India Market Analysis: 2022 office demand comes tantalizingly close to historic peak.

submitted by Savills India

graphics courtesy of Savills India Research

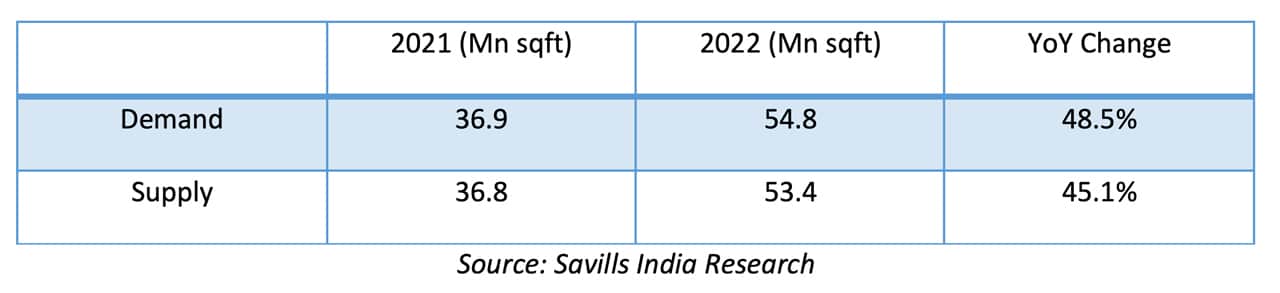

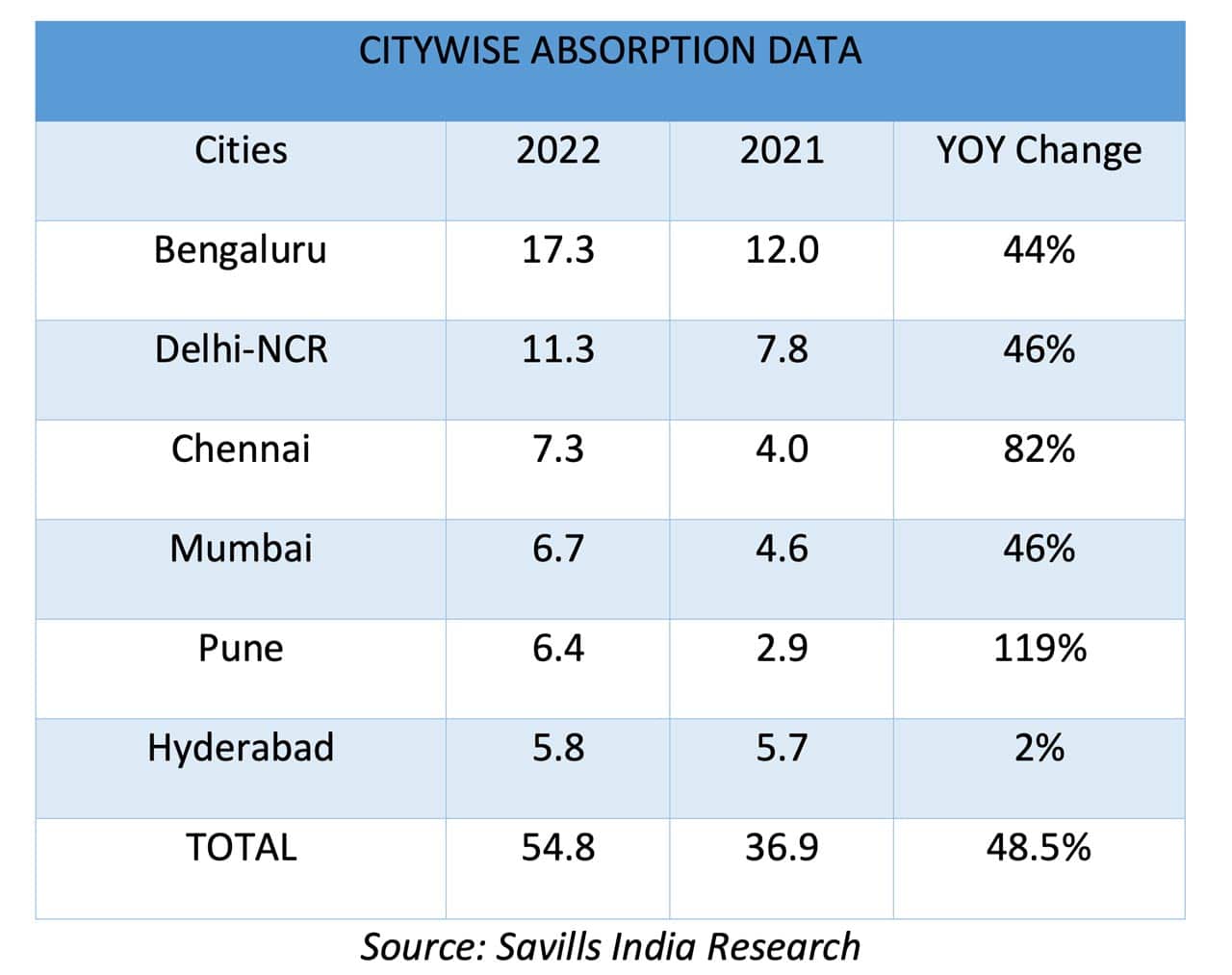

Office space absorption across India’s six major cities stood at 54.8 million ft2, recording a 48.5% increase in 2022. This was very close to the historic peak of 55.7 million ft2 recorded in 2019, falling short by less than 1 million ft2. Bengaluru, the longstanding flag-bearer of office markets, recorded its all-time peak at 17.3 million ft2, and so did the National Capital Region (NCR) and Chennai at 11.3 million ft2 and 7.3 million ft2, respectively. New supply rose by 45.1% at 53.4 million ft2 when compared to 2021.

However, signs of caution are in the mix: Despite the first half (H1) of 2022 recording an all-time-high demand, the second half (H2) slowed, as if picking up signals of global slowdown. H2 performance leaves observers wondering if 2022 would have broken all previous records, but for the deceleration in the last quarter.

Key Data Points

- All cities have registered an increase in demand compared to 2021, with Pune and Chennai witnessing the highest annual growth of 119% and 82%, respectively.

- Of the 54.8 million ft2 of gross absorption at the India level, Bengaluru, Delhi-NCR and Chennai had a cumulative share of 66%.

- Incidentally, all three cities — Bengaluru, Delhi-NCR and Chennai — registered all-time high leasing activity of 17.3 million ft2, 11.3 million ft2 and 7.3 million ft2, respectively.

- While this translates to 4% growth for Delhi-NCR compared to pre-pandemic times (2019), Bengaluru and Chennai witnessed 11% and 12% growth, respectively.

- Bengaluru and Delhi-NCR continue to be the top two commercial real estate markets in terms of yearly gross absorption. Chennai, however, rose from fifth position among the top six in 2021 to take third place.

- Mumbai remains in fourth place, despite registering a significant jump of 46% year-on-year (YoY) in gross absorption.

- 2022 has been a story of two halves, with H1 2022 outperforming H2 considerably. Apprehensions regarding global growth prospects have put real estate decision making on hold, especially in the last quarter of the year.

Half-Yearly Gross Absorption Trends at India Level

Savills India CEO Anurag Mathur said:

“Although the pandemic had slowed down activity through 2020 and 2021, a strong rebound in 2022 has shown the inherent strength of demand in India. The bounceback further establishes two things: The flex spaces proposition is on solid ground, and secondly, office occupancies have returned resoundingly, even for the tech sector. These and several other factors speak to the long-term potential of the office market in India. While the need to remain vigilant is unquestioned, the policy ecosystem and industry actions will hopefully create the right path in 2023.”

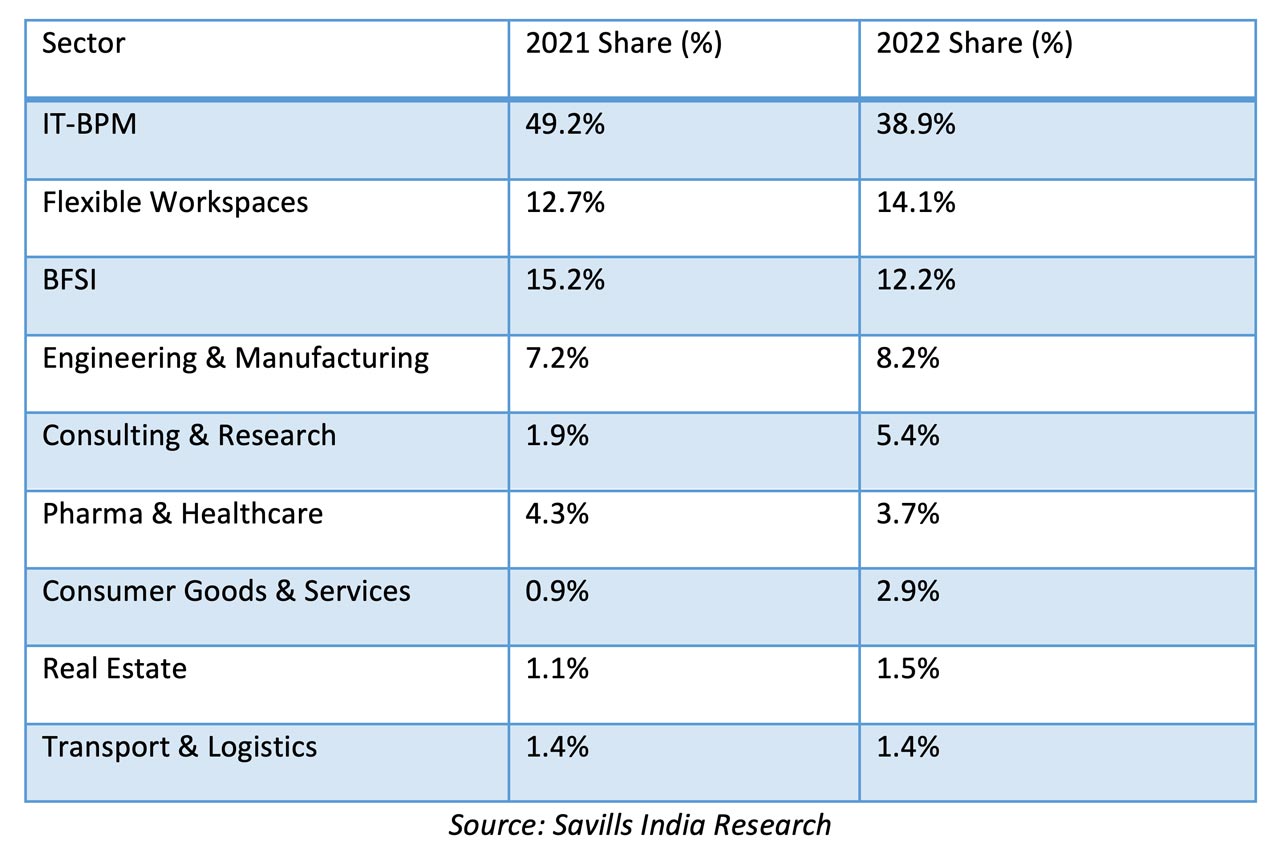

Sectorial Split: Coworking Picks Up Again, Along With IT and BFSI

IT continues to drive the office market, with a 38.9% share of total leasing in 2022. With increased adoption of hybrid work, flexible workspace contribution improved from 12.7% in 2021 to 14.1% in 2022. Banking, financial services and insurance (BFSI) also maintained its preeminence at a 12.2% share. Engineering and manufacturing, another important segment of demand, registered approximate 8.2% share of demand in 2022. Arvind Nandan, managing director, research and consulting, Savills India, observed:

“The force of the technology sector is now a well-established fact in Indian office markets. The big performance, however, was delivered by flexible spaces, which had nearly collapsed from having taken a frontal hit during the pandemic. All the same, it needs to be remembered that the story of 2022 is that of two contrasting halves. This necessitates a deeper understanding of the probable impact of global economic events in near term.”

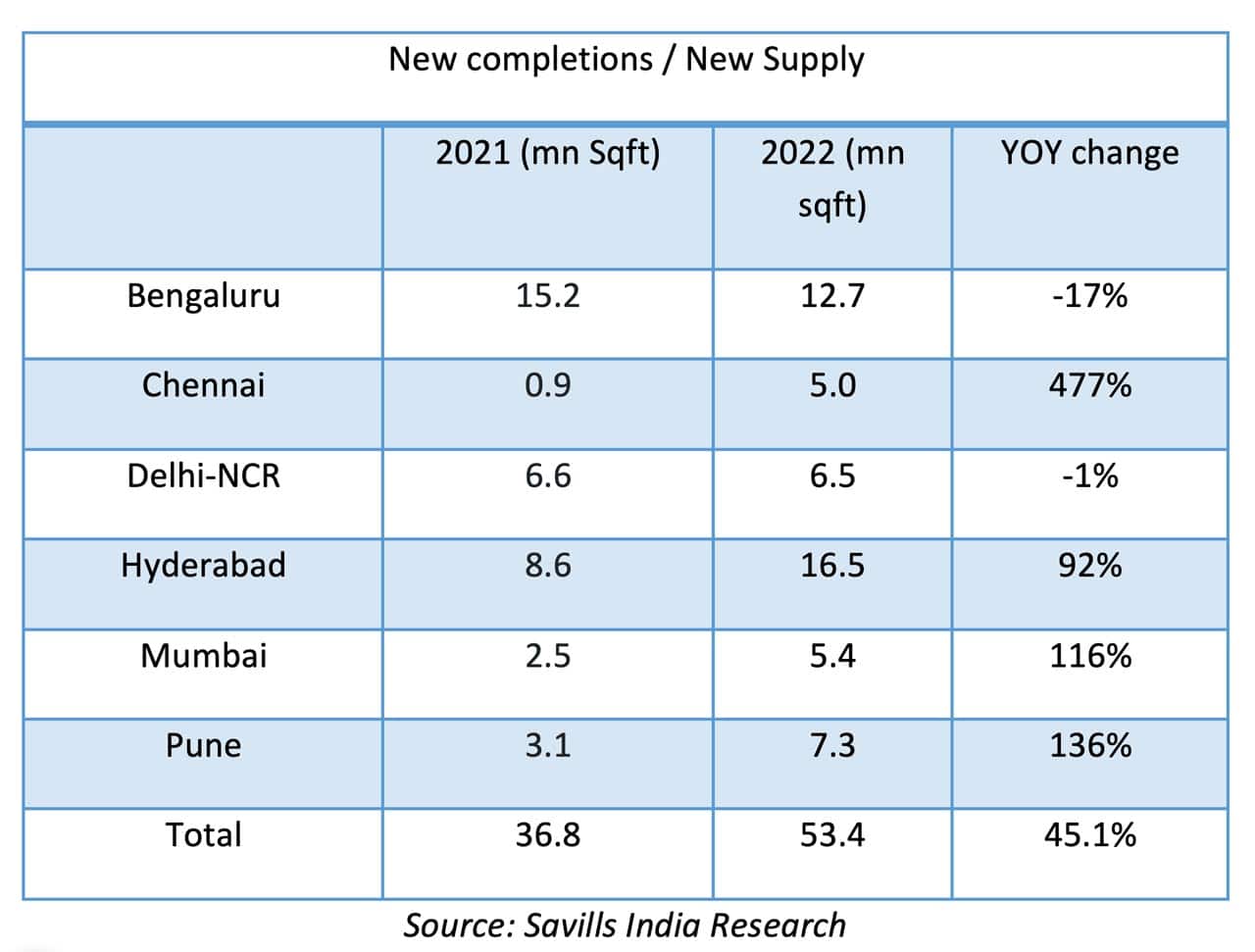

Supply, Vacancy and Rents

Strong supply infusion was the theme across all cities. Of the 53.4 million ft2 of new completions across the six major markets, Bengaluru and Hyderabad alone accounted for more than half the supply addition. While the all-India stock of Grade-A office space stood at more than 700 million ft2, Hyderabad breached the 100 million ft2 mark for the first time in 2022. Hyderabad, with a supply infusion of 16.5 million ft2 in 2022, witnessed outstanding YoY growth of 92%.

While the need to remain vigilant is unquestioned, the policy ecosystem and industry actions will hopefully create the right path in 2023.

— Savills India CEO Anurag Mathur

On account of portfolio reallocations, the average vacancy level has increased marginally, from 18.3% in 2021 to 18.9% in 2022. This has resulted in rentals remaining largely stable.

The rental value change across micro markets varied within each city and even within micro markets. While rentals remained stable in low-demand micro markets, a developer-oriented market has resulted in strong yearly increases in other localities.

Disclaimer: Numbers represent the market on December 26, 2022. Minor modifications to these for the eventual year-end numbers, though unlikely, should not be completely ruled out.

Get more of Elevator World. Sign up for our free e-newsletter.