Adjusting, Surviving, Thriving

Sep 1, 2025

Survey of the U.S. elevator industry reveals determination and cautious optimism.

by Kaija Wilkinson

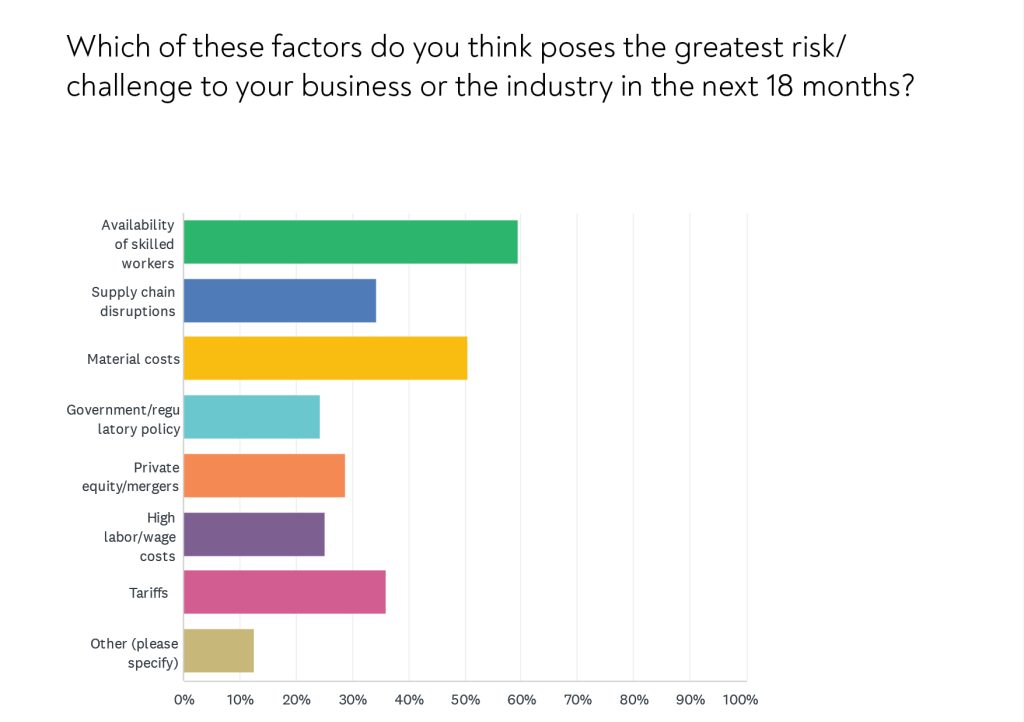

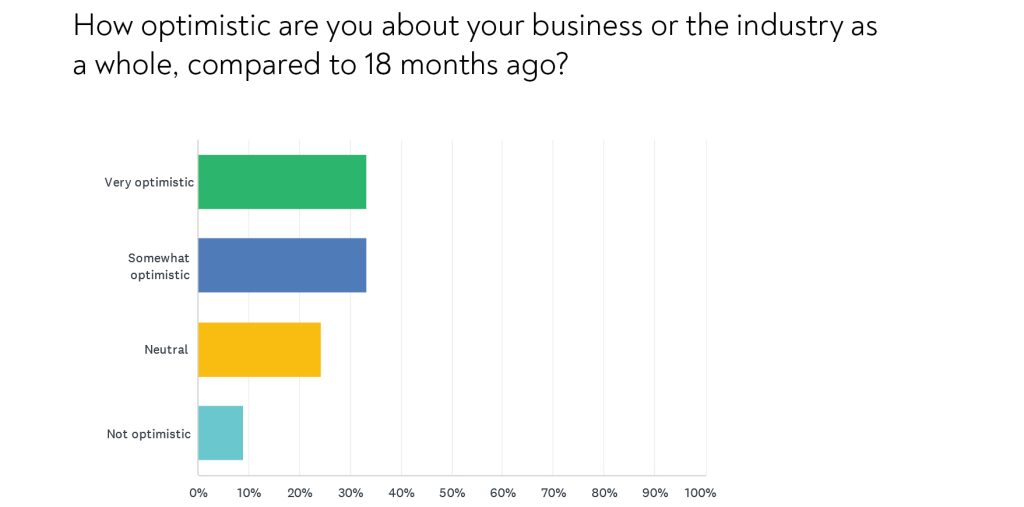

Vertical-transportation (VT) industry professionals filled out ELEVATOR WORLD’S State of the U.S. Elevator Industry 2025 Survey earlier this year, revealing that, despite challenges including employee recruitment and rising costs related to issues like inflation, higher wages and taris — not to mention a VT landscape that is changing due to mergers and acquisitions — they are at least somewhat optimistic about business compared to 18 months ago. For many respondents, independents in particular, private equity (PE) remains a dark cloud over the industry, albeit one that has a silver lining in some cases as customers return to the personalized touch of independents.

One respondent said:

“Mid-sized companies that were predominantly family owned are being sold to corporations that are, in turn, owned by investment groups with no plans to invest in the long term. The trades suer dearly when short-term profits take the lead in directing company decisions. OEMs have turned away from providing true service, convincing customers that remote monitoring allows for fewer service visits. So, they reduce their contract prices to a point that prohibits technicians from spending the time truly needed to prevent shutdowns and accidents.”

Another respondent spoke specifically about the PE silver lining, saying, “In a weird way it’s been beneficial, as customers who used to buy from our competitor came to us after they were bought out by PE,” which doesn’t exactly have a stellar reputation in the VT industry.

Some respondents see both good and bad in PE, with one stating:

“On the positive side, PE investment has brought in muchneeded capital and resources, allowing for innovation and modernization in the industry. It’s helped improve eciencies and expand capabilities, which ultimately benefits businesses that can leverage those advantages.

“On the flipside, there’s sometimes pressure to prioritize short-term profits over long-term accessibility, which can lead to cost-cutting measures that aect quality or customer service. In some cases, the focus shifts toward larger-scale projects and reducing operational costs, which can make it harder for smaller, specialized firms like ours to stay competitive. Overall, the impact has been mixed, but for companies that can adapt and innovate, PE has opened up new opportunities.”

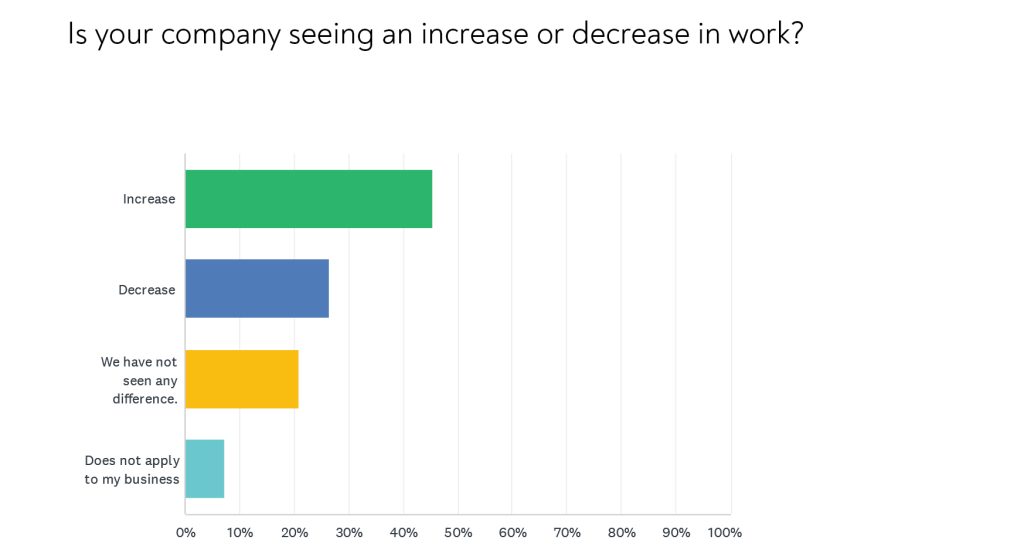

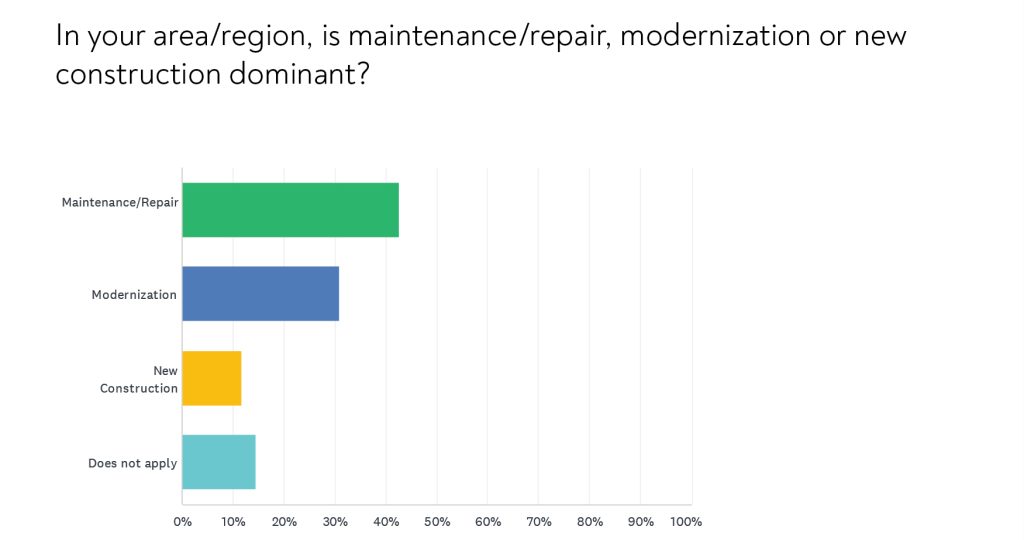

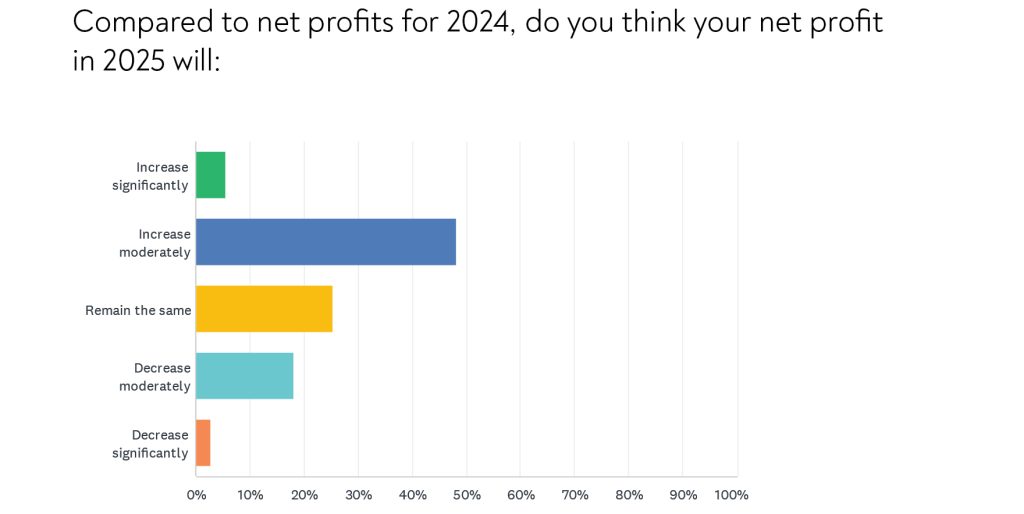

Most respondents — more than 45% — expect an increase in work, compared to 21% who expect no change and more than 26% who expect a decrease. Regardless of geographical location, maintenance/repair is the main business driver for most, approximately 43%, as new code requirements go into effect and property owners — much like automobile owners — want to hold on to what they have and make sure it lasts and is safe. One respondent said he’s seen a greater emphasis “on keeping existing equipment running, so maintenance and repair have increased, along with modernization.”

For companies that can adapt and innovate, PE has opened up new opportunities.

– Survey Respondent

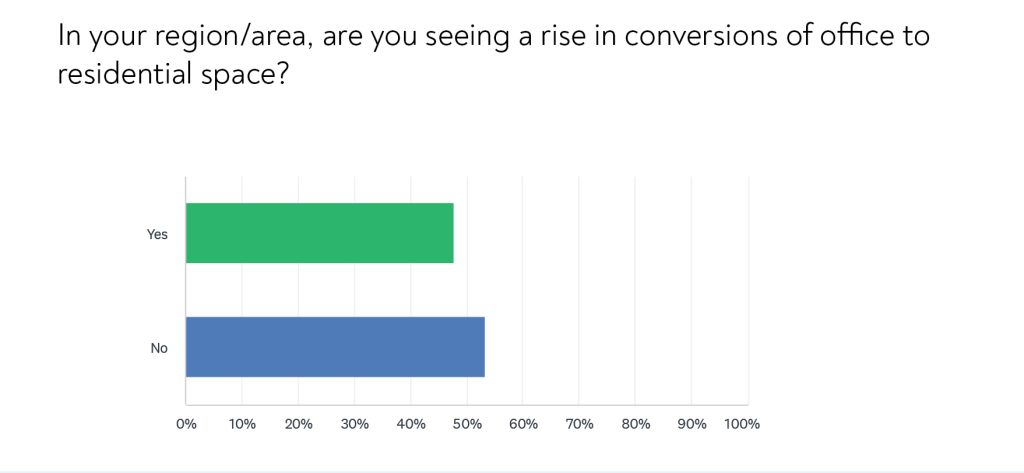

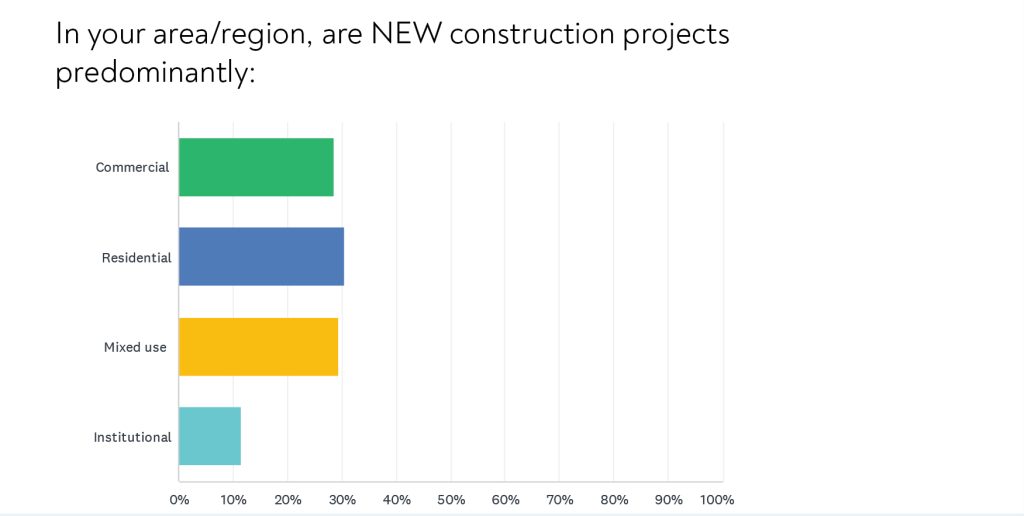

Another added that modernization is also being fueled by office-to-residential conversions. “New construction is a bit quieter compared to the other two, as many are focusing on upgrading what’s already there rather than starting from scratch,” the respondent said. What new construction VT work there is is primarily residential (more than 30%), followed closely by commercial and mixed use at approximately 30% each. Institutional work accounted for only about 11% of respondents’ new construction work.

Yet another modernization driver is the trend towar sustainability and energy efficiency, supporting the need to modernize older VT systems and opening new doors for VT firms that have accreditations such as the U.S. Green Building Council’s Leadership in Energy and Environmental Design or LEED. Green-building standards are guiding VT companies to offer energy-efficient elevators and smart systems to help buildings reduce their overall energy consumption. “Plus, being a part of the sustainability movement adds a lot of value to our reputation, especially with clients who are increasingly focused on environmental impact,” one VT professional noted.

Still, some expressed nostalgia for the old, less energy-savvy days, observing that “the durability that was built into older elevators is gone with the green elevators.” Even with proper maintenance, the respondent said, they do not last as long.

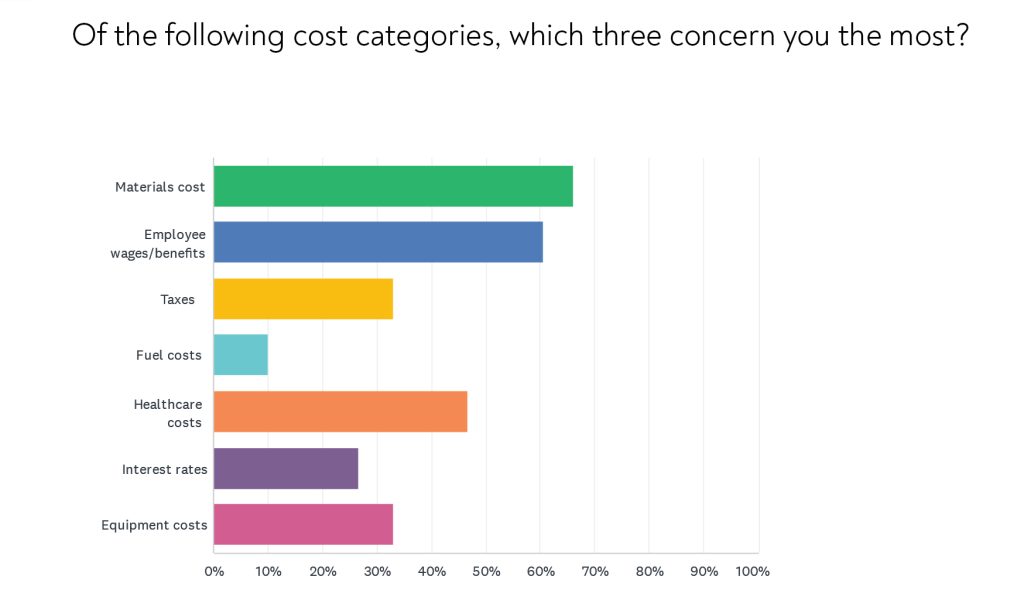

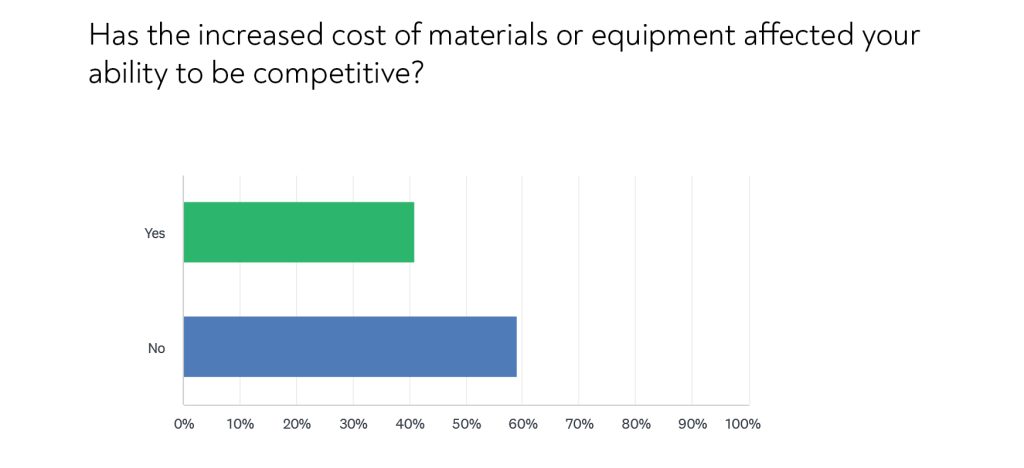

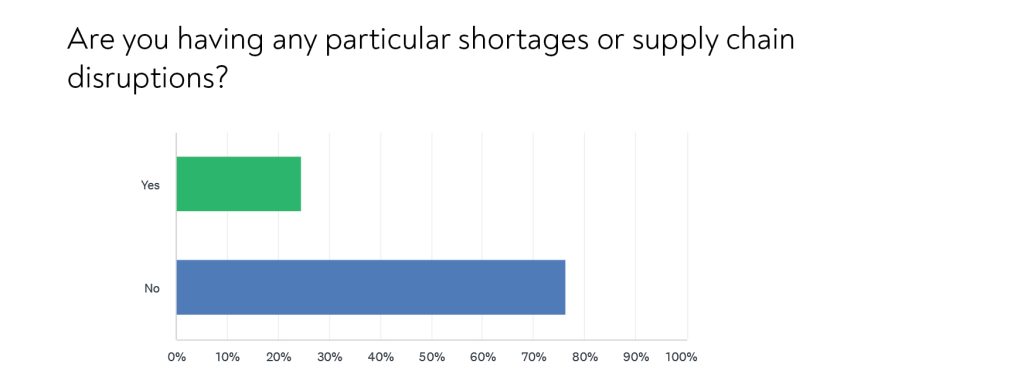

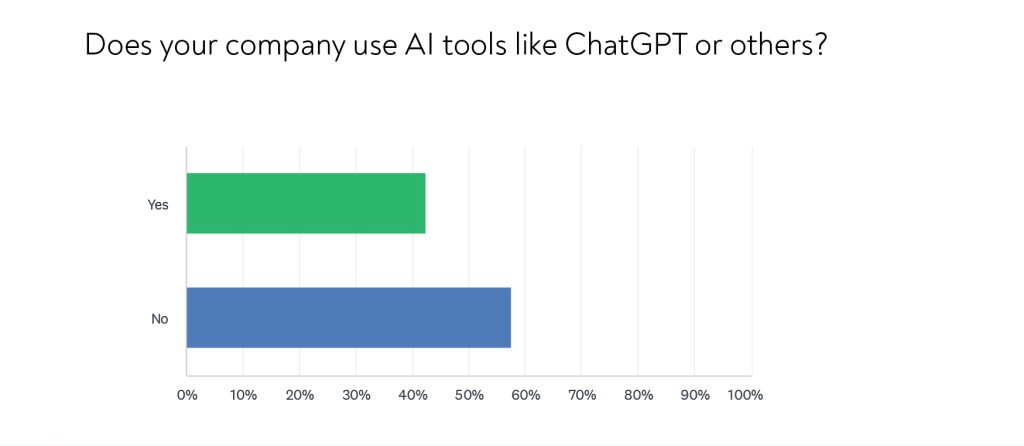

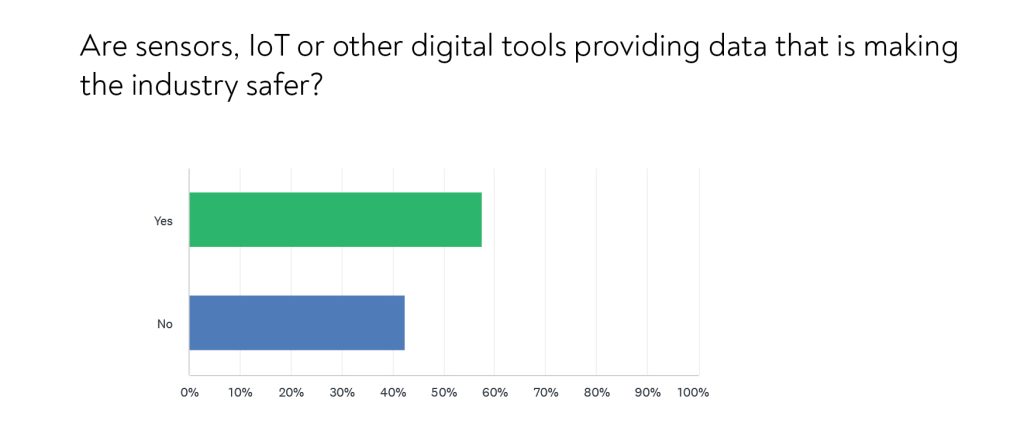

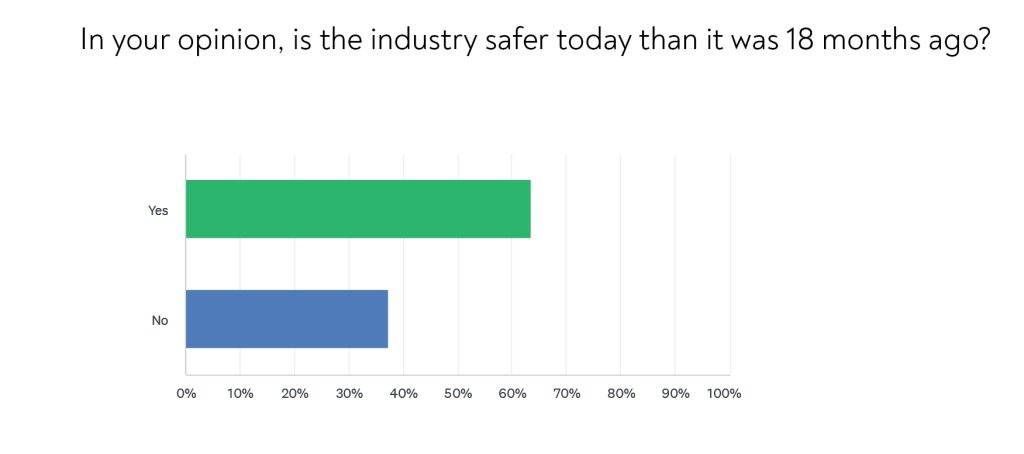

The more than 100 VT professionals who responded within the 10-day window also provided insight about how various factors are aecting their business: sensors, the Internet of Things and digital tools the entry of international manufacturers taris and inflation supply chain issues and shortages and materials costs. They spoke about the drive to recruit more young people to the industry, their individual safety programs and whether or not overall safety is improving. We hope you enjoy diving into this in-depth and current snapshot of the U.S. VT industry, and urge you to participate in our future surveys!

Get more of Elevator World. Sign up for our free e-newsletter.