Chicago in the Spotlight

Aug 1, 2016

From the office tower in Chicago’s West Loop where Adams Elevator is based, the steady beat of pile drivers serves as the soundtrack for day-to-day business. It is an indication of the vast amount of construction underway that’s driving orders for vertical-transportation equipment. “When you come here, you can hear the drumbeat of progress,” Adams General Manager Rick Stumpf observes. “It’s all around us.”

Indeed it is. There are 40 high rises under construction in Chicago, including nearly 30 at least 20 stories and approximately a dozen skyscrapers of at least 400 ft.[1] Since this information was released in March, several towers have been completed and several more begun. Apartment construction is leading the way. Shawn Ursini, data researcher at the Chicago-based Council on Tall Buildings and Urban Habitat (CTBUH), observes:

“It’s an absolute boom in terms of rental-apartment construction. The market is white-hot. There are 4,000 apartments completing construction in 2016 and another 4,400 in 2017, with numerous proposals even further out. With more than 90% occupancy, the absorption is there, and the financing is there. I wouldn’t say veteran developers were totally surprised by it, but it goes perhaps even deeper than they could have imagined.”

Ursini says the market shifted from condominium to rental construction in the latter 2000s, when mortgage lending tightened after the recession. At the time, he stated, there were very few apartment rental options in downtown Chicago. Stricter lending criteria, combined with pent-up demand, converged to “ignite this massive building boom in Chicago,” he observes.

Hotel construction is also hot, Ursini states. The city is in the home stretch of the “biggest hotel-building boom in nearly 30 years,”[2] which includes the 40-story Marriott Marquis hotel that is part of the McCormick Place event center. Otis is providing the vertical transportation for the entire project (ELEVATOR WORLD, February 2016).

There is also significant office construction taking place, including multimillion-dollar modernizations, as property owners strive to stay competitive with all the new property coming online.

In 2015, the amount of commercial investment in Chicago hit a high, with sales of office, industrial, retail, apartment and hotel properties reaching US$22.64 billion, up 44% from 2014. The last record high was US$22.55 billion in 2007.[3]

Corporations Migrate Downtown

Chicago’s central business district is the place to be, with major corporations increasingly choosing downtown over the suburbs. It’s a “reverse corporate migration aimed at attracting an urban millennial workforce” that has seen nearly 40 companies moving downtown since 2011.[4] McDonald’s announced it is moving its corporate headquarters from Oak Brook, Illinois, to the former home of the Oprah Winfrey show, a skyscraper in the city’s West Loop. In 2015, Motorola Solutions announced it would move its headquarters from Schaumburg to downtown Chicago.[4] Also in 2015, Kraft Heinz (with some 2,000 employees in the suburbs) announced a move from Northfield to downtown Chicago.

Adding that United Airlines moved its headquarters (and some 4,000 workers) into the Willis Tower in 2013, Ursini notes tech startups are also strong.

Like NYC but Different

thyssenkrupp Elevator’s Chicago branch managers sat down with your author recently at thyssenkrupp’s North American regional headquarters in the West Loop. They elaborated on how the building boom is affecting business and shared statistics, history and distinguishing market features of Chicago. They said if they had to liken the Chicago construction and elevator market to that of another U.S. metropolis, it would be New York City (NYC). There, as in Chicago, towers are multiplying at a dizzying rate.

Justin Richards, thyssenkrupp branch manager for the Chicago Lombard Central Region, states:

“We’re seeing a lot of both new builds and modernizations, compared to what it was years ago. A lot of the new builds are residential, and we’re also seeing a lot of medical. People are moving back to the city, and places that were once industrial are becoming residential, like the meatpacking district, where there were once warehouses, now being home to lofts and high-rise condos. We’re seeing a boom in construction, and business is good.

“We are seeing the effects of the current trend of urbanization. People are moving back to the cities. We also maintain a good deal of medical facilities, but we service everything from steel mills to airport to gas refineries in Chicago.”

Although many agree with KONE Marketing and Communications Director Patrick O’Connell’s assertion that the Chicago market is “vibrant, dynamic and growing,” everything is not wine and roses. Projects in the pipeline now, some of which have not even broken ground yet, promise to keep elevator companies busy for the next several years. However, behind the mass corporate migration and brisk business, there are murmurs of discontent. Cullen Bailey, vice president of Mid-American Elevator in the gentrifying East Village neighborhood, says the market is “not undergoing ‘crazy growth’ but is healthy.” However, he observes, “Chicago has got some fundamental political and economic issues” with which it must deal.

Despite consistently leading the U.S. pack in landing new and expanded corporate facilities, Chicago’s job growth has been slowing overall, and the trend is expected to continue.[5] Its credit rating is poor: only Detroit has a lower rating, and its jobless rate of 6.6% puts it in 51st (last) place among metropolitan areas with populations of more than 1 million.[5] Despite having some of the most restrictive firearms laws in the country, gun violence continues to be a problem.

However, the government and corporations are making efforts to reverse negative trends, and companies big and small — including those in the elevator industry —would be loath to see a city where they have roots dating back to the 1800s crumble.

While Chicago is similar to NYC, it’s also different. It is possible to drive around the city comfortably, a feat nearly impossible in NYC. It’s also an architecture capital of the world. Notes Otis Chicago Regional Sales Manager Scott McGuire:

“What makes Chicago stand out is its numerous architecture firms, including Solomon Cordwell Buenz & Associates, Inc., Studio Gang, Skidmore Owings & Merrill, Gensler and Goettsch Partners. These firms have constructed landmark buildings in various styles, many with Otis elevators. Otis has installed elevators in five of the 10 tallest buildings in Chicago and continues to command a leading presence in the service business.”

A Rich History

Otis established a presence in Chicago in 1870, when Norton Otis (son of Elisha Graves Otis) reached an agreement with Walworth, Brooks & Co. to sell Otis products in the city. It has the distinction of building the elevator system for the circa-1921 Palmolive Building, which would become the first building to have elevator music in 1948. Otis explains:

“As buildings grew taller, passengers started feeling the sway of the building on windy days. Psychologists theorized that soft music might take their minds off the sway, so Otis worked with The Muzak Co., and elevator music was born!”

Otis is responsible for many noteworthy historic Chicago elevator systems, including:

- Grand Central Station, 1900

- The Majestic Building, the first gearless traction elevators in the city using just one set of ropes, 1903

- The Wrigley Building, 1921

- The John Hancock building, 1968: it was here that Otis debuted its Sky Lobby system, in which residents take one of three express elevators to a 44th-floor lobby, thus avoiding numerous stops. From this lobby, passengers connect to other elevators to reach their destinations.

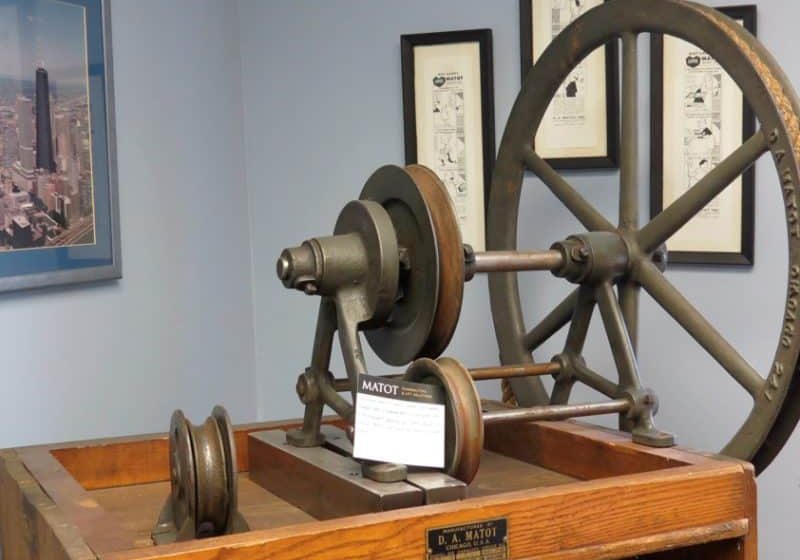

thyssenkrupp entered Chicago through acquisitions, dating back to the 1893 World’s Fair when a company it later acquired debuted a locomotive there. In elevators, thyssenkrupp gained a major foothold with the acquisition of Dover Elevator in the mid 1990s. Through that acquisition, thyssenkrupp has had a large presence in Chicago and other major American cities for 17 years, building upon the hydraulic expertise of Dover to become a major player in the new construction, service and modernization markets. The company has two branches in the Chicago market, one downtown and the other in Lombard, which serves the suburbs. “Our size is an advantage in the market,” Jeff Boomer, vice president of thyssenkrupp Chicago’s North District, observes.

Chicago’s wealth of historic properties makes modernization here an important revenue driver for thyssenkrupp. Mike Askren, branch manager of Chicago Downtown, observes new construction drives modernization. Askren states:

“The strength of the construction market is driving the modernization market, because it’s becoming more of a challenge to keep tenants in existing buildings. Building owners are having to upgrade and provide amenities to keep tenants from going to the beautiful new building down the street.”

Those “beautiful new buildings down the street” include the 52-story, Pickard Chilton-designed River Point, for which thyssenkrupp provided the elevator system (see story, p. 108). In addition to River Point, thyssenkrupp’s Chicago new projects include:

- Optima Chicago Center II, a 42-story residential building located where the Chicago River meets Lake Michigan, five momentum and two endura machine-room-less

- (MRL) elevators

- The Sinclair, a 35-story residential tower on the Gold Coast, one endura MRL, four momentum and two synergy elevators

- No. 9 Walton, a 34-story residential tower in the Gold Coast, four momentum elevators

- Alta Roosevelt, a 33-story residential tower in the South Loop, one endura MRL and five momentum elevators

- Van Buran and Aberdeen, a 32-story residential tower in the West Loop, three momentum elevators

- 625 West Adams, a 20-story Class-A commercial office tower, one endura MRL, two synergy and eight momentum elevators

thyssenkrupp is also handling numerous modernization projects in Chicago, including:

- AMA Plaza (formerly the IBM Building), a 52-story office tower on the Chicago River, 30 elevators

- 125 S. Wacker, a 31-story Class-A office building, 14 elevators

Property owners are going so far as to completely rebuild properties, which was the case with the London Guarantee & Access building (housing the London Hotel) on the riverfront, which recently reopened with 16 new floors.

For London House, Otis was contracted to provide two new elevators, modernize others and install the CompassPlus destination-dispatch system. Otis’ McGuire elaborates:

“The US$200-million renovation and expansion of the 1923 Alfred Alschuler-designed London Guarantee & Accident Building involved W.E. O’Neil completely gutting the iconic building and constructing an adjacent, 16-story building with hotel rooms, four floors of office/meeting space, a restaurant and rooftop bar. The architects went to great lengths to retain the original look of the lobby and elevator entrances. Otis is no stranger to such custom design work.”

Recent modernization projects awarded to Otis in Chicago include:

- The Rookery, a historic landmark that was outfitted with six Elevonic® R-Series with RM-H controllers, one Elevonic with RM controller, one HydroFitTM MRL hydraulic elevator, the CompassPlus destination dispatch system and the PanoramaTM elevator management system

- 500 W. Madison, (Citigroup Center), a 42-story skyscraper designed by Murphy/Jahn Architects in the late modernist style that has 24 Elevonic 411, two Gen2® and two HydroAccelTM elevators and the Panorama system

- 70 W. Madison, (Three First National Plaza), a 57-story office tower with a sawtooth design by Skidmore, Owings & Merrill designed to minimize obstructions to nearby buildings: the project included 17 SkyRise elevators, 11 Elevonic R-Series with RM-H controllers and the CompassPlus and Panorama systems.

- 111 S. Wacker, a 51-story Leadership in Energy and Environmental Design-certified building designed by Lohan Caprille Goettsch Architects; 18 Elevonic elevators and the CompassPlus system

- Aon Center, a modern supertall in the Loop designed by Edward Durell Stone and Perkins+Will standing 1,136 ft. tall: with 83 floors, it is the city’s third-tallest building. Modernization included installation of CompassPlus on eight existing double-deck Elevonic elevators.

The most challenging aspect of doing business in Chicago is the vast amount of competition, states Boomer. He estimates there are approximately 70 companies, ranging from smaller independents to mid-sized companies to the big OEMs. Boomer says:

“Our major competition, such as Schindler, Otis and KONE, has a large presence in this market. There’s very diverse competition and a lot of it. Also, this is a very active consultant market, which has its positives, because they can bring a lot of business by recommending upgrades or modernizations.”

For this reason, forming and maintaining relationships with consultants is vital. Once a job has been secured, it’s important to be consistent and meticulous with customer service, Askren states. “The responsiveness, the communication: you can never let up. You always have to be on top of your game.”

Cornelius Walls, vice president of North American Operations for elevator-door system and safety-edge manufacturer Formula Systems, who is based in Chicago, observes that modernizations that had been put off are now coming to fruition. There are very few, if any, employees “sitting on the bench,” Walls says.

Despite the competition, everyone agrees there is plenty of work to go around in Chicago these days. The outlook is sunny. States Otis’ McGuire: “Currently, we’re seeing strong bidding activity in both the new-equipment and modernization markets. It is an exciting time to be doing business in the Windy City!”

References

[1] LaTrace, A.J. and Koziarz, Jay, “Mapping the 40 Highrises Under References Construction in Chicago Right Now,” Curbed Chicago, March 22, 2016.

[2] Gallun, Alby, “New Downtown Hotel Openings Will Slow in 2016,” Crain’s Chicago Business, August 10, 2015.

[3] Gallun, Alby, “Commercial Property Sales in Chicago Soared to New High in 2015,” Crain’s Chicago Business, February 8, 2015.

[4] Channick, Robert, “Motorola Solutions Moving Headquarters, 800 Jobs to Chicago,” Chicago Tribune, September 15, 2015.

[5] “Chicago in Crisis,” The Week, May 13, 2016.

Get more of Elevator World. Sign up for our free e-newsletter.