This article is based on a report titled “The Future of Elevator and Escalator Market in India to 2021” published by Madras Consultancy Group of Chennai, India. The full report provides a comprehensive analysis of the Indian elevator and escalator markets and detailed forecasts through 2021. It is available at elevatorbooks.com. . . . Editor

The Indian economy has performed well over the last decade, clocking a growth rate of 7.1% per annum in 2006-2007 and 2016-2017, and the gross domestic product touched US$2.3 trillion in 2016-2017. The real-estate sector, one of the key components of the Indian economy, is now expected to change the way it works owing to the structural reforms introduced over the last 18 months. For the manufacturing sector, including elevators and escalators, the introduction of the Goods and Services Tax in July 2017 was a welcome measure, as it simplifies the indirect taxation structure, rules and procedures. More than 65% of India’s population of 1.32 billion is below the age of 35, and, consequently, rapid urbanization is inevitable. Given the burgeoning population and limited land availability, most cities are now witnessing vertical growth. New initiatives such as the Smart Cities Mission and increased government spending on infrastructure projects (including metro rail and airports) will also fuel the demand for elevators and escalators in the country.

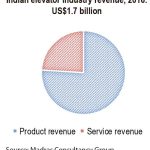

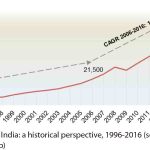

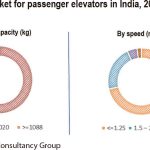

The modern elevator has evolved rapidly from the innovative and cyclical paternoster of the late 19th century. The focus during the last few decades has been on safety, energy efficiency, speed and passenger convenience. The elevator market in India has grown well over the last two decades, with growth rates averaging around 12.5% per annum. The Indian market volume is estimated at 68,000 units in 2016 — though a distant second to China, the Indian market holds great potential for the future. The elevator industry clocked an estimated revenue of US$1.7 billion, of which more than 70% was from the new installation sector and the rest from services. The Indian market has risen rapidly over the last two decades from its small base of 6,500 units in 1996. More importantly, the market has also been upgrading itself in terms of product quality. Over this period, the market has transitioned from collapsible gates to automatic doors, from AC to variable-voltage, variable-frequency drives, from geared to gearless motors and so on. While the passenger-elevator segment accounted for 85% of the total market, the demand for home elevators, automobile lifts and freight/bed elevators is also on the rise.

The elevator industry in India is now home to more than 350 elevator manufacturers. Of these, 25-30 are national or regional players. Johnson Lifts, KONE, Mitsubishi Electric, Otis, Schindler India and thyssenkrupp Elevator are some of the leading players in the elevator market in India. Other major international companies present in India include Fujitec India, Hitachi Lift, Kinetic Hyundai Elevator and Toshiba Johnson Elevator. While some of the global manufacturers have recently expanded their facilities or are in the process of setting up new greenfield operations, regional players are scaling up their operations and capabilities.

With the marquee names of the global elevator industry now present in India, the country’s elevator sector is steadily adopting international standards and technologies. The market for machine-room-less elevators is rapidly expanding and now accounts for nearly 25% of the passenger elevator market. The country has also moved up the value chain in terms of greater sophistication, such as energy efficiency, advanced safety mechanisms, improved aesthetics, and better installation and maintenance methods. The Indian elevator industry is fast aligning itself to global standards; an example is the updated National Building Code released by the Bureau of Indian Standards in 2016.

Vertical growth, driven by urbanization and sharp appreciation in the cost of land, is now increasingly visible in the ever-expanding cities of India. Apart from the large metropolitan cities, Tier I and II cities are witnessing a space crunch, especially within core areas. Demand for elevators 2.5 mps and faster is expanding rapidly, especially in the National Capital Region, Mumbai, Bengaluru and Pune.

The elevator component industry in India has kept pace with the OEMs and is geared to meet the needs of the industry, from small electronic components to sophisticated cars. The need to move faster with a high safety level has led to several changes in materials and components used. Elevator component suppliers are spread across the country, with a significant concentration in the western region. Though the Indian component sector is well developed, import of components is still significant, and China continues to be the key source.

Elevator maintenance is now a focal point, given the heightened concern for passenger safety, need for reduced waiting time and better image of the building. Thus, the revenue generated from elevator maintenance and modernization programs has begun to contribute significantly to the top, as well as bottom lines of these companies. While modernization and maintenance revenues play a larger role in the developed markets, it is still a smaller component of the revenues in India. However, with an installed base of 460,000 units of elevators and 16,500 units of escalators, the modernization business is set to emerge as a significant component of the elevator industry in India.

The trend toward high-rise buildings, rapid expansion in the residential and commercial real-estate sectors, and increased spending in the infrastructure sector will have a positive impact on the Indian elevator industry. Safety, aesthetics and energy efficiency will be some of its key drivers for the foreseeable future.

- Figure-1

- Figure-2

- Figure-3

Get more of Elevator World. Sign up for our free e-newsletter.