COVID-19 Impact, Outlook

Oct 1, 2020

Industry survey received nearly 600 responses worldwide.

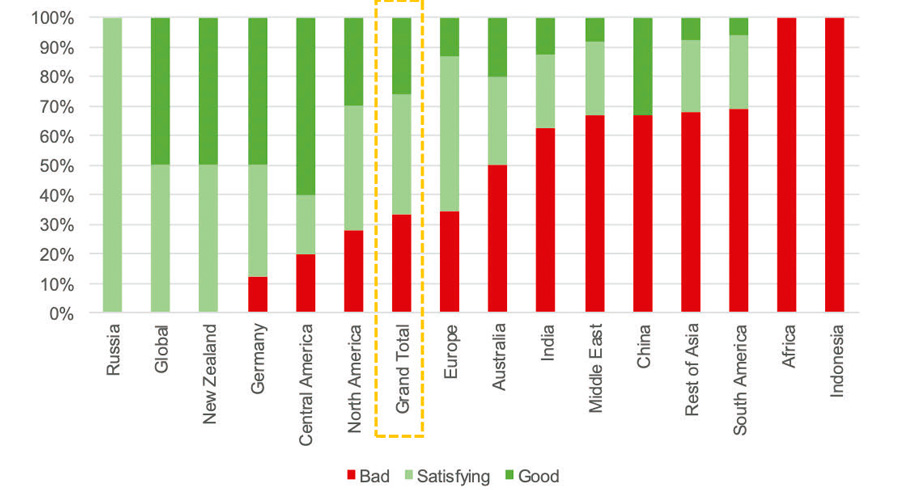

Elevator World, Inc., the German elevator association VFA Interlift e.V. and fair organizer AFAG, in association with Credit Suisse, recently shared results of the first of several surveys of elevator industry representatives on the current industry status and anticipated effects of the COVID-19 pandemic on business. The survey was sent out in early July, and the results were tabulated in mid-July. Credit Suisse Managing Director and Head of European Capital Goods Equity Research Andre Kukhnin assisted with preparation of a chart analysis, including breakdowns by country, of the results (excluding China, as only three of the nearly 600 responses were from that country). Calculating results using a method akin to the widely followed, evenly balanced Purchasing Manager Index, observations include:

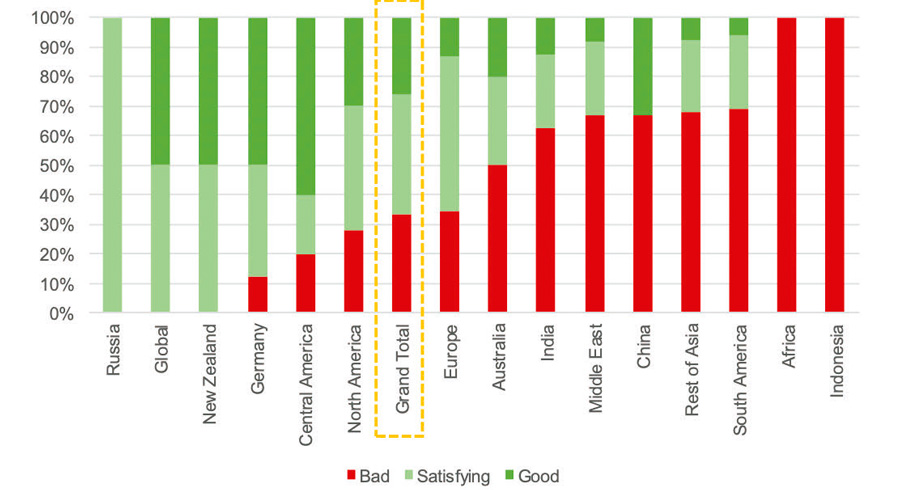

- Overall assessment of the current economic situation leaned toward “challenging,” with 34% answering “bad,” 26% “good” and the remaining 40% “neutral.”

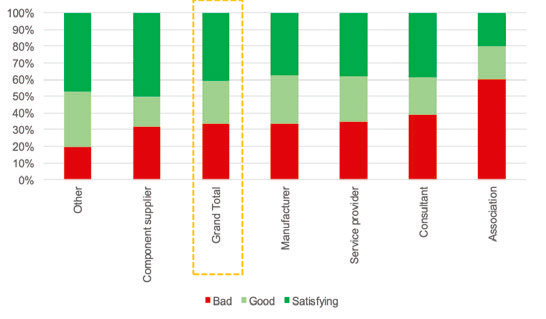

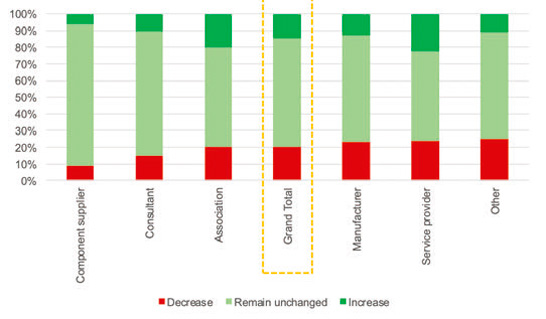

- Industry associations were most negative in their outlook versus pre-pandemic times.

- Manufacturers and service providers are least negative in their outlook versus pre-pandemic times.

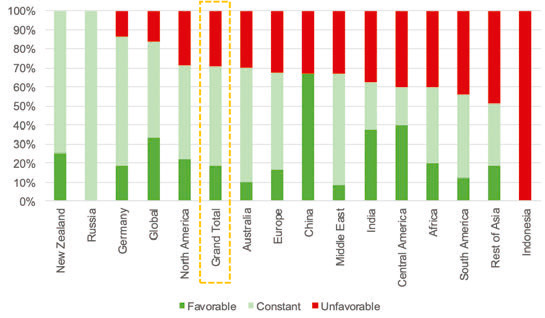

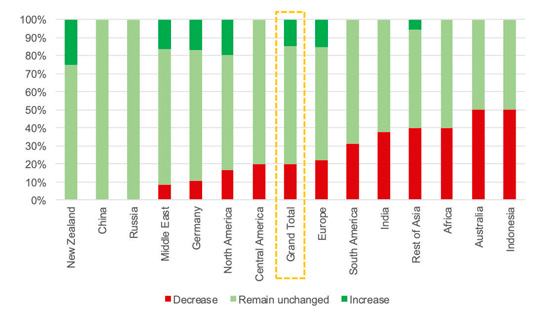

- Overall, the industry outlook was slightly cautious, with 29%expecting unfavorable development over the following six months (essentially the remainder of 2020), half expecting stability, and 19% expecting favorable development. Respondents from Europe and North America were less negative.

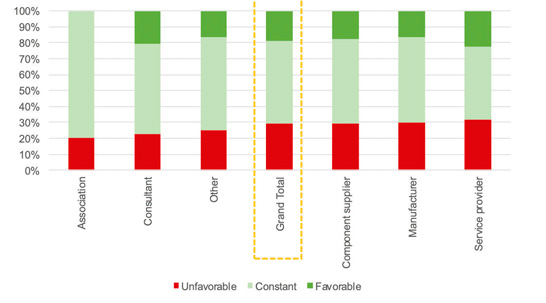

- In terms of business outlook, industry associations were most cautious in their pandemic-era outlook, followed by manufacturers/components suppliers and consultants/service providers.

- The most-cited business-limiting factor was COVID-19-related restrictions, followed by economic uncertainty and lagging demand.

- Those in Europe and North America planned to maintain current levels of employment over the following three months, but those in the Asia-Pacific region planned to decrease them.

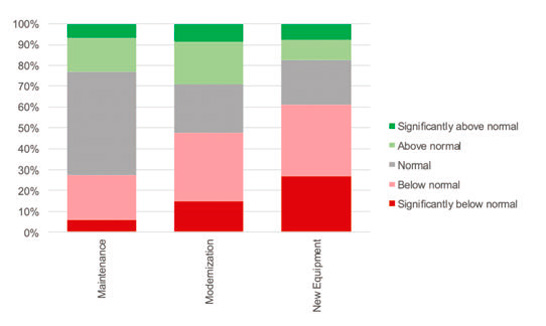

- New equipment providers in Europe anticipated business to be up to 10% below pre-COVID-19 levels, while modernization providers expected it to be only 3% below previous levels. The charts provide further detail.

Manufacturers and service providers were least negative in their outlook versus pre-pandemic times.

Get more of Elevator World. Sign up for our free e-newsletter.