Third industry survey enjoys growing participation and a new webinar discussion as shift toward positivity continues.

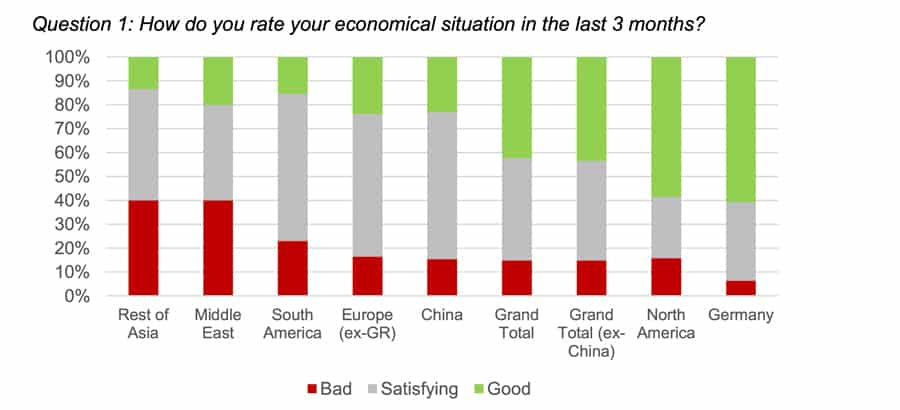

Elevator World, Inc.; the German elevator association VFA Interlift e.V.; and fair organizer AFAG, in association with Credit Suisse, shared results of its third survey of elevator industry representatives on current industry status and future business outlook during the COVID-19 pandemic in January. The survey received 600 responses, compared with the 572 in the second iteration (ELEVATOR WORLD, December 2020) and 550 in the first. Credit Suisse Managing Director and Head of European Capital Goods Equity Research André Kukhnin assisted with preparation of a chart analysis, including breakdowns by country, of the results, including responses on the risk of rising raw materials costs to businesses in 2021.

For the first time, the release of the results was followed by a webinar in which approximately 200 people participated, hosted by Kukhnin; Achim Hütter, chairman, VFA-interlift; and Henning Könicke, CEO, AFAG. They shared further insight and information, observing that initiatives such as the surveys promise to “put vertical transportation (VT) on the map as one of the most resilient [sectors] in the industrial world” and that there is a “clear divide and fork in the road regarding how VT companies will monetize the Internet of Things.” Könicke provided an overview of upcoming industry events around the world, and the trio said their aim is to increase the number of survey participants and countries covered. Additional observations included:

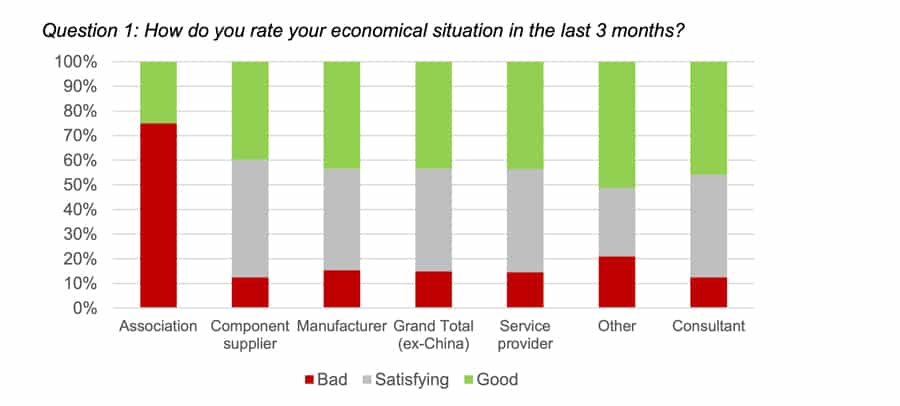

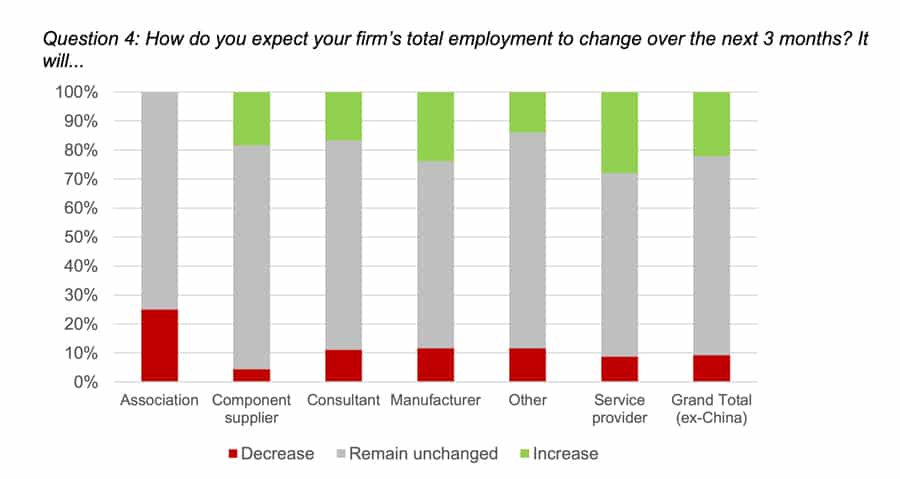

All the layers of the industry supply chain − components suppliers, manufacturers and service providers − turned increasingly more positive, while industry associations remained cautious.

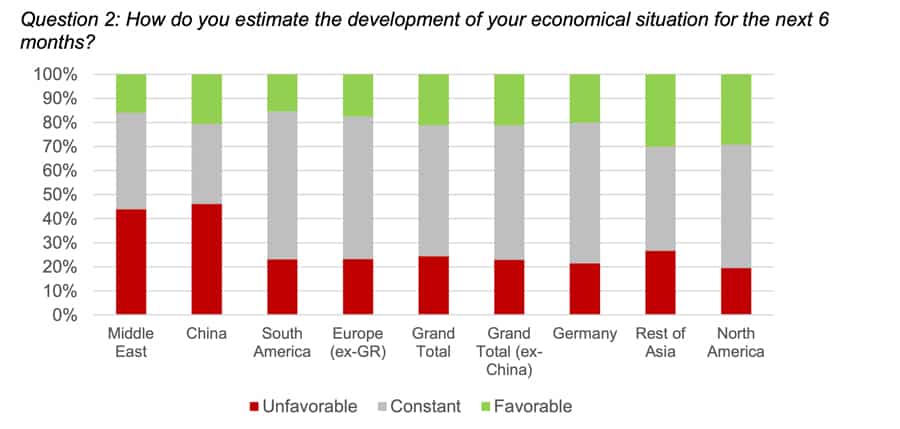

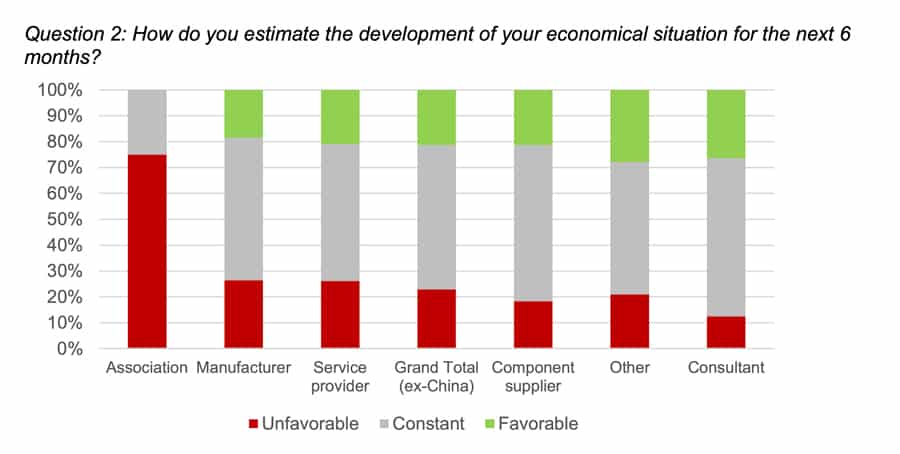

Outlook: Industry view on perspectives over the next six months further improved, but slightly, now nearly reaching the equilibrium of cautious versus positive responses, with 24% still expecting unfavorable developement, versus 21% expecting favorable (29%) versus 24% in October 2020 and 29% versus 19% in July 2020. North America respondents became most positive, improving further into a firmly net positive territory. Notably, respondents in Germany titled away from their previously clear net positive to a broadly neutral one in this survey. Europe, besides Germany, clearly improved and reached a near-neutral position. The China outlook moderated and remained in a net-negative territory. Asia, besides China, saw a significant improvement in becoming the second most positive with an overall net positive balance.

Looking across the supply chain, manufacturers’ outlook moderated slightly and turned to a small net negative. Components suppliers turned most positive, with a small net-positive balance of “favorable” versus “unfavorable” responses. Service providers’ outlook responses remained broadly unchanged compared to October 2020 results, in a nearly neutral stance.

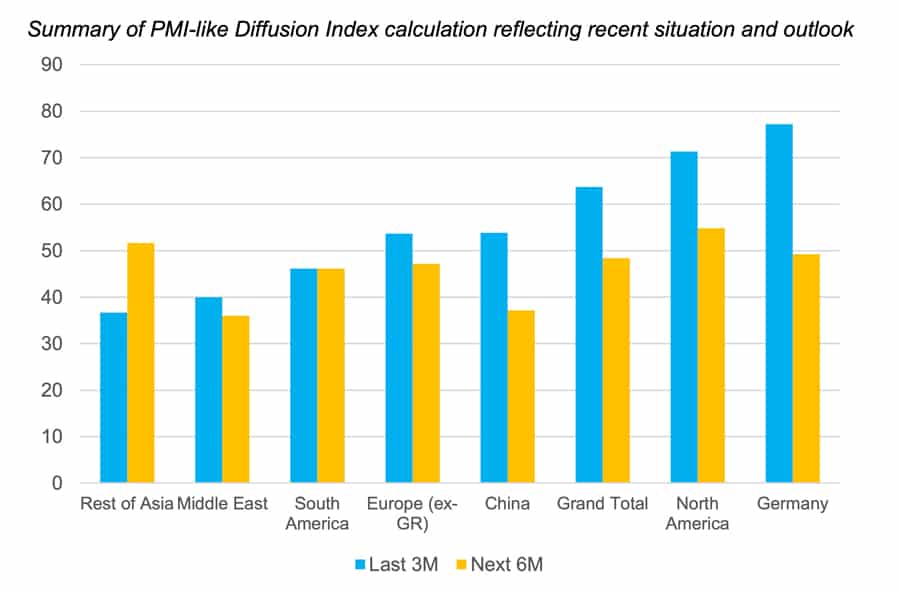

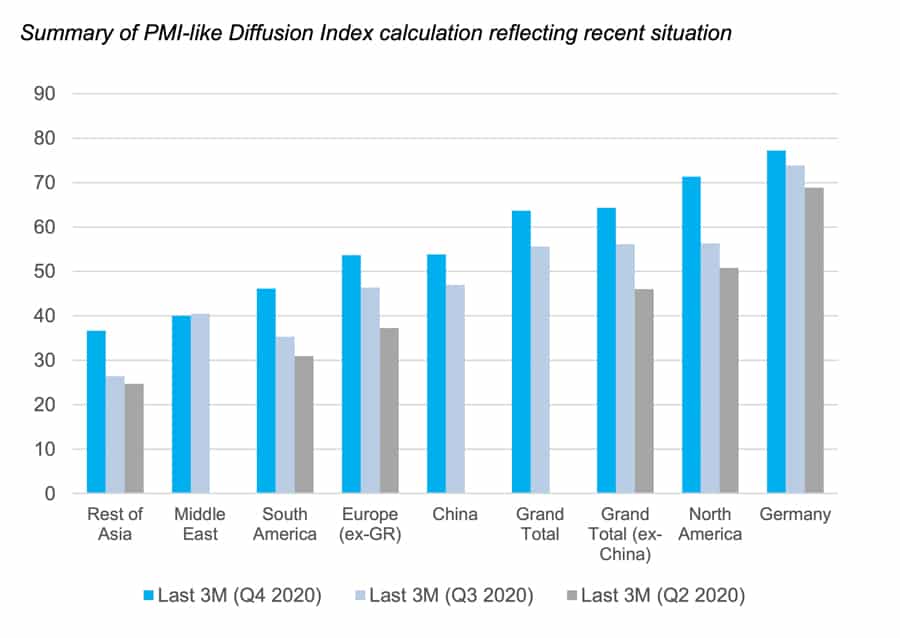

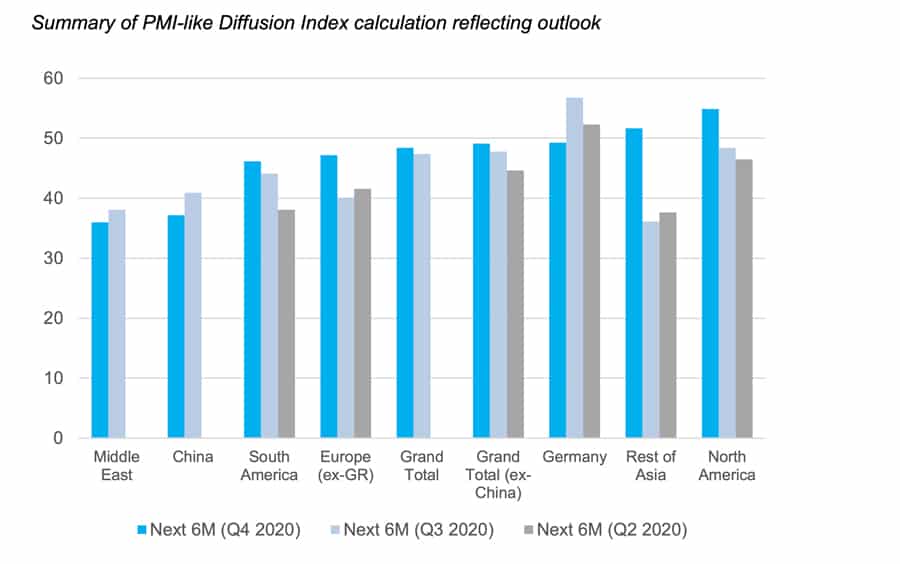

Expressed as a PMI-like diffusion index, globally, the “Current Situation” score is 64, a further substantial improvement versus 56 in October 2020 and 46 in July 2020 and hence indicating sustained return to growth. The forward-looking commentary PMI-like score is now 48, slightly improved versus 47 in October last year (45 in July, but still pointing to a net cautious outlook.) Outlook improved in North America, Asia except China, Europe except Germany and in South America, while it worsened in Germany, China and the Middle East.

Summary of PMI-like diffusion index calculation reflecting recent situation and outlook

Summary of PMI-like Diffusion Index calculation reflecting recent situation

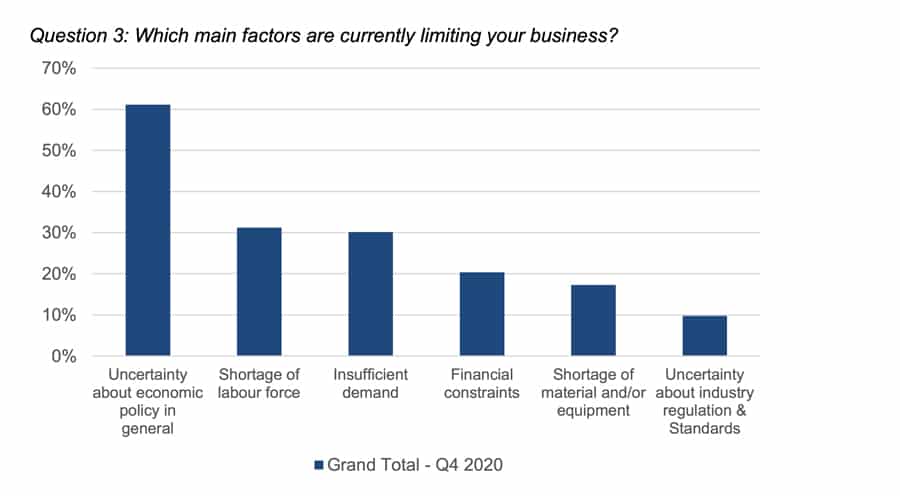

Limiting factors: Uncertainty over economic policy remains a key limiting factor for business performance, according to this survey, consistent with October 2020 and July 2020 readings. Insufficient demand slipped to the number 3 position as a limiting factor, highlighted now by only 30% respondent versus 35% before. Labor remained a key limiting factor, unchanged versus October, while financial constraints and shortages of materials and/or equipment have lessened further.

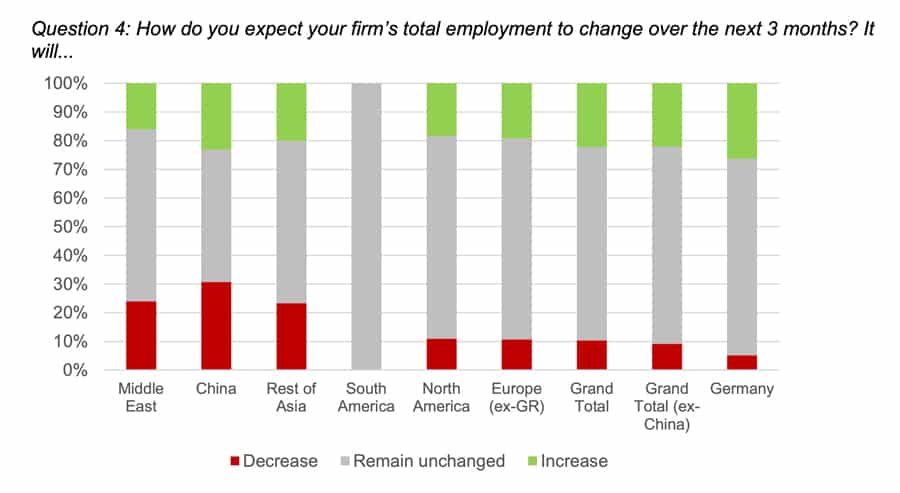

Employment prospects: The industry employment prospects overall have moved further into the positive territory in this survey, with now 22% indicating increase versus 10% decrease (67% unchanged) and hence a 12% net positive reading. This was driven by improvement in all regions apart from Asia, besides China, that fell into a small net negative; Germany that stayed stable at a clear net positive level; and South America that remained stable at net neutral. The most marked improvement in employment prospects was seen in the Middle East.

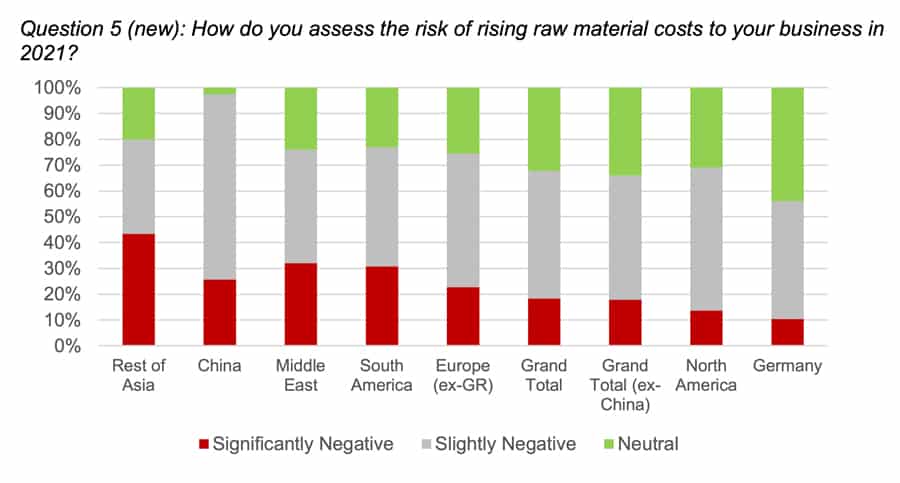

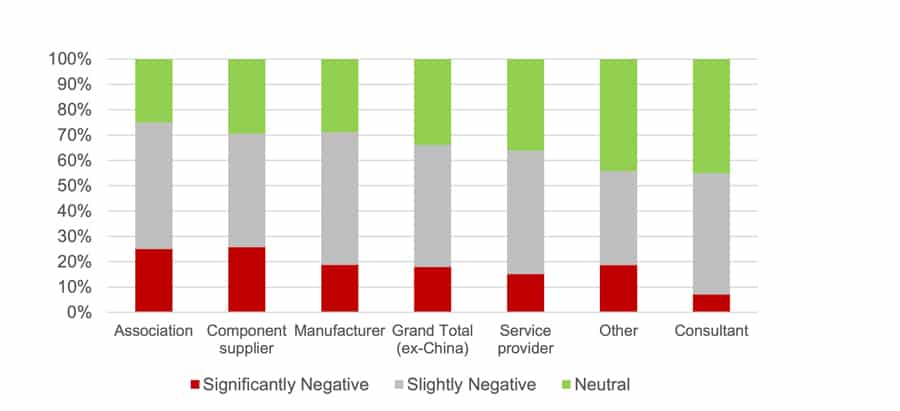

Raw materials: This question was introduced in this version of the survey to gauge industry views on the risk from the recently risen commodities spot prices. Around one-third of the overall respondents anticipate a netural impact, and a further half expect a slightly negative one, leaving just under 20% expecting a significant impact. Looking across the supply chain, service providers expect the most benign impact (85% expecting netural or slightly negative impact), followed by manufacturers (c80%) and by suppliers (c75%) who are most concerned, with c25% expecting a significiantly negative impact.

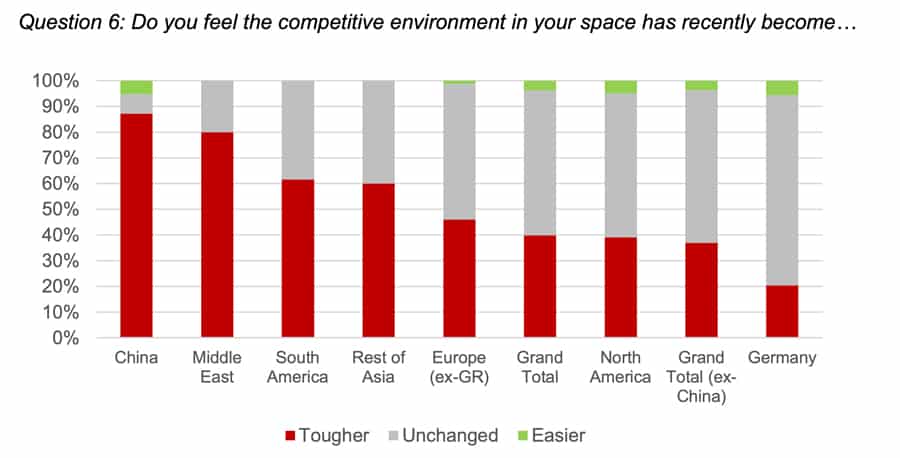

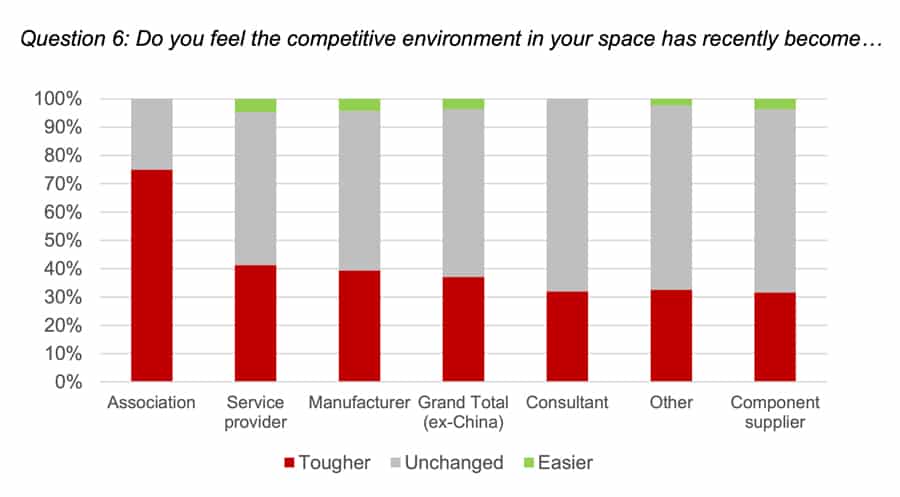

Competitive environment: Responses to this question pointed to continued tough competitve environment globally and across the supply chain but pointed to a small improvement versus October 2020. Geographically, Germany; North America; and Asia, besides China, improved clearly but remained in net negative, while Europe, besides Germany, remained largely unchanged (in net negative). China, the Middle East and South America saw a clear deterioration in the competitive environment. Looking across the supply chain, manufacturers, service providers and component suppliers globally all saw a small improvement in this survey versus October 2020 but remained in a net negative. Component suppliers again pointed to the least net negative result.

- Assessment of the current situation clearly improved further in the fourth quarter of 2020 across all regions and across the supply chain.

- The outlook for the next six months gradually moved to a less cautious stance, but with significant variations across regions and the supply chain.

- Consultants are more positive than associations.

- Businesses are more optimistic about increasing employment, with the most marked improvement seen in the Middle East.

- The competitive situation assessment remains cautious but has become slightly less so versus the October 2020 survey.

- Employment prospects remain positive and improved further globally.

- Uncertainty over economic policy remains the key limiting factor, while others have generally abated.

- Raw materials inflation is now seen as a significant risk by less than 20% of respondents.

Get more of Elevator World. Sign up for our free e-newsletter.