A Look at the Numbers

Aug 5, 2022

Turnover of technical maintenance in buildings and facilities in Spain grows by 4%.

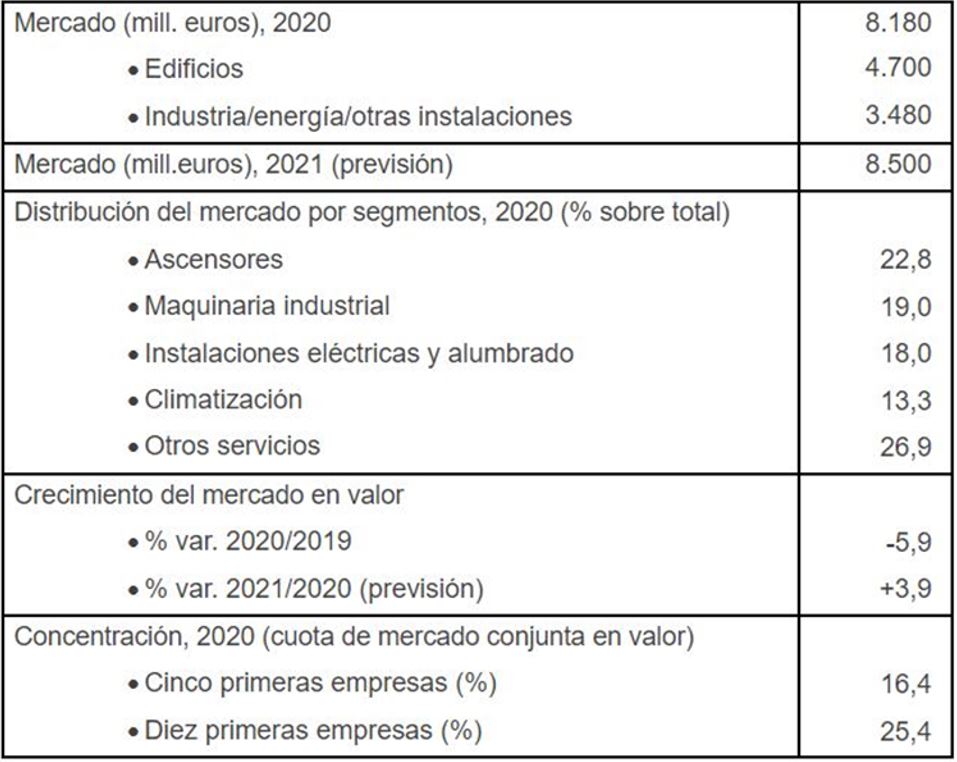

The turnover of the technical maintenance sector for buildings and facilities in Spain amounted to EUR8,500 million in 2021, which represents a 4% increase compared to the previous year, according to the Informa Sectorial Observatory DBK (subsidiary of Cesce), a reference company that provides commercial, financial, sectorial and marketing information from Spain and Portugal.

After several years of growth, the volume of business derived from the provision of services related to the technical maintenance of buildings and facilities registered a moderate decrease throughout 2020. One reason for the decrease was “the impact of the COVID-19 pandemic, which led to a drop in demand from some customers in the main sectors, due to the temporary closure of non-essential activities, to which was added the subsequent deterioration of the economic situation,” according to sources from DBK.

Thus, they indicate the sectoral turnover stood at EUR8,180 million, 5.9% less than 2019, a year in which there was a 2.5% growth. The segment related to building maintenance exhibited much worse behavior, billing EUR4.7 billion, a decrease of 6.3%, while industry, energy and other installations registered a smaller drop of 5.3%, which represented EUR3,480 million.

If broken down according to the type of maintenance services, that relating to lifts accounted for 23% of the sector’s turnover, which corresponded to EUR1,881 million. This was followed by services from the maintenance segment of industrial machinery, with a share of 19%, followed by electrical and lighting installations at 18%, and air conditioning at 13%.

One of the characteristics of the maintenance sector is the strong atomization of supply, as indicated by DBK Informa: “The sector registers a growing degree of concentration of activity in the main companies.” Thus, the first five gathered a joint market share of 16.4% in 2020, a percentage that stood at 25.4% when considering the first 10.

It is a fact that the companies with the greatest weight in the market continue to apply “a policy of expansion in what refers to their portfolio of services with the aim of meeting the demand that is occurring due to the increase in comprehensive maintenance offers,” DBK sources said. In addition to this excess of offers, these sources added that “the opportunities launched by customers in the field of energy efficiency services are also being expanded” in the face of the demands imposed by the 2030 Agenda on buildings, as well as in the facilities.

Thus, this Sectorial Observatory highlights that among the main operators are the multiservice groups, which are specialized in providing auxiliary services to companies, to which are added companies specializing in installations and assemblies. This section includes lift manufacturers and installers, which are responsible for carrying out maintenance work on installed equipment.

The table below shows the main data related to maintenance, which shows that the elevator segment has the highest market share:

Get more of Elevator World. Sign up for our free e-newsletter.