VT business in Spain and Portugal recovers to pre-pandemic levels.

by Olga Quintanilla Marful

The vertical-transportation (VT) market in Spain and Portugal closed 2021 with an approximate 3% recovery of its growth levels, according to a year-end report prepared by the DBK Sector Observatory of INFORMA (a subsidiary of CESCE), a leader in the supply of commercial, financial, sectorial and marketing information in Spain and Portugal. The report attributed the recovery of the growth trend to the reactivation of the economy and the impulse of investment in building construction.

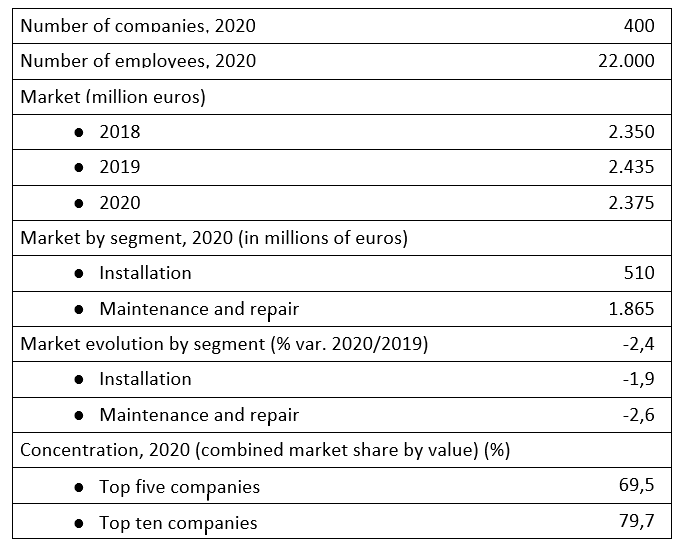

This Observatory includes in its elevator market study, all activities linked to the installation, maintenance and repair of elevators in Spain and Portugal. Likewise, the report points out that “2020 was the year in which the upward trend was broken” by registering a business of €2.38 billion, which was a decrease of 2.4% compared to 2019. This negative evolution of turnover was influenced by the COVID-19 pandemic and affected hundreds of businesses in the sector.

The temporary standstill and limitations imposed on construction work led to project delays, which hit the elevator installation segment hard. Despite this, the number of residences completed continued to grow over the year as a whole, which moderated the fall in the demand for new equipment. Turnover in this installation segment fell by 1.9% to €510 million.

The impact of the healthcare crisis on the maintenance and repair segment during 2020 was also limited, as it was not classified as a core business. In addition, the closure of hotels and tourist buildings, among other factors, had a negative impact on demand. According to October 2020 data from the National Statistics Institute (INE), a total of 7,654 hotels and 61,139 tourist apartments closed in Spain. It must be noted that the tourism sector in Spain is the largest percentage of the gross domestic product (GDP).

In this regard, October 2020 was a key month in the closure of hotels and construction buildings in Spain as, to a large extent, it proceeded with the extension of the Temporary Employment Regulation Files (ERTE) in the tourism and hospitality sector. The managers of many establishments ended the summer season early, on September 30, and decided to re-suspend the ERTE disaffected staff during those months. The downturn was of such magnitude that the latest report of the World Tourism Organization regarding the situation in Spain indicated that “tourism fell back to 1990 levels, with a drop in tourist arrivals of more than 70%.” Consequently, this had a major impact on the value of the VT market, which reached €1.87 billion, i.e., 2.6% less.

The closure of the borders led to a sharp contraction in foreign trade in 2020, and the negative trend that had begun the previous year intensified. Thus, the value of exports fell by 16.6%, i.e., by €514 million.

The VT sector is made up of approximately 400 companies. The contraction in demand and financial difficulties led to the closure of some small companies, while some of the leading companies continued to manage takeover operations. In this regard, DKB points out that in the elevator market in Spain “there is a trend of a progressive increase in the degree of concentration, so that the top 10 companies had a combined market share of 80% in 2020.”

Get more of Elevator World. Sign up for our free e-newsletter.