dipl.-Ing (TU) Undine Stricker-Berghoff, CEng, MEI

According to the European Elevator Association (EEA) in Brussels, nearly one billion Europeans use lifts every day. EEA estimates that about 125,000 new lifts are installed in Europe each year. These figures justify a closer look at the German lift industry.

The German Lift Market

The European Lift Association (ELA) Statistical Committee collects market data for Europe each year. In 2009, 4.75 million lifts were in operation throughout Europe, with 680,000 (roughly 14%) in Germany. In 2010, these numbers grew to 690,000 in Germany and nearly 5.2 million in Europe. In 2010, Germany was ranked third in size, behind Italy with 915,000 lifts and Spain with almost 795,000, followed by France, Greece and Turkey.

Table 1 shows the number of newly installed lifts in Europe between 2008 and 2010. A small decrease was shown in 2009 due to the global economic crisis. But, in 2010, the German lift market exceeded the numbers of 2008, while the rest of the European lift market remained under the thumb of the economic crisis.

Table 2 shows the value of the newly installed lifts in Europe from 2008 to 2010. In Germany, the revenues show a flatter decline and recovery when compared to the newly installed units.

Table 3 shows the value of lift modernization in Germany and Europe in 1.000 EUR/US$. These numbers are steadily rising in parallel to the rising average age of European lifts. Many buildings in Germany were rebuilt after World War II, leading to the comparatively high German percentage.

Lift-industry employment did not fully develop in parallel to the positive trends shown in Table 3. In 2009, the German lift industry employed 18,000 people. In comparison, Europe employed 146,000. In 2010, employment across Europe rose to about 162,000. In Germany, the number of employees stayed at 18,000 without reflecting the disproportionate growth in the country.

| – | Electrical Lifts | Hydraulic Lifts | Total Market | Difference in % |

| 2008 | 11,137 | 1,065 | 12,202 | – |

| Europe | – | – | 127,880 | – |

| 2009 | 11,106 | 1,008 | 12,114 | – 0.7 |

| Europe | – | – | 110,663 | – 13.5 |

| 2010 | 12,410 | 996 | 13,406 | + 10.7 |

| Europe | – | 98,620 | – 10.9 | – |

The German Economy

Let’s place the German lift industry in the total German economy. Table 4 shows selected data for Germany and Europe 27. The gross domestic product (GDP) in Germany rose at an above-average rate when compared to that of Europe. The German unemployment and inflation rates are lower, too. The lift industry is moving along smoothly with these general German tendencies.

| – | Electrical Lifts | Hydraulic Lifts | Total Market | Difference in % |

| 2008 | EUR511,352 (US$738,707) | EUR46,025 (US$66,476) | EUR557,377 (US$805,014) | – |

| Europe | – | – | EUR4,079,939 million (US$5.9 million) | – |

| 2009 | EUR518,733 (US$749,351) | EUR43,741 (US$63,177) | EUR562,474 (US$812,406) | + 0.9 |

| Europe | – | – | EUR3,520,116 million (US$5.1 million) | – 13.7 |

| 2010 | EUR558,667 (US$807,039) | EUR44,762 (US$64,652) | EUR603,429 (US$871,559) | + 7.3 |

| Europe | – | – | EUR3,496,061 million (US$5.1 million) | – 0.7 |

| – | 2006 | 2007 | 2008 | 2009 | 2010 | 2009/10 in % |

| Germany | EUR194,904 (US$281,481) | EUR198,804 (US$287,101) | EUR220,696 (US$318,709) | EUR208,664 (US$301,333) | EUR232,116 (US$335,193) | + 11.2 |

| Europe | EUR1,282,247 million (US$1.8million) | EUR1,488,321 million (US$2.1million | EUR1,683,078 million (US$2.4million) | EUR1,547,838 million (US$2.2million) | EUR1,729,351 million (US$2.4 million) | + 11.7 |

| – | First Quarter 2010 | Second Quarter 2010 | Third Quarter 2010 | Fourth Quarter 2010 | December 2010 |

| – | Quarterly GDP in % | Unemployment Rate in % | Inflation in % | ||

| Germany | 0.6 | 2.3 | 0.7 | 6.6 | 1.9 |

| Europe 27 | 0.4 | 1.0 | 0.5 | 9.6 | 2.4 |

| – | June | Last 12 months |

| Domestic | – 14% | + 24% |

| Foreign | + 10% | + 33% |

| Total | + 1% | + 30% |

| Lifts and Escalators | – | + 20% |

Let’s break the overall German economy down into the two sectors most influencing and reflecting the lift industry:

- Construction

- Mechanical and plant engineering

Construction

In March 2011, GAT Aktuell, a German lift news ticker, reported that the construction sector in Germany was growing slowly but surely because national and international investors had resumed investing in real estate. Also, the demand for luxury housing in cities is rising. Still, they forecast steady growth in the German construction sector. In contrast, July figures from the Euroconstruct Network including 13 European countries show a decrease in the European construction industry for the fourth time in a row. Though the differences between the various countries are significant, it seems that Germany contributed to the lower numbers.

Mechanical and Plant Engineering

The strong growth of Germany’s mechanical- and plant-engineering industry is shown in Table 5, though June’s figures indicate an increase of orders only in the lower one-digit rank, depending mainly on the weaker internal market. In comparison, the orders in the lift and escalator industry are lower, but still steadily and strongly growing, with a capacity factor of 95.4%. These tendencies fall in line with the European Union numbers that show a 28% increase in orders for the first quarter of 2011. Globally, a 12% increase has been seen in 2011.

The Lift Market Drivers

Three major factors led to Germany’s stable growth during previous decades:

- Eastern Germany extended the domestic market by approximately 20%.

- Following World War II, the modernization of buildings from the 1950s and 1960s became a strong need.

- The introduction of the EN 81-80 Safety Norm for Existing Lifts in 2002 as a governmental regulation enforces regular supervision and technical upgrades.

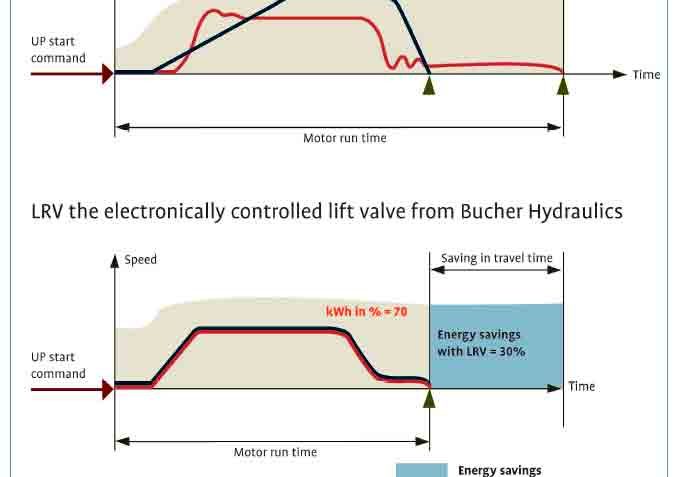

In the last two years, VDI-Guideline 4707 Energy Efficiency, Part 1: Lifts, dated March 2009, has played a major role as facilitator in the German market. Lift and lift-component technology developed quickly, as did user demand for energy-efficient lifts labeled by VFA-Interlift. VDI-Guideline 4707, Part 2: Components will reinforce this development during the next years, not only in Germany but throughout Europe.

Several forces are expected to drive the German market to new heights in the upcoming years:

- The demand for barrier-free buildings and, thus, lifts will increase due to the aging population.

- Energy efficiency, noise protection, component lifespan and maybe even life-cycle analysis of the entire lift installation will become an integral part of environmental protection.

- Design and architecture will receive greater attention.

- EN 81 parts 20 and 50 will accelerate technological development.

Summary

This article is based on lectures given at Lift 2010 in Milan and Asansör Istanbul in April. It provides a benchmark for the German lift industry and its position in Europe. Following developments in the German, European and worldwide lift markets in the months after these trade fairs proved interesting. Taking the driving forces into account, let’s hope the German lift market will continue its strong and steady growth, despite the economic crisis.

For information about the German lift industry, contact: VFA-Interlift e.V., Rahlau 62, D-22045, Hamburg, Germany; phone: (49) 40-727301-50; fax: (49) 40-727301-60; e-mail: [email protected]; or website: www.vfa-interlift.de.

For information about the European lift industry, contact: ELA European Lift Association, Boulevard du Souverain/ Vorstlaan 207/5, B-1160, Brussels, Belgium; phone: +32 2 779-5082; fax: (32) 2-772-1685; e-mail: [email protected]; or website: www.ela-aisbl.org.

Get more of Elevator World. Sign up for our free e-newsletter.