Savills India report shows life sciences R&D real estate likely to create large demand until 2030.

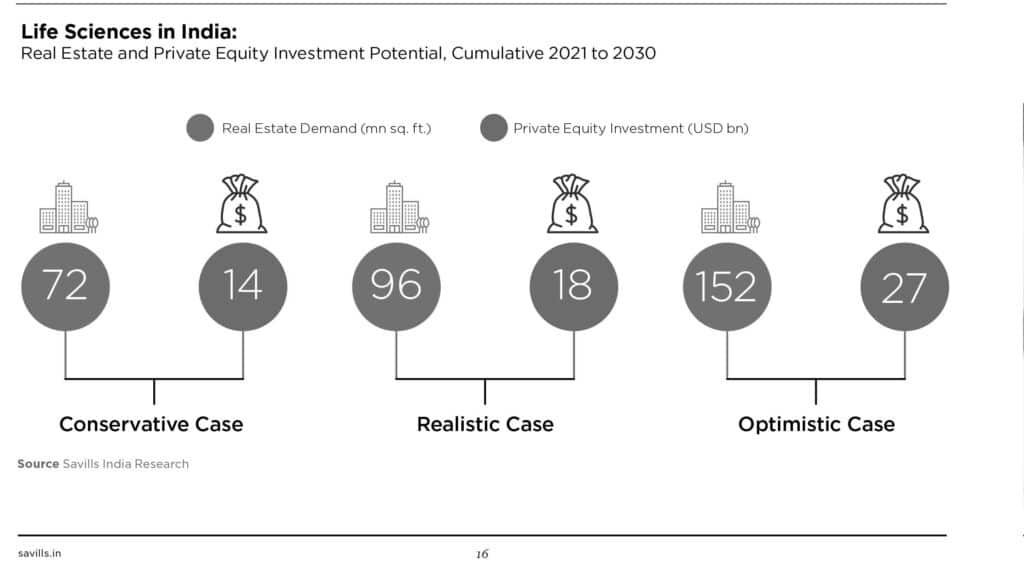

India has the potential to create demand for approximately 96 million ft2 of life sciences R&D real estate during this decade. Consequently, the life sciences R&D real estate universe holds the potential to attract private equity institutional investment amounting to approximately US$18 billion (INR1,350 billion) over the same period, as per the latest report, “On a Booster Dose: Life Sciences Real Estate,” by global property consultancy firm Savills India.

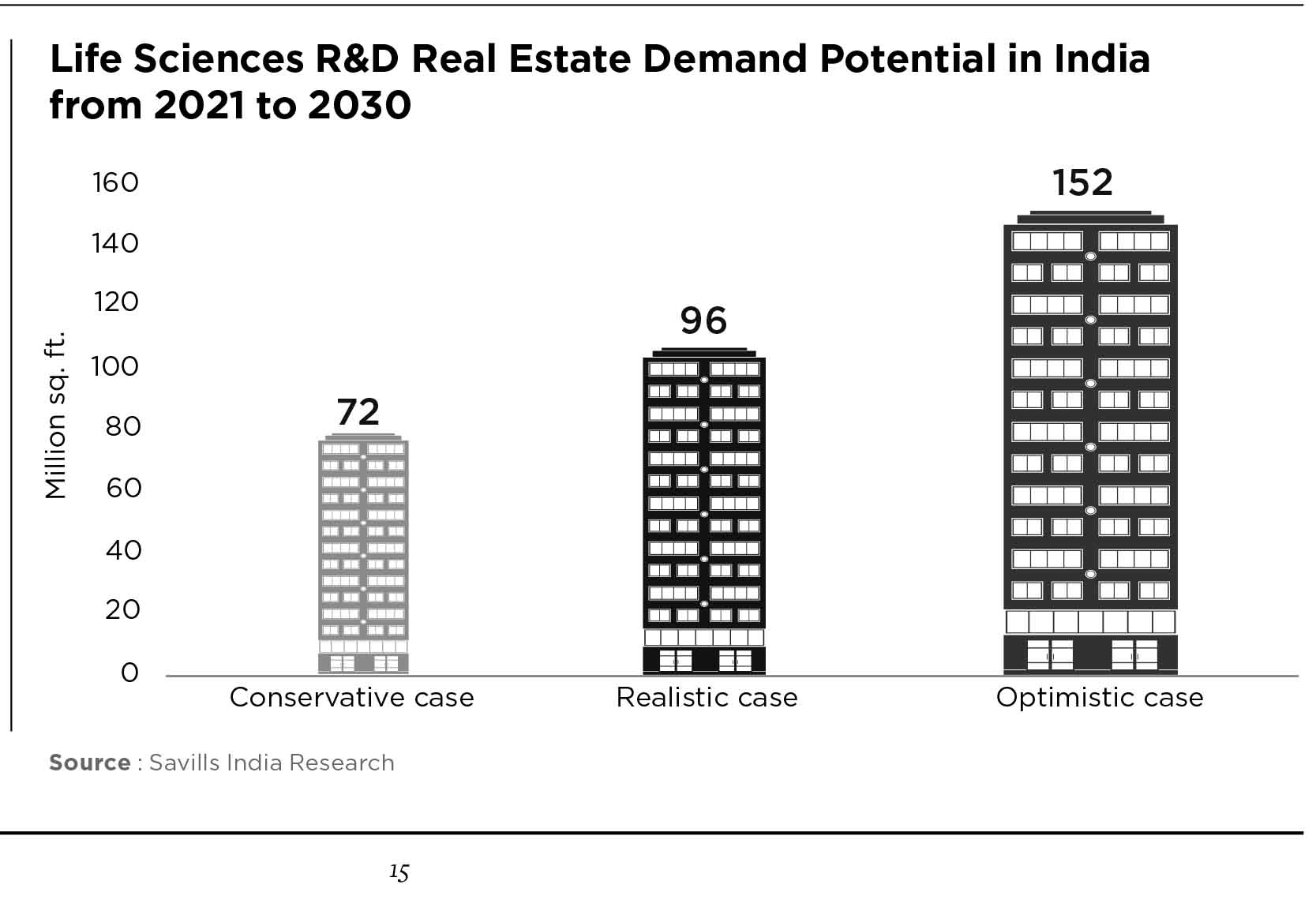

The report works out alternative scenarios for conservative and optimistic cases wherein the potential demand for life sciences real estate ranges from approximately 72 million ft2 to 152 million ft2, respectively.

Over the next decade, Savills India estimates the requirement of the life sciences R&D real estate universe in India to grow to somewhere between US$16 billion (INR1,200 billion) and US$34 billion (INR2,550 billion) as per conservative and optimistic scenarios. Realistically, the requirement is estimated to be around US$21 billion (INR1,575 billion).

The COVID-19 pandemic accelerated deal activity and confirmed investor interest in life sciences and healthcare companies. Venture capital funding into the life sciences industry in India stood at US$448 million (INR34 billion) in 2021 through August — almost three times the annual average of the last five years.

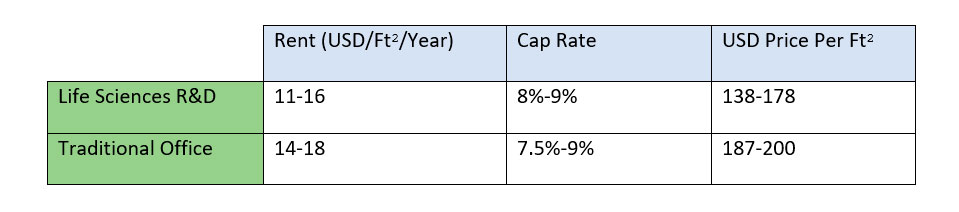

Life sciences cap rates are currently higher than similar-quality office cap rates. Further, strong growth in demand for the life sciences sector coupled with the unavailability of core assets during the initial phase of development is likely to drive higher rental growth, offering attractive returns to investors.

Diwakar Rana, managing director, Capital Markets, Savills India, said:

“Lifesciences has firmly established itself as a predominant part of the new global economy pushed by increased private equity funding and catalyzed by the COVID-19 pandemic. Aided by exponential global demand growth, geopolitical environment, policies initiatives and a skilled workforce, India is on the path to becoming a major global contributor for this sector. Consequently, life sciences R&D real estate is emerging as a high-potential asset class for institutional investors. This segment will play a pivotal role in the overall growth of the Indian real estate industry.”

The World Economic Forum suggests that COVID-19 is perhaps not the last pandemic and that better preparation is needed to fight future disease outbreaks. As a result, Savills India believes that life sciences research funding could increase both to fight the current COVID-19 pandemic and to build a better infrastructure for future.

The Bottom Line

India offers cost efficiencies in terms of lower manpower cost and lower real estate rents than other major economies. This places the Indian market in an advantageous position. The ability to manufacture high quality, low-priced medicines presents a huge business opportunity for the domestic industry.

Life Sciences Real Estate Specifications

Similarities and Differences with Office Real Estate

Life sciences facilities and office space overlap to a certain extent, but there are distinct differences related to certain structural characteristics, costs of development/ongoing capex and tenant base.

- Structural: Life sciences lab spaces have certain elements that differ from traditional offices. These include higher floor load capacity, higher floor-to-floor ceiling heights, heavier HVAC usage and increased environmental control. Additionally, life sciences properties tend to be “low and wide” with larger floor plates.

- Costs: Initial building infrastructure generally costs more in case of life sciences properties than traditional offices, given the specific needs of lab tenants.

- Tenants: Life sciences properties are typically occupied by those involved in the medical research industry: research institutions, pharmaceutical companies, biotechnology firms, medical device companies and the like.

Get more of Elevator World. Sign up for our free e-newsletter.