Vestian, in association with FICCI, releases report on shifting Indian office market trends.

submitted by Vestian

Vestian, in association with the Federation of Indian Chambers of Commerce & Industry (FICCI), has released a report titled “Shifting Trends in the Indian Office Market: Understanding the New Cogs.” The report walks one through the COVID-19 outbreak and sheds light on key insights perceptible during this period.

Sanjay Dutt, joint chairman of the FICCI Real Estate Committee and managing director and CEO, Tata Realty & Infrastructure Ltd., said the emerging trends revealed in the report are being adopted nationwide, with India embracing changing work cultures and environments. “I am confident that the report’s findings will be useful, not only for realtors but also for consumers, the government, research and academic institutes and the industry,” Dutt said. “These ideas and deliberations will go a long way in addressing the regulatory challenges and help guide our way forward.”

Vestian CEO Dr. Shrinivas Rao said:

“This report aims to provide insight into the various facets that emerged during the pandemic, most of which are still evolving in tandem with the changing scenario. With COVID-19 impacting occupier expectations and consequently leading to a shift in market dynamics, it is imperative to understand the opportunities presented in the new environment. Newer cogs such as property technology (proptech), environmental, social and corporate governance (ESG) implementation and policy changes have emerged on the real estate scene and harbor potential to take the sector to the next level of development.”

With COVID-19 impacting occupier expectations and consequently leading to a shift in market dynamics, it is imperative to understand the opportunities presented in the new environment.

— Vestian CEO Dr. Shrinivas Rao

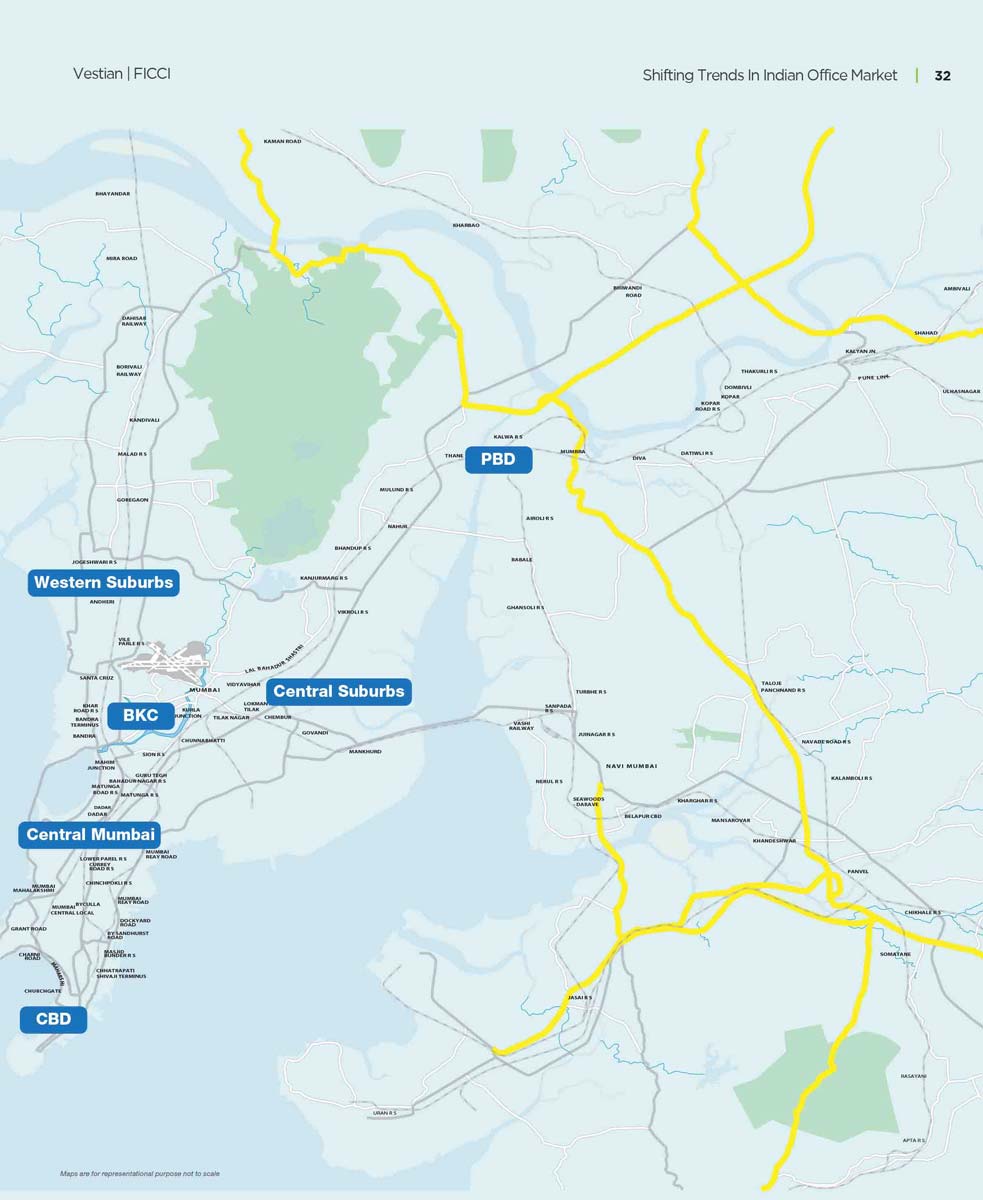

The distinction of being the financial capital of the country puts Mumbai at the forefront of the economic landscape. Mumbai’s office market is driven by companies from the Banking, Financial Service, Insurance (BFSI), IT/ITeS, and other service sectors. Besides, it is the base for corporate headquarters of Indian, as well as multinational, companies. This ensures the city has a well-diversified mix of corporate office occupiers.

Key highlights of Mumbai in the report include:

- Being the financial hub of the country, the major demand driver for the city’s office market has been the BFSI sector, and it continued to lead occupier share during 2019-2022, though it declined greatly post-pandemic. From a high of 63% share in the second half of (H2) 2019, it shrank to 28% in H2 2022.

- Engineering/manufacturing companies, however, saw their share in absorption strengthen. From a 15% share in the pre-pandemic period of the first half of (H1) 2019, its share improved to 25% in H1 2022.

- Interestingly, in contrast to the increasing share of co-working/managed office space operators in other key office markets, Mumbai saw a reduced share of the segment in the past year.

- Mumbai’s western suburbs office market saw its share in absorption vary significantly over 2019-2022. While its share was recorded at over 60% in H2 2019, it declined substantially in the pandemic period of H1 2020. Subsequently revived, its share has again declined in the past year.

- In contrast, peripheral office markets along the Thane-Navi Mumbai belt have shown better traction in the past 12 months, their share exceeding that of the pre-pandemic period.

- The central suburbs market, too, has picked up its pace after witnessing a lull during 2020.

Gearing up for the future by understanding the “new cogs” of Indian office market dynamics includes the following four factors:

- A push to develop infrastructure has been one of the major catalyzing factors to stimulate the market in the aftermath of the pandemic. Additionally, policy announcements such as granting infrastructure status to data centers and rebuilding SEZ (Special Economic Zone) norms promise to impact the office market.

- In fiscal year 2021, approximately 30 companies hired 3.6 lakh freshers, out of which India’s top five tech companies — including TCS, Infosys, Cognizant, HCL Tech and Tech Mahindra — hired 2.3 lakh freshers. This alone would translate into the absorption of more than 18.5 million ft2 of office space in India.

- With ESG coming into the picture, the emphasis on sustainability has driven considerable investment in green buildings and clean energy infrastructure. Compared with conventional structures, buildings with stronger environmental credentials that depict ESG compliance generate higher rents, fetch higher prices, increase retention rates and have lower obsolescence rates.

- India’s co-working spaces, initially occupied by start-ups and freelancers, are now seeing increasing preference by larger corporations in Tier I and II cities. Not surprisingly, the sector accounted for nearly 20% of transacted space during H1 2022, versus 15% during the same timeframe in 2021.

About Vestian

Vestian is an occupier-focused workplace solutions firm specializing in the commercial, residential, industrial, retail and hospitality sectors. Headquartered in Chicago, Vestian has offices across the U.S., India, China, Sri Lanka and the Middle East. The company believes its strength lies in providing customized innovative solutions that are aligned to the client’s business objectives. Vestian’s service portfolio includes investment/consultancy services, transaction advisory services, project services, retail business solutions and integrated facilities management services. Vestian is the only global workplace solutions organization to be certified in both quality management systems and ESG standards such as ISO 9001, ISO 14001, ISO 45001 and ISO 37001.

About FICCI

Established in 1927, FICCI is the largest and oldest apex business organization in India. Its history is closely interwoven with India’s struggle for independence, industrialization and its emergence as one of the most rapidly growing global economies. A not-for-profit organization, FICCI is the voice of India’s business and industry. From influencing policy to encouraging rebates and engaging with policymakers and civil society, FICCI articulates the views and concerns of industries. It serves members from the Indian private and public corporate sectors and multinational companies, drawing its strength from diverse regional chambers of commerce and industries across states, reaching more than 250,000 companies. FICCI provides a platform for networking and consensus building within and across sectors and is the first port of call for Indian industries, policymakers and the international business community.

Get more of Elevator World. Sign up for our free e-newsletter.