Powering Through

Mar 1, 2021

After a tumultuous and uncertain 2020, the Windy City’s VT industry looks to the future with hope.

Floods, riots and — as was the case all over the world — COVID-19 distinguished 2020 Chicago. With the hospitality and downtown office markets taking a beating (downtown vacancy rates pushed past 14% in the fourth quarter, and sublease availability hit a 12-year high[1]), construction and vertical-transportation (VT) companies’ work schedules continued, as much as they could, thanks to what was described to your author as dedicated, hardworking employees. René Hertsberg, co-CEO of Urban Elevator Service, LLC, said for elevator companies like his, when COVID-19 hit, “it kind of felt like the great standstill of 2020.” Illinois was largely shut down from March-May, and VT companies felt the impacts. Those who had been handling hospital VT jobs could no longer gain entry to facilities. Hertsberg observed:

“All of a sudden, everyone put the brakes on new capital work. Maintenance was still going on, because buildings were still occupied: people didn’t flee their apartments and condos, and office space was still rented (though, in most cases, sparsely populated). So, although maintenance was still happening, it was sort of like everyone was playing freeze tag. Someone shouted, ‘Freeze!’ and then no one moved.”

With the transition of the U.S. presidency and the new year, Hertsberg said, the situation is starting to “thaw.” Over the undeniably brutal spring, Urban Elevator, which serves the Chicagoland area out of its Cicero office, made it a point to ease off on capital project sales efforts, he said. “It just didn’t feel appropriate to chase people for work with the whole city hunkered down at home,” he said. From conversations with clients, the company determined at the time that those in commercial real estate were concerned about how to allocate money to “get people back into buildings once this is all over.” He said:

“Everybody was trying to figure it out. I think that’s why all these capital projects were put on hold, because property owners and managers were trying to figure out where the market’s headed and where they should be investing their money. Now, vaccines are coming out, the process of calling people back to work has started and schools that have been closed this whole time seem to be on the path to reopening. So, things are getting closer to workers being back in the office. We’re seeing folks in the commercial property business starting to revisit capital projects they had budgeted prior to the pandemic.”

One independent VT company owner told ELEVATOR WORLD she has heard anecdotally that there will be a push to get workers back into downtown offices in summer 2021.

Although maintenance was still happening, it was sort of like everyone was playing freeze tag. Someone shouted, ‘Freeze!’ and then no one moved.

— Urban Elevator Service co-CEO René Hertsberg on the pandemic’s effects

Different Specs

No one doubts the specifics of VT projects will be different from what they were pre-COVID-19. Across the board, clients are requesting features such as touchless technology and UV light disinfection, an idea Urban Elevator began exploring early in the pandemic. Technology to help “COVID-19-proof elevators” is evolving quickly. Urban Elevator sold quite a few UV-light disinfection systems over the summer and fall, and now a slew of offerings, like touchless buttons, foot controls, voice-activated buttons and ever-more-sophisticated elevator-specific UV devices are available. New products are being rolled out all the time. Prior to publication, Urban Elevator was already in the process of incorporating Vantage touchless buttons into a project.

Urban Elevator has several Chicago projects of which it is proud, including (on West Jackson Boulevard in the Loop):

- Chicago Board of Trade, a 605-ft-tall Art Deco building built in 1930 at 141 West Jackson Boulevard. Its interesting design resulted in it appearing in Hollywood movies such as Ferris Bueller’s Day Off and The Dark Knight.[2] In 2020, Urban Elevator took over service of all its VT equipment.

- The Monadnock Building, a 16-story building dating to the 1890s, adapted through the years to accommodate additional elevators. “The result,” Hertsberg said, “is a very complex VT system,” which Urban Elevator was selected to modernize. The job is underway.

In observing that both new and modernization projects will have specs that reflect the new, virus-sensitive world, OEMs echo the independents. KONE, which Senior Vice President of New Construction Aaron Ites said “had a great run in Chicago pre-COVID,” is incorporating more and more of its bells and whistles into Chicago projects. A great example, he said, is 110 North Carpenter, headquarters to one of the world’s largest corporations in the Fulton Market neighborhood on the near West Side. Formerly home to Oprah Winfrey’s Harpo Studios, the US$250-million project[3] included its VT system, prior to its grand opening in 2018. “We integrated KONE Access™ and KONE turnstiles into the project,” Ites said. Although installed pre-pandemic, such technology promotes a smart, touchless experience and lays the groundwork for health and well-being as people return to offices, he said.

There seems to be a nice push from [Chicago] customers to incorporate the latest in smart-building technology, and they are thinking more toward what’s going to be the big thing three or four years down the road, versus what’s available now.

— Aaron Ites, KONE senior vice president of new construction

Technology, he added, is something Chicago has been hip to for quite some time. Ites observed:

“Chicago has proven to be a tech-forward kind of partner for us. There seems to be a nice push from customers to incorporate the latest in smart-building technology, and they are thinking more toward what’s going to be the big thing three or four years down the road, versus what’s available now. They are kind of wired that way.”

Julie Brandt, Otis regional vice president for the western U.S, said the company has seen increased interest in health-related products such as cab air purifiers, the eCallTM app for CompassPlusTM destination dispatch, touchless security options, antimicrobial escalator handrails and the Otis ONETM Internet of Things predictive-maintenance offering. It is piloting touchless technologies such as voice- and gesture-controlled elevators. She observed that Otis commissioned a study on elevator airflow and what it means for the relative risk of COVID-19 transmission (p. 36).

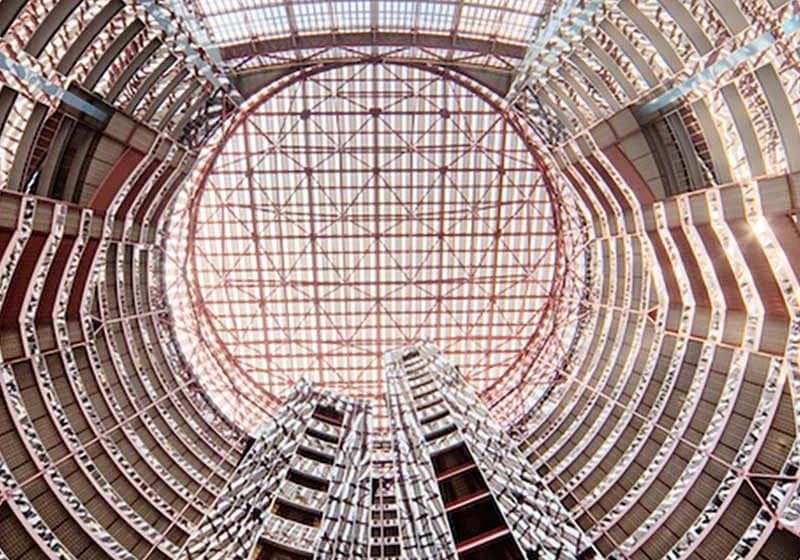

Meanwhile, work continues on projects that began pre-pandemic, and that includes their VT systems. Salesforce Tower, the 58-story third and final phase of the Wolf Point megadevelopment, will have 26 Otis SkyRise® and six Gen2® elevators connected by CompassPlus and the EMS PanoramaTM 2.0 elevator management system, Brandt said. Otis also provided the VT systems for the previous two Wolf Point towers.

Brandt also updated EW on the VT modernization underway at Willis Tower, one of the largest modernizations in the company’s history (EW, July 2018). Brandt said:

“It will cover 83 units serving the tower, plus a complete tearout and rebuild of the two cars that bring visitors to [Skydeck Chicago]. We installed our CompassPlus destination-dispatch system in advance of the modernization to better support passengers during the project, and in the second quarter of this year, we will install our eCall smartphone app for passengers to call elevators and log destinations from their cell phones.”

The Chicago market, she said, has “embraced” CompassPlus. Towers in the Loop that have adapted the technology include:

- The 60-story Franklin Center, completed in 1989 for AT&T and later modernized

- The 37-story building at 131 South Dearborn, also in the Loop, completed in 2003 and renovated in 2018

- The 51-story 111 South Wacker Drive, completed in 2005 and later modernized

- 161 North Clark, also known as the Grant Thornton Tower, a 51-story tower completed in 1992 that underwent a complete elevator renovation in 2019

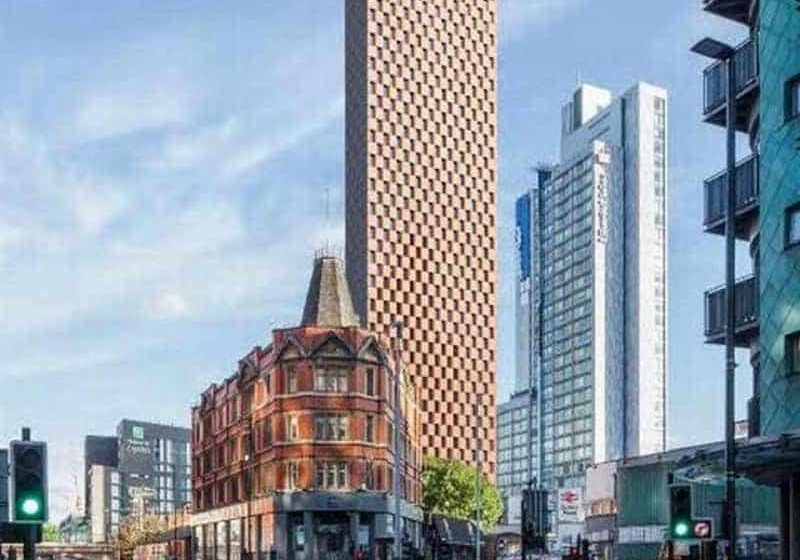

In addition to 110 North Carpenter, KONE has smart building technology in two other major high-rise projects in the Loop’s Riverside development: the just-finished, 55-story 110 North Wacker (also known as the Bank of America Tower) and the 50-story 320 South Canal Street, currently in progress. KONE is involved in offbeat projects, too, such as the renovation of Chicago’s historic Marshall Fields department store (and current Macy’s department store) to include a new entry, smart lobby and premier office space on upper floors, which Ites described as “a really interesting case study in repurposing retail space.”

Craig Zomchek, managing partner at Colley Elevator Co., said his company has seen an increase in adaptive reuse of Chicago buildings such as Macy’s. Elevators serving offices in the old department store will be outfitted with all the latest technology, including touchless. “There is a lot of capital floating around,” Zomchek observed. “We are seeing a lot more requests for technology in elevators, but, for the most part, our customers want a ‘vanilla’ experience, which means that service is first rate, reliable and on time, but nothing out of the ordinary.”

That said, Colley has landed a few unusual Chicago jobs recently. It had been servicing the elevator in the administration building at the Lincoln Park Zoo for a quarter century when further opportunity presented itself. Zomchek elaborated:

“About five years ago, we had the opportunity to take over maintenance on their entire portfolio. The zoo built a building and had an OEM install an elevator two years ago. When the zoo was starting to plan its Lion House renovation, they allowed us to bid the new construction. What we offered the general contractor was a very easy installation months before they anticipated the project being complete. Our longtime customer gave us a shot, and we were able to produce for them. Credit doesn’t go to one person; it goes to the 17-20 people who have worked with the account over the past 25 years and on this project. That allowed us to be successful.”

Another interesting project Zomchek said came to fruition thanks to teamwork was the limited-use/limited application (LU/LA) lift at a new Chick-fil-A location in a historic building on Michigan Avenue. Colley typically doesn’t install LU/LA lifts, but it was driven to tackle this particular challenge. Zomchek said:

“We knew working with a very large design team and many trades on a nontraditional installation was going to be tough. Then, COVID came in the middle of installation in an 80-plus-year-old building. Our onsite team did a wonderful job working with the steel, glass and laborer teams to coordinate the job, which involved removing the machine room and installing the lift in an all-glass hoistway.”

Essentially, there was like US$30 million of bidding opportunities that never came out.

— Mid-American Elevator Vice President Cullen Baily on NYC transit projects

Elevator lobby at 110 North Carpenter; image courtesy of Studio O+A

Otis is rebuilding two elevators that bring visitors to Skydeck Chicago as part of the VT modernization at Willis Tower, one of the largest such jobs in Otis’ history that encompasses 83 units; photo by Ranvestel Photography for Choose Chicago.

Elevator bank at the former Macy’s department store, which is being transformed into offices; image by Lamar Johnson Collaborative for Clayco

Escalators serving the offices in the former Macy’s; image by Lamar Johnson Collaborative for Clayco

Some Contracts Evaporate

Depending on their specialties, Chicago industry players have been affected to varying degrees by the pandemic. Mid-American Elevator Co., which specializes in what Vice President Cullen Bailey describes as the “ultra-weird stuff” like car elevators at the Porsche Design Tower and explosion-proof elevators for Kennedy Space Center launch pads in Florida, experienced a precipitous falloff in transit work. In a typical year, transit work accounts for roughly half of business, and Mid-American does a lot of work for NYC’s Metropolitan Transportation Authority. Prior to the pandemic, Bailey said:

“I was bidding an average of US$4 million to US$5 million a month for NYC transit, which is one of our best customers. Then, there was not a single NYC transit bid from March through September. Essentially, there was like US$30 million of bidding opportunities that never came out. NYC transit has a pretty detailed procedure for getting through the whole bidding process. We got all the way through it and expected a notice of award in early March. Then, COVID and all the shutdowns happened, and we didn’t get the notice until the week before Christmas.”

Mid-American, which has a rack-and-pinion construction hoist partner company, USA Hoist, is powering through, thanks in part to Chicago maintenance contracts with all the local Veterans Administration hospitals and the Chicago Housing Authority.

Colley’s maintenance portfolio, meanwhile, mainly consists of residential buildings outside of downtown, which Zomchek said didn’t see the vacancies that downtown office buildings did. “Our construction partners have said they are busy, we are busy, and new maintenance and service requests have been very steady,” Zomchek said, although he agreed there is a “rather intense” economic retraction going on in the downtown core. In January, halls in the 1,136-ft-tall office tower Aon Center looked more like those of the hotel in The Shining, with only about 300 workers, or 5% of its pre-coronavirus average, working onsite.[4]

Bailey said Mid-American plans to move to the suburbs from its current location in East Village, primarily because of a “better tax situation.” The company will retain a downtown location for its service and maintenance departments.

Credit doesn’t go to one person; it goes to the 17-20 people who have worked with the account over the past 25 years and on this project.

— Colley Elevator Managing Partner Craig Zomchek on the Lincoln Zoo Lion House elevator project

The trend was suburbs to downtown a few years ago, but that may flip-flop in the post-COVID-19 era. KONE’s Ites said:

“Maybe if there’s a bit of a bright spot, it’s seeing some movement of people outside of the city center to get out where there’s a little more space. Maybe that will spur a bit of development. I think we can safely say the big, tall residential-type stuff in the city centers is going to be down for a bit. If people are working from home only part of the time, the idea of a commute becomes more appealing. People will say, ‘I can live 45 mins away and commute to the office two days a week.’”

At Aon Center, the pandemic delayed construction of a 1,000-ft glass exterior elevator — the tallest such elevator in North America — from fall 2020 to the second quarter of this year, with a targeted opening in 2023.[5] In anticipation of tenants’ desire for more outdoor space, property owner 601W Cos. is also undertaking a US$6.5-million revamp of its underutilized, half-acre plaza.[6]

Having Faith

Positive trends underway prior to the pandemic are likely to pick back up once it’s over. Otis’ Brandt points to the Fulton Market area in downtown’s West Loop as an up-and-comer. “We’re seeing developments in all segments: commercial office, residential and hospitality,” she said. In a vote of confidence that they have faith in the emerging neighborhood over the long haul, Pittsburgh investor Normandy Properties bought the McDonald’s property for US$412 million in October 2020. Although shy of the estimated US$450-million expected price tag, the transaction “easily shattered the record for the highest-priced property sale in the Fulton Market neighborhood.”[7]

Normandy isn’t the only one with long-term faith in Fulton Market. In November 2020, developer Marc Realty Capital filed plans for a 14-story hotel at 311 North Sangamon Street — its second such project in the trendy neighborhood.[4] This occurred at the same time many developers were vastly downsizing the hotel components of projects or scrapping them altogether.

Chicago’s VT industry players remember the 2008-2010 recession. They also remember the good times, such as 2016, when your author visited and they reported more than enough work to go around. While it’s certainly not 2016 anymore, it’s not the end of the world, either, Bailey said:

“I think business will come back. 2021 is definitely going to be down compared to 2020, but it may very well be that, in 2022, we’ll be right back at it, and everyone will be busy. That depends on a lot of actors, including what goes on in Washington, D.C.”

References

[1] Friedman, Alexi. “Chicago’s Q4 Office Report Was Grim Tally,” The Real Deal, January 5, 2021.

[2] wikipedia.org/wiki/Chicago_Board_of_Trade_Building

[3] Bomkamp, Samantha. “McDonald’s officially opens HQ in Chicago; site formerly housed Oprah studios,” Herald&Review, June 5, 2018.

[4] “Iconic Chicago Building Getting Massive Plaza Renovation,” the Council on Tall Buildings and Urban Habitat, via the Chicago Tribune, January 21, 2021.

[5] Associated Press. “Construction halted for Aon Center observatory in Chicago due to pandemic,” USA Today, June 29, 2020.

[6] Koziarz, Jay. “Sterling Bay Sells McDonald’s HQ in Fulton Market for Record-Shattering $412 million,” Block Club Chicago, October 29, 2020.

[7] TRD Staff. “Marc Realty Plans Another Big Hotel in Fulton Market,” The Real Deal, November 23, 2020.

Get more of Elevator World. Sign up for our free e-newsletter.