The past three years in Europe were dominated by the Eurozone crisis and the various bailout packages to overcome the governmental debt crisis in many Eurozone countries. Gross domestic product (GDP) in the European Union de-clined by 0.4% in 2012, and in the Euro-zone, by 0.6%. In 2012, even an economi-cally stable country like Germany could only achieve growth of 0.7%, after 3.3% in 2011.[1]

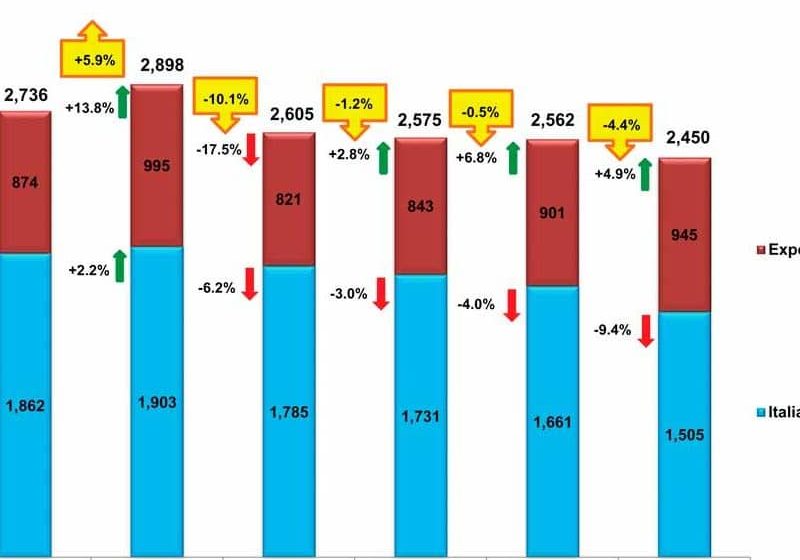

These developments also had an im-pact on the European elevator market. In 2011, 131,375 lifts were placed on this market. In 2012, that amount was only 121,290. Especially in countries such as Spain, Portugal and Greece, the number of new installations decreased by almost 50%. Germany was able to escape this trend (Table 1). After 15,314 new installa-tions in 2011, that number rose (in 2012) to 16,730 units. The order value of new in-stallations has climbed even more – by 15.6% – to around EUR719 million (US$948.33 million) in total (Table 2).

The important modernization market showed a rather reserved development. After a significant increase in 2011, the modernization volume in Germany de-creased by more than 10%, to EUR241 million (US$ 317.8 million). This is in con-trast to developments in Europe, where sales in modernization could increase (Table 3).

However, when evaluating the data, one must take into account that the European Lift Association, which collected this infor-mation, tried to improve its quality in 2012. As a result, more countries reported their industrial figures. The total figures for all European countries are, therefore, not di-rectly comparable with figures of previous years.

The number of employees in the Ger-man elevator market remains stable at 18,000, despite the growth in sales, which increased the number of existing lifts in Germany to 657,000. In 2012, the overall German mechanical-engineering sector significantly contributed to the growth of the German economy as one of its largest fields of industry. The industry employed, on average, 971,000 people and had a turnover of approximately EUR207 billion (US$ 273.06 billion). By comparison, the elevator and escalator industry had weak development. Incoming orders dropped by 8% versus 2011; within the mechanical-engineering industry, this figure was only 3%.[3] In 2012, the German machinery ex-port of EUR149 billion (US$196.64 billion) reached the all-time high of 2008. With a turnover of EUR918 million (US$1.21 bil-lion), the elevator sector plays only a minor role in this segment.

How will the German elevator market develop in 2013? This question cannot be

answered conclusively, since conditions are too uncertain. After a subdued perfor-mance in the first quarter of this year with zero GDP growth, figures in the second quarter (with a GDP growth of 0.7%) show a positive trend. According to the German Federal Statistical Office, building invest-ments rose as much as 2.6% in the second quarter after a poor first quarter, due to the long and cold winter. In June, German civil-engineering orders increased by 12.4%. This development allows the lift industry to close out the year on a positive note.

A realistic estimation and good overview of further development may also be taken during Interlift. Compared to the record In-terlift iteration in 2011, an additional 3,000 m2 of exhibition space had been booked as of August 2013, so the previous record number of 499 exhibitors should be ex-ceeded. Exhibitors from more than 40 countries will show their products in Augs-burg, Germany, and a varied program of lectures is offered at the VFA booth in Hall 2 and at the VFA Forum. Topics include standards, international markets, new products and services, design and decora-tive elements in elevators and elevator solu-tions for privately used buildings.

References

[1] European Commission: Eurostat (epp.eurostat. ec.europa.eu)

[2] European Lift Association Statistical Committee (www.ela-aisbl.eu)

[3] VDMA (German mechanical engineering associa-tion) (www.vdma.org)

Get more of Elevator World. Sign up for our free e-newsletter.