EW survey of the North American VT industry reveals challenges and opportunities.

ELEVATOR WORLD’s recent survey of the North American vertical-transportation (VT) market, conducted in late March, paints a picture of a vast, powerful, storied and — most importantly — essential industry full of challenges and opportunities. As experienced industry leaders retire or pass away, it’s crucial that VT companies repopulate the workforce with skilled, enthusiastic, determined younger people in light of the “silver tsunami” that’s upon us. Over the next four years, nearly 40% of respondents said losing experienced leaders will have somewhat of an impact, with more than 30% stating it will have a great deal of impact.

Meanwhile, concerns about VT companies — particularly the larger players — favoring profits over customer service, failing to achieve a balance between technology and actual, trained technicians and allowing component quality to drop have some respondents worried about the future. Private equity, many feel, is not a good thing, as investors who have little or nothing to do with VT swoop in to run things, and in ways that, in some people’s eyes, are not as effective, efficient or customer-centric as before. “They destroy customer relations,” said one respondent of M&A. Another summed it up thus: “Private equity has gutted some formerly reputable companies,” naming a specific example.

”[Working from home] does have an impact on culture and comradery, but it also provides for better candidates when you don’t have to narrow your search to a certain area.”

Sometimes, it depends on perspective. “For our business, it has been positive,” one respondent said. For the industry as a whole, however, it has been negative, the respondent added. Customer service has suffered. Industry consolidation has resulted in longer lead times as salespeople who are sometimes new to the industry struggle to fill orders and a “general lack of maintenance” persists. On the upside, a strong base of support exists for the VT industry in the form of various associations and organizations. Relationships are strong — strong enough to outweigh issues like inflation that lead to price increases. Throughout North America, VT is growing in nearly all areas. Many opportunities exist for entrepreneurs, salespeople and laborers.

Those who responded to our survey were primarily from independent companies: nearly 74% were employed by independents versus slightly more than 15% by OEMs. They included contractors (40.35%), manufacturers (15.79%), suppliers (12.28%), inspectors (11.40%) and consultants (16.67%).

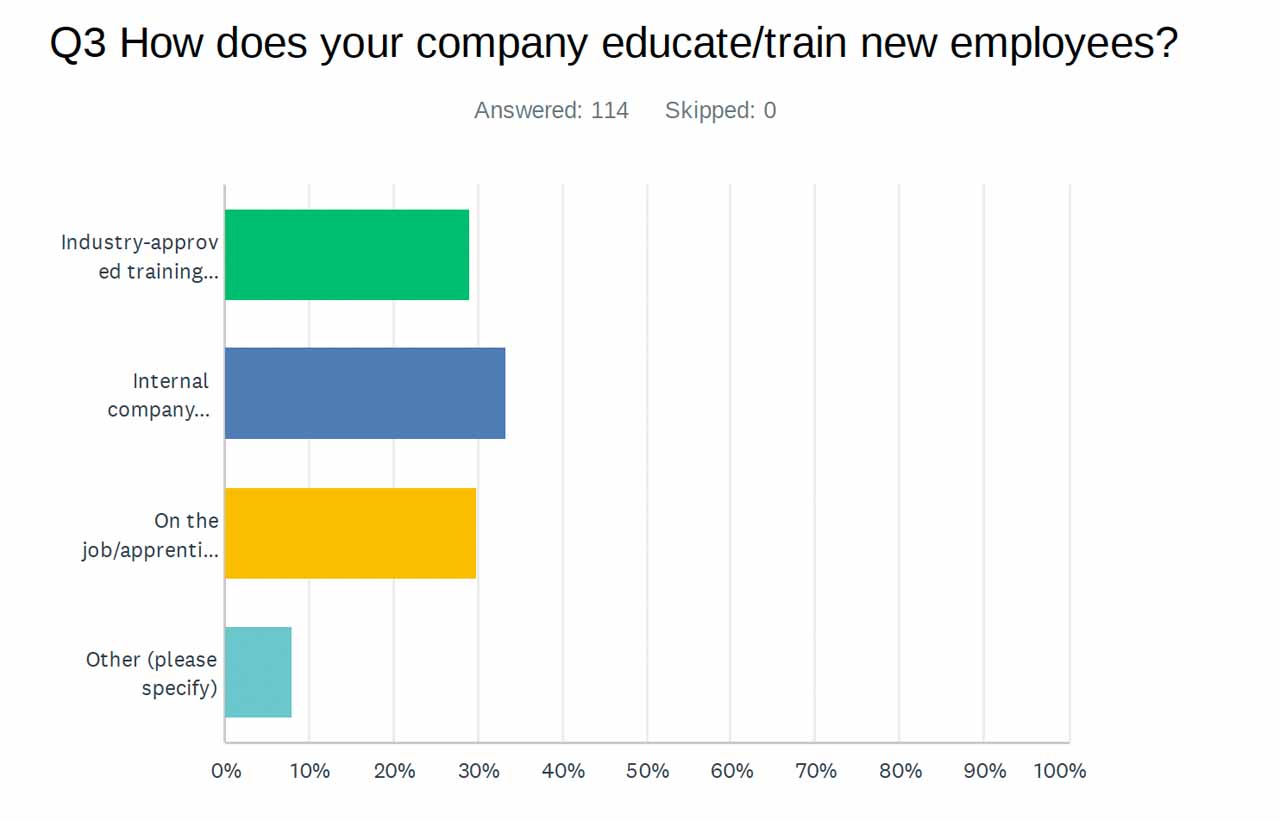

Most respondents said their companies train new employees through internal programs (33.33%), followed closely by industry-approved training programs at nearly 29%. How these new employees are being trained is a cause of concern for some, with one respondent (speaking on the emergence of the Internet of Things [IoT] and technology) observing:

“A program on a computer will not take the place of experience. It will enhance it, but elevators are electrical, mechanical devices that have evolved over the last 100 years. Working on numerous manufacturers’ equipment makes it necessary for technicians to be trained on and familiar with many pieces of equipment. When a technician plugs an elevator into a computer and relies solely on that, the necessary work that needs to be done on that unit is probably lacking.”

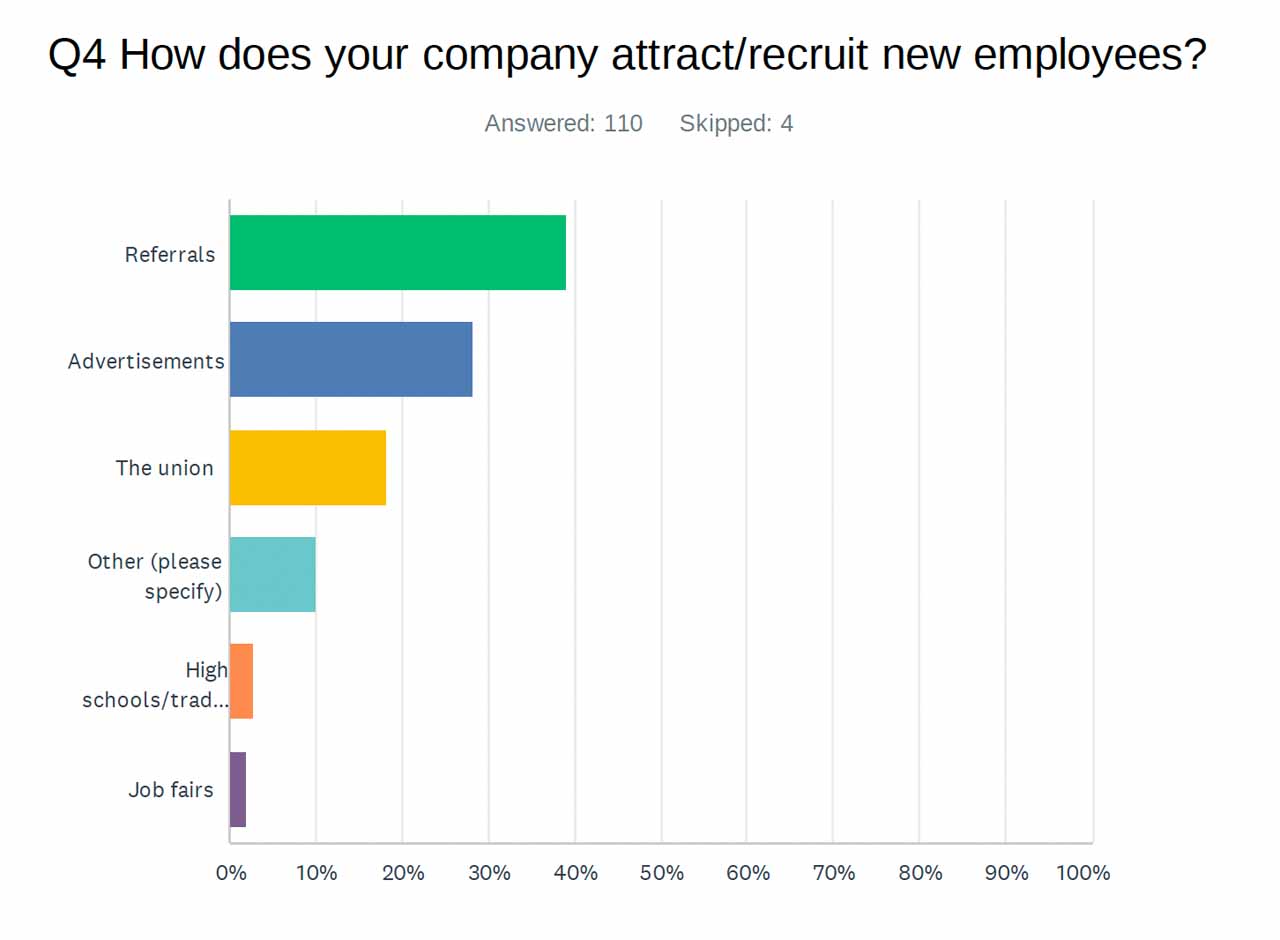

Respondents said referrals (more than 39%) are the primary way their companies attract new employees, followed by advertisements at 28.18% and the International Union of Elevator Constructors (IUEC) programs at 18.18%.

Attracting the Younger Generation

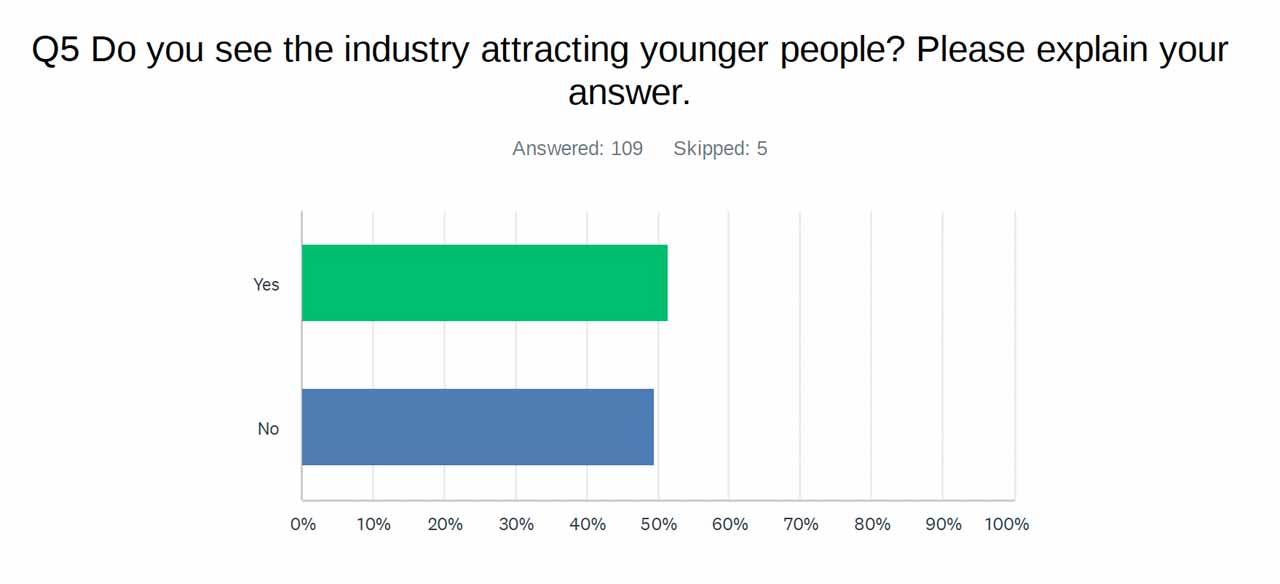

Responses were split nearly half and half between whether the industry is seeing success at attracting the younger generation. Even when they do, some remarked on the lax work ethic of some younger workers. One person stated:

“There is a strong interest in getting into the IUEC apprenticeship program. The issue is whether or not they understand the basic principles and if they want to work. The younger generation’s work ethic is different from that of the older generation’s. With AI, white collar jobs may be disappearing, and there may be a renewed interest in the trades. Let’s hope so; we need the talent!”

When it comes to attracting the next generation, the VT industry has a few unrealized opportunities. Only 2.73% said they reach out to high schools and trade schools, and only 1.82% said they attend job fairs. This topic comes up frequently during meetings, such as the recent National Association of Elevator Contractors Women in Motion gathering at the Elevator Conference of New York Supplier Showcase in Bronx, NY, this past spring.

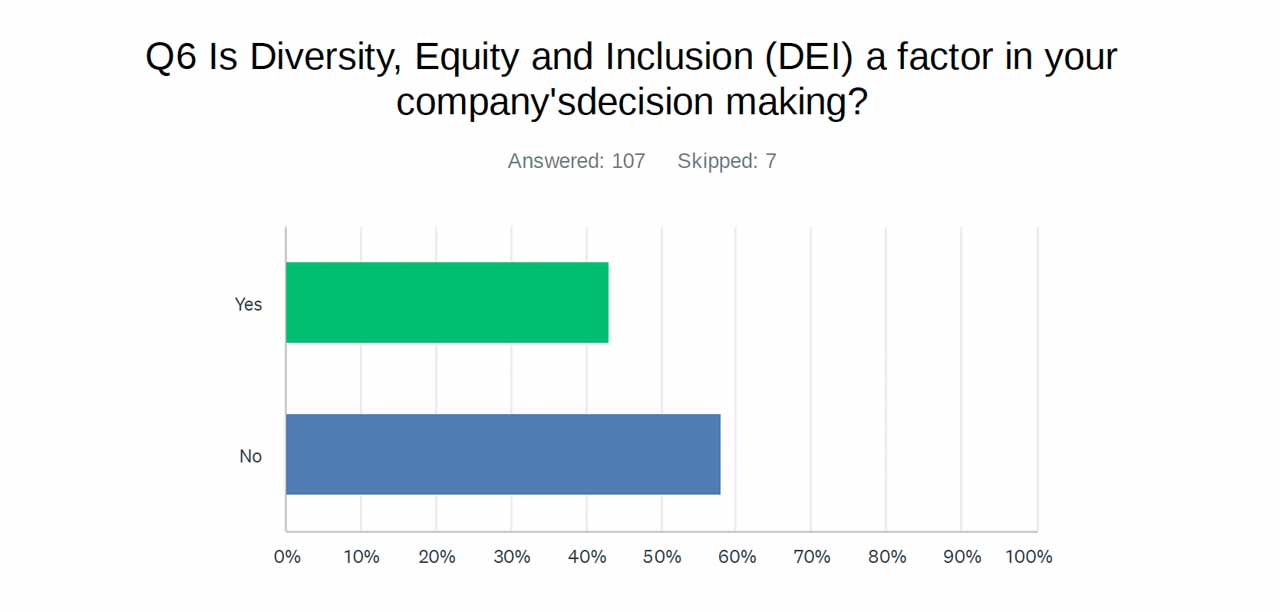

Nearly 58% of respondents said that diversity, equity and inclusion (DEI) is not a factor in their company’s decision-making; the consensus being that hiring is “based on skills and abilities, regardless of DEI aspects.”

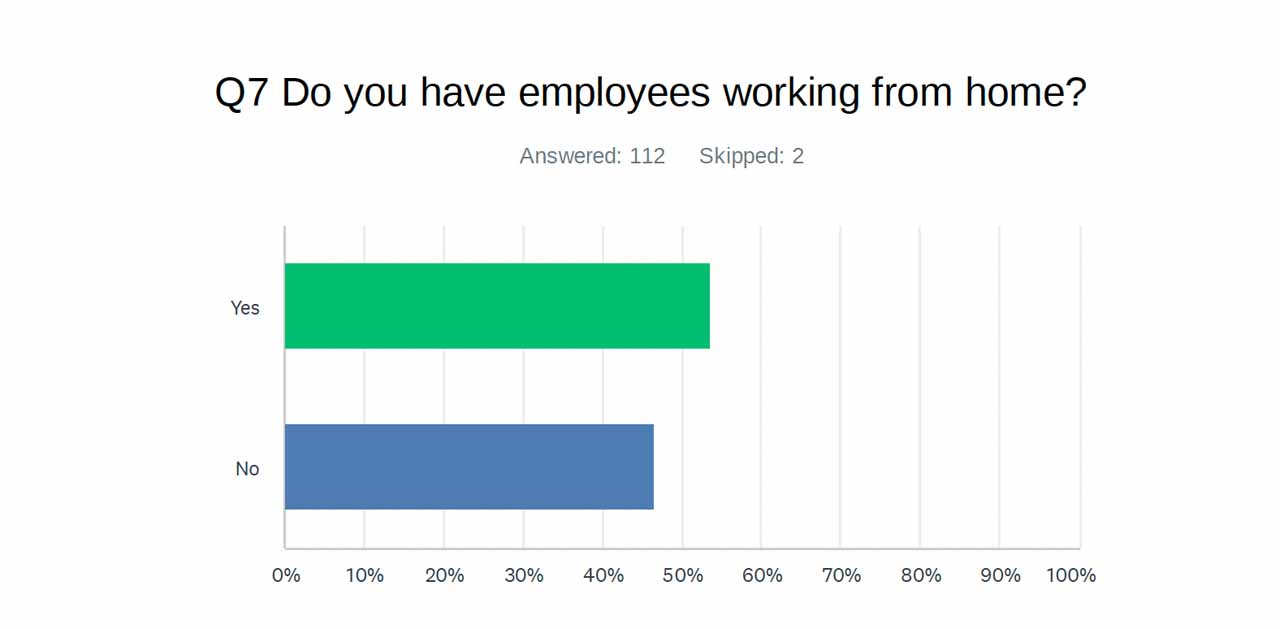

Work From Home

Work from home, or at least a hybrid version of it, is here to stay, with more than half saying they have some employees working from home. The trend that gained a foothold during the pandemic received both praise and criticism, with responses mixed as to how it affects productivity. Describing “work from home” as a permanent model, one respondent said:

“We are geographically diverse, and many people are fully remote because there is no office in their geography. We also have lots of people that are hybrid. It does have an impact on culture and comradery, but it also provides for better candidates when you don’t have to narrow your search to a certain area.”

Others described it as a “necessary evil,” with some saying it flat-out failed at their business. “Only a few employees work from home,” one said. “It is tangibly better to have everyone working in the same place.”

Several respondents said, depending on the employee’s role, work-from-home can be perfectly fine. Code-compliance filing and category testing scheduling, as well as plenty of other administrative work, can be easily and efficiently done remotely, for example.

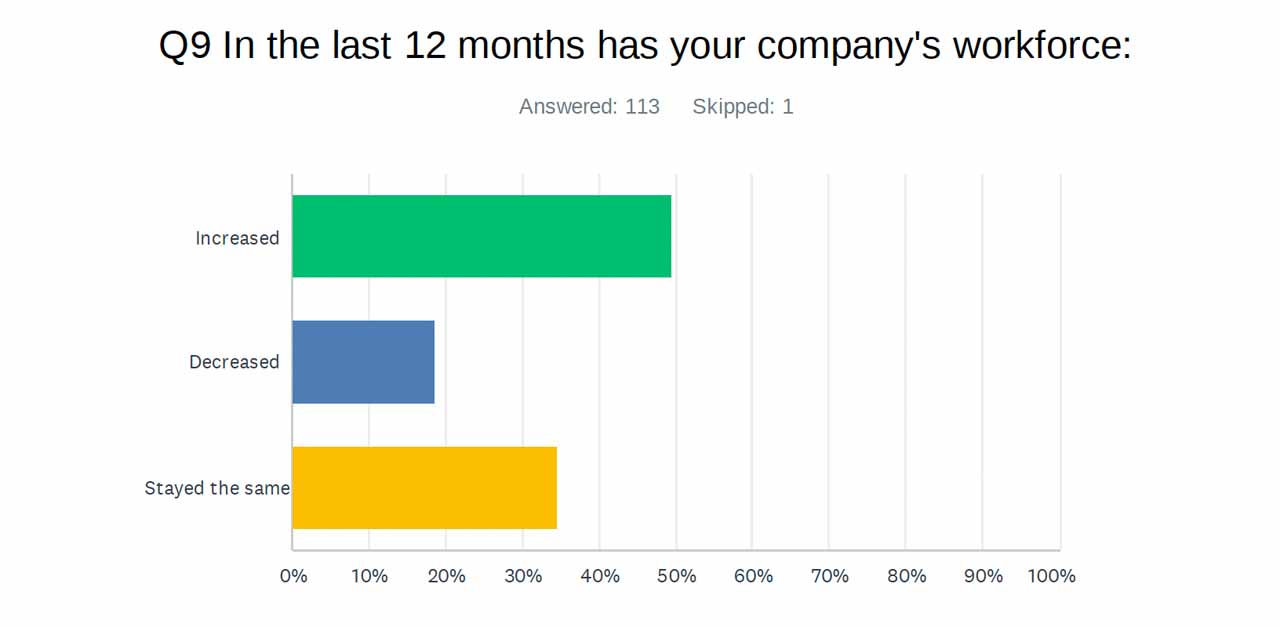

A Growing Workforce

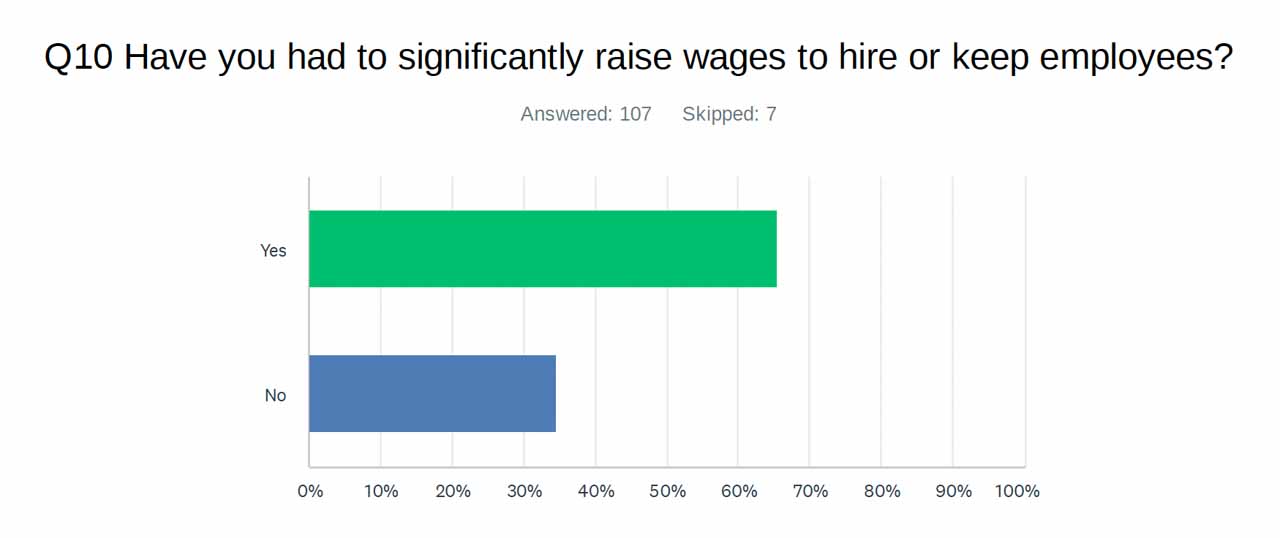

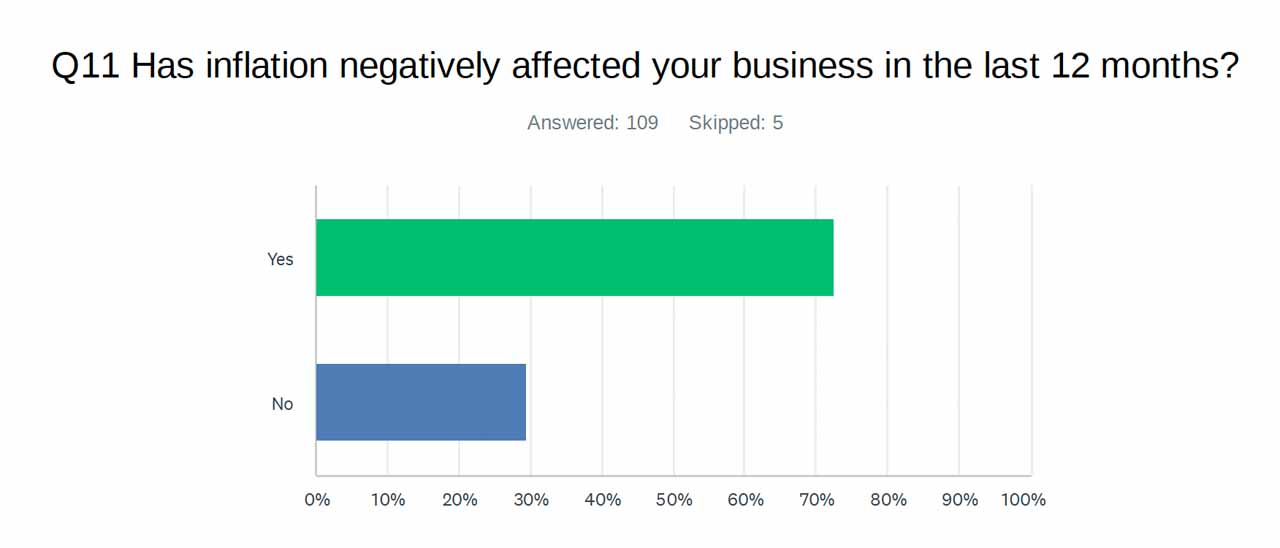

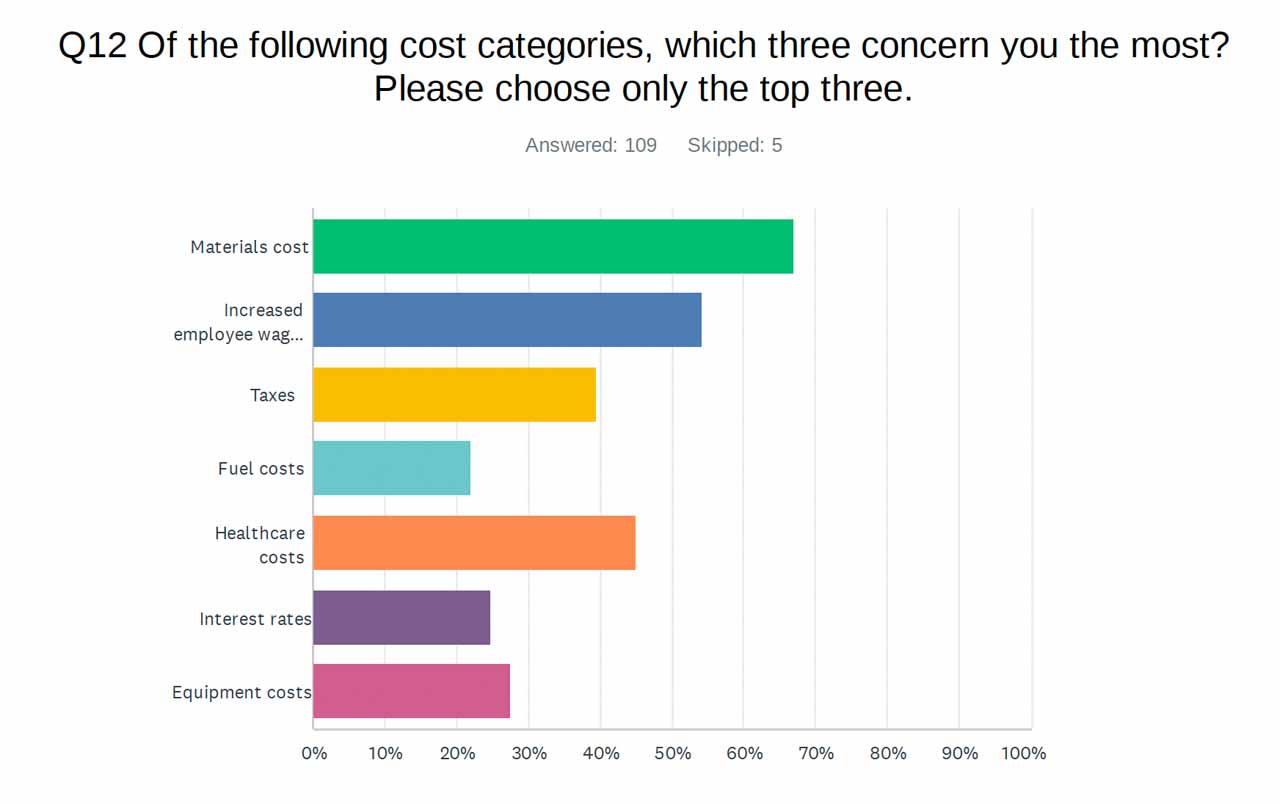

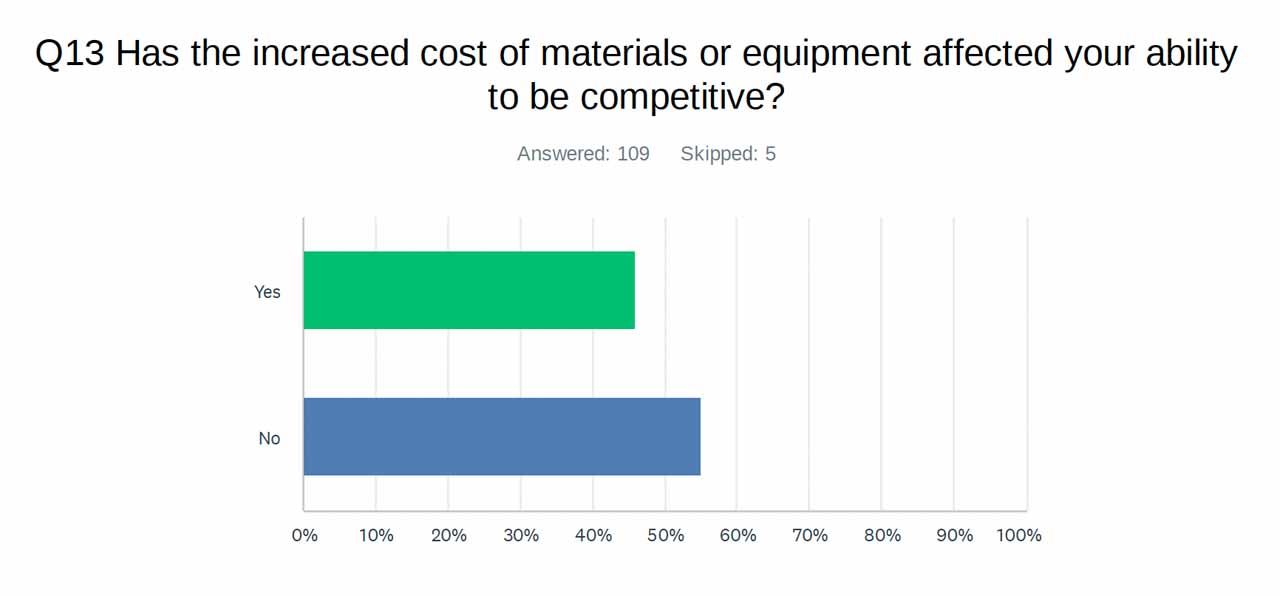

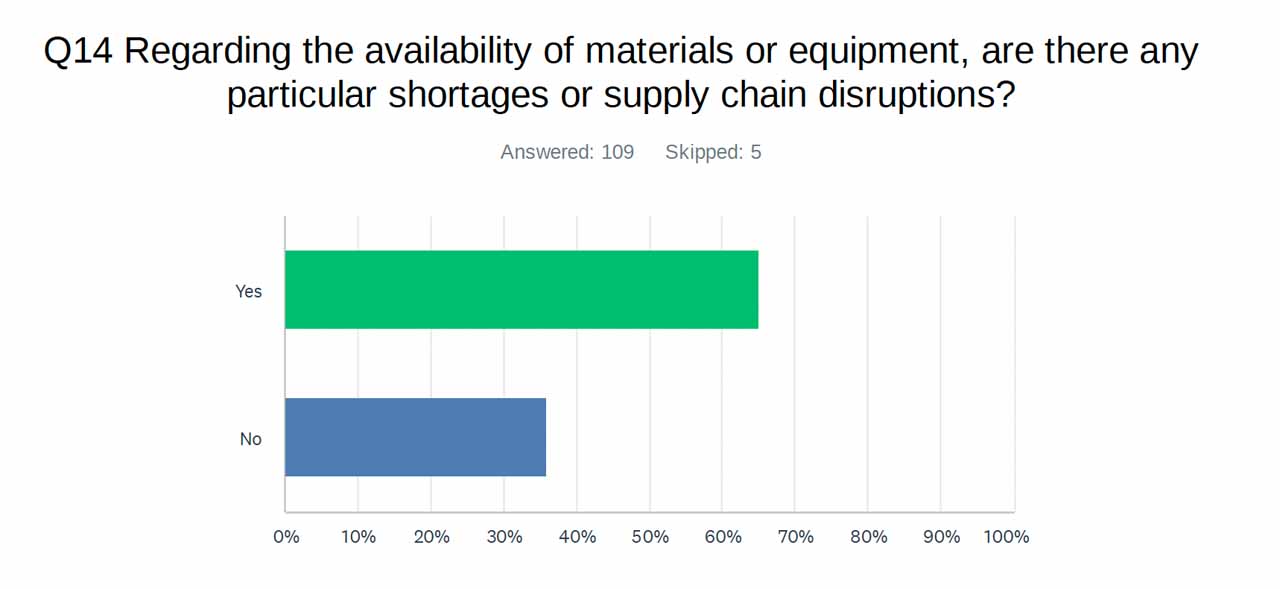

The VT workforce is by and large growing, with nearly half of respondents stating their workforce has increased over the past 12 months. Thirty-four percent of respondents said it stayed the same, and 18% said it decreased. Extra people on the payroll are coming at a cost, however, as more than 65% of respondents said they have had to significantly raise wages to hire and keep employees. The reasons for that include inflation, which ties into the rising cost of materials — the top answer given when respondents were asked which three issues concern them most. Materials cost was followed by increased employee wages and taxes.

”There’s all sorts of creative, adaptive reuse that’s happening that is going to give architects, construction firms and city code officers plenty of experience with how this can be done, and lay the groundwork for it to be done more efficiently.”

Despite the rising cost of materials, most respondents — 55.05% — said they have remained competitive. One respondent shared they have experienced materials price jumps four times since 2020, while only raising their company’s prices once. Another said they have raised prices three times over the past 2 1/2 years. “I have to balance covering my company’s ever-increasing basic costs,” one person said. “I also have to charge competitive prices. It’s a tough balancing act.” The bottom line: “Once relationships are established, price is not that big of a factor.”

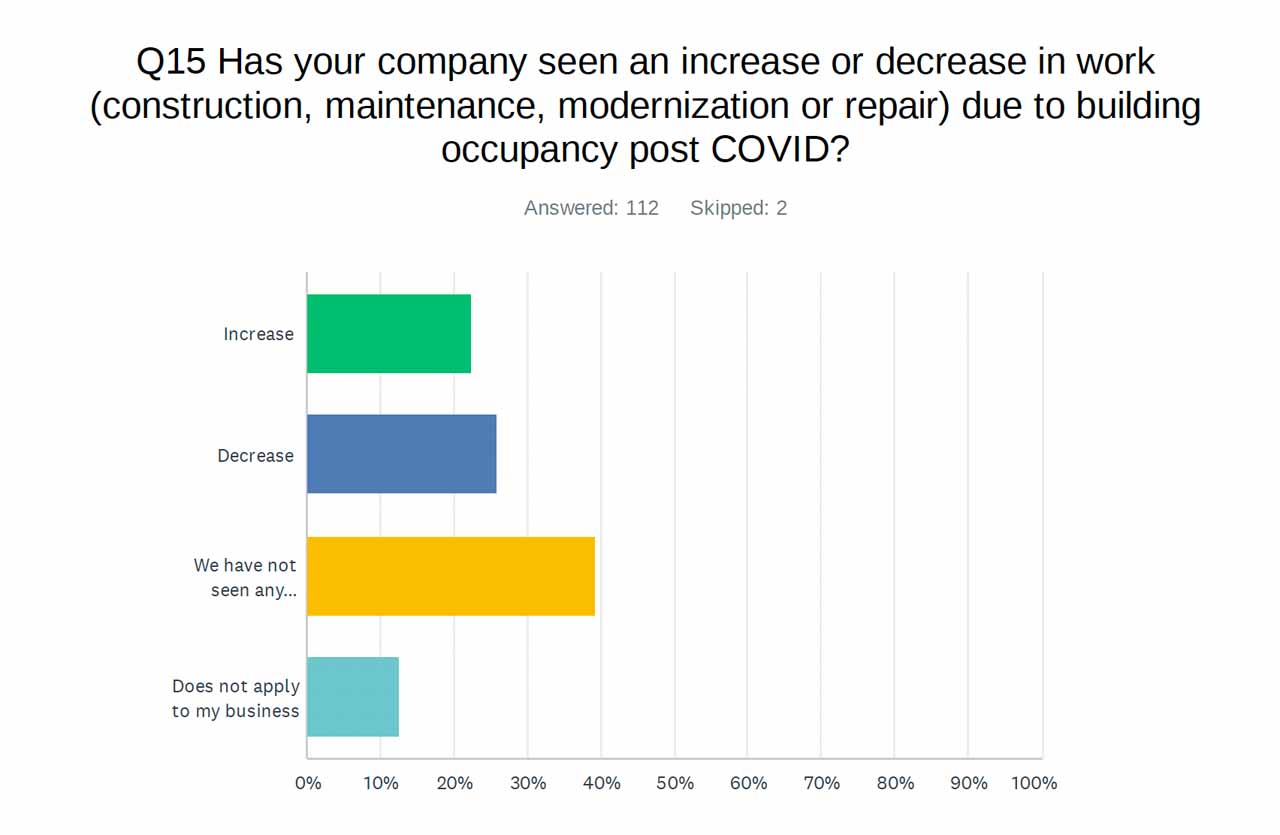

Occupancy and Conversions

As for building occupancy post-COVID affecting new construction, maintenance, modernization and repair work, the majority of respondents — nearly 40% — said they have seen no difference. More than a quarter of respondents said they have seen a decrease, and more than 22%, an increase.

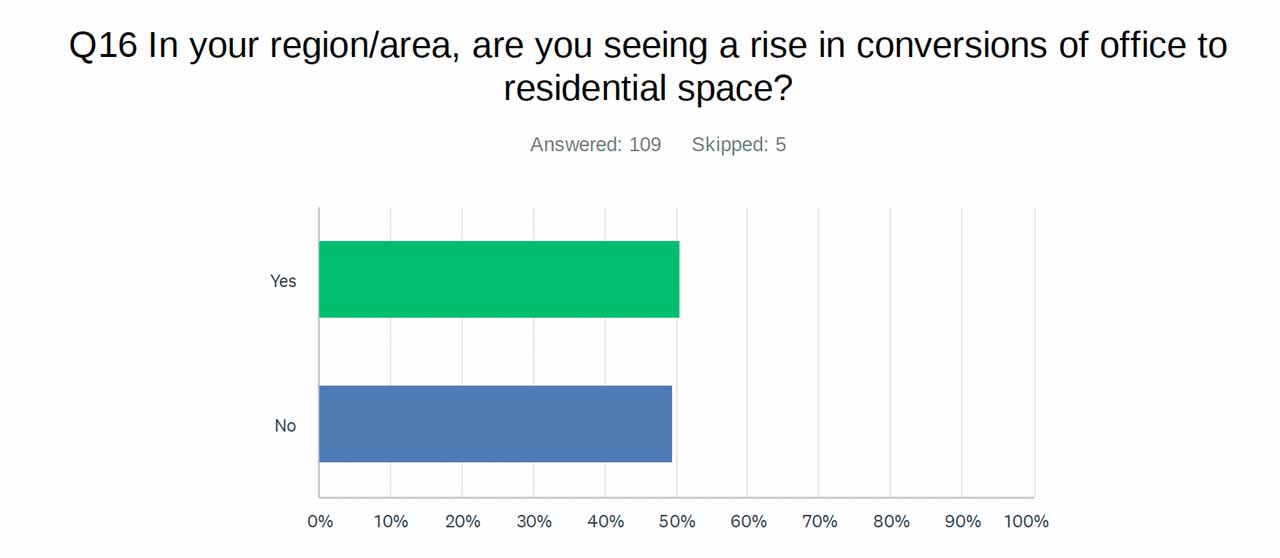

Buildings being converted from office to residential space is a trend that continues, with roughly half of respondents saying they have not seen it and the other half saying they have, depending on geographical location. NYC, for example, is seeing “an abundance” of such conversions as city leaders strive to address the housing crisis. Conversions go beyond residential, one person noted, stating:

“I am optimistic that a surge in post-pandemic interest in office conversions will create a lasting trend. There’s all sorts of creative, adaptive reuse that’s happening that is going to give architects, construction firms and city code officers plenty of experience with how this can be done, and lay the groundwork for it to be done more efficiently.”

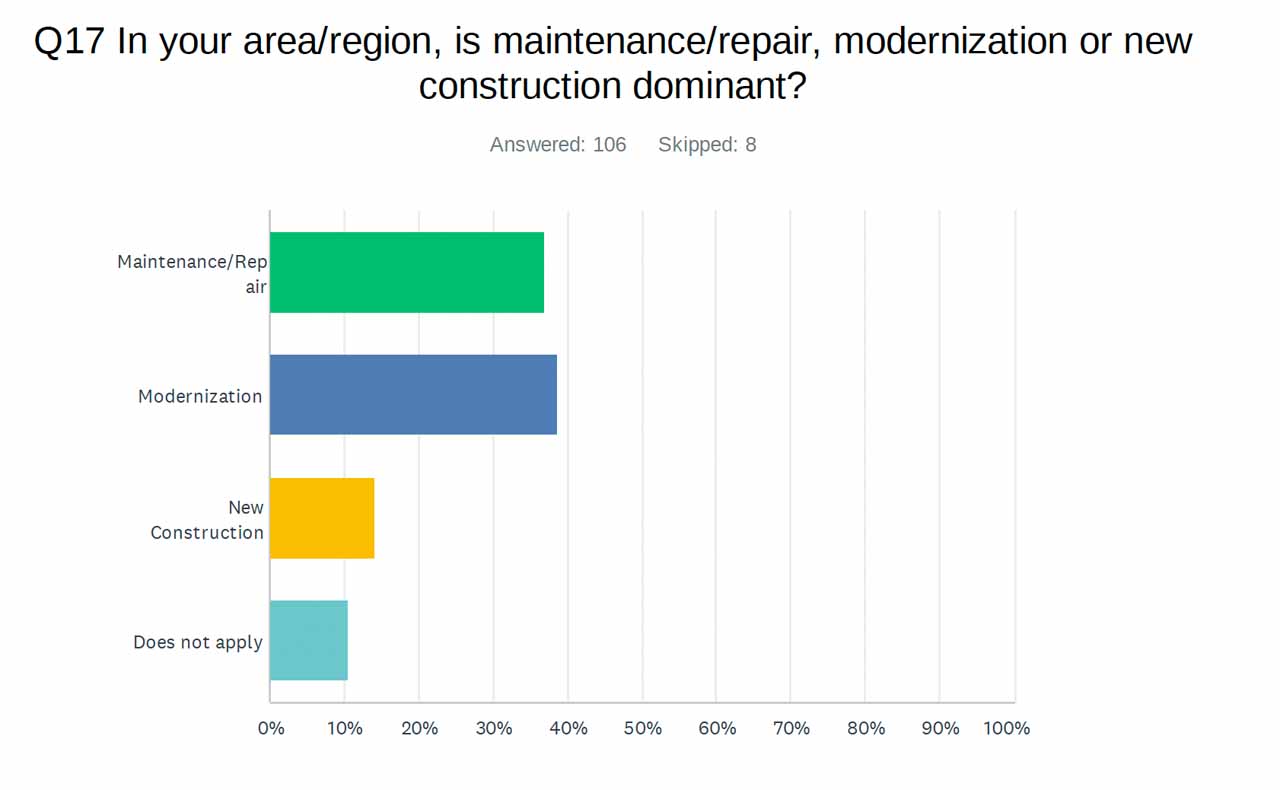

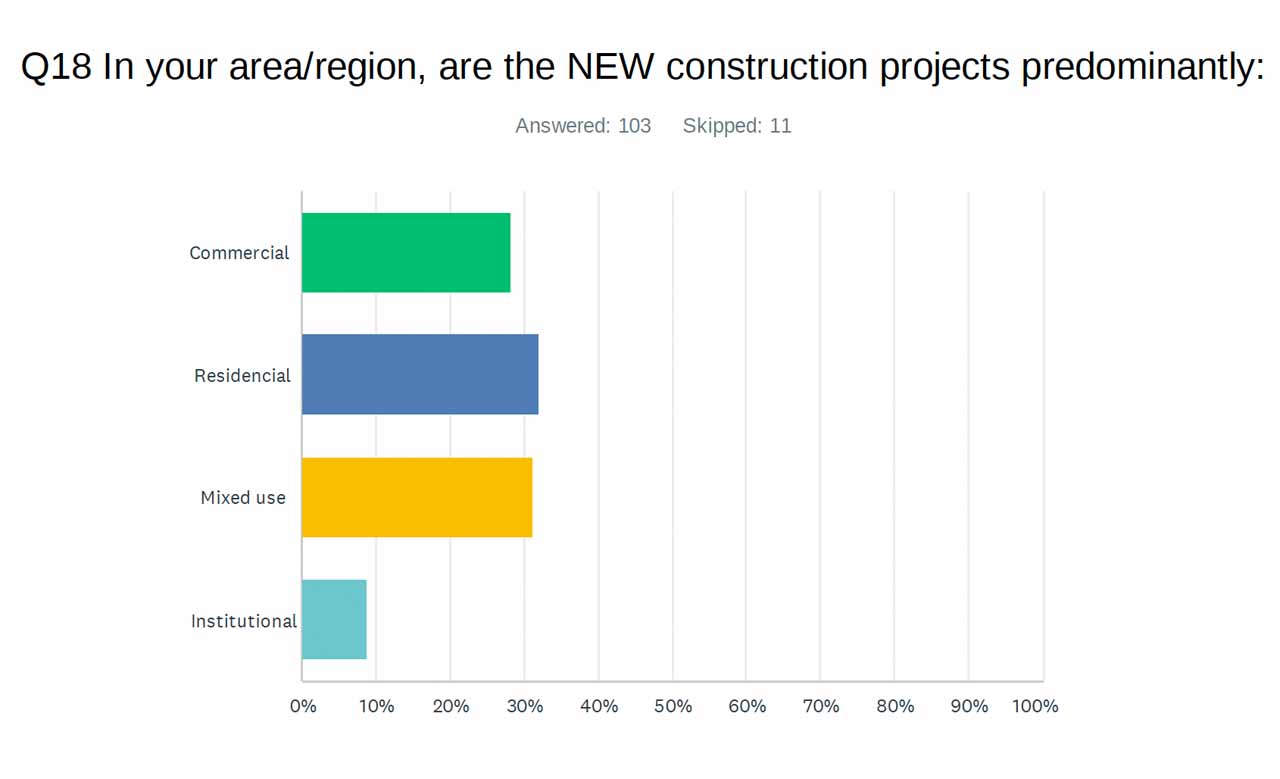

Regardless of geographical region, maintenance, repair and modernization work far outpace new construction, which was named by only 14.15% of respondents as the main business driver. When there is new construction, it’s typically residential or mixed-use, rather than solely commercial, although the margins were smaller than one might expect, with 28.16% of respondents naming commercial, 32.04% residential and 31.07% mixed-use.

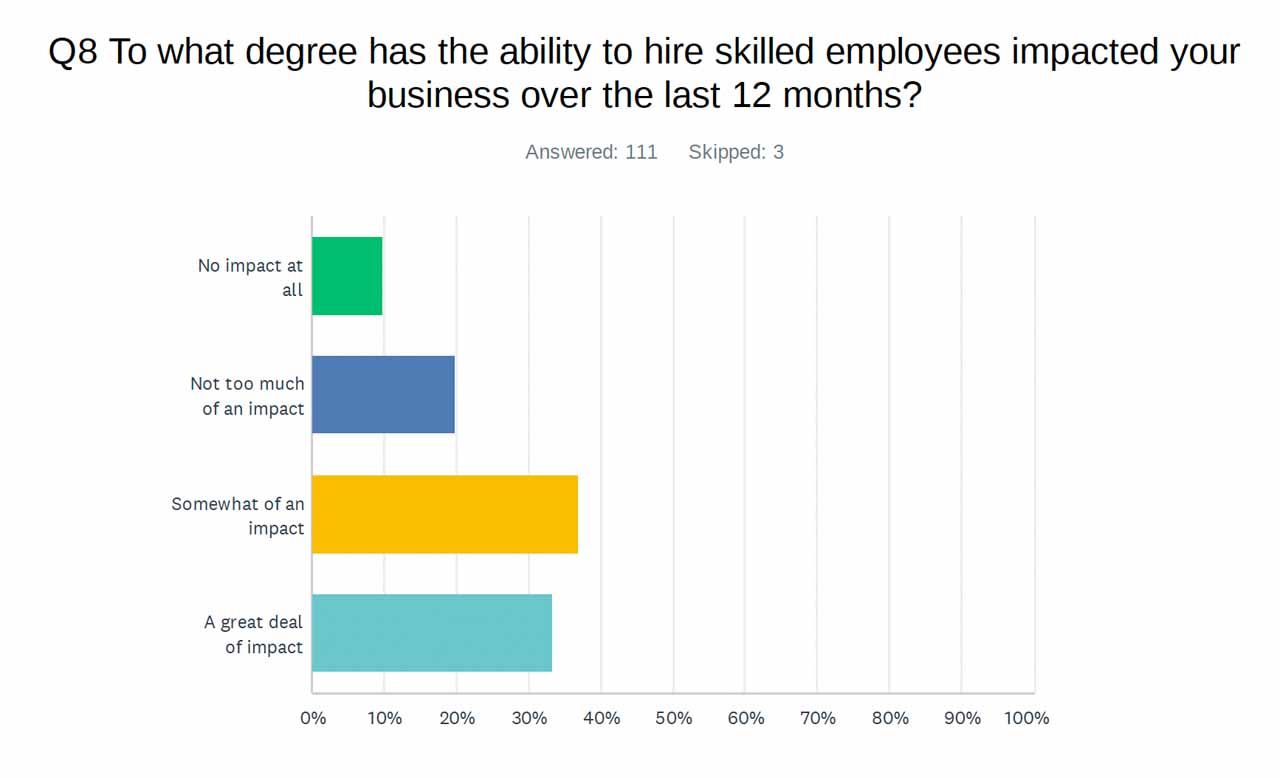

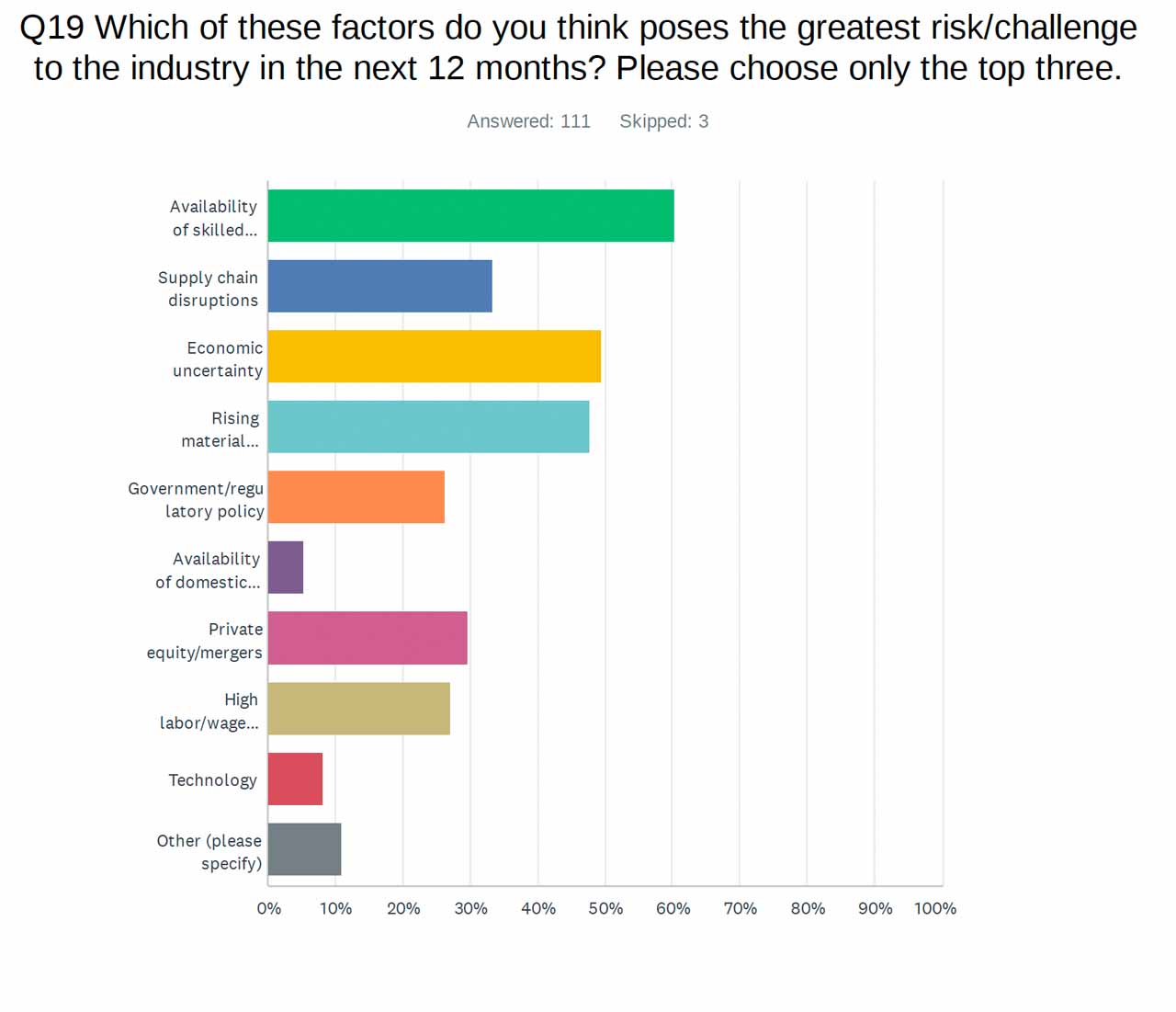

Looking forward to the next 12 months, the biggest challenges are availability of skilled workers, economic uncertainty and rising materials cost/inflation, in that order. Inflation, however, has failed to stifle the installation and repair market, as people still need to get up and down and codes still need to be met for public safety. Most respondents — more than 57% — feel the industry is safer than it was 12 months ago.

The majority of respondents, 40.54%, said they are “somewhat optimistic” about the industry as a whole compared to 12 months ago. A noteworthy 22.52% remain “very optimistic,” with 9.09% of respondents expecting net profit to increase significantly in 2024, 35.45% expecting a moderate increase and 32.73% expecting it to hold steady/remain the same.

Get more of Elevator World. Sign up for our free e-newsletter.