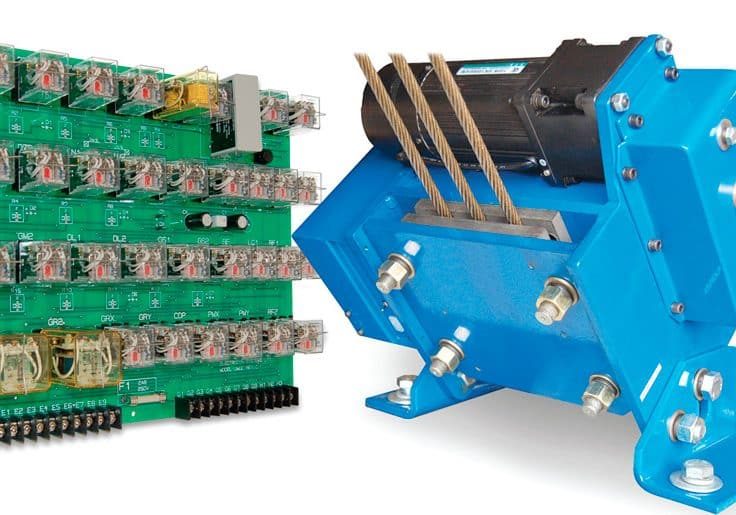

NBSL Elevator Components Group manufactures core elevator components. After 30 years of sustained growth since its founding in 1983, NBSL has become one of the largest component manufacturers in China, where it has more than 30% of the market, thanks in part to its acclaimed overspeed governor. Its main products have passed consumer electronics and TÜV certification, and are fire rated. NBSL maintains relationships with major elevator companies, including Shanghai Mitsubishi, Otis, KONE, Fujitec and ThyssenKrupp Elevator. Its products are exported to more than 30 countries in Europe, the Middle East, Southeast Asia and South America. Recently, ELEVATOR WORLD (EW) sat down with Guoping Lu (GL), chairman of NBSL, to discuss global and domestic market trends and company strategy.

EW: As one of the earliest entrepreneurs of elevator-component business in China, could you share some insight on business-development strategy with your counterparts in India?

GL: Significant development of the elevator-components industry in China has mainly been driven by sustained, rapid development of the industry over the last two decades. In the meantime, larger-scale elevator-components companies with brand influence have been cultivated. Today in China, the elevator-components market pattern has basically been established.

Regarding future development of elevator-components enterprises, each company is constantly seeking and exploring the best development model. Personally, I think the large elevator-components companies should pay more attention to the model of scale and globalization, and the medium-sized and small elevator components companies should focus on a model of differentiation and specialization.

Large elevator-components companies should first focus on product development and innovation to provide more advanced, competitive products for elevator companies. Second, they should consolidate existing markets and customers, and cooperate strategically with world-famous elevator companies and components companies. This will enable them to establish a strong foothold in the domestic market, while also expanding in the international market, which leads to enterprise scale and global development.

Medium-sized and small elevator-components companies should first focus on the special needs of market segments, and actively identify target markets and clients. Second, they should cooperate with counterpart manufacturers, realizing it is mutually beneficial to provide complementary products. Third, they should focus on product R&D, which will improve competitiveness in their specific area of expertise. Fourth, they should improve customer service in terms of quality, delivery and after-sales service.

Of course, companies’ development models will vary based on their individual processes, scale and strategic positioning. However, as long as they are realistic in formulating a development model suitable to their individual enterprise, I believe they will see rapid development.

EW: In light of macroeconomic fluctuation and the impact of the ailing housing market, how do you see the elevator industry in China in 2013 and beyond?

GL: On the one hand, overcapacity in the elevator industry leads to intensified competition. On the other, the status of the real-estate industry as a foundation of the national economy has not changed. Housing needs created by increasing urbanization exist objectively. The fact that the central government plans to complete 6 million units of affordable housing in 2013 has created a big boost for the elevator market that will continue.

EW: As the international market continues to decline, global elevator giants will, predictably, continue to expand in China to increase their influence and market share. How does NBSL approach this?

GL: The global elevator giants have employed multiple strategies to respond to market differentiation, i.e., offering premium/medium/basic product lines, introducing Lean manufacturing and utilizing global procurement and supply-chain management to continuously reduce operation costs and improve performance-to-cost ratio to achieve business expansion in China. NBSL constantly develops diverse elevator components and solutions to meet these multilevel needs of elevator companies. For example, the economy-type door system developed for the affordable housing market is especially popular.

EW: Do you think the structure of the Chinese elevator industry is changing? If so, how?

GL: From the perspective of geographical distribution, as the country’s central and western development has intensified, the Chinese elevator industry is gradually moving from the traditional Yangtze and Pearl river delta regions to the central and western regions. In addition, the industry is shifting from foreign enterprises being the majority to having foreign and private enterprises coexist. From the perspective of market demand, it is now not only sales and installation of new elevators, but also modernization and maintenance.

EW: Which factors are driving market competition? Which capacities do companies need to strengthen?

GL: First, national policy control; second, technical standards; third, international market demand. Enterprises need to strengthen strategic planning capacity and make timely judgments, because domestic and international markets change. They need to formulate corresponding development strategies and strengthen R&D capabilities. To keep new technology, they must realize new standards will be applied. They must strengthen production and operation management capabilities in order to continue to improve efficiency and quality. Finally, they must expand service capacity to improve customer satisfaction.

EW: What is NBSL doing to remain sustainable in light of future changes in the market?

GL: In 2013, we set up NBSL Elevator Components Group, which includes our headquarters, R&D and marketing departments in a new Shanghai factory, and opened an operation in Ningbo at the same time. A new Shipu factory with 160,000 m2 in the Shipu Technology Zone will be put into operation by the end of the year. To better serve increasing demand in China’s middle, western and southern regions, the company is actively developing Chongqing and Guangzhou logistics centers. Upon completion, delivery time for clients in these regions will be significantly reduced. Internationally, the company plans to launch sales offices in India in an effort to further strengthen our cooperation with world-famous brands and local companies in India.

Get more of Elevator World. Sign up for our free e-newsletter.