Steady Growth

Apr 1, 2020

German elevator/escalator market shows upgrade.

The German elevator and escalator industry holds a strong third place in Europe, and is showing steady growth. It is embedded within a German economy and construction industry that are also relatively strong and provide good conditions for a small — but highly specialized — technical industry. Figures and trends, as well as facts and estimates, describe the current status and expected future development.

German Economy Grows and Industry Flags

According to Eurostat, Germany’s GDP in 2017 was about €3,300,000M (US$3.6 trillion), compared with Europe’s approximately €15,400,000M (US$17 trillion), and was continuing to rise, as the last dip was recorded in 2009. The unemployment rate in November 2018 was 3.3% (compared to the European Union’s 28 member states’ (EU28) 6.7%), and inflation in November 2019 was about 1.2% (compared to the EU28’s 1.3%). Primary energy consumption has remained relatively constant for about five years, while gross electricity consumption has tended to fall relatively significantly for more than 10 years. In 2017, the EU Commission considered Germany to be one of the strong innovators, ranking seventh out of the 28 member states, although with a slight downward trend, compared to 2011. Austria is in ninth place, with a substantial increase compared to 2011. For 2018, the World Economic Forum placed Germany in third place for global competitiveness, after the U.S. and Singapore.

The Institute of German Economy (Institut der Deutschen Wirtschaft, or IW) economic activity “traffic light” of December 2019 shows a comparison of Germany, the EURO zone and the U.S. regarding production, employment and demand, the main data characterizing the economies.

| December 2019 | Germany | Europe | U.S. |

| Industrial production | Worse | Worse | Stable |

| Incoming orders | Stable | Worse | Stable |

| Employees | Stable | Stable | Better |

| Consumer confidence | Stable | Stable | Stable |

| Investments | Stable | Stable | Stable |

| Exports | Stable | Stable | Stable |

Building Sector Booms With Rising Construction Prices

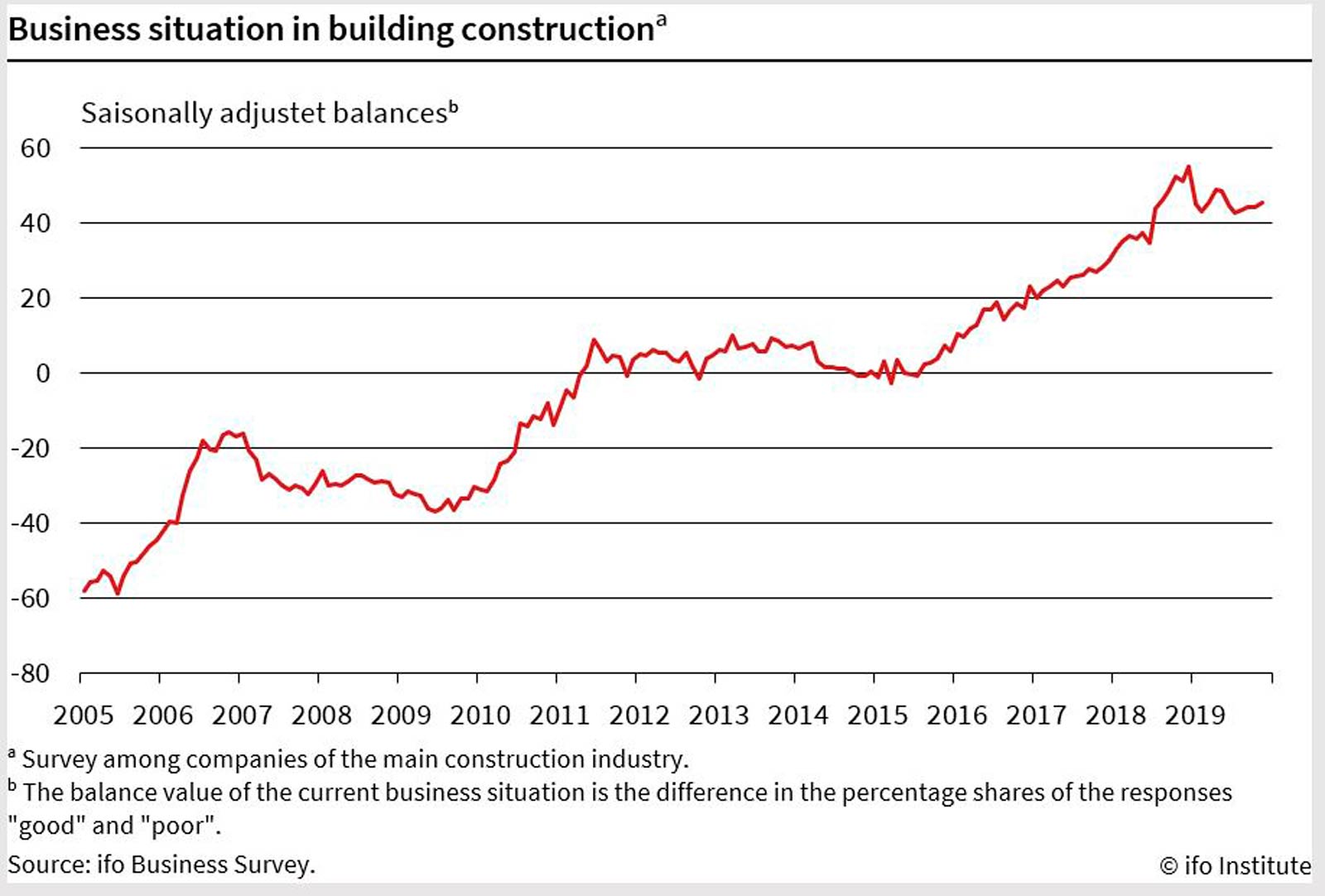

Ludwig Dorffmeister, specialist for construction and real estate research at the Ifo Institute for Economic Research, reports that the business situation in building construction, a part of the main construction industry, saw a steady increase until December 2018 and has since remained stable, with only small ups and downs. Assessing the current status, Dorffmeister said:

“The need of additional rental and privately owned flats will stay high for some time. At the same time, commercial construction and single-family homes might be developing downward due to dampened economic development. Due to the continuing construction demand, the shortage of skilled personnel has become more pronounced, especially in the crafts. Governmental requirements but also the raised the demands of users enforce more elaborate construction workmanship.”

Since 1949, the Ifo Institute has regularly surveyed companies on their economic situations. The monthly Ifo Business Climate Index, which includes the main construction industry, receives the most attention. The survey for the main construction industry, including building construction, collects assessments of the current business situation and future business expectations as well as order backlog, capacity utilization, price trends and employee trends and obstacles to construction activity. VDMA (The German Mechanical Engineering Industry Association) reported that sales in building construction rose by 9.5% from 2017 to 2018, while order intake was up 6.7%.

Trends in the business situation for building construction show two impressive upswings. The first came in 2010-2011 with the beginning of a long-term upturn in residential construction and economic recovery. Then, in 2015, construction demand began to pick up again due to a dramatic increase in refugee immigration. In 2016 and 2018, companies and municipalities again initiated significantly more new construction projects, too.

The building construction business situation slowed down slightly in 2019 but maintained an excellent level. Companies, especially, are acting more cautiously. The sharp deterioration in the industry situation may currently leave its mark on the construction of detached and semi-detached houses via reduced job security. In the long term, the consequences of the aging population are increasingly slowing construction activity. Multifamily residential construction is likely to continue to grow for some time but slower. The main construction industry manages to increase its workforce continuously, but, in the finishing trades, the increase in workforce appears to be limited. This is one reason why it is taking increasingly longer to complete new buildings.

Even if the period of high growth rates is likely to be over soon, a substantial market decrease is not expected. There are still areas where further significant action is needed, for example, in several agglomerations concerning multifloor residential constructions. There is also some potential in the areas of office and warehouse space, and schools. At present, however, it is not so much a lack of money but, rather, bottlenecks in terms of building land, capacities in the construction industry and of authorities and planners.

The Elevator and Escalator Market

The elevator market in Germany has been influenced by several forces during the past few decades:

- Integration of the large East German market

- Modernization of the many postwar buildings

- EN 81-80 and -20/-50

- Energy efficiency based on VDI Standard 4707.

The comprehensive actual technical trend is digitalization across many facets: for example, hardware embedded systems, predictive maintenance, information technology safety and security, software simulation and building information modelling (BIM).

The strongest economic trend and greatest risk is reflected in the question repeated everywhere, “Can we find capable employees for our vacancies?” Because of the shortage of skilled workers, growth in the elevator industry is reaching capacity limits, resulting in a concentration of work, particularly among service personnel. There is a growing need for education and further training. Other remedies for the shortage include increased efforts to recruit qualified personnel, investment in efficiency-enhancing measures, cooperation with educational institutions, higher salaries and more-flexible working hours.

The elevator market today and in the near future is driven by urbanization, the aging population, ISO 8100 and resource efficiency.

These trends are directly reflected in the five key areas of the European Lift Association’s (ELA) new roadmap, which involves safety, accessibility, environmental contribution, global harmonization and industry attractiveness.

The ELA Statistical Committee says the data for 2018 shows a slight increase in the number of elevators and escalators in Europe and Germany, compared with 2017 — as in the years before. In terms of the number of new elevators, Germany ranked third in 2018, behind Turkey and France. Switzerland will account for about 40% of Germany’s total, and Austria, just under 25%. This also applies to the number of existing elevators, with Spain and Italy ahead of Germany. Switzerland accounts for approximately one-third of Germany, and Austria, approximately 15%. For details on other European countries or additional years, visit bit.ly/3aHaCgU.

VDMA collects quarterly data on the business climate in the German elevator industry. The latest Lift Index was published at the end of December 2019. For more detailed information, see bit.ly/38Ebi4y.

Companies and Associations

The German elevator market is composed of the “Big 4” but also has a 40% market share of Small and Medium Enterprises (SMEs). In Switzerland, 90% of elevator and escalator work is done by multinationals. In total, more than 600 companies are active in the German elevator market. SMEs are mostly active in construction and components. Many are regionally oriented.

Partially overlapping, the companies are organized through three industrial associations:

- VDMA Technical Group Lifts and Escalators: 85 German member companies representing about 90% of the elevator and escalator market in Germany (https://auf.vdma.org)

- VFA-Interlift: Industrial association of medium-sized companies with more than 230 members and with an annual turnover of about €1 billion (US$1.1 billion) (vfa-interlift.de)

- VMA: Represents more than 70 exclusively independent companies, from one-person to large medium-sized companies (vma.de)

| 2018 (numbers rounded) | Europe | Germany |

| Number of elevators | 6.2 million | 765,000 |

| Number of escalators | 149,000 | 36,500 |

| Newly built elevator units | 157,000 (4.2% hydraulic) = +8.7 % from 2017 | 22,000 (3.1% hydraulic) = +2.1 % from 2017 |

| Newly built elevators value | EUR5.4 billion (US$5.9 billion) = +9.4% from 2017 | EUR970 million (US$1.07 billion) = +9.0% from 2017 |

| Modernization of elevators | EUR1.7 billion (US$1.9 billion) = +8.8 % from 2017 | EUR283 million (US$312 million) = +12 % from 2017 |

| Newly built escalator units | 5,400 | 500 |

| Newly built escalators value | EUR367 million (US$404.6 million) | EUR49 million (US$54 million) |

| Employees | 158,000 | 17,000 |

| Companies | 600+ | |

| Users per day | 1 billion-plus |

Get more of Elevator World. Sign up for our free e-newsletter.