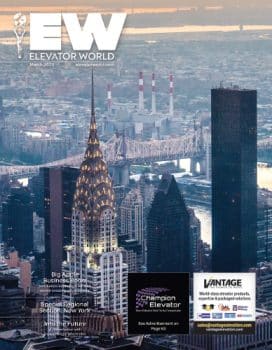

Big Apple Business Boom

Mar 1, 2020

Across the boroughs, NYC continues to redefine itself with record-breaking development, and there is more than enough VT work to go around.

by Kaija Wilkinson

Merriam-Webster defines “boomtown” as “a town enjoying a business and population boom.” Dictionary.com, meanwhile, describes a “boom town” as a “a town that has grown very rapidly as a result of sudden prosperity.” This definition is what most people think of when they envision a boomtown, like Detroit during the emergence of the automotive industry in the 1950s and California gold-rush towns in the 1800s. Tall-building construction and, in turn, the vertical-transportation (VT) industry, are booming throughout NYC’s boroughs. But does that make the Big Apple a boomtown? While NYC has certainly enjoyed its rapid growth spurts, to describe it as a boomtown seems a little off the mark. The city has, for centuries, enjoyed relative prosperity, a prosperity of which the VT industry has been an integral part since Elisha Graves Otis founded his company and installed his first elevator in the 1800s.

[Mayor Bill de Blasio’s] push for affordable housing in these areas offset some losses in the solely market-rate sector, which dominates in the heart of the city.” — Nikolai Fedak, founder, New York YIMBY

The city keeps growing and reinventing itself, with unique, record-breaking skyscrapers (Manhattan’s 111 West 57th Street, the skinniest building in the world, and the highest observation deck in the Western Hemisphere at 30 Hudson Yards, to name a couple) closing in on completion, and landmarks being modernized and revitalized. All is driving business for the VT industry, and there is more than enough work to go around.

John Corey, Otis general manager, new equipment, Manhattan, says NYC “has served as a stage for Otis to set many company-specific and industrywide milestones” since its founder delivered its first elevator to a Hudson Street factory in 1853. Corey shares that, in 1857, Otis installed its first passenger elevator in the five-story E.W. Haughout Building in the SoHo neighborhood of Manhattan; in 1903, the first gearless traction elevator in the Beaver Building in the Financial District; and, in 1931, elevators serving the first building in the world to top 100 floors: The Empire State Building. There, Otis recently completed one of the largest and most complex modernizations in its 166-year history (ELEVATOR WORLD, January 2020), including a custom, panoramic unit to the 102nd-floor observatory.

Otis also designed and installed an elevator for the tallest residential building in the world, Central Park Tower, developed by Extell and designed by Adrian Smith + Gordon Gill Architecture. At 1,550 ft tall, it even looks down on the Empire State Building. A special high-speed unit traverses 131 floors at 2,000 ft/min in a minute and a half.[1]

“We are seeing continuing levels of high activity in the medium to high-rise residential markets in Manhattan, Queens and Brooklyn.” — Schindler Senior Vice President, New Installations Mike Ramandanes

The big OEMs are handling major projects throughout the city: thyssenkrupp, as the official VT provider for the Hudson Yards megadevelopment developed by The Related Cos. and Oxford Properties Group on Manhattan’s Far West Side; Schindler, which is providing VT for towers including the skyline-altering, 1,201-ft-tall One Vanderbilt next to Grand Central Terminal (EW, August 2019); and KONE, whose projects include the intricate and challenging elevator system for One Wall Street, the largest office-to-condo conversion in NYC history (p. 66) to name a few.

Schindler Senior Vice President, New Installations Mike Ramandanes says NYC is undeniably a major market for the company:

“We have an established record in the premium, high-rise office market. Modernization projects involving hospitality properties, high-rise residential buildings and sports arena infrastructure are also an expanding business area for Schindler in the city. We are seeing continuing levels of high activity in the medium- to high-rise residential markets in Manhattan, Queens and Brooklyn. In 2020, we expect to see increased activity in transit (Manhattan) and infrastructure (La Guardia and John F. Kennedy International airports).”

Indeed, infrastructure is vital to supporting the city’s growth. Rarely a week goes by that EW does not receive news about improvements (most often for accessibility) to the NYC subway system. A couple of years ago, your author toured the amazing VT system KONE installed to serve the Second Avenue Subway extension and Hudson Yards (EW, March 2018), and when she visited One Vanderbilt, Grand Central Terminal next door was also in the process of upgrading its VT system.

In terms of modernizations, code compliance is playing a role in what D&D Elevator President Bobby Schaeffer describes as “a major bump in business.” In 2014, NYC established an elevator door-lock-monitoring (DLM) requirement that calls for every elevator in the city to have a separate circuit for DLM and be outfitted with a rope-gripping device. Compliance by January 1, 2020, was mandatory, with scofflaws incurring fines. Schaeffer says:

“From what I can tell, on average, only 25-30% of elevators have been retrofitted to comply with DLM. We are about 60% done with our customer base, so we’re actually ahead of the game. By September, we should be pretty well done with our customers. But, I still have [approximately] 100 customers who haven’t even approved expenditures for DLM yet.”

Some, he says, are opting for complete modernizations, making it “the busiest it’s ever been” in NYC for D&D. Business grew by 25% in 2019, and Schaeffer predicts a similar outcome this year, fueled in large part by modernization. He says:

“There is a lot of antiquated equipment in the city that has to be either upgraded, repaired or replaced. We have somewhere in the neighborhood of 60,000-70,000 elevators that have some age on them. If there are a couple thousand a year that are modernized and multiple tens of thousands that aren’t, you do the math. By the time you finish modernizing every single one of them, it’s time to modernize them again. So, it just keeps going.”

Elevator modernization, Schaeffer says, is strong throughout the boroughs. In terms of new construction, Manhattan and Brooklyn lead the way.

“Manhattan’s Manifest Destiny”

The biggest private real estate development in U.S. history, the 28-acre Hudson Yards on Manhattan’s Far West Side was conceived nearly two decades ago and “viewed by developers and city agencies alike as Manhattan’s Manifest Destiny” and the last piece of significant property

Planning, “dreams and ambitions are limitless; land is not.” By creating infrastructure that didn’t exist before, the city’s failed bid to host the 2012 Olympic games served as the catalyst for Hudson Yards on the former site of railyards.[2]

Today, portions of its first phase — the 27-story 10 Hudson Yards with numerous high-end retail tenants and others; the 88-story, residential 15 Hudson Yards; the 51-story office tower 55 Hudson Yards; Thomas Heatherwick’s interactive sculpture, Vessel; the mixed-use, 72-story 35 Hudson Yards; and multiarts center The Shed, where Icelandic performer Björk enjoyed a sold-out residency in April-June 2019.[2] — have already opened. 50 Hudson Yards is set to open in 2022, with the second phase, Western Yard, expected to start opening in 2025. The development has been praised and panned, with descriptions ranging from “an ambitious experiment in urban planning, sustainability and smart infrastructure” to a “billionaires’ playground” and NYC’s own Westworld.[2] Regardless, Hudson Yards is driving business for OEMs and independents alike.

In 2018, thyssenkrupp announced it would install up to 40 TWIN elevators at 50 Hudson Yards and more than 100 units throughout the megaproject, including 27 elevators at 55 Hudson Yards and 12 elevators and escalators at The Shed. Upon completion in 2022, 50 Hudson Yards will become Manhattan’s fourth-tallest office building. Its TWIN elevators, featuring two cars operating independently in the same shaft, will be the first such installation in NYC and the second in the U.S.

Suppliers including National Elevator Cab & Door Corp. (NECD) agree projects like Hudson Yards are driving business. The company will supply 88 elevator cabs and more than 1,100 entrances at 50 Hudson Yards. NECD CEO Jeff Friedman says the percentage of his company’s NYC workload has ranged from 60% to 90% in any given year in its 90-plus-year history. Right now, he says, “that’s close to the top of that range” with close to 20 20-plus-car projects underway. In addition to Hudson Yards, NECD is handling 58 cabs for the modernization of the MetLife Building at 200 Park Avenue above Grand Central Terminal in Midtown Manhattan and 33 cabs for the modernization of the Trump Building at 40 Wall Street in the Financial District. Friedman says NECD is also strong in market-rate and public- housing residential projects.

Providing further insight, Friedman shares:

“Manhattan continues to be the busiest borough for us. Job growth and rezoning, [the latter of] which allows new construction and encourages existing buildings to modernize to keep up with the new space, are big business drivers. The trend can continue; there’s still development opportunities in many markets: Hudson Yards, Grand Central, Penn Station, downtown Brooklyn, Long Island City (LIC) and more. We have a list of more than 1,000 buildings in NYC with five or more elevators — a list that’s not complete, by the way — whose average age is almost certainly more than 50 years old — and we’ve modernized around 150 of them, so there’s still work to be done.”

Otis’ Corey agrees, observing the city’s high-rise market is cyclical, with older buildings being either modernized or torn down and reconstructed as companies move into new ones. “Whether or not a building is modernized or reconstructed depends on a number of factors,” Corey says. “I typically see those built within the past 20 years get modernized.” Across the boroughs, NYC is generally well-suited for skyscrapers, he says, pointing to 57th Street as a longstanding example.

He elaborates:

“There are particular areas like LIC, downtown Brooklyn and Manhattan that now seem to be especially booming. For example, LIC’s skyline has grown significantly in the last decade. If you were to look across the river toward LIC 10 years ago, you would’ve seen a breadth of factories. Now, an even mix of residential and commercial high rises fill the space.”

Residential construction permitting numbers increased slightly in 2019 compared to 2018, and 2018 was a major increase from 2017, New York YIMBY’s Nikolai Fedak says. He believes this year holds more of the same or, perhaps, a slight decrease in overall filing activity. “In either case, construction across the five boroughs has been doing well in recent years,” Fedak states, continuing:

“The current momentum in construction across the boroughs appears to be geared toward high-density housing in the urban periphery. This includes the Bronx, Queens and Brooklyn. [Mayor Bill de Blasio’s] push for affordable housing in these areas offset some losses in the solely market-rate sector, which dominates in the heart of the city. Staten Island’s overall activity isn’t necessarily high enough in any given year that meaningful trends can be taken in activity from one year to the next, barring a massive gain or drop. In 2019’s case, I think things remained largely unchanged.”

Growth Begets Growth

Fedak observes the emergence of Hudson Yards and Midtown East promise to fuel further development. The expansion of Manhattan’s commercial core into new neighborhoods will result in a gradual but sustained development boom in these same neighborhoods, he says. As the western railyards transform into greenspace (Hudson Yards will eventually incorporate 14 acres of it),[2] new developments will rise in the surrounding blocks, he projects. “Many of Midtown East’s antiquated office buildings are also destined for the wrecking ball, given the tremendous allowances provided by the recent upzoning [changing zoning to allow for higher value, such as industrial to residential or to higher density],”[3] he continues.

NYC has another record in the upcoming tallest intentionally demolished structure in history: the 52-story JPMorgan Chase building at 270 Park Avenue in Midtown Manhattan. In its place, JPMorgan plans to construct a 1,322-ft-tall, 57-story supertall starting construction as early as next year. There are 27 supertalls — buildings that exceed 984 ft tall — either completed, under construction or proposed in NYC, representing a “supertall boom” that was mapped by Curbed New York.[4] But is the era of supertalls in the city coming to an end? Perhaps not, Fedak says, stating:

“Midtown East is perhaps the next contender for any new supertall proposals. Last year, YIMBY posted plans for another Vornado supertall at 350 Park Avenue. That one is apparently still in the very early stages of ideation, but it shows that much of the stretch of Park Avenue north of 42nd Street is ripe for new construction, so I would not be surprised to see plans leak for another tower or two in that corridor.”

With new construction and modernization across NYC showing no signs of letting up, the main challenge for VT companies will be the availability of qualified labor. “While the number of high-rise office projects is reducing, activity in other segments and the increasing supply of modernization and maintenance projects are applying pressure on the labor market,” Ramandanes says.

References

[1] Frank, Robert. “What It’s Like to Live on the 123rd Floor of the World’s Tallest Condo Tower,” CNBC Markets (September 18, 2019).

[2] Fixsen, Anna. “Everything You Need to Know About the Hudson Yards Grand Opening,” Architectural Digest (March 13, 2019).

[3] urban-regeneration.worldbank.org/node/21

[4] Plitt, Amy. “NYC’s Skyscraper Boom, Mapped; These 20-+ Skyscrapers Will Forever Alter the NYC Skyline,” Curbed New York (January 23, 2020).

Get more of Elevator World. Sign up for our free e-newsletter.