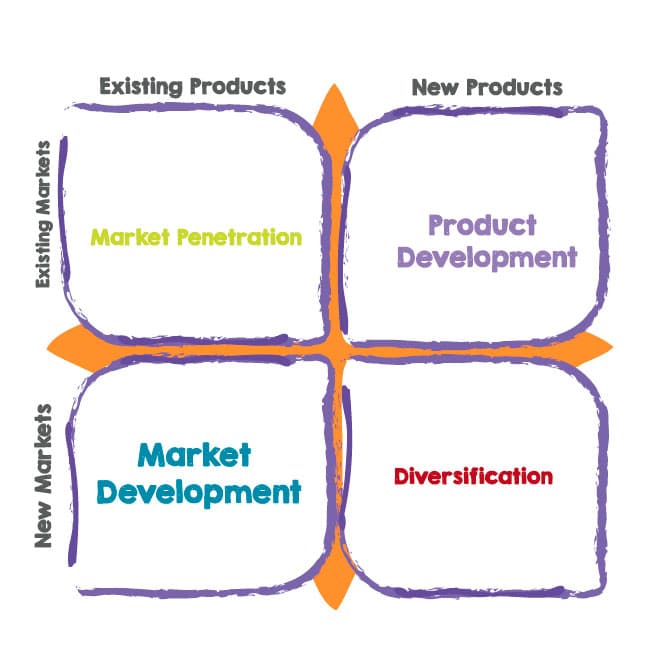

What is the Ansoff Matrix?

The Ansoff Matrix is a 2 x 2 matrix with its roots in a paper written by Igor Ansoff in 1957, but it is still relevant and useful today. The paper proposed that product marketing strategy could be categorised by thinking about new and existing products and new and existing markets, an approach which results in four archetypal strategies:

- Market penetration

- Market development

- Product development

- Diversification

When displayed visually, these four areas create the Ansoff Growth Matrix.

How to Use the Ansoff Matrix

The Ansoff Matrix is essentially a communication tool that helps you identify different growth strategies for your organisation, so this article will take a look at each of the different strategies, not forgetting that it may also be that different strategies could, or should, be applied to different products or services. It is not necessarily one size fits all.

In this example, we are going to use a small South London-based company of 30 people selling photocopiers and other equipment to clients also based in South London to illustrate how the Ansoff Matrix might be applied.

Market Penetration

This is the first quadrant in the matrix and is probably both the most common and least risky strategy, essentially for both our photocopier company or any international mega company. The strategy is “more of the same”: existing products and services are sold into an existing market. It’s really about increasing market share either by expanding the market or, more usually, taking share from the competition. Market penetration is about the company being more aggressive in its current sandpit and is achieved by selling more products or services to established customers or by finding new customers within existing markets. Typical tactics employed might include:

- Dropping prices

- Increasing promotion and distribution support

- Acquiring a rival in the same market

- Modest product refinements

Market Development

The market development strategy is used when a firm targets a new market (counties or countries) but with existing products or services. Car producers, like BMW, Mercedes or others, targeting new markets, like China or India, would be a good international example, as would Lidl or Aldi penetrating the U.K. grocery market. However, equally, it could be a photocopier (or lift or any other product) company in South London targeting customers in North London, or beyond. Typical market development tactics include:

- Targeting different customer segments

- Focusing on industrial buyers for products and services previously only sold to households (or the other way around)

- Targeting new areas or regions of the country

- Expanding into foreign markets

Product Development

Product development is where a firm has a high market share in an existing market and, to fuel growth, needs to introduce new products, as a market penetration strategy is no longer practical. This often involves extending the product or service range available to the firm’s existing markets. As a result, routes for developing new products might include:

- Investing in research and development to create new products

- Acquiring the rights to produce/market someone else’s product

- Buying products and “re-badging” them as your own

- Joint development with another company who need access to your distribution channels

Continuing the car company example, think of Ferrari or Aston Martin going into other luxury goods: watches, luggage, clothing, etc. Alternatively, if our photocopier company was pursuing a product development strategy, they might be adding products like phones or IT equipment to the goods and services provided to the client base. Alternatively, a lift company might venture into refrigeration or air conditioning or begin to morph into a facilities management company (God forbid!).

Diversification

Diversification is the riskiest strategy, as it involves the company competing in new markets with new products. Everything is new and, therefore, unknown, so both product and market development is required. If this strategy is pursued to its limits, the company would end up becoming a conglomerate. On a small scale, like in the South London example, diversification may mean the photocopier company selling telecom products in Truro.

More well know examples of diversified companies might include Virgin, which has been involved in record stores, airlines, soft drinks and banking. The other example is perhaps Berkshire Hathaway, which is the investment vehicle used by the sometimes-richest man in the world, Warren Buffett, who has interests in bricks, banking, insurance, media and food. In both of these cases, there is no direct connection between any of the products or markets.

Related tools and ideas

- PESTEL Analysis

- Porter Analysis

- SWOT Analysis

Recommended references

Dragon Slaying: A Better Way to Manage by Mark Woods; email [email protected] to receive your free copy.

Get more of Elevator World. Sign up for our free e-newsletter.