Entrepreneurship, demand and cost are main drivers.

The innovation which results in new and emerging technologies is the driving force underlying the Capitalist system, and the economic principles which drive developments in our industry are worthy of consideration.

The driving forces of innovation are entrepreneurship, demand and cost. Innovation may be evolutionary, in the incremental development of existing products, processes and services, and revolutionary in terms of the introduction of new products, technologies, processes materials and services.

KONE’s development of the MonoSpaceTM initiated a wave of technological development in what had previously been a market characterised by incremental development of the traditional lift. The machine-room-less (MRL) lift system is undoubtedly the most significant development of recent years, and one which has changed the face of the industry, such that the MRL is now the predominant product.

The MonoSpace and Otis Gen2® are iconic products and immediately recognisable brands in terms of the product itself and in the technology underlying the design — specifically, the KONE flat gearless machine and the MRL itself, and in Otis belt technology and associated reduction in machine size. Both products are, in my view, elegant design solutions, which is evident in the extent to which many competitor designs appear clumsy by comparison and in terms of design and function or are copies or derivatives of the originator products.

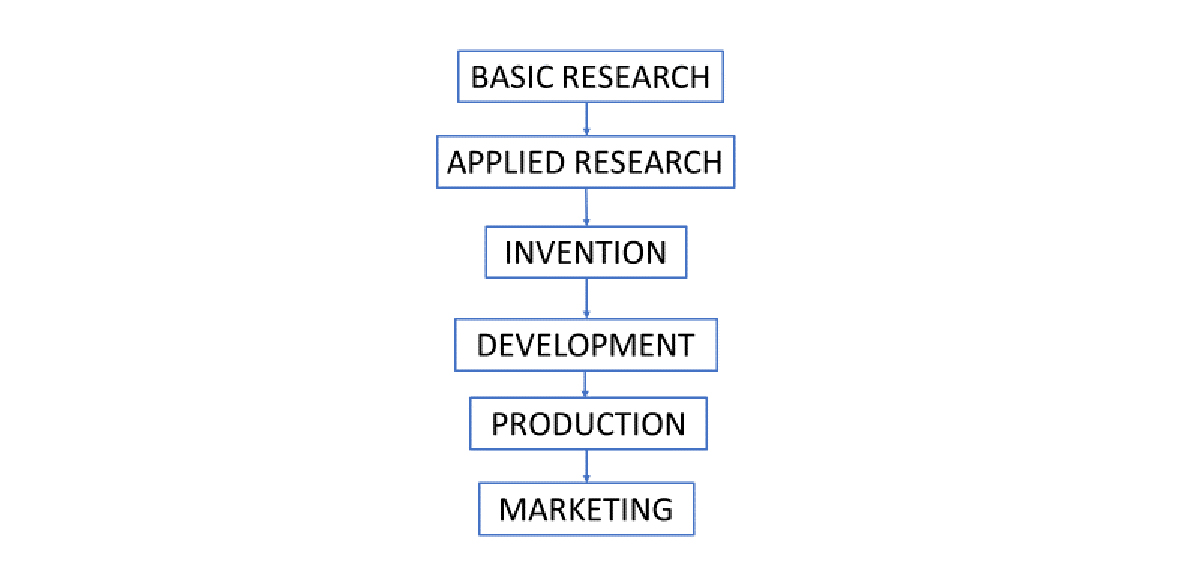

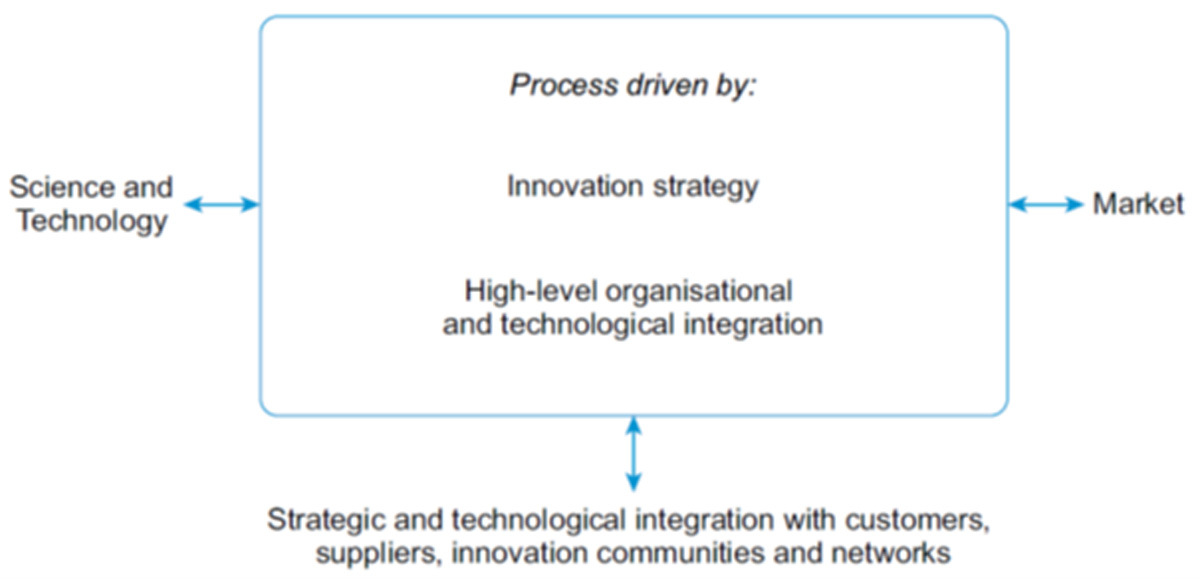

The MonoSpace may be considered in the context of the Technology-Push, or Linear, Model of Innovation (Image 1) with the basic research lying in the development and production of the flat gearless machine, without which the MonoSpace would have proven impracticable. Thereafter, a costly and protracted development process was required before the new product materialised. A similar process applied to the Gen2, with the basic research lying in the belt and drive machine technologies and, thereafter, the development of the technology into a lift design.

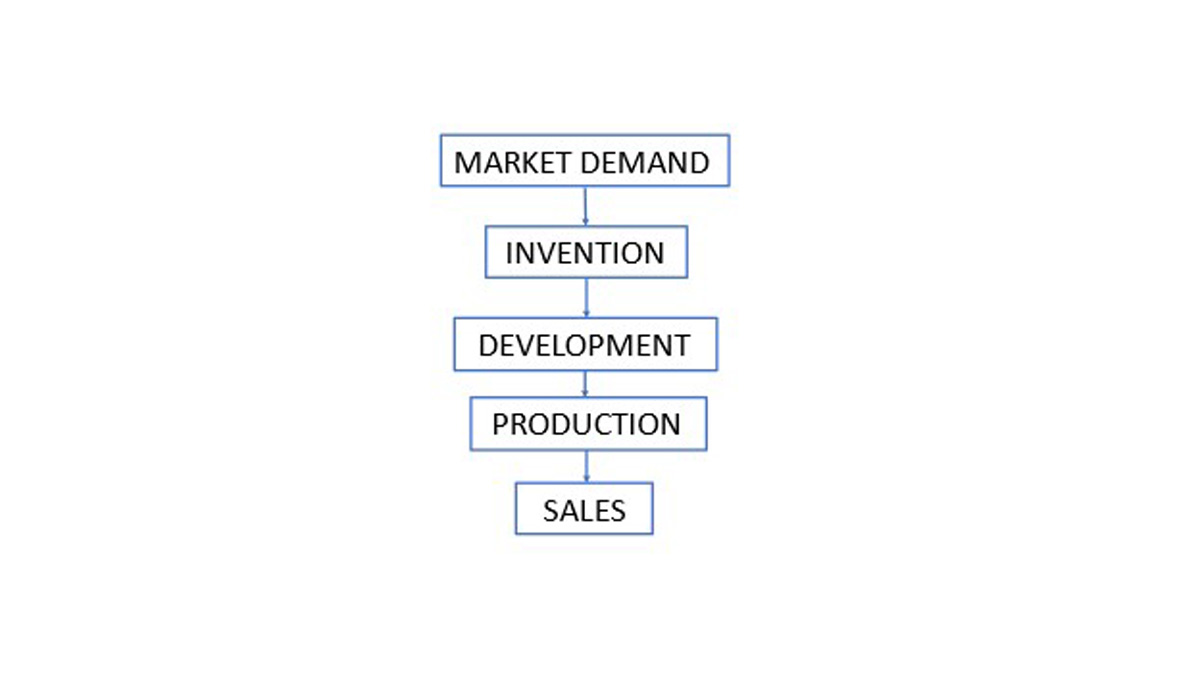

Once demand (for an MRL product) was established, other firms focussed their investment into what was an area of growth, with the economic gains to be realised (together with a wish to avoid being left behind) reflective of a Demand-Pull Model of Innovation in which demand is seen as a primary driver of innovation (Image 2).

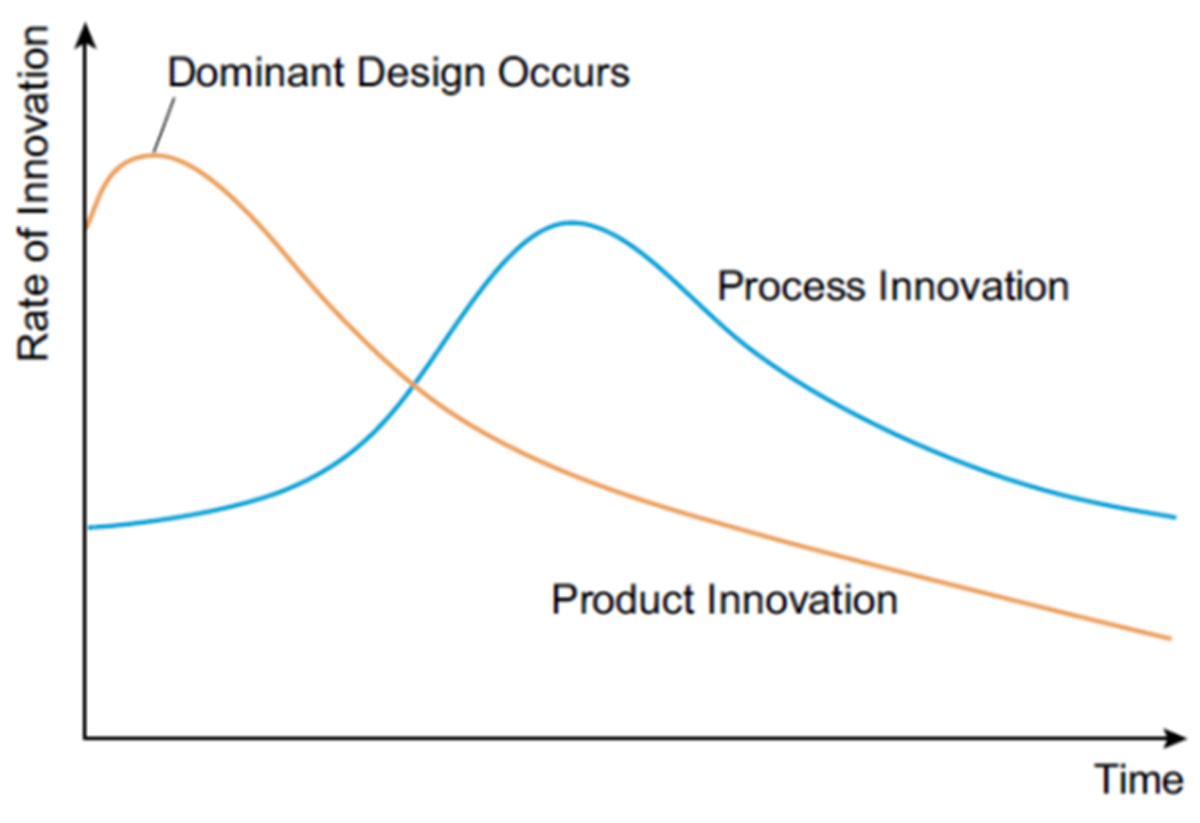

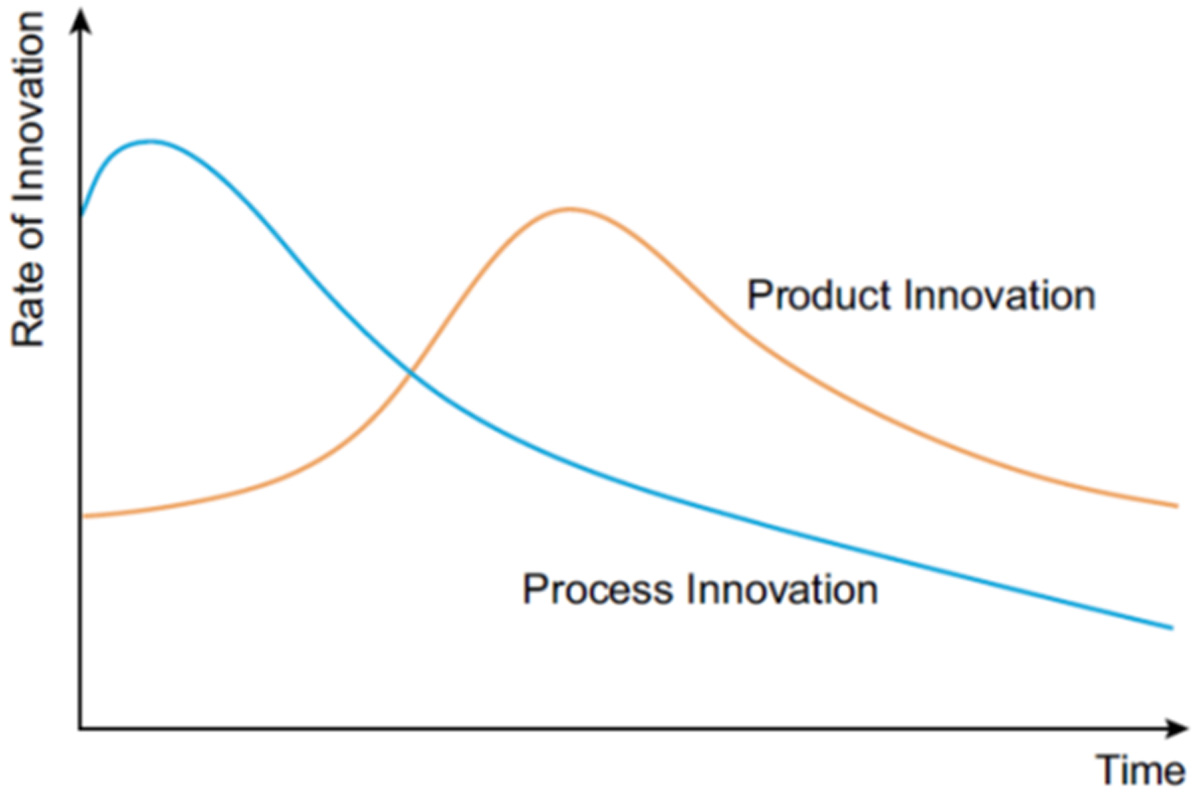

As the MRL developed and became established as the dominant product, further developments in product innovation fell away whilst developments in process innovation emerged in the form of cost reduction and value addition, reflected in Image 3.

Thereafter, a consideration of the innovation process is indicative of a progressive development over a number of years, which is currently founded within an increasingly complex information technology context reflective of a Fifth-Generation (Strategic and Integrated) Process, depicted in Image 4.

Having reflected upon the theory, I recognise that the MonoSpace has been with us now for 27 years, and whilst the MRL is now ubiquitous, it is no longer new technology.

A significant secondary effect of the MRL arose in its disruption of traditional industry structures. Prior to the MonoSpace, KONE was viewed as the weakest of the global firms and, as such, unlikely to survive in the longer term when competing with Otis, Schindler, TK Elevator (TKE) and the major Japanese firms. The MonoSpace changed this!

Whilst the application of microprocessor controls in the late 1970s was revolutionary, its legacy may lie in a disruption of the dominance of the major firms in terms of manufacturing and particularly in high-speed equipment. However, in terms of product development, the microprocessor may be considered an incremental development of the lift (be this electric or hydraulic), in that no discernible product change was evident to the customer. A lift was still a lift (albeit with a machine room). Whilst enhanced levels of reliability and performance (particularly in drive technologies, floor levelling and group control systems) were realised, these were available throughout the market, enabling many new entrant firms, as access to what had previously been sophisticated systems of control and drive became more readily available. The effect was, therefore, market disruption and heightened price competition as traditional technology advantage withered, manufacturing costs fell (due to the application of microprocessor technologies in manufacturing) and more firms entered the market.

Today, we have a significant number of internationally operating manufacturing firms which offer complete lift systems or major elements of lift equipment and whose route to market is through numerous regionally operating small and medium-sized enterprises (SMEs). Indeed, it is this emergence of global manufacturing that has enabled SMEs, whose markets often lay in service, repair and modernisation, to access the new equipment market, traditionally the forte of the majors.

In marketing terms, the MRL offers obvious advantages to architects and designers in the elimination of the machine room. In this sense, the MRL provides a tangible advantage to the customer (which manufacturers could exploit through a price premium and/or increased market share).

I recall development work on inductive power transfer (from the moving car to charge elements of shaft equipment) with a potential to eliminate shaft wiring. Whilst this looked promising, it was unsaleable as a customer feature. No value is added to the product and, therefore, unless a cost benefit which enables a manufacturer to reduce its cost below that of shaft wiring is realised, the research is restricted to its academic value. So, whilst this may be technologically achievable, we don’t see it, as cost is increased with no saleable value.

Evolutionary innovation has, in the main, arisen in the application of new technologies (drawn from other sectors) to traditional designs and currently facilitates engineering design concepts long considered obsolete. An example lies in the rigid chain designs currently developing in relation to lift drives.

Another current trend, the Internet of Things (IoT), may be considered an incremental development of monitoring systems. Similarly to the microprocessor, IoT technology is available to all industry firms, although if the major firms have an advantage, it lies in their established IT systems and management infrastructures. IoT applies mainly in the service sector with a heightened focus upon IoT, reflective of the relatively high levels of return (in comparison to new equipment) attained in maintenance.

An area open to exploitation is that of emergency communications and monitoring. The significant barriers to development have lain in the application of proprietary technologies by the major manufacturers and in network effects. The indications are that this is changing, with technologies now more readily available across the wider industry, and with the development of third-party management resources in the form of organisations which handle the telecommunications, servers and call handling, response and monitoring functions. The effect is to enable independent contractors with technologies and systems equivalent to those of the majors in terms of service and infrastructure.

A clear success lies in the TKE TWIN with two cars sharing a shaft. However, the application tends to be building-specific in terms of particular lobby configurations at the terminal floors, and the concept is suited to buildings with a reduced floor plate area (with pressure to minimise the number of lift shafts), which may serve to limit its market.

One could perhaps consider the TWIN a derivative of the paternoster. Whilst the engineering may differ, the intent and application, in increasing passenger traffic flows, particularly in applications involving high levels of inter-floor traffic, are the same. Indeed, the TWIN provides what is perhaps the optimum solution in terms of a paternoster direct replacement product.

The development of systems integrating vertical and horizontal motion, including the Otis Odyssey and TKE MULTI, have yet to make a discernible impact upon the industry. This may be a case of the technology being ahead of the market, as we haven’t yet developed buildings to accommodate these products.

Suspension technology is a rapidly developing field and one which operates as an enabler of wider design, including supertall applications. The innovation lies in materials engineering and in strength-to-weight ratios. That said, the MonoSpace incorporates conventional steel ropes, and the Gen2 belt technology is now emulated throughout the market. Outside of particular supertall projects, further developments in suspension technologies are likely to be cost driven.

Door operator design has converged on the linear belt solution, which, in my opinion, is a triumph of cost over performance. Once again, though, the technology is widespread and cost effective and, in most cases, (except perhaps in high-performance applications) effective.

Developments in door protection have stalled somewhat with the technology centred upon the multi-beam detector. Whilst a number of 3D applications have appeared (and disappeared), these have not, to date, proven successful. I would suggest that developments in sensor technology and AI software provide scope for further development. The market is assisted by the EN 81-20 requirement for automatic reopening during the closing cycle, reflective of a change in the state-of-the-art, which provides opportunities to market upgrades, albeit that mechanical safety edge applications are now few and far between.

The effect of the MRL upon the hydraulic market has generated significant debate. One effect has been that of an evolution in hydraulic technology with many excellent products available at attractive price levels. Whilst the electric traction MRL (I’m not a fan of the hydraulic MRL) provides the optimum new equipment solution for the majority of low- and mid-rise applications, as is evident in market statistics, the hydraulic is by no means dead. Indeed, a healthy demand in modernisation and in specialist applications continues and will be with us for years to come. The prevailing market trends are those of performance, energy efficiency and environmental compliance. As such, the likelihood is a falling market share over the coming 20 years as existing hydraulics are replaced and with hydraulic applications forming a specialist niche market.

PESSRAL applications are now more common, particularly in high-rise applications where performance and cost benefits are maximised. As costs fall, the technology will no doubt trickle down into the mid-rise market.

We see little by way of successful innovation in escalator design. Perhaps it is the case that current products have evolved to reflect the optimum or dominant design (in terms of utility and cost over technology application) using currently available technologies and materials? Although history indicates that I will, at some stage, eat my words in this respect.

Traditionally, takeover and acquisition were considered solutions in cases where firms lacked expertise or market presence in a product or a geographic region, or in earlier years, this was necessary for a firm to establish itself outside of its home country. The pattern in recent years, of the takeover of smaller (and sometimes not so small) independent contractors by the majors is, in my view, counterproductive. There is a loss of market diversity and competition. Whilst I recognise the economic argument providing for an entrepreneur to liquidise his or her assets, I cannot but bemoan the loss of choice and service, and I see little or no benefit to the consumer.

Innovation in the service sector is predominantly that of process innovation, which tends to operate in reverse of that in product manufacture and is reflected in Image 5. Whilst technology-based process developments continue to roll out, it is workforce retention and development, together with the training and development of field engineers and managers, which presents the immediate challenge for industry firms. In my view, these factors are likely to separate the winners from the losers.

Until recently, Otis and TKE benefitted from the basic research undertaken by their parent companies and, given that both are now out on their own in that respect, it will be interesting to observe how they both adapt in terms of innovation and product development.

Overall, other than for developments in monitoring and emergency call systems, there appears to be little on the immediate horizon by way of disruptive technology and/or product development. It may be that three years of COVID-19, coupled with war in Ukraine and wider global economic and political tensions, have disrupted markets to the extent that product development has taken a backseat. That said, the tendency is for disruptive innovation to emerge during periods of wider socioeconomic disruption and when least expected.

Eur Ing Colin J Craney BA (Hons) BSc (Hons) LLB (Hons) MSc LLM MBA CEng CMgr FCIBSE FCMI FCIArb CMIOSH

Colin Craney has 45-years industry experience, initially in a number of field and management roles with Otis, followed by 18-years in consulting, and is a consulting engineer with SVM Associates. He is a UK Chartered Engineer and Fellow of CIBSE, European Engineer, Chartered Safety and Health Practitioner, Accredited Consultant on the HSE Occupational Safety and Health Consultants Register (OSHCR) and is a Member of the Chartered Institution of Occupational Safety and Health (IOSH). Craney is a barrister, having been called to the Bar by the Honourable Society of the Middle Temple. He is a Fellow of the Chartered Institute of Arbitrators, an Accredited Mediator, and is a Chartered Manager and Fellow of the Chartered Management Institute. Craney has been appointed in relation to hundreds of failure investigations, regulatory enforcement prosecutions, commercial claims and disputes. Areas of interest and expertise include the EU Directives, law and regulatory compliance applicable to the lift industry, management, health and safety in the lift industry, CDM 2015 Principal Designer, Authorising Engineer under NHS HTM 08-02, the modernisation of historical lift installations, lift- and escalator-related dilapidations and landlord and tenant disputes, competition and intellectual property law, incident and failure investigation, alternative dispute resolution and expert witness. Craney is a Forensic and Consultant Engineer, Accredited Mediator, Management Consultant and Chartered Safety & Health Practitioner with SVM Associates, a practice of independent lift and escalator and building services consulting engineers, and may be contacted at [email protected].

Get more of Elevator World. Sign up for our free e-newsletter.