The Indian Elevator Industry Ascends

May 1, 2012

India’s economic trends and challenges, with an emphasis on its rapid urbanization

In a world battered by financial meltdowns, India’s economy has performed well, with an average annual gross domestic product growth rate of 8.1% between the periods of 2007-2008 and 2010-2011. Strong economic growth has resulted in rapid urbanization. Of India’s total population (1.2 billion), 31% reside in urban areas; this figure is expected to rise to 38% by 2025. Over the last two decades, rapid expansion of the information and communication technology sectors, growth in the service and industry sectors and the retail boom have paved the way for employment opportunities and, consequently, the expansion of India’s mega cities. Large metropolitan cities and their peripheral or suburban areas have rapidly developed in recent years.

The vertical development of real estate has become the norm across metropolitan and Tier I cities, primarily to resolve space constraints. Urbanization, coupled with a growing middle class, has created significant demand for housing. According to a report by the World Bank, India is facing a 26-million-unit housing shortage. Maximum demand stems from the mid-range housing segment. The National Capital Region (NCR) is expected to have the highest demand, followed by Mumbai and Bangalore. Limited land availability, relative to a population increase, primarily led to India’s high-rise growth.

Tall buildings play a significant role in determining a city’s skyline, with regions becoming known for their tallest skyscrapers, records that seem to be continually broken. This trend is also reflected in India. Most of India’s major cities are witnessing an increase in residential and commercial buildings taller than 30 floors. Currently, 80-100 high-rise buildings are under construction. Mumbai, the commercial capital of India, houses a majority of the country’s constructed or under-construction skyscrapers, with many above 300 m. Noida, Gurgaon, Bangalore, Ahmedabad and Hyderabad are also witnessing an increase in the number of high-rise structures.

However, each city has committees to govern the development of high-rise buildings, and planning authorities zone special areas for construction. The trend of high rises has not yet gained popularity in smaller cities. Even in larger cities, several challenges are posed in terms of floor space index norms and regulatory guidelines. Nevertheless, the high-rise trend is likely to continue. Advanced engineering and technology have played an important role in enabling high-rise construction, and elevators have been a catalyst in the overall skyscraper boom.

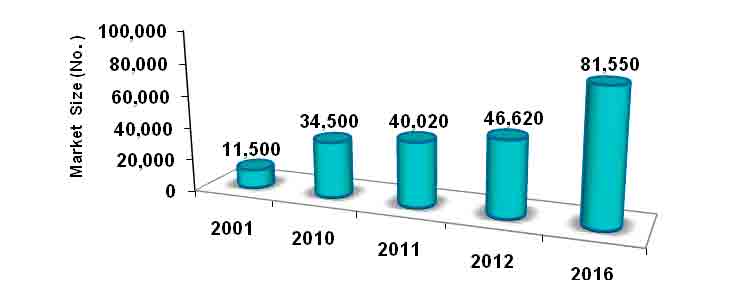

Driven by strong economic growth, rapid urbanization, increasing population density and a surge in construction projects in the residential and industrial sectors, especially high rises, India has emerged as the second-most promising market for elevators in the world, behind China. With more global players entering the Indian realty sector and increased expenditure on infrastructure projects by the government, such as airport modernization and metro rail initiatives, the demand for elevators and escalators is on a high-growth trajectory. In 2010, the Indian elevator market was estimated at 34,500 units. Growing at a compound annual growth rate of 15.3%, the elevator market is expected to reach 81,550 units by 2016.

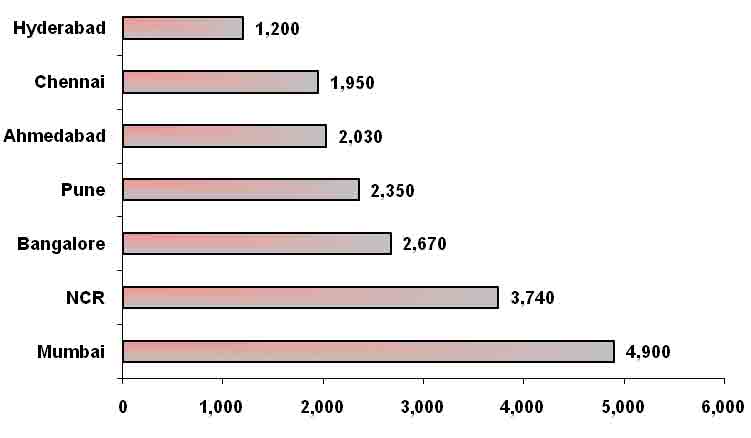

India’s western region continues to be the leading market for elevators, followed by the north and south. Among cities, Mumbai remains the most important market for elevators, followed by the NCR, Bangalore and Pune. The next five key markets are Ahmedabad, Chennai, Kolkata, Hyderabad and Jaipur. Demand for elevators from Tier II and Tier III cities, such as Amritsar, Bhopal, Cochin, Coimbatore, Chandigarh, Jaipur, Kanpur, Lucknow, Nagpur and Surat, is also on the rise.

Passenger elevators account for the bulk of India’s elevator market; home elevators are increasingly popular due to an increase in high-end residential projects and townships. Due to the increasing number of high rises and a need to transport people faster, India is witnessing an increase in the installation of high-speed elevators. In 2010, elevators with speeds greater than 1.8 mps were estimated to comprise 15% of the market.

Over the last decade, India’s elevator market has witnessed a major shift from AC drives to variable-voltage, variable-frequency (VVVF) drives, with the share of VVVF drives increasing to more than 80% in 2010. Gearless motors are poised to capture a major share of the market; however, recent price increases for permanent-magnet motors could cause some slowdown in their growth. Thanks to a ban on manual collapsible doors and demand for improved aesthetics, automatic doors are now a standard feature, though some low-end buildings (particularly in non-metropolitan areas) continue to use manual doors.

The Indian elevator market is clearly growing, with demand for higher safety, improved features and aesthetics. Gone are the days when elevators were looked upon as a functional platform for moving passengers. Quality elevators are becoming a lifestyle statement, and developers and builders are paying more attention. Given the heightened building activity anticipated during the next decade, the future of India’s elevator industry is bright.

Get more of Elevator World. Sign up for our free e-newsletter.