Although COVID-19 is a less dominant driver of sentiment, familiar challenges — including materials shortages and inflation — persist, an eighth industry survey finds.

Elevator World, Inc.; the German elevator association VFA Interlift e.V.; and fair organizer AFAG, in association with Credit Suisse, shared results in August of its eighth survey of elevator industry representatives on business status and outlook. The survey received 330 responses — a drop compared to past iterations that received well over 500. While the COVID-19 pandemic itself is still in the background, specific issues, including materials shortages and prices, continue to create concern, although in some cases to a lesser degree. Bright spots, such as employment prospects, were also observed. Credit Suisse Managing Director Andre Kukhnin assisted with the presentation of a chart analysis, including breakdowns by country, of the results.

Following are some key findings:

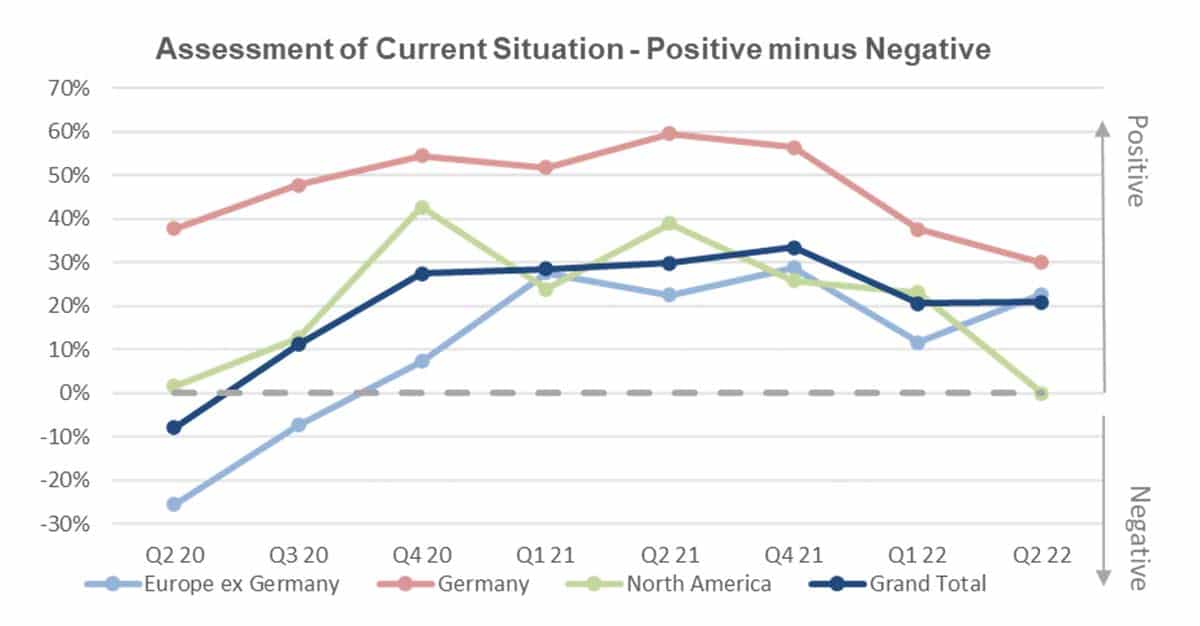

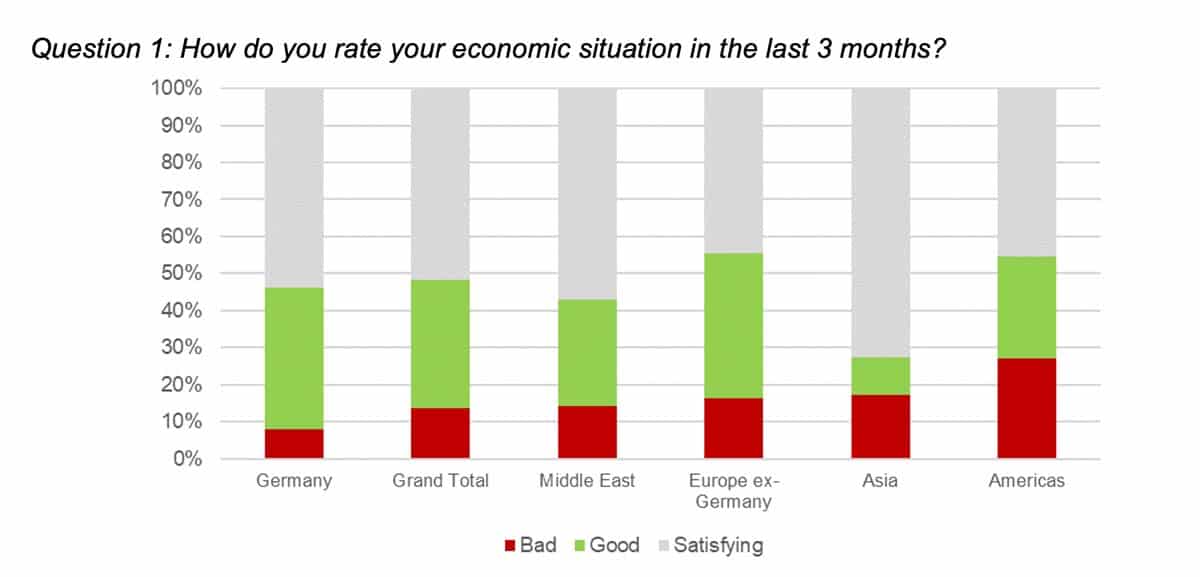

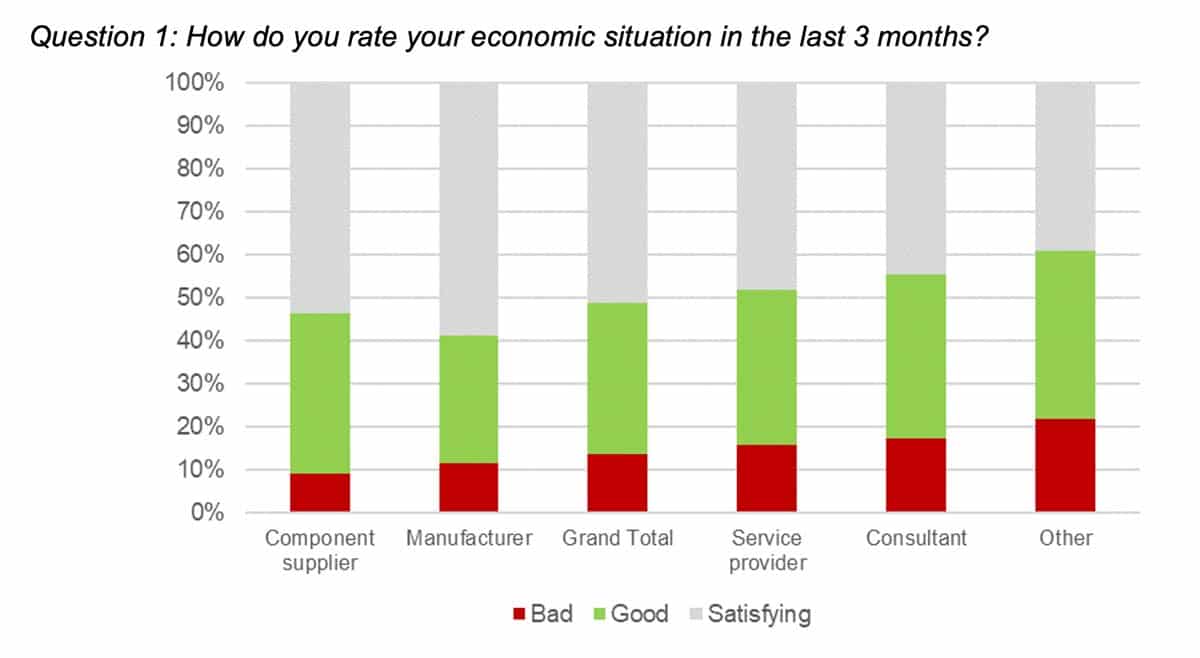

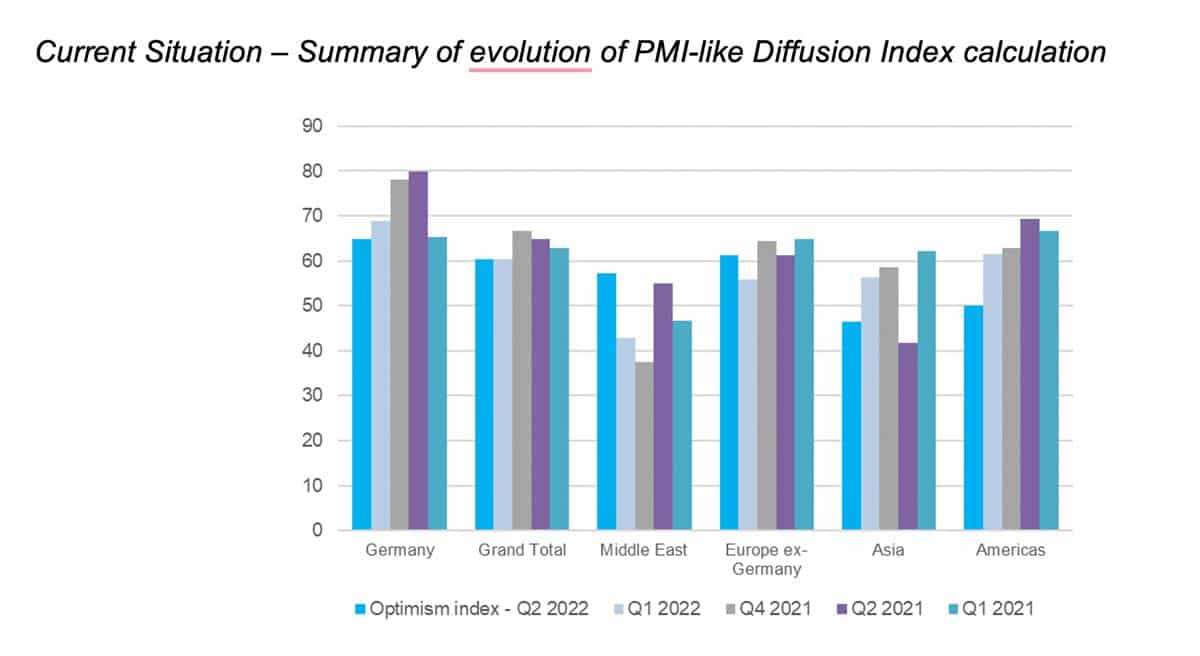

- The current situation assessment is broadly unchanged at the global level, but is clearly diverging across geographies, with Asia and the Americas deteriorating and Europe (excluding Germany) trending up. No particular layer of the industry supply chain has shown any significant change.

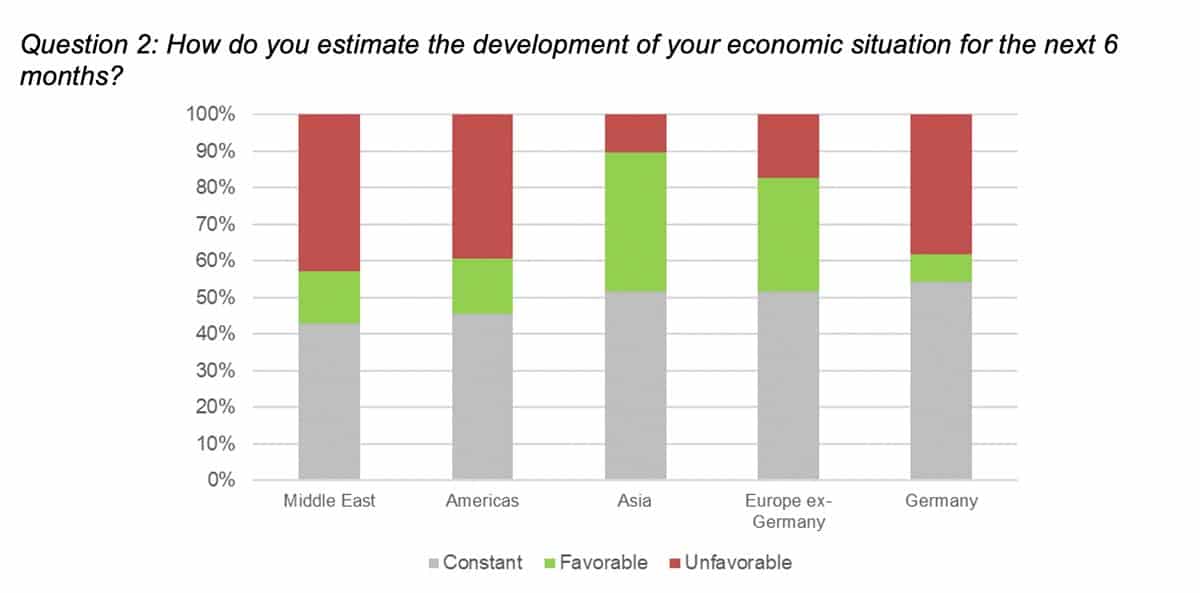

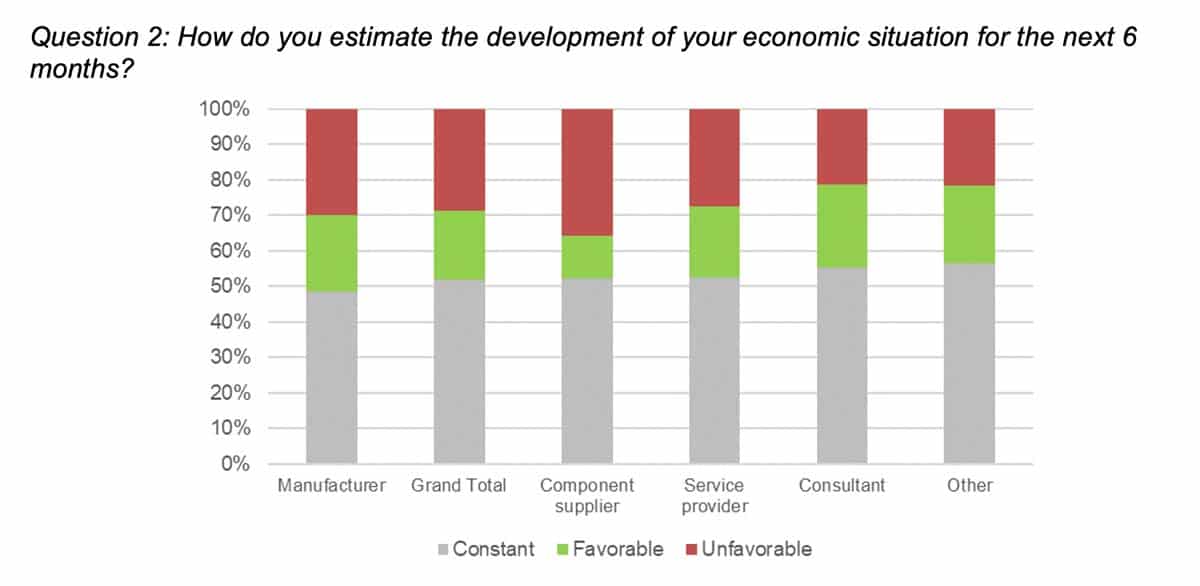

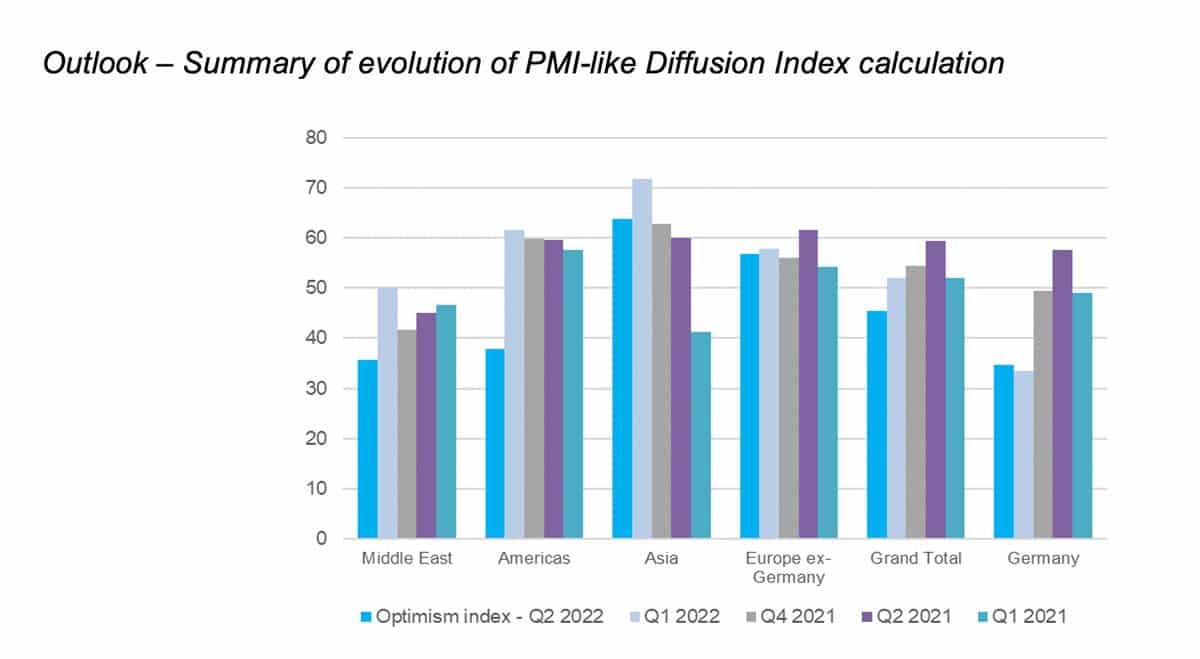

- Outlook for the next six months clearly declined to negative, driven by regions other than Europe. Component suppliers’ outlook were unchanged, while all others across the supply chain reported less optimism.

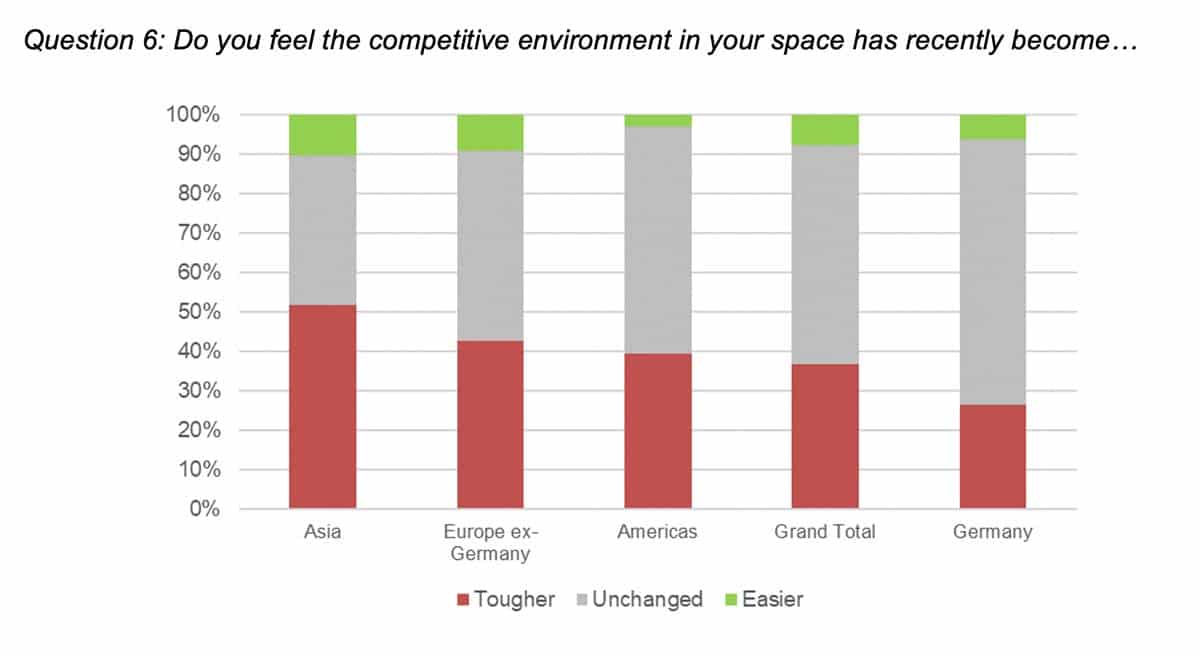

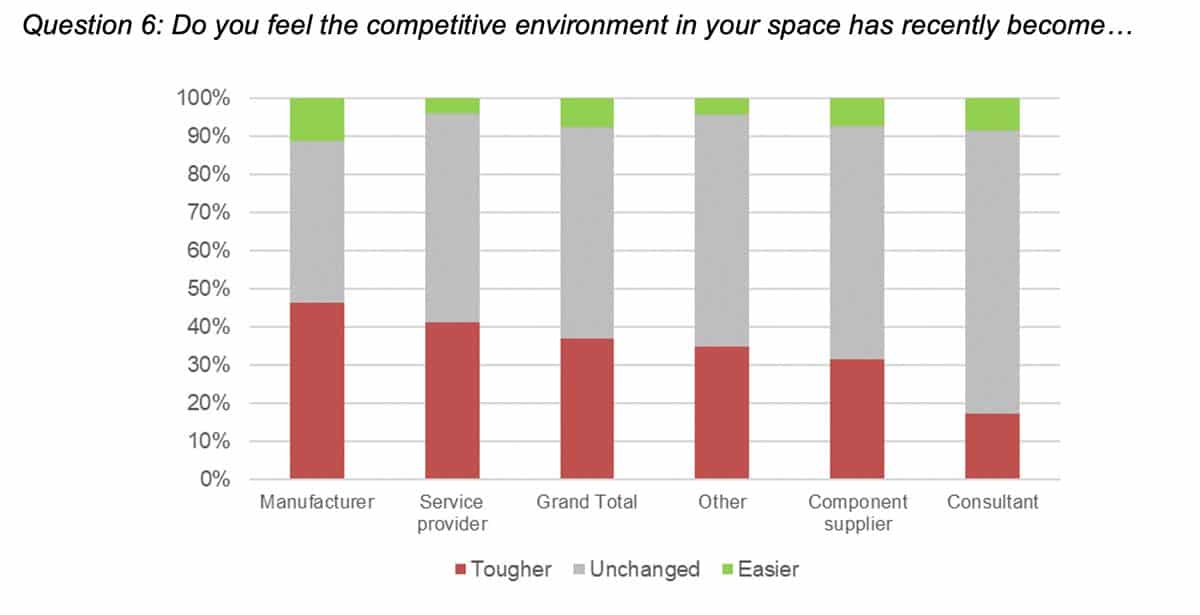

- The competitive situation eased across geographies and supply chain compared with April 2022, with broad-based improvement in all regions except Germany.

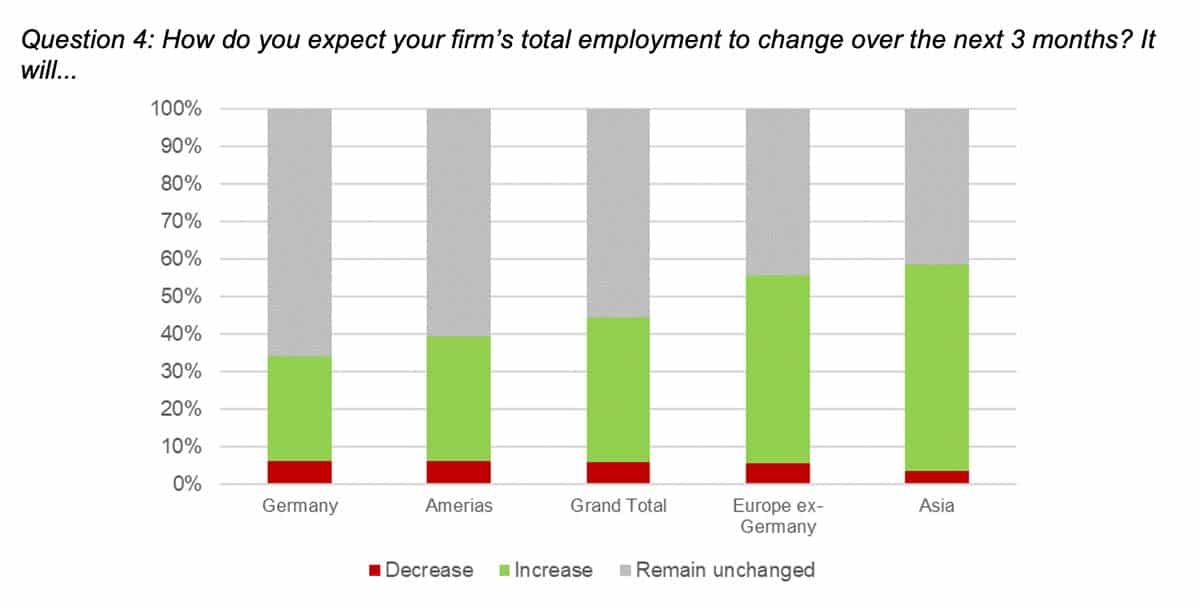

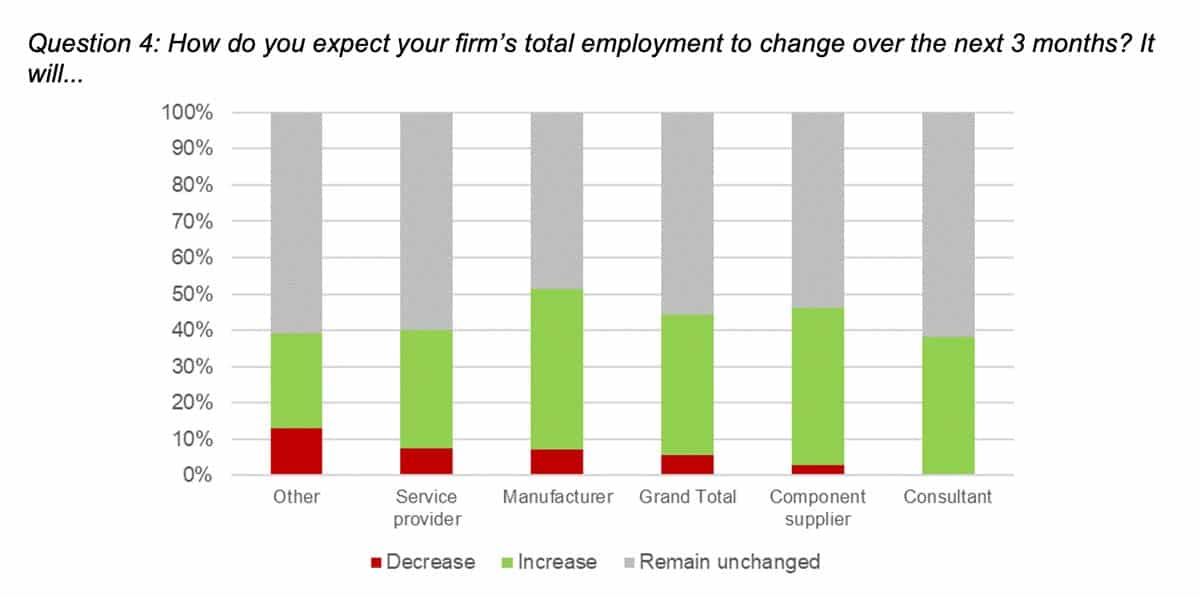

- Employment prospects showed further signs of improvement.

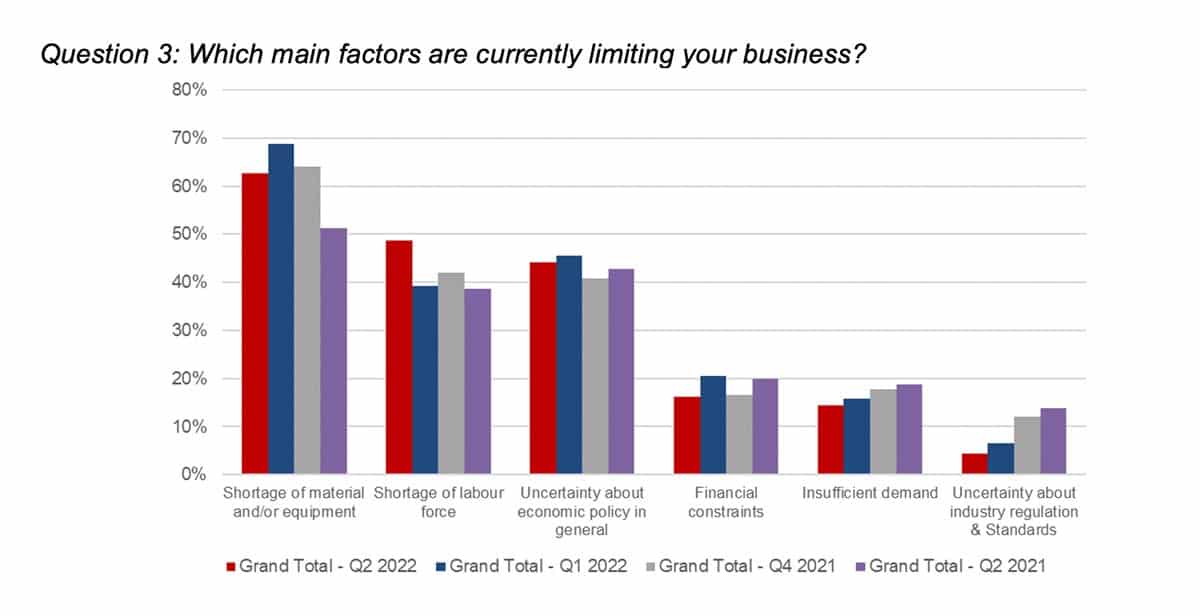

- Materials and equipment shortages remain key limiting factors.

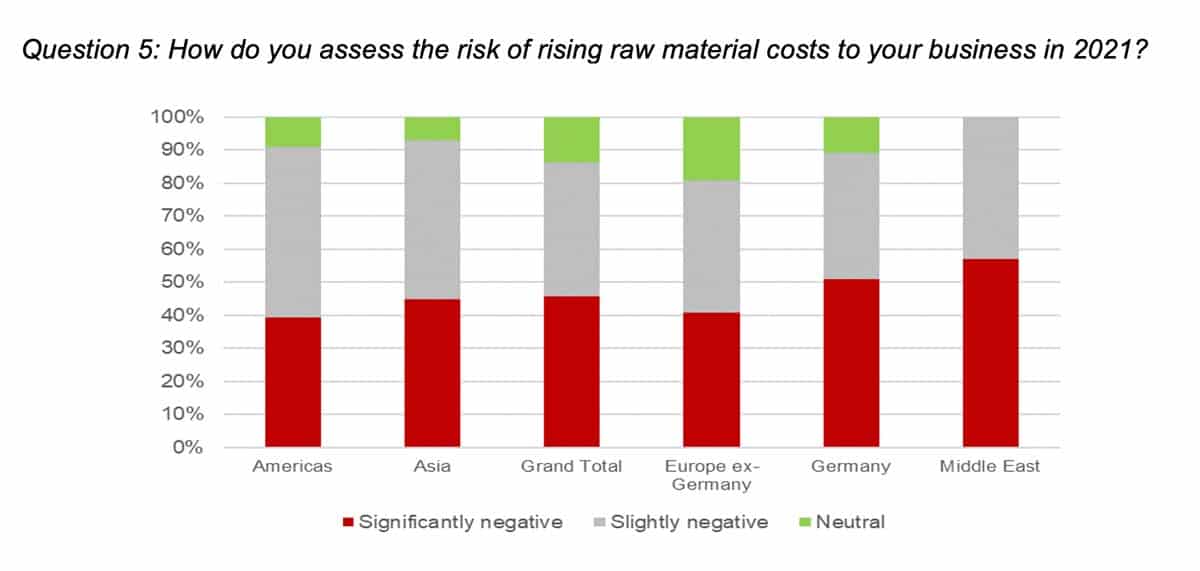

- Raw materials inflation risk remains prominent, but has become less concerning since April. It is now seen as a “significant risk” by approximately 45% of respondents, versus 60% in April 2022 and 45% in January 2022.

Detailed Review

Assessment of the Current Economic Situation

At a global level, the overall industry view on current trading has been broadly unchanged versus 1st Quarter 2022, with a net positive of 21% (“good” minus “bad”). A divergence across geographies was observed, with Asia transitioning to net negative territory and the Americas showing noticeable deterioration. Europe, excluding Germany, showed clear improvement.

Looking across the layers of the industry supply chain, no business segments have shown any material change currently versus the previous quarter. Component suppliers continue to report the healthiest economic situation.

Outlook

Industry outlook for the next six months clearly declined to negative territory, with a 10% net negative response rate versus positive by approximately 5% in April 2022 and a roughly 10% position in January 2022. Asia and the Americas showed substantial deterioration, while Europe has remained broadly unchanged. Asia and Europe, excluding Germany, continue to point in a net positive direction.

Looking across the supply chain, outlook overall turned down across the board, with the exception of component suppliers, which remained unchanged versus the already low level of April 2022. Outlook deterioration was most pronounced among manufacturers in the three months prior to the survey, going from 18% net positive to 8% net negative.

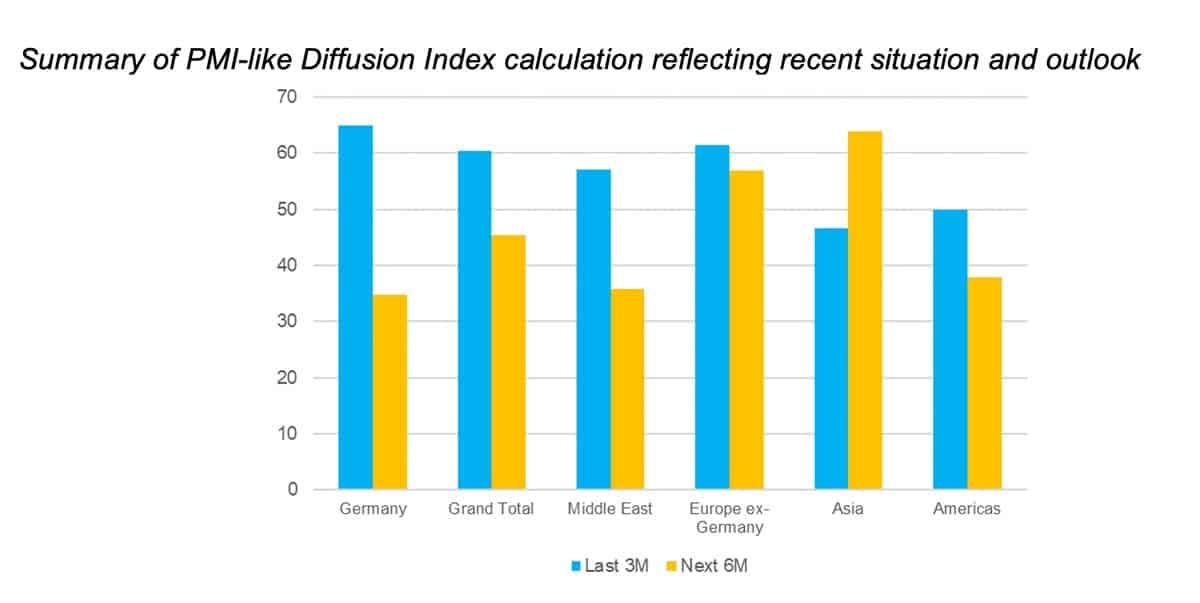

Expressed as a Purchase Managers Index (PMI)-like index globally, the “Assessment of Current Situation” score is 60, remaining flat versus levels seen in April 2022. (Results over 50 indicate growth; results under 50 point to contraction.) The forward-looking PMI-like score of responses to a question about outlook for the next six months is now 45 — a clear deterioration versus 52 in April 2022 and 54 in January 2022, but still pointing to growth in Europe (excluding Germany and Asia).

Limiting Factors

Shortage of materials and/or equipment remains the dominant limiting factor, albeit it came down in importance slightly compared to April 2022. Approximately 50% of respondents saw shortage of labor as one of the main limiting factors, followed by economic policy uncertainty at 44%.

Employment Prospects

Interestingly, industry employment prospects edged up slightly overall into the positive territory, with 39% of respondents indicating increases, versus 6% expecting a degrease. Fifty-five percent indicate remaining stable, resulting in a 33% net positive reading (versus 31% in April 2022 and 27% in January 2022). Hiring intentions improved clearly in Asia and Europe (excluding Germany), consistent with the current economic assessment responses above. We noted an interesting discrepancy between the responses in the industry outlook question above turning down and entering net negative territory, despite the still-improving hiring perspectives.

Raw Materials

Raw materials uncertainty remains one of the key uncertainties across the industry, given the degree of materials spot-price inflation. Hence, we continue to gauge industry views on risk from commodities inflation.

Interestingly, industry employment prospects edged up slightly overall into the positive territory, with 39% of respondents indicating increases, versus 6% expecting a degrease.

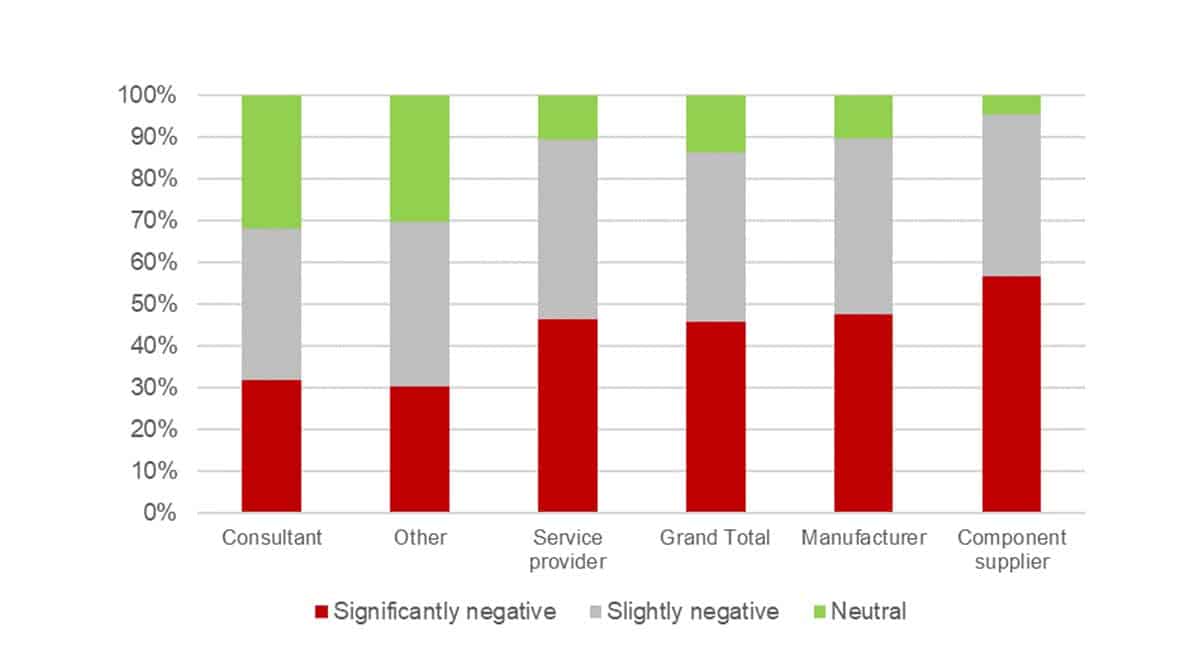

Roughly 14% of overall respondents now anticipate a neutral impact (up versus 9% in April 2022) and a further approximate 40% expect a slightly negative one (30% in January), with now approximately 45% expecting a “significantly negative” impact. This has clearly moderated compared with the 60% level in April 2022. This quarter’s survey result hence marks an inflection point (toward easing) in the inflationary trend for the industry.

Looking across the supply chain, component suppliers expect the most negative impact (57% said “significantly negative”), followed by manufacturers and service providers, which were both at approximately 45%.

Competitive Environment

Responses to this question pointed to an easing competitive environment globally and across the supply chain. The overall net reading (“easier” minus “tougher”) improved to negative 30% in July versus negative 40% in April 2022. The results show broad-based improvement, except in Germany, which remained unchanged.

Looking across the supply chain, the competitive environment responses improved for all market participants to some extent, apart from component suppliers, which remained unchanged versus April 2022.

Get more of Elevator World. Sign up for our free e-newsletter.