Cities to see a 2.5-billion increase in population by 2050.

In 1950, urban population represented only 30% of the world’s total population, whereas this figure is expected to more than double to 70% by 2050. Currently, more than half the world’s population lives in urban areas, leading to the worldwide development of megacities with populations of more than 10 million. Most of the expected growth will be concentrated in Africa, Asia and South America.[1]

With better living conditions, education, healthcare and culture as continuous drivers for urbanization, the migration to cities is one of the most significant shifts in economic activity ever witnessed, resulting in significant transformations in urban-development trends.

In just a decade, people living in cities in emerging economies will account for 50% of the world’s population, with 90% of a projected 2.5 billion increase in urban population numbers by 2050 being concentrated in Asia and Africa.[2]

Due to space constraints, urban development in the form of mid- to high-rise buildings has proven to be the most economical and environmentally viable solution to accommodate such large numbers of people. In addition to taking up less space, this type of construction allows for smart, centralized control of energy. In addition, skyscrapers are increasingly taller. In 2000, the average height of the 50 tallest buildings in the world was 315 m, while in 2013, this figure reached 390 m, a 25% increase in just one decade. However, although the means exist to build even taller buildings, these structures lack the necessary infrastructure to efficiently transport their occupants. Therefore, the functionality of the skyscraper is, at present, limited, which means a loss of potential income from the rental of residential and commercial spaces.

The Global Elevator Technology Market

The 21st century is the century of the metropolis, with cities prospering in the new global economic order. Today, 600 cities account for 60% of the world’s gross domestic product. In this age of unprecedented development, the mobility of people in cities and their buildings is as important as the water or energy supply, upon which the economies of scale of urban conglomerations are heavily dependent.

Meeting the mobility demands of the urban masses, especially in emerging economies, is the current challenge facing the elevator industry. By 2016, the global demand for elevator equipment (including elevators, escalators and moving walks) is expected to rise 5% annually to 52 billion euros.[3] In emerging economies, cities such as Shanghai; São Paulo; Istanbul; and Lagos, Nigeria, are just a few examples of relatively new megacities (with a population of 10 million or more) redefining the urban landscape. By 2020, China will lead the list with 121 cities (each with a population of 1 million or more), followed by India with 58 and the U.S. with 46. The countries with the fastest growth rates are to be found in sub-Saharan Africa, South and Southeast Asia, the Middle East and Central America.[4]

However, the continuous growth of large cities is not an exclusive trend of emerging economies. In Europe and North America, recent censuses show that the largest urban areas are growing faster than other cities. In the U.S., metropolitan areas with more than one million people are those recording the fastest growth by far at 3.2%, considerably higher than the 2.4% growth rate for the U.S. as a whole. Medium-sized cities, with a population between 500,000 and one million, have grown at the same rate as the nation as a whole, while the country’s smallest geographic units, its 536 micropolitan areas with less than 500,000 people each, have grown at an average rate of only 0.2%. More than half of these micro cities (286) have registered either a decline or no change in their population between 2010 and 2013.

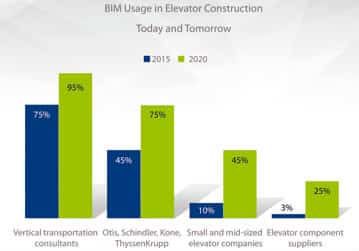

Just as population and construction growth are concentrated in emerging markets, a December 2013 study by HSBC found a similar trend in the elevator industry. While the European market is expected to decline, the Chinese elevator market alone grew by 10-15% in 2014.

The trend in construction shows that the customer base for elevators is extremely varied across the different markets. Buildings occupied exclusively by offices accounted for 48% of the total market demand in 2014; hybrid buildings with mixed uses, 27%; hotels, 5%; and strictly residential buildings, 20%.[5]

The scale and geography of global growth and the prospect of many new buildings will require some major advances in the technologies currently used by the world’s leading elevator companies. Major global companies like ThyssenKrupp are researching the development of new solutions in employee training and in expanding their global footprint to help make the cities of the future the best living spaces ever created.

Needed Innovations

A project on elevator transportation carried out by Columbia University students found that office workers in New York City spent a total of 16.6 years waiting for the elevator and 5.9 years inside the elevator in 2010.[6] This demonstrates the need to increase elevator availability and efficiency.

Therefore, as building construction evolves, it is imperative that the elevator industry adapt its technologies to meet the current demands for efficiency, from the predominant one-dimensional vertical arrangement to two-dimensional horizontal/vertical structures with more than one car operating in each shaft.

By 2020, China will lead the list with 121 cities (each with a population of 1 million or more), followed by India with 58 and the U.S. with 46.

ThyssenKrupp’s TWIN elevators have represented a great improvement over single-car systems, increasing their capacity and operating efficiency. However, incrementing the number of cars in this system is restricted by the use of complicated cabling systems and requires one car to always be above the other. Constant safety concerns have also prevented progress in the use of rope-less elevators. This is where linear drive technology offers a great advantage, eliminating the use of hoist ropes and allowing more than one car to be used in the same shaft, such as the case with the company’s under-development MULTI system (ELEVATOR WORLD, February 2015).

The Elevator Technology Market in Spain

With a market value of EUR1.6 billion (US$1.76 billion) in 2013, the Spanish market is expected to reach EUR1.9 billion (US$2.1 billion) by 2018. It is the fifth-largest market in the elevator industry, after China, the U.S., Germany and France. Its current industry tendency is toward new installations (4.7% growth) and modernization (11.8% growth), while services will decrease slightly, by 0.2%, over the next three years. The market is highly competitive, with four companies holding a similar position in the market. ThyssenKrupp ranks second, with an upward trend.

References

[1] Credit Suisse Emerging Market Research Institute report, “U.N. Projections,” 2012.

[2] United Nations, “World Urbanization Prospects,” 2014.

[3] Various market research studies since 2013

[4] Credit Suisse Emerging Market Research Institute report, 2012

[5] The Council on Tall Buildings and Urban Habitat. “Year in Review: Tall Trends of 2014,” 2015.

[6] Dong, James and Zafar, Qasim. “Elevator Scheduling,” Columbia University, 2010.

Get more of Elevator World. Sign up for our free e-newsletter.