ELEVATOR WORLD’s 2022 North America Elevator Industry Survey reveals trends, provides insight.

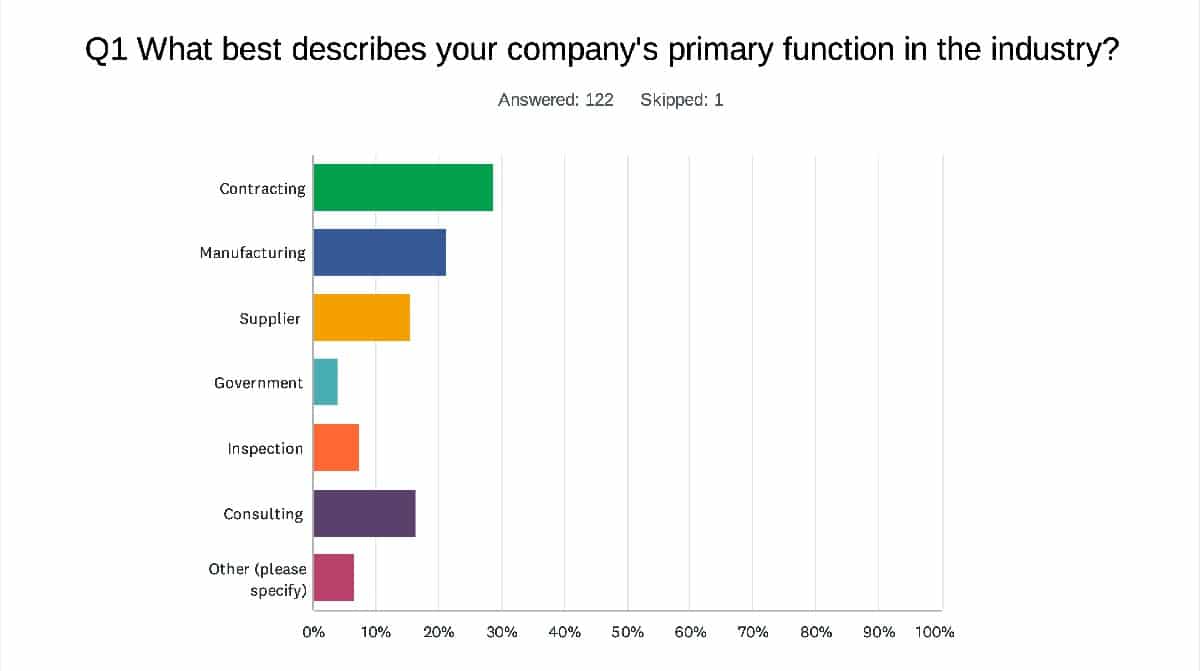

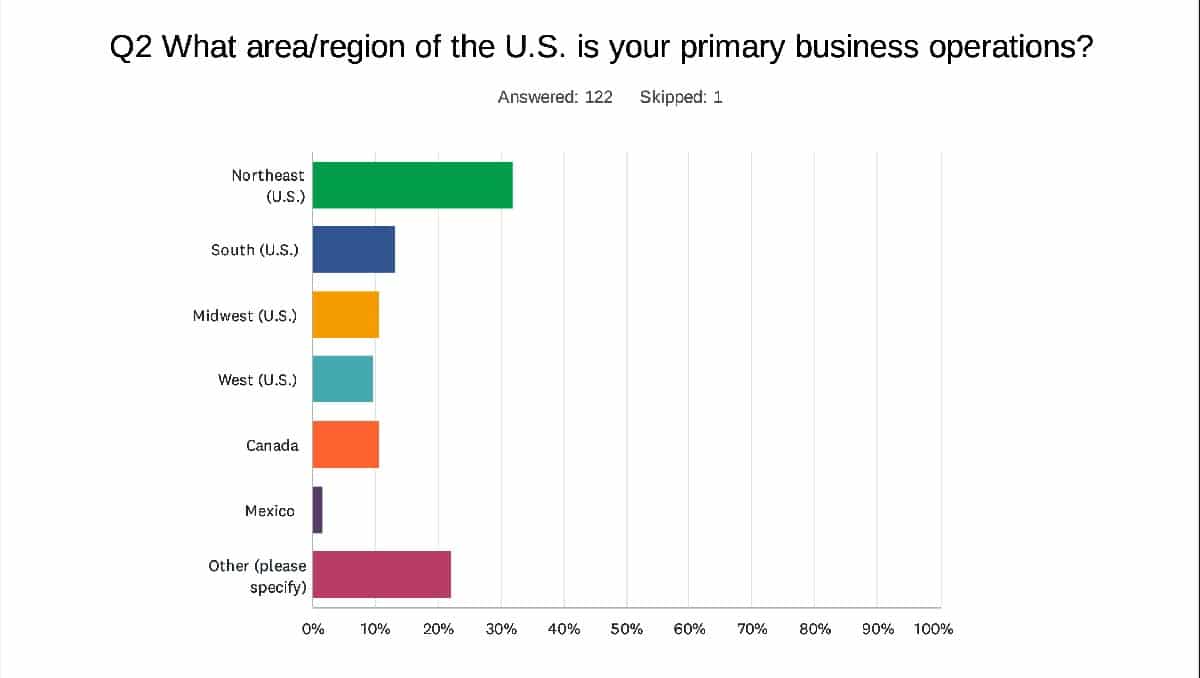

Supply chain bottlenecks, material shortages, rising prices and shifting occupancy/workforce habits brought about by COVID-19 are among issues putting pressure on the more than 120 vertical-transportation (VT) professionals who responded to ELEVATOR WORLD’s 2022 North America Elevator Industry Survey. The majority of responses came from contractors, followed closely by manufacturers. Geographically, responses from those in the Northeast U.S. led by a considerable margin (approximately 32%), followed by the U.S. South (13%) and Midwest (10%). There were also responses from Canada and a handful from Mexico.

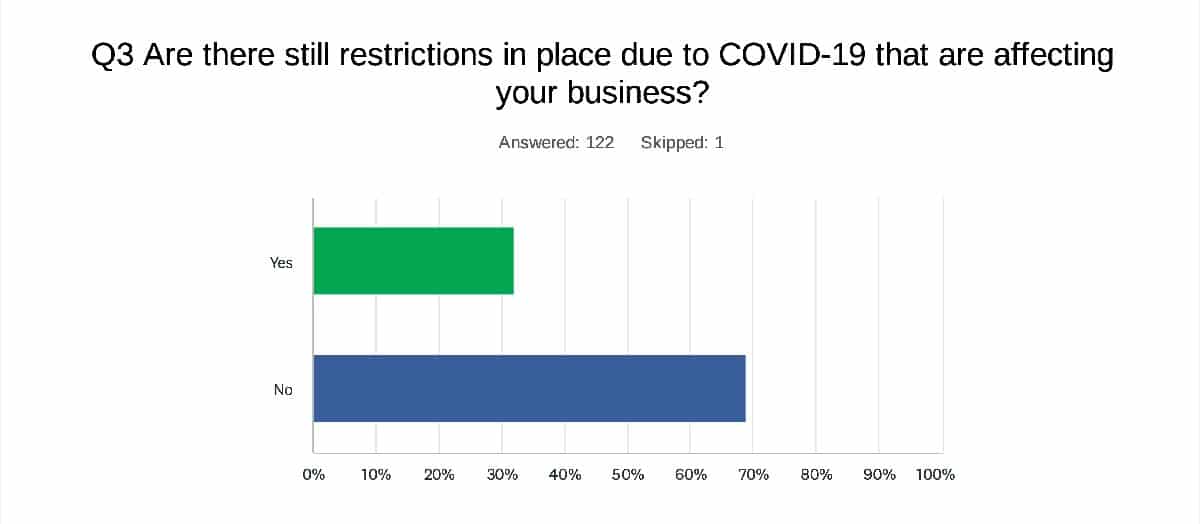

In response to a question about whether COVID-19 restrictions are affecting their businesses, most, nearly 69%, said, “no.” Exceptions exist, however. These include large nursing homes requiring elevator inspectors to provide proof of vaccination. One respondent observed some U.S. government agencies, such as the National Aeronautics and Space Administration and the U.S. Navy, do so as well. Another observed that “NYC just lifted all restrictions.”

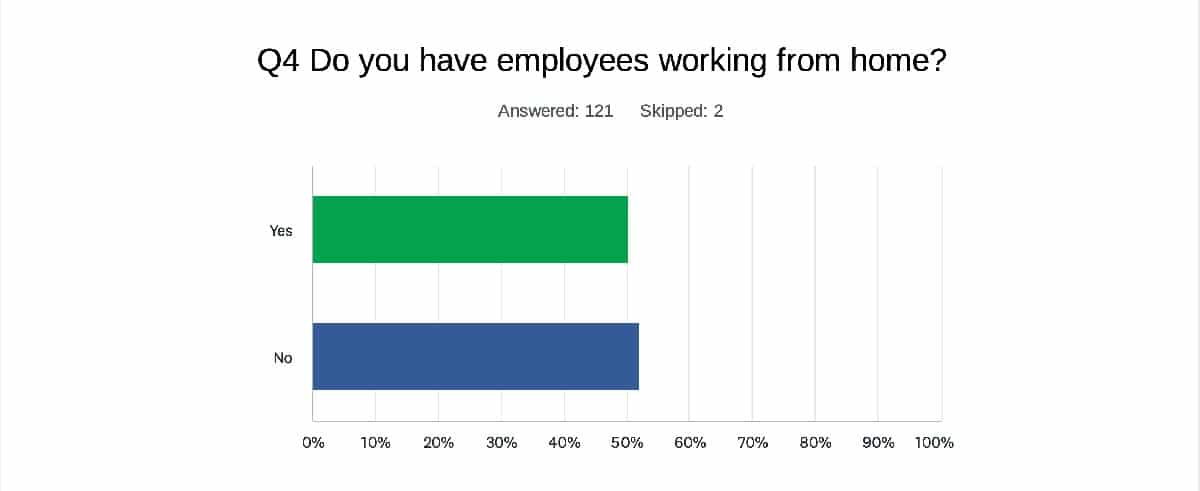

But are VT workers coming back into their offices? Not entirely, respondents said, adding that they believe a hybrid work model is here to stay. “With technology, our office phones are answered in Florida, our bookkeeper is in North Carolina and our accountant is in Colorado,” one VT professional said. Another said:

“Due to the very competitive labor market, we are leaving this up to the employee. If it works for them, then we don’t change it and give them a reason to leave. Also, due to crazy housing prices, we have seen people move farther away from the office over the past two years. Making them come into the office (introducing a commute they haven’t had in two years) could be a reason for them to look for a job elsewhere.”

On the flipside, some respondents spoke out against working from home. One said home has “too many distractions” that affect focus and productivity. Employees who are in the office often have to help those working remotely, the respondent said, which creates conflict. “When we do require them to come back, we expect some resistance,” one respondent said. If an employee refuses to return to the office, “we will part ways.”

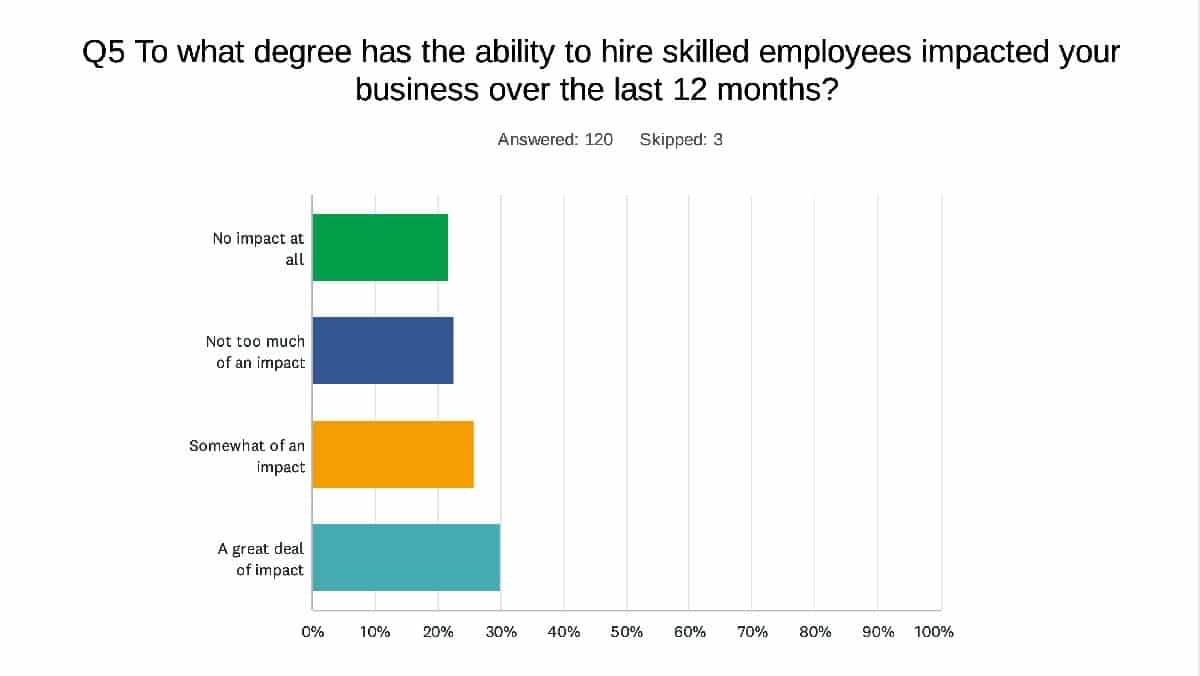

Slightly more than 25% of respondents said the ability to hire skilled employees has impacted their business over the past year, while nearly 22% said it has had no impact. Slightly more than 22% said it has had “not too much of an impact.” One respondent observed the pandemic-related slowdown in new installations meant a slowdown in hiring.

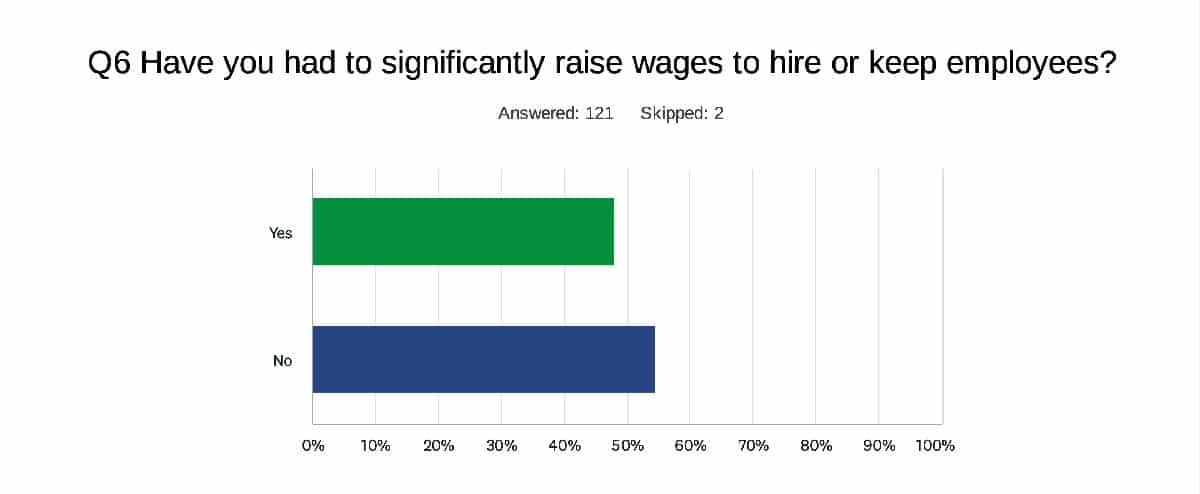

When it comes to hiring, if an employer wants a qualified worker, it will have to pay higher wages. One respondent said:

“In order to compete, I have had to compensate almost double what I would have otherwise, reduce our profit and reduce our client base — not by choice, but because the residential market is unwilling to pay for skilled help in a market where licensed and skilled technicians are not required. They opt to call the ex-bowling alley attendant or drywaller turned ‘residential elevator mechanic.’”

One merit shop representative said unions have taken his top employees “with promises I can’t match,” and another said he has had to raise wages 30% for hourly workers.

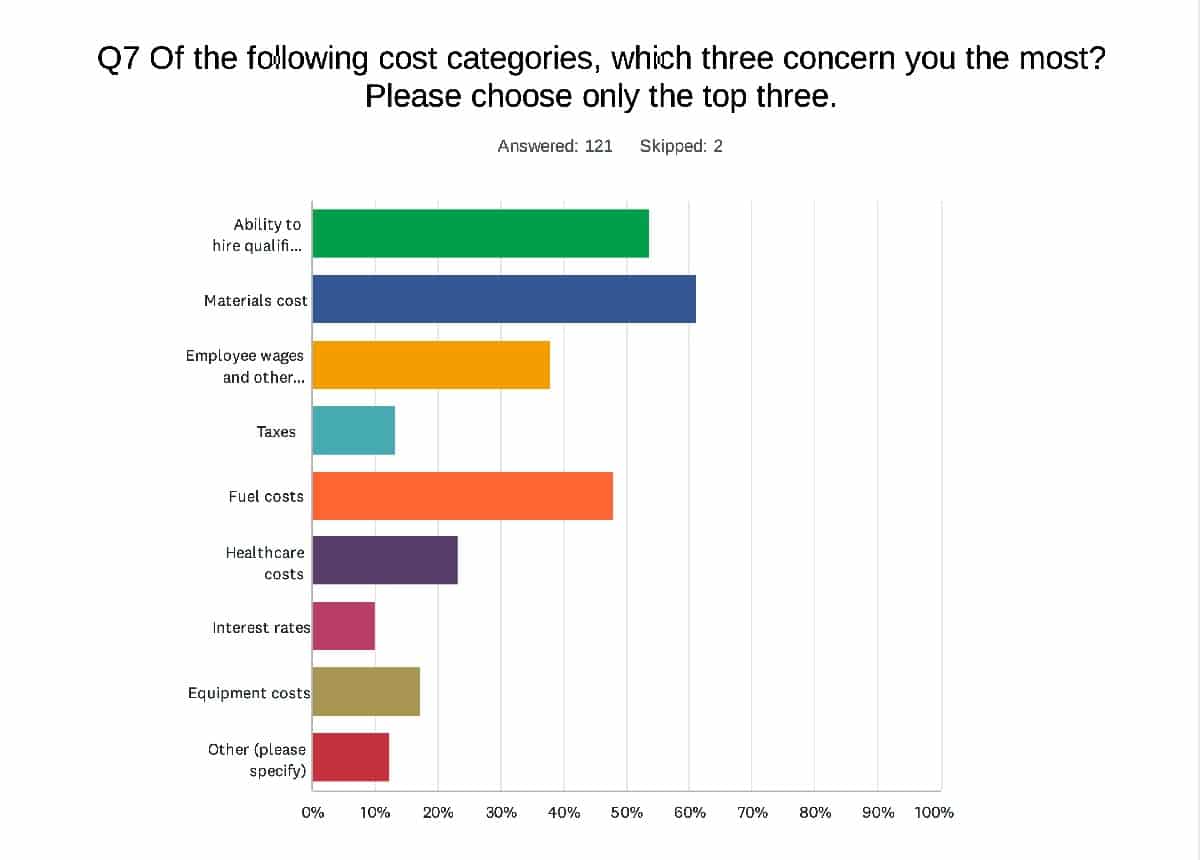

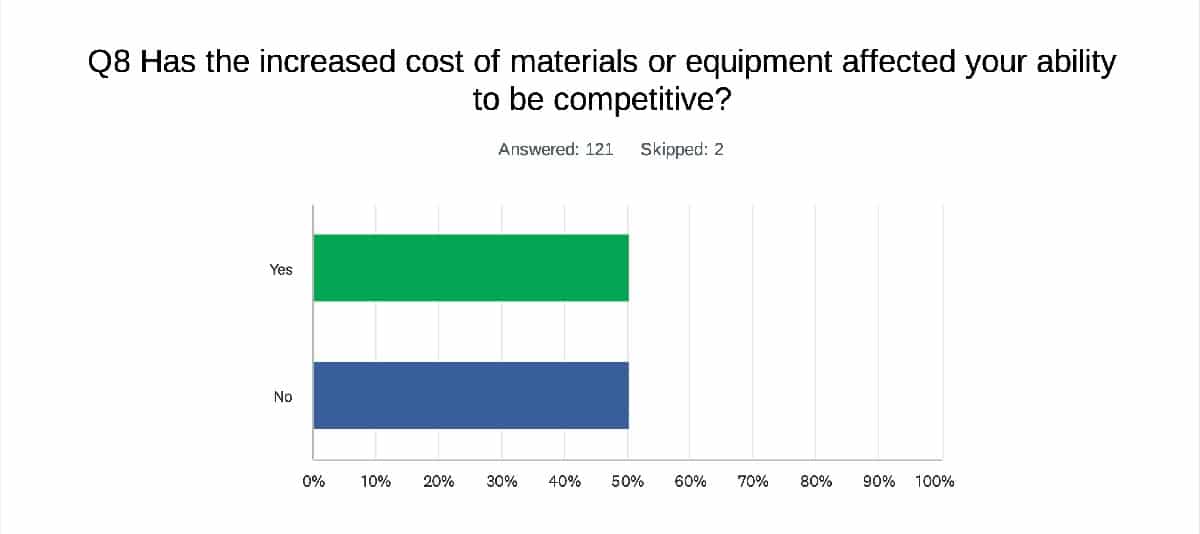

Costs — of materials and fuel — along with the ability to hire qualified staff, are the top issues of concern for VT professionals. Those saying that increased costs of materials and equipment are affecting their ability to be competitive amounted to approximately half of respondents. Even if rising costs are affecting bottom lines, many respondents observed that pretty much everyone is in the same boat.

We’ve increased prices twice already in 2022 to keep up with rising materials and transportation costs.

It can be a balancing act when it comes to raising prices. One respondent revealed updating prices has transitioned from every three months to monthly. Another said:

“We were being outbid on a lot of jobs that were in play with competitors having greater resources and likely a larger inventory. Eventually, the increased prices caught up to them as well. We’ve increased prices twice already in 2022 to keep up with rising materials and transportation costs.”

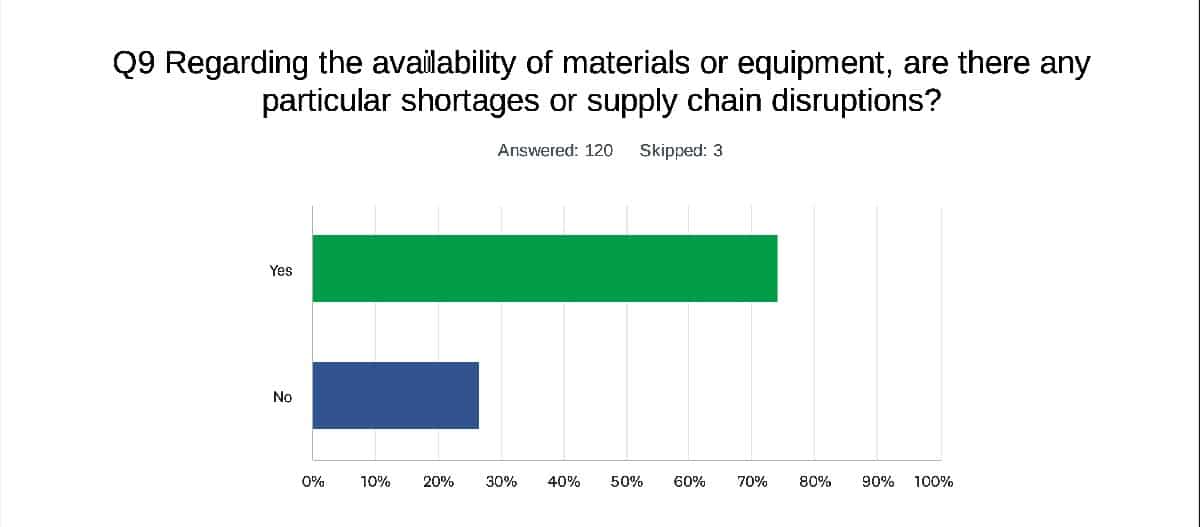

Close to 75% of respondents pointed to particular supply chain disruptions, including “outlandish” lead times for:

- Back-ordered elevator parts in general

- Semiconductors (chips)

- Stainless steel

- Other electronic components

- Raw pipe (which affects lead times for hydraulic cylinders)

- Office supplies such as toner

- Copper

- Electric motors

- Aluminum diecast products

- Third-party items such as brakes and encoders

Limited shipping space is exacerbating delays. When a shipping container is secured, it will, without question, be more expensive. This creates a domino effect, and VT players are feeling it. One said:

“Delivery of equipment no longer has regular, predictable lead times. Numerous parts go into the manufacture of an elevator, so a shortage in a single area affects the entire elevator manufacturing chain. Suppliers cannot ship what they do not have. Transport companies no longer post ETAs. One particular shipment that would have normally taken seven days from [U.S.] East Coast to West Coast takes about six weeks.”

One respondent said buying today for components that might arrive one year later makes inventory management incredibly challenging. VT equipment manufactured in North America requires tiny, but critical, components from overseas — often China — that are slow to arrive. Printed circuit boards are a particular issue.

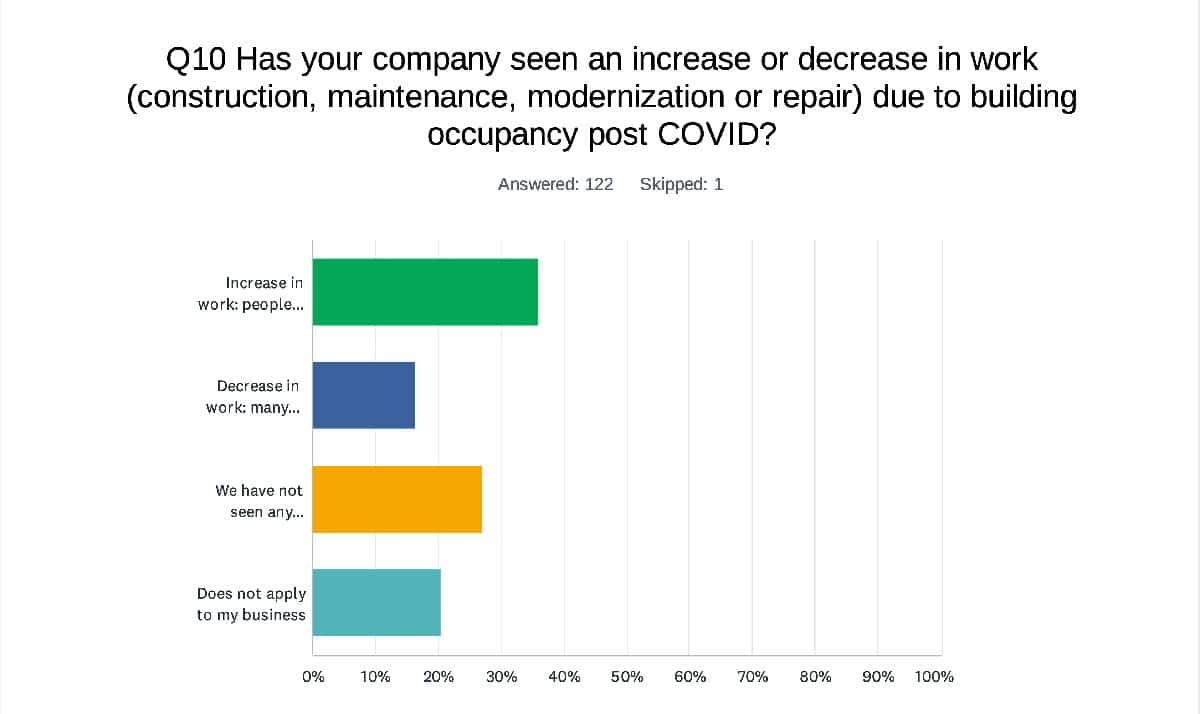

A question about building occupancy post-COVID revealed larger geographical trends, with one respondent observing that “people in the North where COVID restrictions and the cost of living have exceeded their quality of life are moving to the South in droves.” In some parts of the South, VT providers are having to deal with additional paperwork, with one respondent saying that more AHJs require elevator testing documentation after the deadly condominium building collapse in June 2021 in a Miami suburb. Approximately 36% of respondents said people are coming back to cities to work and live, but 16% reported seeing only a small difference, and expect long-term low occupancy to hurt the office sector.

A Canadian VT professional observed that new residential and commercial construction all but stopped during the pandemic, but is starting to pick back up again. On the bright side, one respondent said property owners and managers are anticipating tenants to return or new tenants to take their place, and took advantage of pandemic-related shutdowns to modernize VT systems. On the down side, “The commercial buildings in NYC are nowhere near what they were pre-pandemic.”

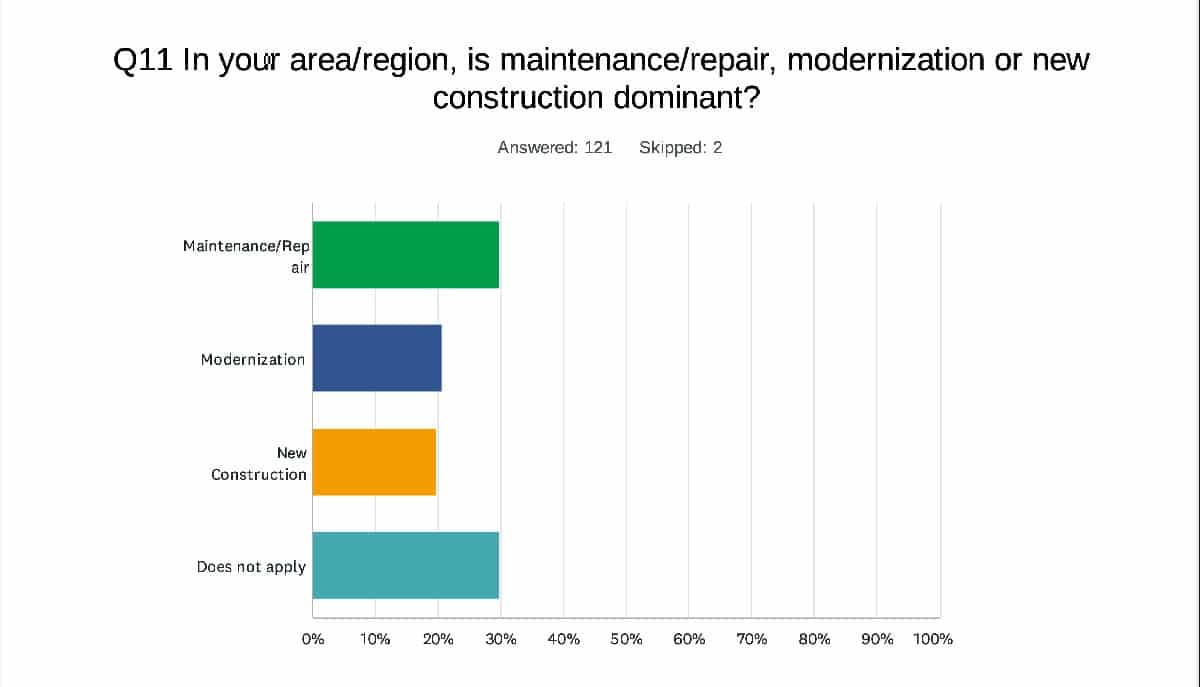

Most respondents — nearly 30% — said maintenance/repair is the primary business driver, followed by modernization and new construction, which were both at roughly 20%. One respondent observed a shift from elevator replacement to modernization among both residential and commercial properties. People in the tristate area of New York, New Jersey and Connecticut; California; and Florida all said that maintenance and repair are the main focus of their business.

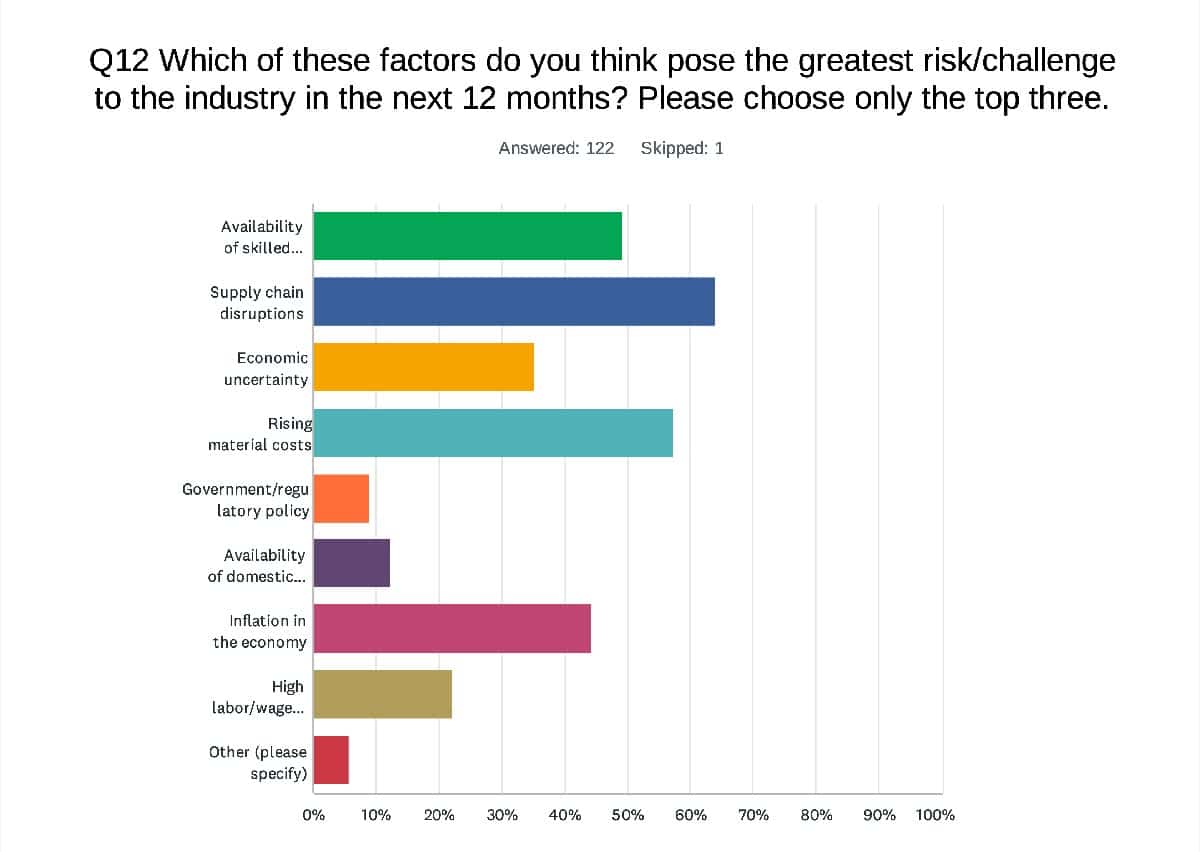

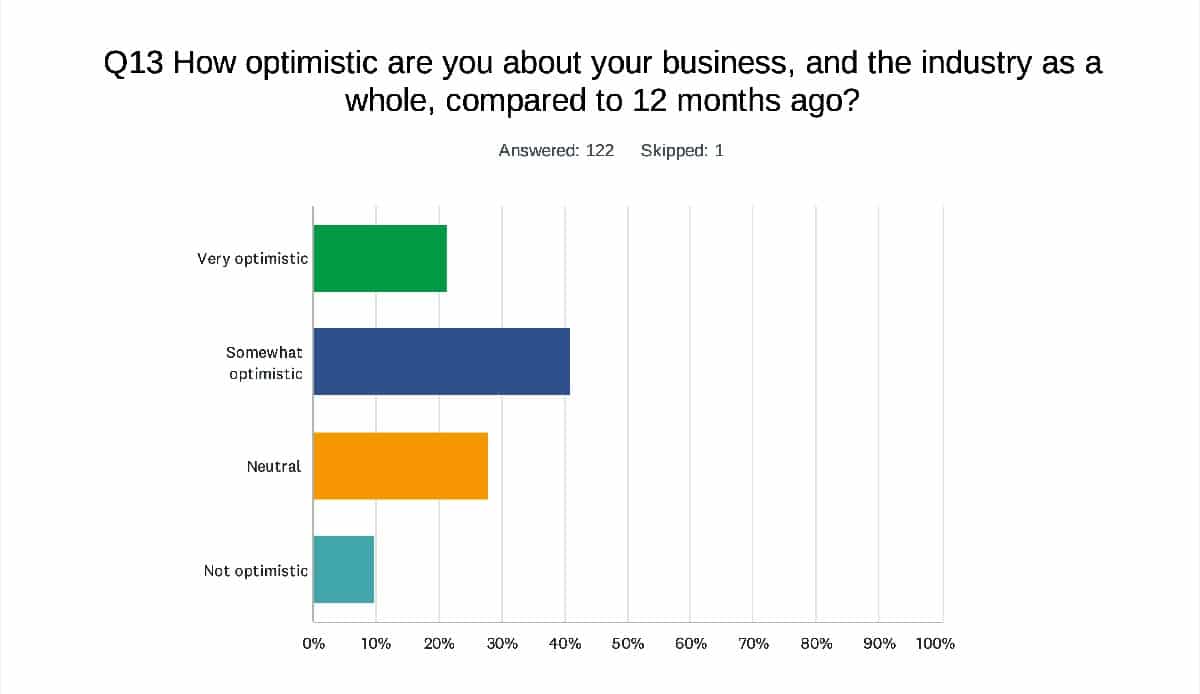

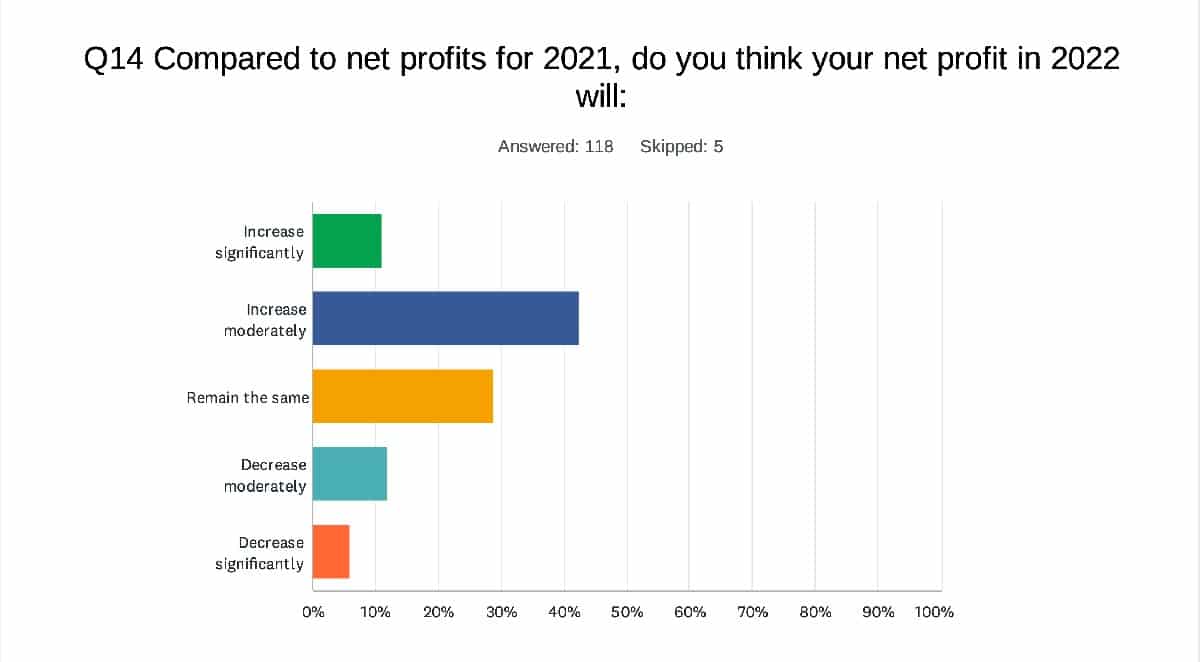

Looking ahead to the next 12 months, the top three challenges will be supply chain disruptions, rising material costs and availability of skilled labor, in that order, respondents said. Still, the majority — nearly 41% — said they are “somewhat optimistic” about both their business and the industry as a whole compared to one year ago. Some even reported a post-pandemic “bottleneck effect” that has resulted in a flurry of business. While the elevator industry is not immune to the global economy, “people still need elevators working, so there might be a slump, but it’s never as bad as other industries,” one respondent observed. Most — approximately 42% — expect their 2022 net profits will “increase moderately” compared to 2021, while nearly 39% expect them to remain about the same.

Numerous parts go into the manufacture of an elevator, so a shortage in a single area affects the entire elevator manufacturing chain.

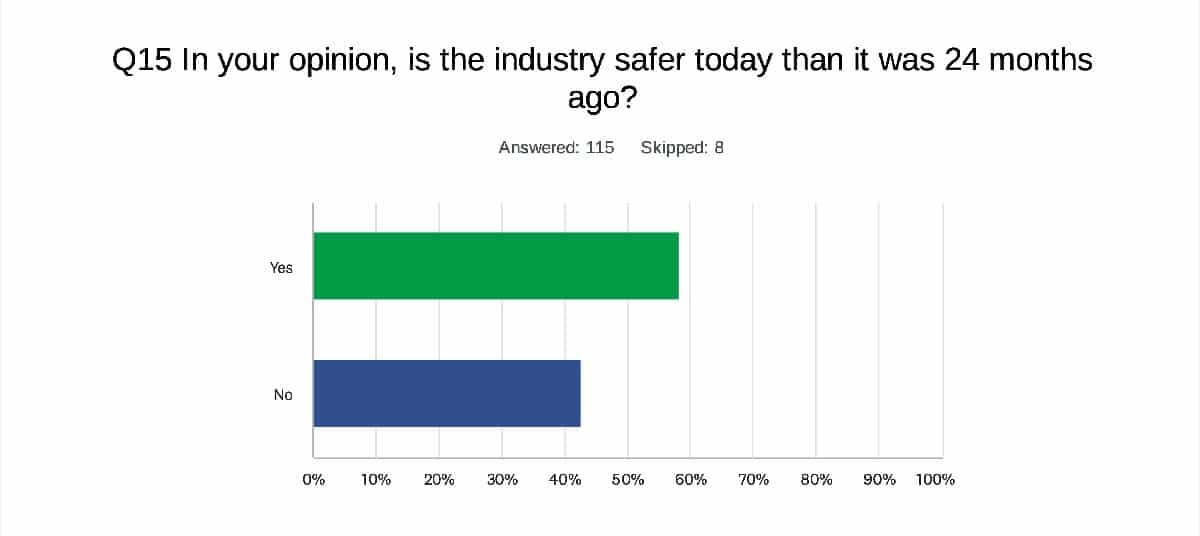

The VT industry is safer than it was two years ago, more than 58% of respondents said, citing reasons such as increased adoption of 2019 A17.1 code and new technology. Those who answered “no” — nearly 43% — listed the rise of machine-room-less systems, lack of one safety program for the entire industry and companies being unwilling to dedicate time and money to training. Lack of a skilled and knowledgeable workforce also comes into play, with one respondent observing a “noticeable uptick in fatalities and injuries among technicians.”

As for the biggest issues facing the VT industry today, three responses provided by 99 respondents tied for first:

- Excessive entry-level labor rates (to compete with government assistance programs and large corporations)

- Lack of education

- Elevator safety bureaucracy

Describing the latter as the “Bureau of Elevator Safety,” one respondent said:

“It’s almost impossible to get qualified answers and, when you do, it’s after umpteen calls/emails. Frontline agents are not trained, and there is not a way to get answers to code or safety issues to prevent incidents. Few understand what can be done, when it can be done and who to contact to find out who/what/where regarding elevator code or permissions. This often reverts to the complicated administrative, building or elevator code and taking a best guess that you got it right, unless you have an ‘elevator code guru’ in your circle of friends. This should not be the case; this service should ramped up so everyone has reliable, competent answers so elevator accidents are avoided, dealers avoid liability issues and mechanics stay out of jail.”

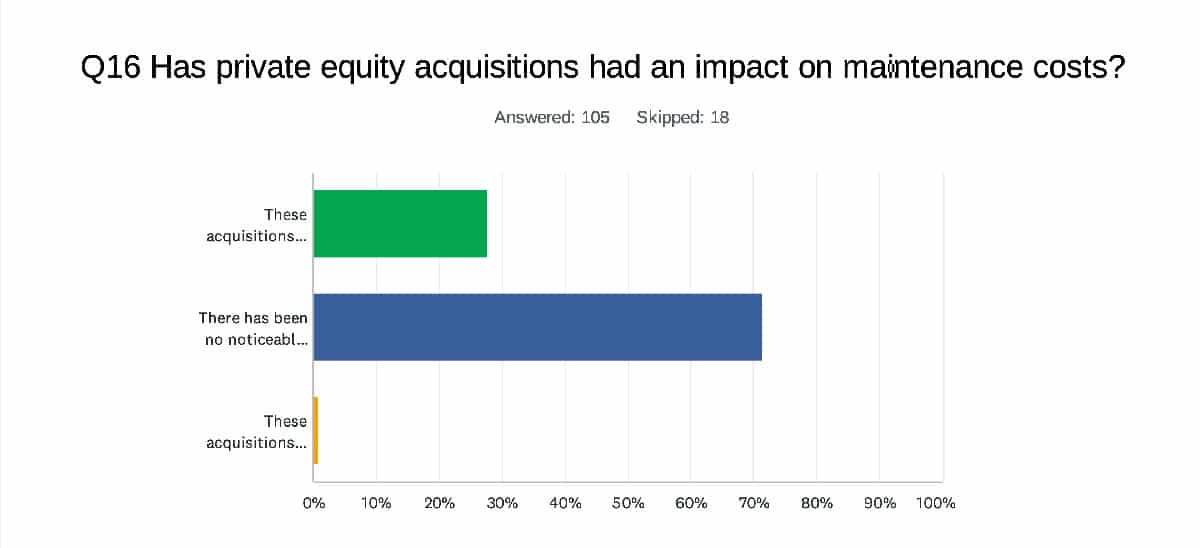

Responses to a question about whether private equity acquisitions are affecting maintenance costs were, for the most part, in the negative, with nearly 72% of respondents saying there has been no noticeable difference. However, one respondent said, given the rise in the number of acquisitions in the past few years, investors expecting profits will ultimately raise prices. Another said these price increases are already happening.

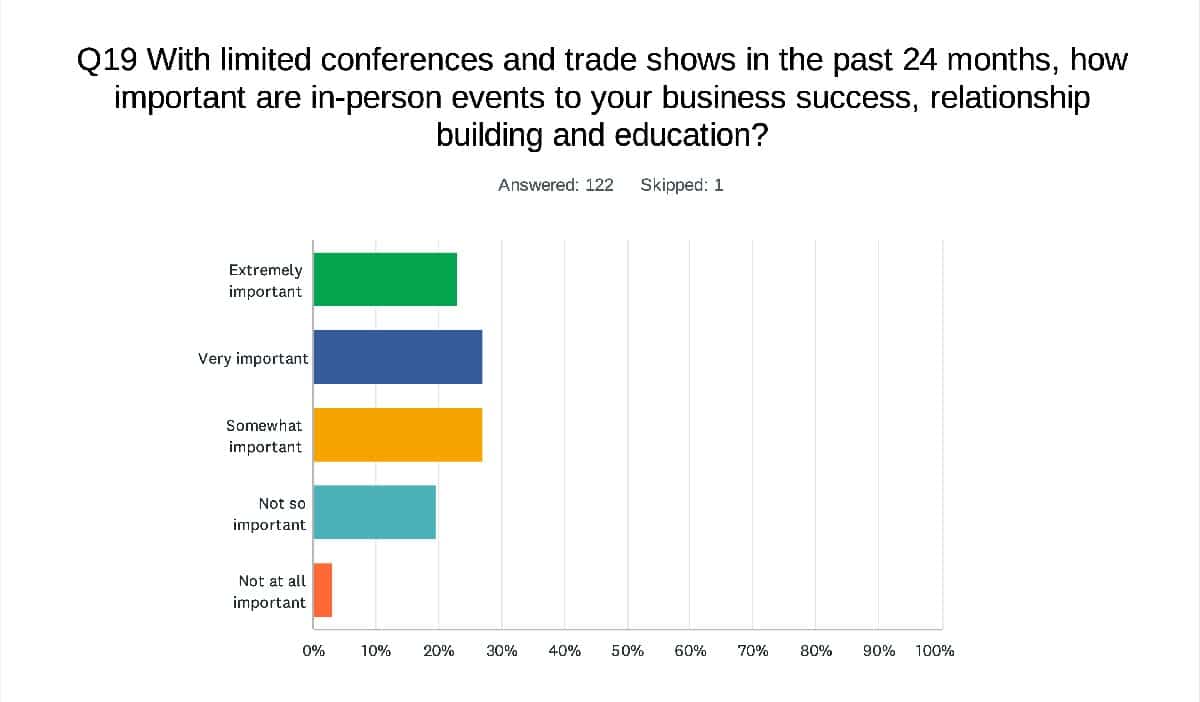

Approximately half of respondents said attending trade shows is at least “very important” for business success, with respondents observing they are a great way to keep up with the latest technology and build relationships. After a nearly two-year hiatus, one said, “It’s getting back to the normal way of doing business.”

Get more of Elevator World. Sign up for our free e-newsletter.