Second industry survey reflects shift to positivity.

Elevator World, Inc., the German elevator association VFA Interlift e.V. and fair organizer AFAG, in association with Credit Suisse, recently shared results of the second survey of elevator industry representatives on the current industry status and anticipated effects of the COVID-19 pandemic on business. The survey ran September 30-October 10, and results were tabulated on October 12-13. Credit Suisse Managing Director and Head of European Capital Goods Equity Research Andre Kukhnin assisted with preparation of a chart analysis, including breakdowns by country and industry segment. Results were calculated using a method akin to the widely followed, evenly balanced purchasing managers’ index (PMI).

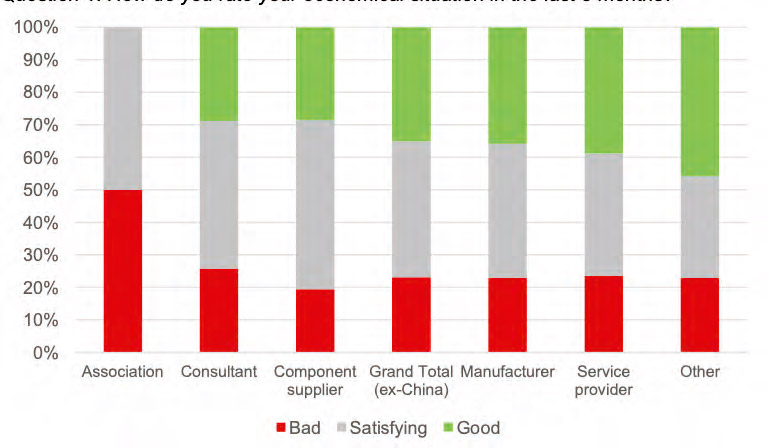

Overall industry outlook has tilted toward the positive, with 34% of responses in the “good” category versus 23% in the “bad,” a reverse of what was reflected in the July survey (ELEVATOR WORLD, October 2020). The latest survey received 572 responses, more than the first iteration that received nearly 550 (only a few from China). To facilitate an even comparison, responses from China were again excluded. Observations include:

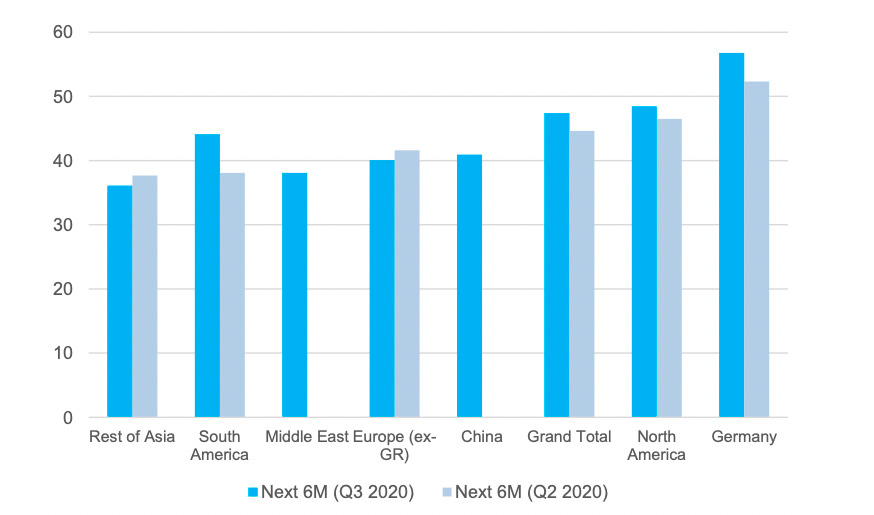

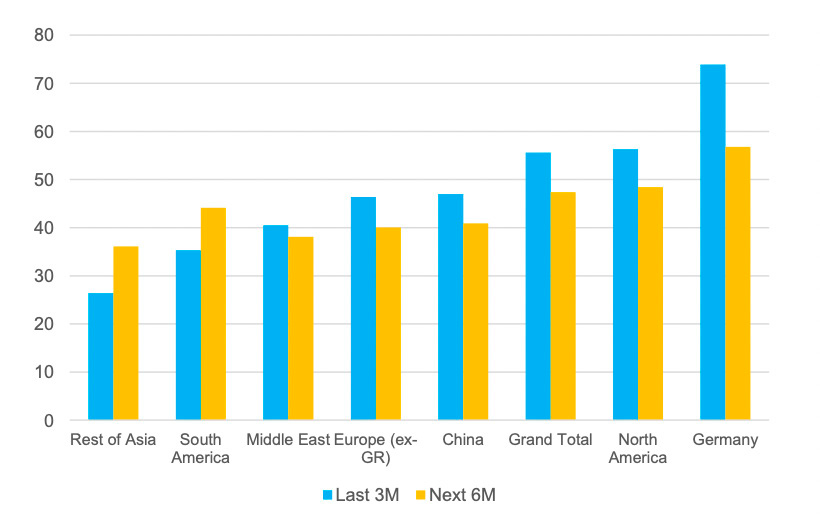

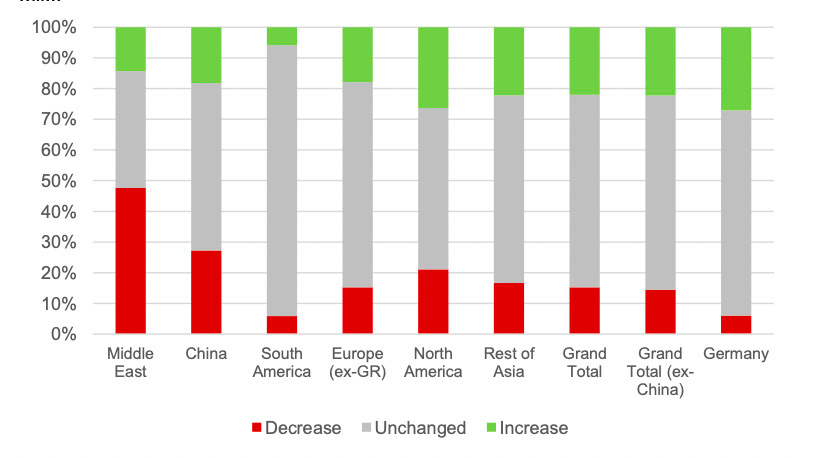

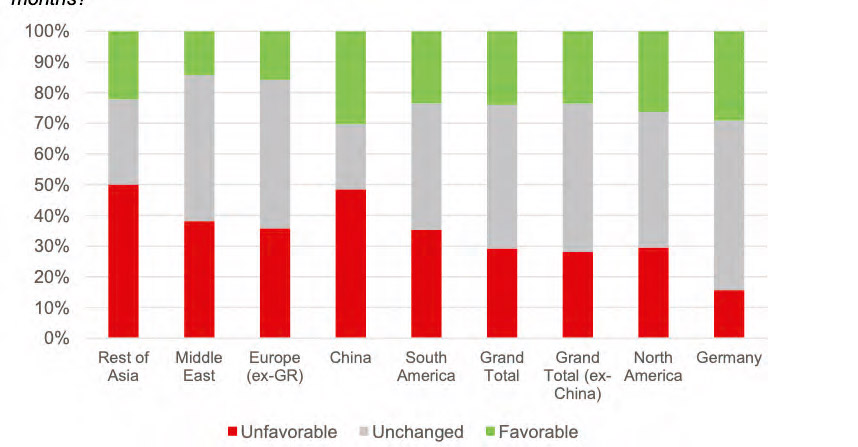

- Respondents in Germany and North America were most positive, while those in Asia (excluding China), South America and the Middle East were most cautious.

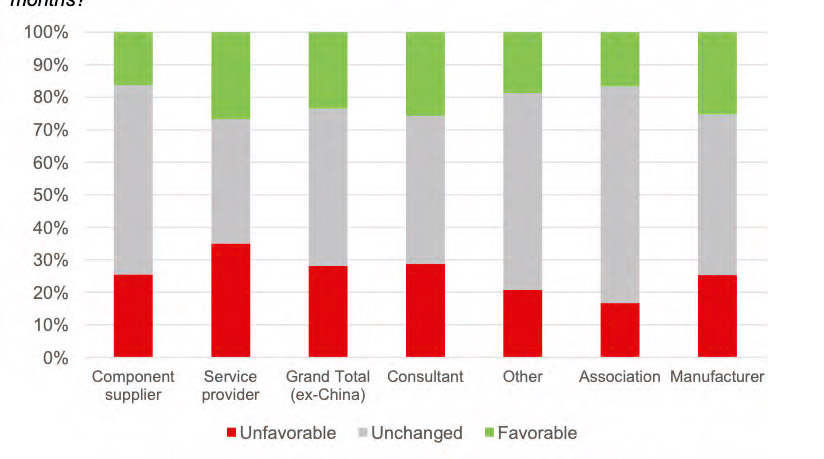

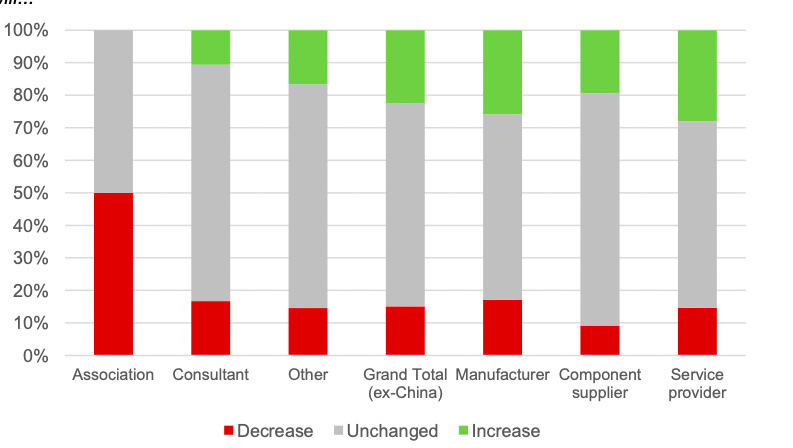

- Industry associations and consultants remain most cautious, while all divisions of the industry (component suppliers, manufacturers and service providers) have become positive.

- Overall, the industry has become slightly less cautious, with 29% still expecting unfavorable development over the next six months (the same as in July) but with 24% now expecting favorable development (versus 19% previously).

- Germany and North America both had improved outlooks compared to in July. Europe (excluding Germany) remained broadly unchanged in terms of negativity, while South America improved.

- Manufacturers’ outlook improved since July.

- Globally, the PMI score of the past three months is 56, substantially better than 46 in July, reflecting an anticipated return to growth. The PMI situation score for outlook is 47, versus 45 in July, pointing to continued overall cautiousness.

- Outlook in Europe (excluding Germany) and Asia (excluding China) worsened slightly.

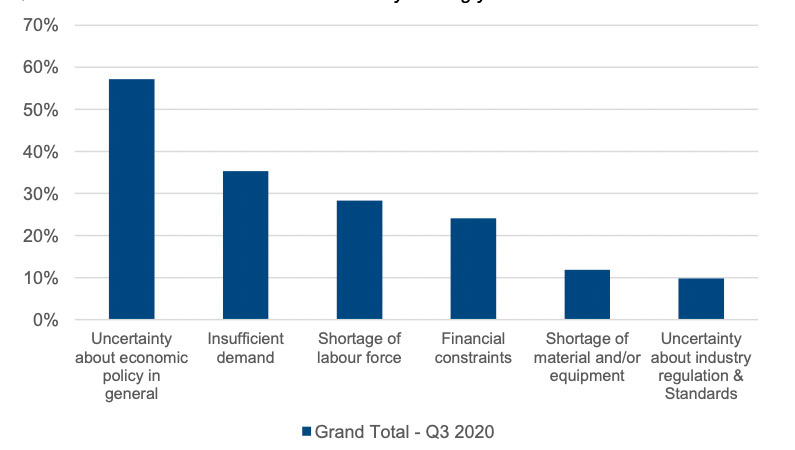

- Consistent with July, uncertainty about economic policy remains a perceived key limiting factor for business performance.

- The level of concern about demand, financial constraints and materials/equipment shortages lessened slightly.

- Employment outlook shifted from slightly negative in July to slightly positive. Further improvement in employment outlook was observed in Germany and North America, and substantial improvement was seen in South America, which is now neutral. The outlook in Asia (excluding China) is now positive and, in Europe (excluding Germany), slightly positive.

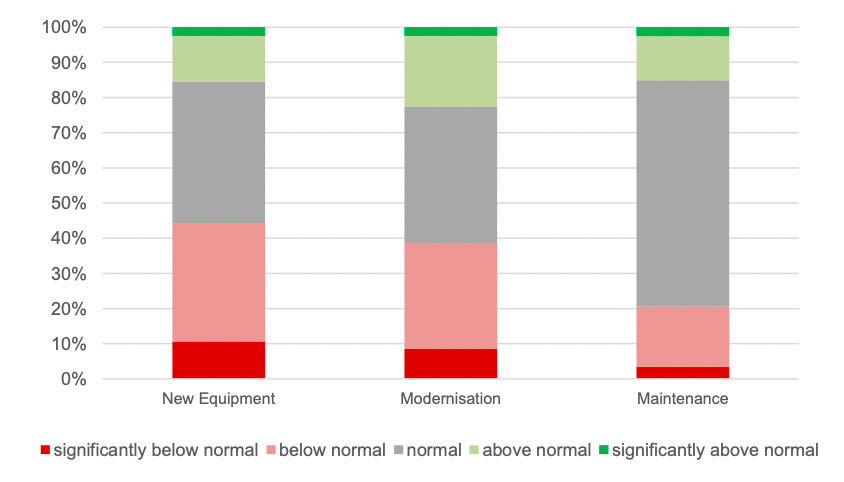

- Globally, business activity is expected to be 5% below pre-pandemic levels. Germany is most positive and nearly fully recovered, while South America and Asia (excluding China) are most negative, with business nearly 10% below pre-COVID-19 levels. Compared to pre-COVID-19, new equipment activity recovered further, modernization deteriorated, and maintenance improved slightly.

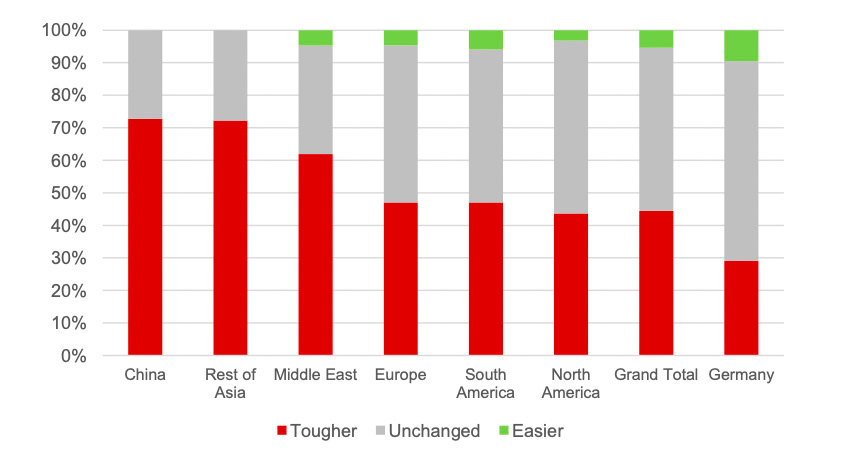

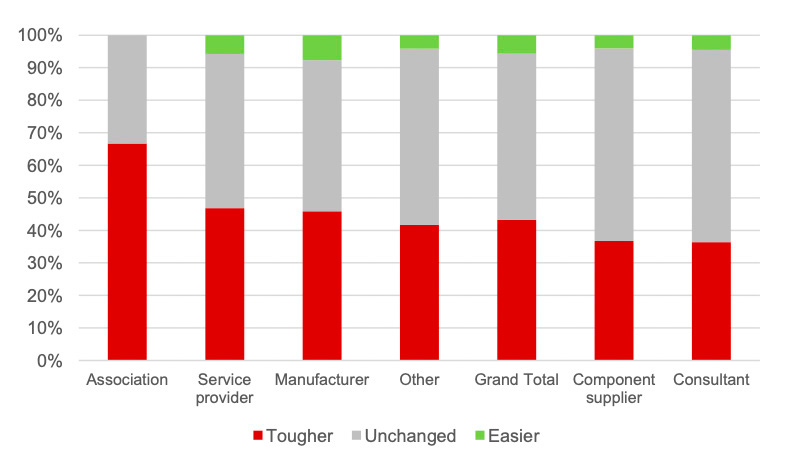

- Responses to a new question about the competitive environment pointed to toughening competition globally across manufacturers, service providers and component suppliers.

Get more of Elevator World. Sign up for our free e-newsletter.