The makeup and outlook of the industry in the home of Interlift

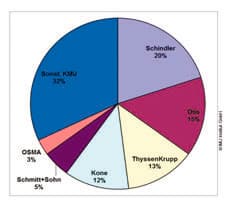

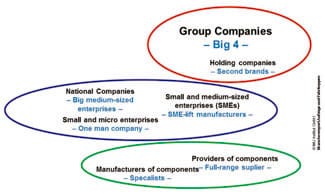

The structure of the German lift industry is characterized by numerous small and medium-sized enterprises (SMEs), which have an approximate market share of 40%, and four large multinational lift companies and their subsidiaries. They offer both elevators and escalators. In addition, there are only a few medium-sized companies that are active in both product groups. The situation could be compared with the U.K. or Italy, whereas in France or Switzerland, 90% is done by the multinationals. In 2015, Dr. Jürgen Dispan from IMU Institute in Stuttgart, Germany, published a new and detailed industry sector report on future trends of the elevator and escalator industry in the country.[1] In 2014, approximately 18,000 employees worked in more than 600 companies in the German elevator and escalator industry.

The majority of SMEs are engaged in elevator construction. The companies often operate in niche markets and/or are primarily oriented in their region. In addition to their regional strength, their flexibility and customer orientation has to be emphasized. An integral part of the value chain are also the manufacturers and suppliers of components for elevators and escalators, as well as microenterprises operating purely in the assembly or service business.

The industry is characterized by some special features: a very strong service orientation, concentration processes within the companies, international value strategies, the expansion of atypical forms of employment (subcontracting) in the construction of new installations and modernization, high work pressure and work intensification, particularly for service technicians.

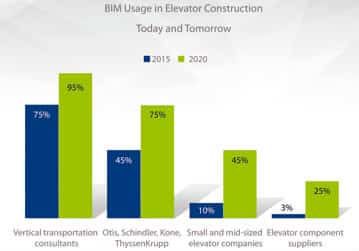

Investment activities and the capacity to innovate are key points for the future viability of businesses and industries, in particular with regard to employment trends. It is noteworthy that, after a disinvestment phase with production relocations and plant closures in the country (as diagnosed in IMU Industry Report 2007), German companies are now investing strongly again: on one hand, in production; on the other hand, in R&D. Challenges around the “human factor” and the world of work have been highlighted in Germany. Securing skilled workers should, therefore, have to come into the center of operational strategies. Important instruments for skilled workers in the elevator and escalator industry are vocational training and continuing-education programs for employees. Needs for action include the expansion of dual company training facilities, and foresighted, strategic workforce planning, both in terms of staffing requirements and human-resource development.[1]

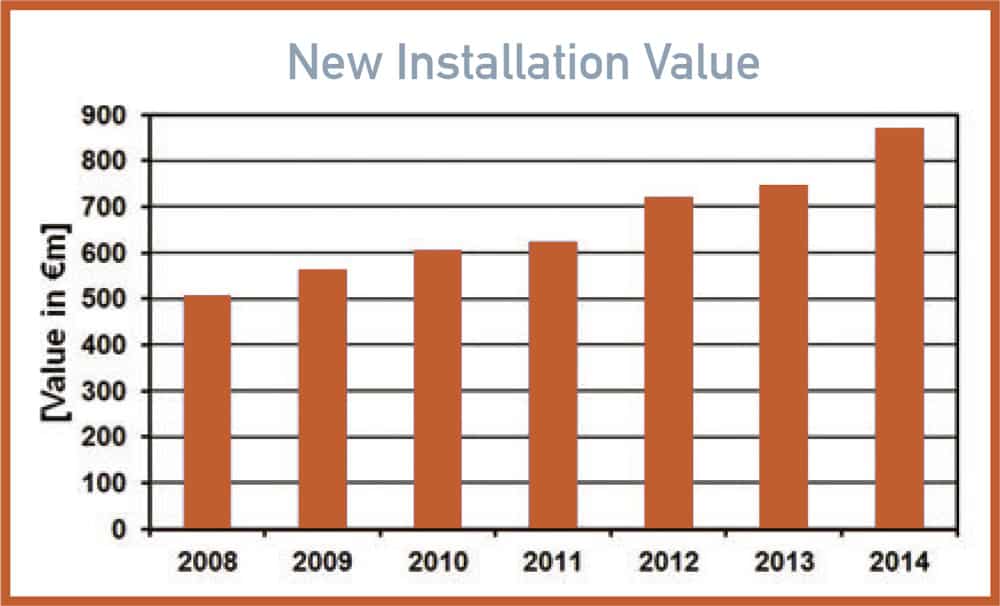

Since 2008, the number of new installations in Germany has grown by an average of 10.4% yearly, and the value of installations has increased by 9.42% per year.[2] A significant growth in incoming orders for new elevators was achieved for six consecutive years.

Compared with other European countries, Germany is still number three in both number of existing and new installations. Before Interlift 2013, the financial crisis in and around Europe was the main topic of economic policy.[3] This year, low oil prices, the heavy fall of stocks in China and critical developments in emerging economies dominate the headlines.

The Eurozone is rebalancing toward a broad-based recovery. Lower energy prices and increased consumer spending helped the Eurozone make a strong start to 2015. And, over the medium term, investment and government spending should begin to underpin this growth.[4] Seasonally adjusted gross domestic product (GDP) rose by 0.3% in the 19-country Euro area EA19 and by 0.4% in the 28-country EU28 during the second quarter of 2015 compared with the previous quarter, according to flash estimates published by Eurostat, the statistical office of the European Union. In the first quarter of 2015, GDP grew by 0.4% in both areas. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.2% in EA19 and by 1.6% in EU28 in the second quarter of 2015, after +1.0% and +1.5%, respectively, in the previous quarter.[5]

The economic situation in Germany in the third quarter rises steadily. GDP noticeably increased in the second quarter by 0.4%, largely due to foreign trade. Supported by the moderate recovery in the euro area and the high level of competitiveness in prices, exports rose much more strongly than imports.

Order activity continues at a high level and indicates a revival of industrial production. Overall, for the second quarter of 2015, there was a high rise in new orders in the manufacturing sector (3%). The portfolio of fi rm-accepted orders in the manufacturing sector in May was 4.9% higher than in the previous year and is equivalent to a scope of five months’ production. The dynamics of the first quarter could not be maintained in the construction industry. In the second quarter, construction output decreased by a total of 2.3%. After a clear downturn of orders in main construction trade within the previous months, they showed a noticeable increase of 5% in May. In particular, the commercial customers extended their orders. Since spring, the economical mood in the construction sector has improved, despite a declining production quote.

In long-term comparison, the business climate in the construction sector has reached a high level. The outlook is positive, and long-term interest rates are low. In addition, rising investment of the public sector indicates a further recovery in the current year. After the weak spring recovery, because of a mild winter with high production, the construction output is likely to change for the better.[6]

This estimation is confirmed by the latest figures from the IFO Business Climate index, one of the main sources for the assessment of the overall economic situation in Germany. This August, the construction index rose to its highest level since March 2014. The construction companies are particularly satisfied with their current business situation and have high expectations.[7]

Actual economic figures and forecasts, as well as discussions with experts in the lift sector, are promising another successful year for the German lift business. A realistic estimation and good overview of further development may also be taken during Interlift this month. With at least 530 exhibitors from 41 countries, this year’s iteration of the exposition makes it the most international platform of the lift industry. The VFA Forum at the event will focus on the development of standards and guidelines, as well as securing skilled workers and advanced training for lift employees.

References

[1] Dr. Jürgen Dispan.

“Entwicklungstrends der Aufzugs- und Fahrtreppenbranche in Deutschland, Ergebnisse des Branchenreports 2015,” IMU Institut Stuttgart, VFA-Mitgliederversammlung; Esslingen, 17 April 2015.

[2] European Lift Association

[3] Klaus Sautter, “The Lift Market in Germany,” ELEVATOR WORLD, October 2013.

[4] EY Eurozone Forecast, June 2015.

[5] Eurostat newsrelease 140/2015, 14 August 2015.

[6] Monatsbericht.

“Bundesministerium für Wirtschaft und Energie, Schlaglichter der Wirtschaftspolitik,” 09/2015.

[7] IFO Geschäftsklima Deutschland, “Ergebnisse des ifo Konjunkturtests im,” August 2015.

Get more of Elevator World. Sign up for our free e-newsletter.