The Impact of Consolidation and Globalization on the U.S. Market

Mar 1, 2025

by Donald Gelestino

This paper was presented at the 2024 International Elevator & Escalator Symposium in Paradise Island, Bahamas.

Purpose

This presentation will discuss the topics of consolidation and globalization within the elevator service and installation business, the technology sector, as well as the material and manufacturing industry.

We will discuss the impact on maintenance and safety in the U.S. market, with a focus on lead time, distribution and opportunities.

Overview of the Elevator Industry

Global market dynamics: The global elevator market is substantial, with a significant segment dedicated to the supply of materials and components and the other segment related to maintenance and safety of the installed unit.

Markets are generally driven by urbanization, code updates and the development of high-rise buildings, leading to steady growth.

Overview of the Elevator Industry — U.S./Global

Global commercial elevator market:

- 2024 Market Size: US$94.05 billion

- 2032 Projected Market Size: US$167.62 billion

- CAGR (Forecast Period): 7.5%

Source: Fortune Business Insights – Elevator and Escalator Market - U.S. commercial elevator market:

- 2024 Value: US$28.60 billion

- 2031 Projected Value: US$41.33 billion

- CAGR (2024-2031): 5.4%

Source: Cognitive Market Research – Elevator Market Report 2025

Overview of the Elevator Industry — Companies

Who are the top largest elevator companies?

- Otis KONE

- Schindler Mitsubishi Electric

- Doppelmayr TK Elevator (TKE)

- Hitachi Toshiba

- Hyundai Hangzhou

- XiOlift Fujitec

See: Dazen Elevator – Best Elevator Companies

Overview of the Elevator Industry — Companies

Major players in the global elevator market

- Top three companies: Otis, Schindler, TKE

- Global market share: Top three companies hold 45%

Key Markets

- China and Europe occupy 80% of global market

Overview of the Elevator Industry — U.S. Service

Major players in the U.S. elevator market

- Top Companies: Otis, TKE, Schindler, KONE, Mitsubishi Electric

- Market Share: Top OEM companies hold 45%, independents hold approximately 55%

- Key Markets

- 80%: Residential and commercial sectors

- 20%: Other sectors (industrial, infrastructure and utilities, healthcare, education, transportation, agricultural, government and public buildings)

Overview of the Elevator Industry — Global Supplier

The global elevator material supply market includes several key players:

- Nippon Steel Corp. (Japan): One of the world’s largest steel producers, Nippon Steel supplies high-quality steel for the structural frames and components used in elevator systems.

- Alberto Sassi S.p.A. (Italy): A well-known manufacturer of elevator gearless and geared traction machines, Alberto Sassi supplies essential mechanical components to elevator companies globally without directly engaging in elevator service. It focuses on providing high-performance, reliable machines.

- Schmersal Group (Germany): Specializes in safety technology, providing essential components such as safety switches, sensors and elevator control systems.

These companies play a crucial role in the industry by providing high-quality materials that enhance the performance and safety of elevators globally.

Overview of the Elevator Industry — U.S. Supplier

The U.S. elevator material supply market includes several key players:

- Vantage Group: A major supplier of elevator components and systems, known for its comprehensive product range and innovative solutions.

- Hyperion Solutions: Specializes in advanced elevator control systems and safety components, significantly impacting the U.S. market.

These companies play a crucial role in the industry by providing high-quality materials that enhance the performance and safety of elevators across the country.

Definition of Consolidation

- Fewer, Larger Suppliers: Consolidation within the material supply chain often results in a smaller number of large suppliers. For example, in the U.S. elevator industry, companies like Vantage and Hyperion dominate the supply of key components.

- Increased Pricing Power: Consolidated suppliers often have more leverage over pricing, potentially increasing costs for smaller elevator companies that don’t have the same bargaining power as industry giants. This can affect the availability and cost of materials such as steel, electronics or specialized parts like car door operators.

- Supply Chain Vulnerabilities: Fewer suppliers mean the risk of disruption is higher if one of the large players faces production or logistics issues, creating bottlenecks.

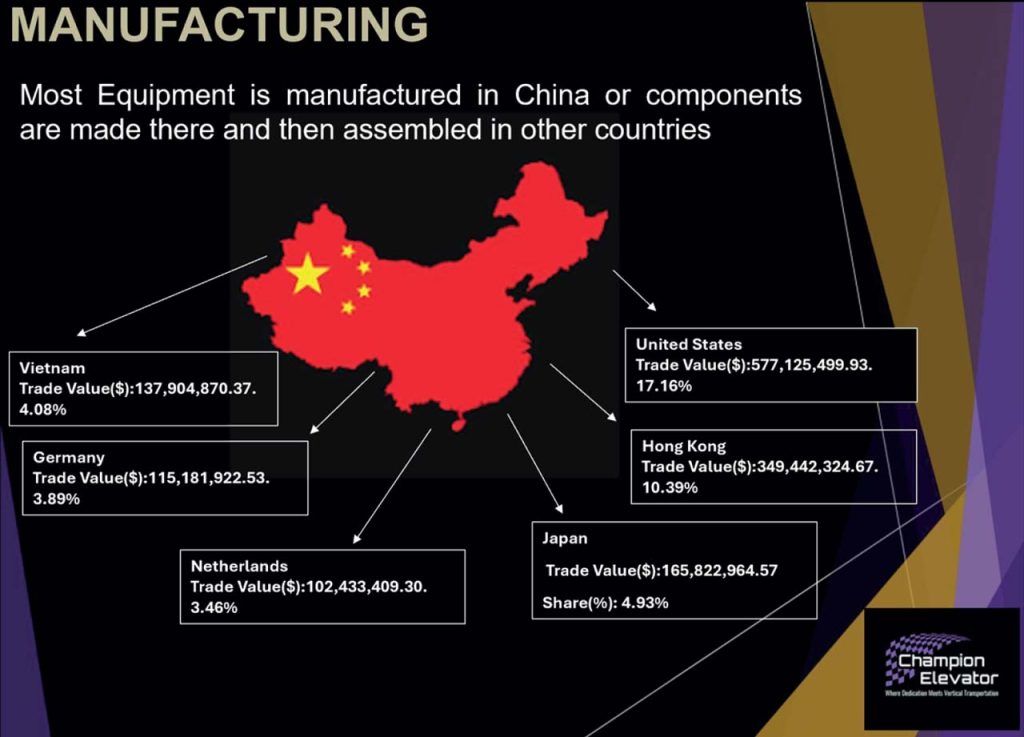

Definition of Globalization

Globalization in the elevator industry means connecting suppliers, materials and technology worldwide to lower costs, increase innovation and expand markets.

Equipment Market

Raw Material – China

China has natural resources estimated to be worth US$23 trillion. Ninety percent of China’s resources are coal and rare earth metals.

Steel and Elevators

- Globalization: Steel, essential in elevator construction, is sourced globally from major producers in countries like China and India. This ties elevator companies to international supply chains and fluctuating prices.

- Consolidation: Large steel companies like ArcelorMittal dominate the market through mergers, limiting supplier options. This raises prices and reduces flexibility for smaller elevator manufacturers that can’t negotiate as favorable terms as larger competitors.

- Have you heard of ArcelorMittal?

Unit Service and Installers

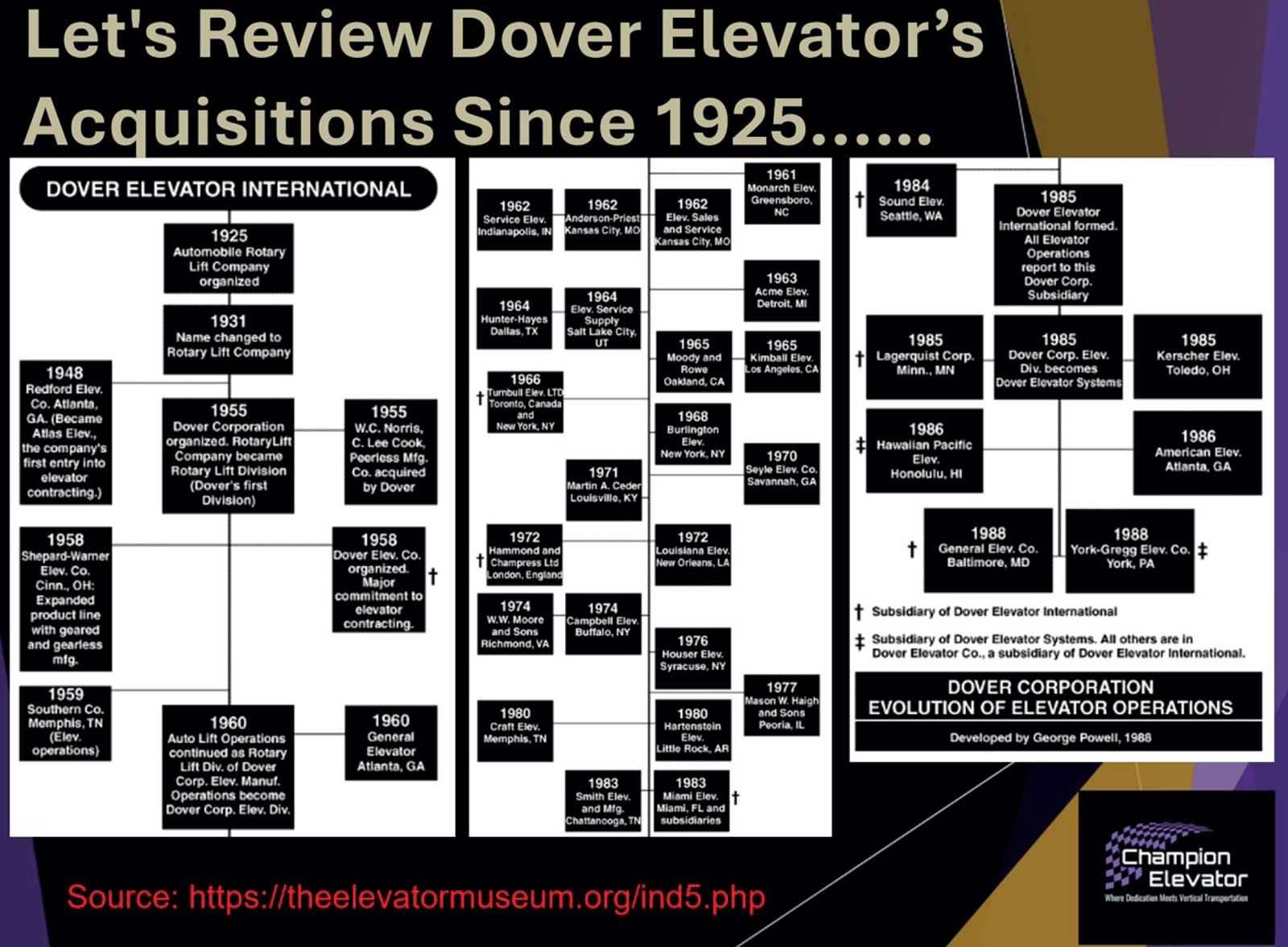

Can you guess when consolidations in the elevator industry started?

What Did All That Consolidation Lead To?

Thyssenkrupp acquired Dover Elevator in 1999 for US$1.1 billion. The acquisition was a good fit for both companies, with Dover’s elevator business ranking about seventh in the world at the time and Thyssenkrupp’s ranking around sixth. The deal gave Thyssenkrupp a strong hydraulic elevator business and moved it up the world rankings

The acquisition would propel Thyssen to third place worldwide in the elevator and escalator industry, behind Otis Elevator, a unit of the United Technologies Corp. of Hartford and Schindler Holding A.G. of Switzerland.

Source: New York Times – International Business Thyssen and Dover in 1.1 billion deal

Interesting Facts

1998 — Dover Elevator was generating approximately US$657 million in annual sales just before its acquisition by ThyssenKrupp in 1998.

Source: Dover Corporation – Dover Reports Record Quarterly Earnings

1999 – Thyssen acquires Dover for US$1.1 billion.

2020 – Advent International, Cinven Group, RAG-Stiftung, Abu Dhabi Investment Authority purchase Thyssen for US$19.214 billion.

The consortium’s offer stood at 17.3x earnings before interest, taxes, depreciation and amortization, and 2.2x revenue of EUR7.96 billion (US$8.62 billion) at the time. Furthermore, the deal was funded by a debt package composed of high-yield bonds and leveraged loans equating to 6.9x adjusted earnings, which is the acceptable upper limit of leverage going into a buyout transaction

Source: Merger Sight – The €17.2 Billion Private Equity Buyout of Thyssenkrupp’s Elevator Unit

Technology

Technology Beyond Small Companies

- Platforming to reduce costs and adjusting value chain coverage, as witnessed among most major players

- Digital partnerships to jointly drive the Internet of Things (IoT), as pursued by Schindler and Telefonica

- Elevator designs that challenge the status quo, such as ThyssenKrupp’s rope-free “MULTI elevator” with several elevators operating in one shaft, including horizontal movement

- Fully automated installations with increased efficiency, as showcased by Schindler’s “R.I.S.E” (Robotic Installation System for Elevators)

Source: Roland Berger – Game changers in the elevator market

Scalable Technology Enables Future Rollups and M&A Markets

- Augmented reality for swifter service reaction time

- IoT and predictive maintenance as key to service contract retention. Internet-connected smart elevators are increasingly becoming commonplace in smart buildings. Coupled with predictive-maintenance algorithms, companies are alerted to faults as soon as they appear or are about to develop, resulting in up to 14-19% less downtime and 5-10% cost savings on repairs.

- Drone-assisted installation and maintenance — Job site preparation, surveying, finishing and testing are manual tasks that cost time and money. Drones can remotely survey hoistways and record measurements, leading to 21-26% time savings and 6-11% cost reductions.

Source: Roland Berger – Game changers in the elevator market

Benefits of Globalization in the Elevator Industry

- Cost Efficiency: Globalization allows companies to source materials and components from regions with lower production costs, driving down prices for end consumers.

- Innovation and Technology Transfer: Global supply chains encourage the exchange of technology and ideas, leading to more advanced and efficient elevator systems.

- Market Expansion: Operating globally enables companies to access new markets, increasing revenue potential and allowing for greater economies of scale.

- Enhanced Product Quality: By accessing a diverse pool of international suppliers, companies can ensure higher-quality products that meet global standards.

Drawbacks of Globalization in the Elevator Industry

- Supply Chain Vulnerability: Relying on global supply chains can expose companies to disruptions, such as geopolitical conflicts or pandemics, leading to increased lead times.

- Increased Competition: Globalization allows for more competitors to enter a market, which can reduce profit margins for local companies.

- Regulatory Challenges: Operating in multiple countries means adapting to varied safety standards and regulatory frameworks, increasing complexity and costs.

- Environmental Impact: The global transportation of materials contributes to a larger carbon footprint, raising sustainability concerns.

Call to Action

- Leverage Global Strengths: Continue harnessing the benefits of globalization by partnering with international suppliers and expanding into new markets.

- Strengthen Supply Chain Resilience: Invest in more robust material, logistics and diversify suppliers to minimize risks from disruptions.

- Local Adaptation: Focus on adapting global practices to meet local regulatory standards while maintaining high safety and quality.

- Innovation for the Future: Drive sustainability efforts by reducing the environmental impact of global operations and investing in green technologies.

Conclusion

- Globalization’s Opportunities and Challenges: Globalization presents U.S. companies with opportunities for cost efficiency, technological innovation and market expansion, but also introduces challenges like supply chain risks and regulatory complexities.

- Adaptation for U.S. Success: To remain competitive, U.S. companies must adapt global strategies to meet local market demands, ensuring compliance with U.S. safety regulations and maintaining the high quality expected by American customers.

- Driving U.S. Market Leadership: By leveraging global partnerships while focusing on domestic needs, U.S. elevator companies can enhance their service or product offerings.

- Building for the Future: Emphasizing sustainability, advanced technology and strong supply chains will be crucial for U.S. companies to secure long-term success in the globalized market.

Get more of Elevator World. Sign up for our free e-newsletter.