The results of EW’s recent industry survey are revealed.

In June, Elevator World, Inc., conducted a 21-question survey to assess the state of the industry a year-and-a-half into the coronavirus pandemic. We sent the survey via email and posted it on our social media pages. Your responses showed us how industry leaders see the vertical-transportation (VT) industry in the immediate past and present and looking to the future.

Not surprisingly, the majority of the questions were directly related to issues caused by the pandemic including “Has your business been affected?”, “Are your employees working from home?” and “What restrictions are you still facing?” A clear key issue is the pandemic’s impact on the cost of materials, the delay in receiving these materials and how this is impacting VT business daily. We touched on the age of those leading, as well as entering, the industry and the impact of technology. We also asked you to look beyond your own business to the larger state of the industry: “Is it seeing an upturn or downturn?”, “Is it safer?”, “Is private equity investment good for it?” and so on.

“As the international publisher for the industry, this survey helps us to communicate/report trends in the industry,” said T. Bruce MacKinnon, president and CEO of Elevator World.

We hope you find value in it for your business and future decisions. Thanks to all of you who took the time and responded to this survey. Here are the results, along with some respondent comments that provide additional insight.

Survey Results

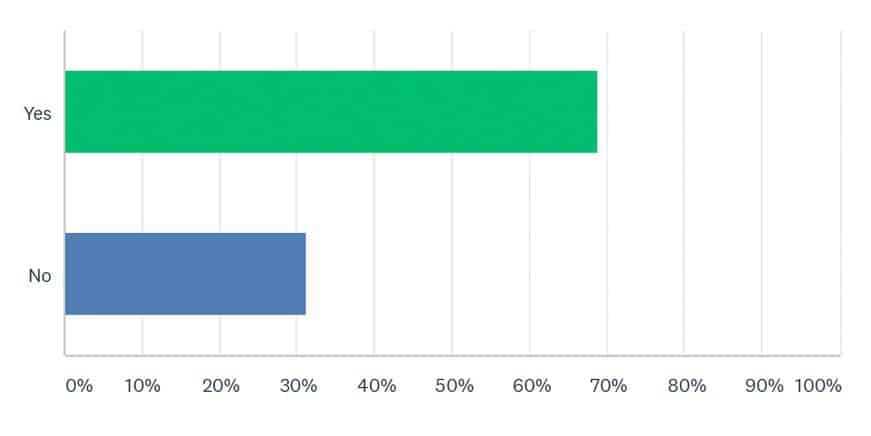

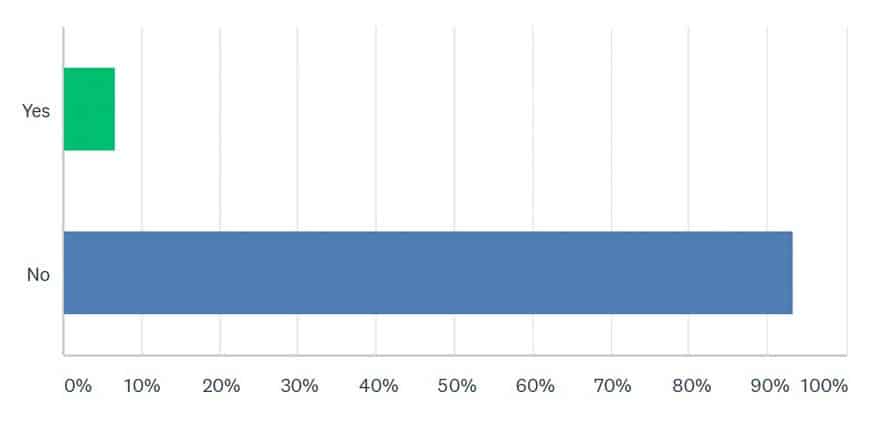

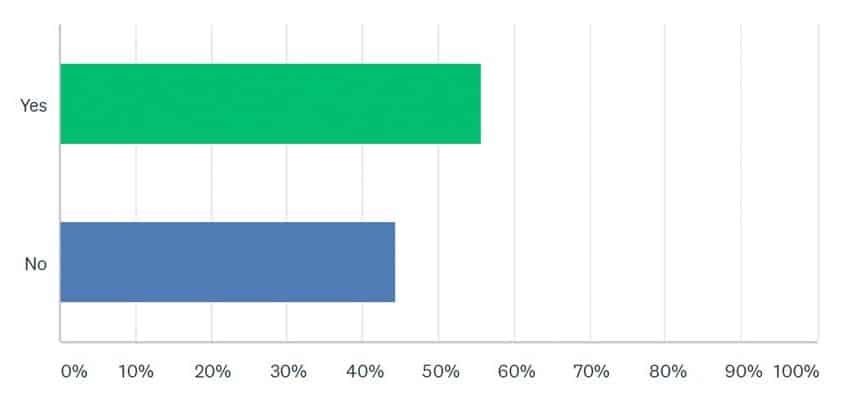

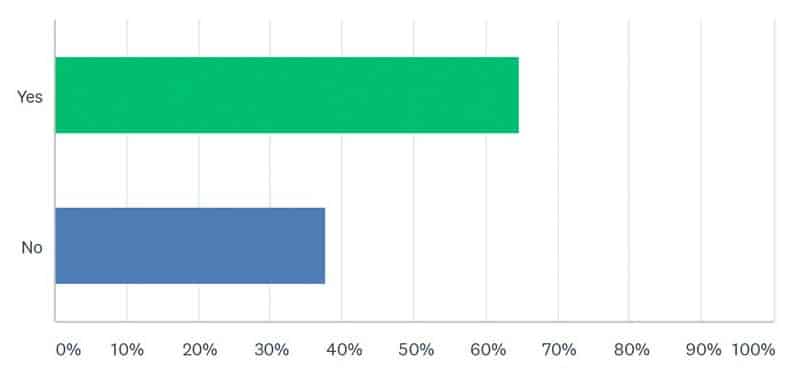

Q1: Has the pandemic affected your business?

“We are maintaining elevators in empty buildings. Parts that used to be readily available now take days or weeks to acquire. Circuit boards sent in for repair sit in storage for a minimum of two weeks prior to repair. Overtime calls are almost nonexistent since the pandemic.”

“We were busy during the whole pandemic.”

“Schools are a large portion of our business. We did not expect schools in all 50 states to ever close simultaneously for an entire year.”

“We have many contracts with small churches, businesses and local governments. The shutdowns affected our ability to gain entry, service and test elevators to comply with state law.”

“2020 was our best year ever.”

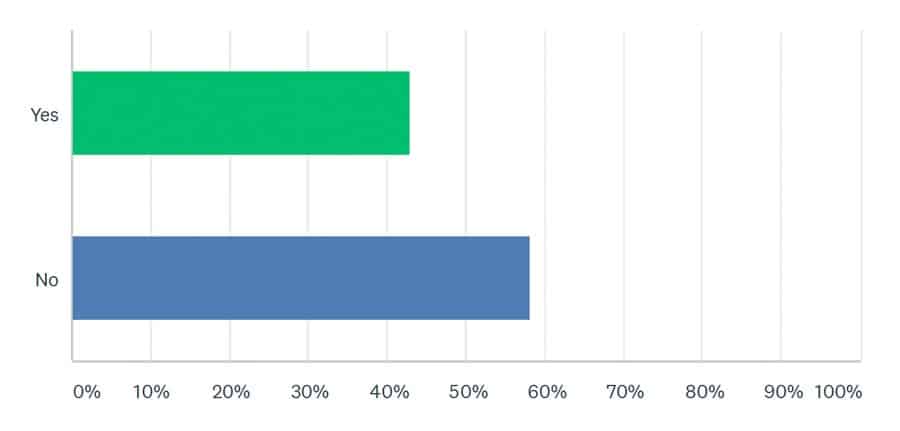

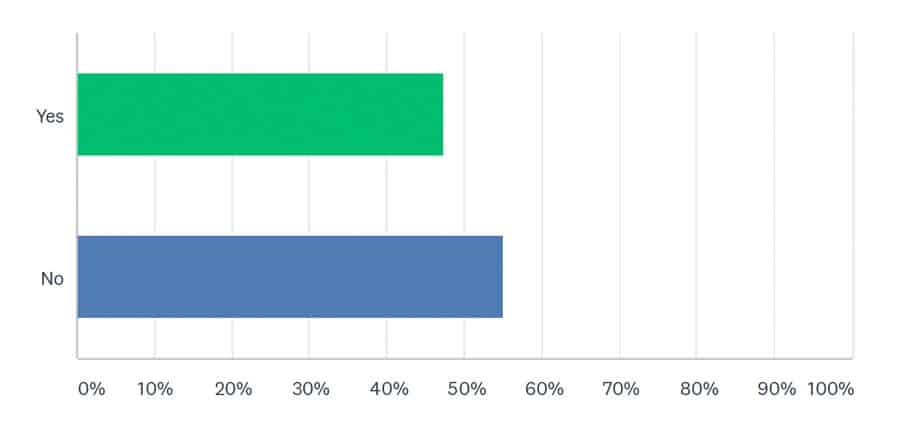

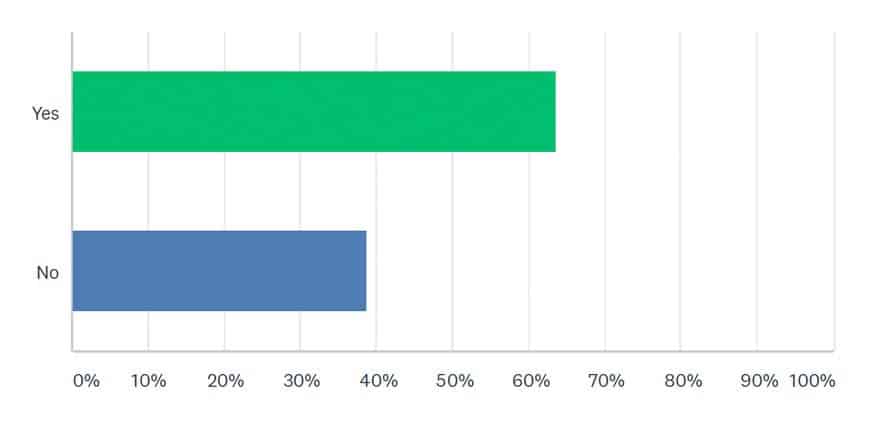

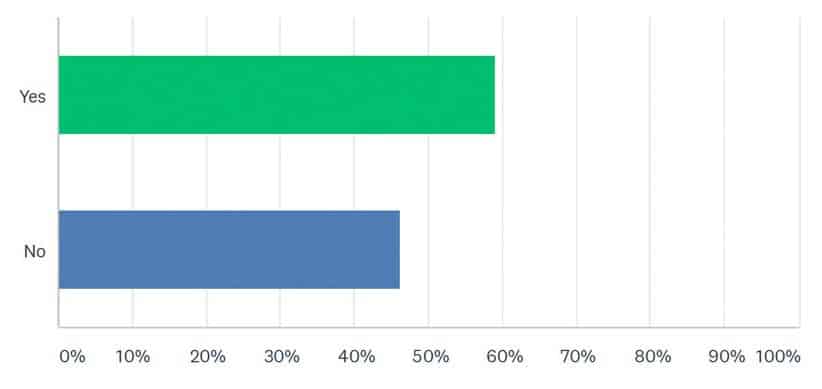

Q2: Are there still restrictions in place due to COVID-19 that are affecting your business?

“We service many nursing and assisted-living homes. They have relaxed a little but are still very conscious of the COVID-19 threat.”

“Although state restrictions have eased, vendors and clients have their own policies, which have affected timelines/scheduling.”

“Any significant change in foot traffic or site access can impact our scheduling. Social distancing and PPE requirements can be awkward or difficult in smaller spaces. Yet we will always comply and do whatever is needed to ensure the safety of our inspectors, as well as the public. Safety is ultimately why we’re there.”

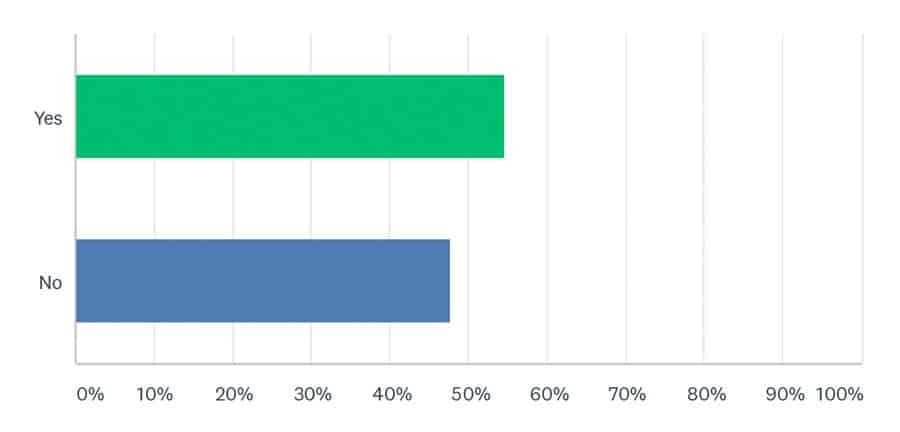

Q3: Are company employees working from home and, if so, when do you expect them to return to an office?

“We have several office staff that are either 100% or partially remote.”

“Many could remain largely home-based since we have staff across the country now versus all in one location.”

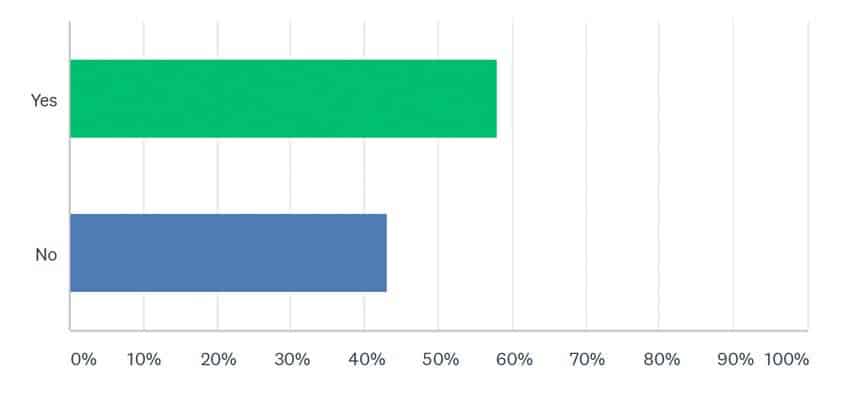

Q4: Has your company downsized or eliminated its office space?

“We are contemplating eliminating the office space.”

“We have expanded our workforce by 125%.”

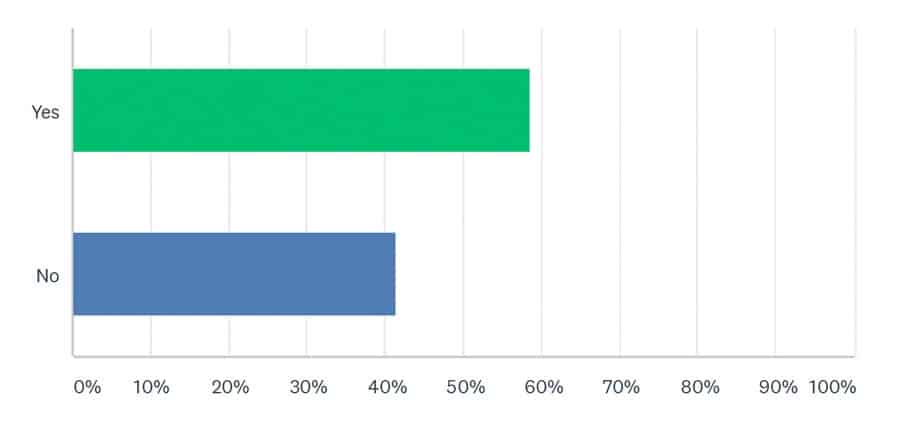

Q5: Do you currently have any challenges with hiring employees?

“It does not have to do with the pandemic, but there’s a shortage of qualified, licensed talent in the industry.”

“It is hard to find employees with necessary skills (C&C, welding, etc.)”

Q6: Does the industry reflect the diversity of the country?

“Pretty obvious — very male, overly white at all levels. In leadership, people of color are even less represented.”

“It never has but is moving in the right direction.”

“Yes, but not to the degree possible.”

Q7: What is the average age of your staff?

Your answers ranged from 27 to 60s.

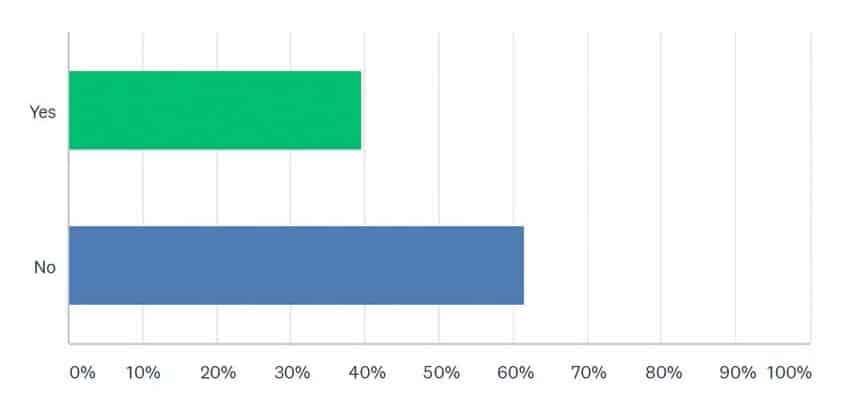

Q8: Do you see the industry attracting a younger generation?

“The educational system put in place by the union requires an intense level of study that most older prospects would shy away from.”

“This industry has always been a secret industry. Only now, it’s starting to become known.”

“If we continue to participate in college programs, as I do, to enlighten recent grads on the opportunities in engineering, financial and electro-mechanical aptitude programs at elevator companies of all sizes.”

“The younger generation is a big hope for the industry, and they are very interested in bringing/implementing innovative methods in operations.”

Q9: Has the increased cost of materials or equipment affected your ability to be competitive?

“Yes. We have seen some costs increase by 260%.”

“Prices are going up everywhere. There are other competitors that are skimming on certain things to bring price down. We will not.”

“Customers that were on the cusp of executing modernization agreements are now balking at moving ahead given a sharp metals index increase. However, we continue to keep them … well-informed of these increases as time moves on.”

Q10: Have you had to increase your prices because of escalating material/equipment costs?

“Cost increases of new door panels are being shared with customers on several new installation projects. We now include clauses in our modernization contracts that reflect metals index increases shall directly affect the overall cost of material should we not have progress payments received ‘on time.’”

“The sudden and steep increase in cost cannot be absorbed by the company. If we did, we would not survive.”

“We have increased our rates and prices at the same rate we have in previous years.”

“We have had to adjust material prices every couple of weeks to reflect market costs.”

Q11: Regarding the availability of materials or equipment, are there any particular shortages?

“Yes, yes, yes and yes. Mostly because much of the nonproprietary equipment has been purchased by a single holding company and not due to the pandemic.”

“Lead times are very stretched out leading to short-term shortages. What used to take one month now takes three.”

“We find that our shipments are delayed as our suppliers are waiting for parts from their suppliers. In particular, we find that our suppliers are waiting upon parts that are outsourced from China.”

Q12: Regarding logistics, are there delays in getting materials or equipment?

“Logistics are working very well, and they can deliver at any time, but factories are closed so it won’t happen.”

“Special materials for projects are taking longer.”

“Limited vessels, high costs of transport plus microchip delays are hurting delivery.”

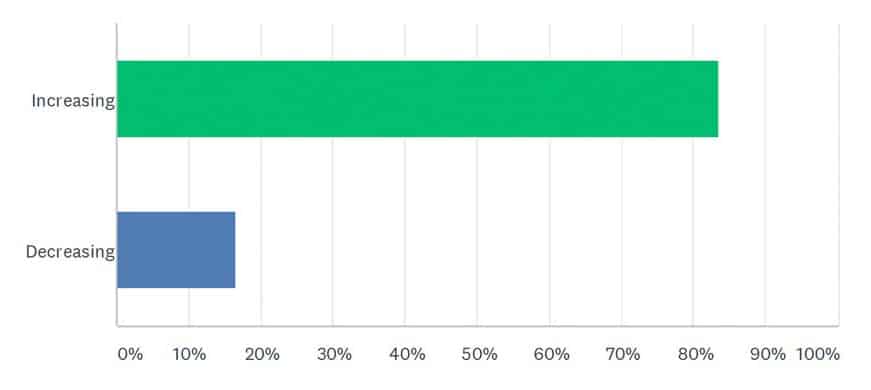

Q13: Is there currently an increase or decrease in demand for your product or service?

“Being a smaller company and having a much cheaper rate, we have increased our customer base under the pandemic. Customers are paying much closer attention to the price and service they receive.”

“Being that tenants are returning to office spaces, clients are looking to continue and restart projects.”

“In spite of timing of the market fluctuations, it remains the same in commercial projects. At the outset of the pandemic, new sales plummeted. While there have been sporadic, intermittent increases, it has not been a steady increase, nor has it yet returned to pre-pandemic volumes.”

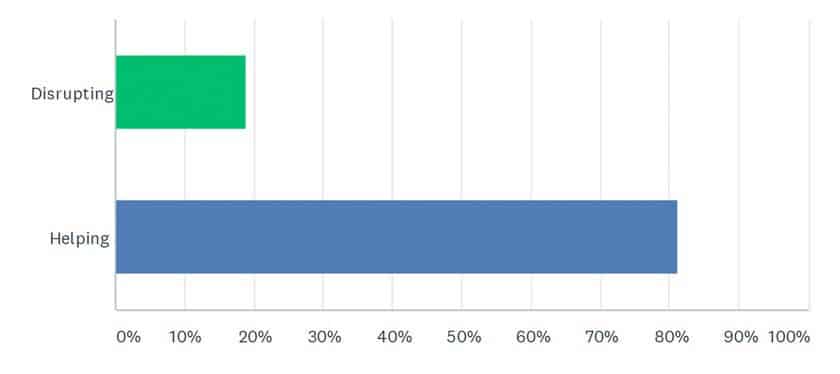

Q14: Is technology disrupting or helping your business?

“This lockdown, we have made our own cloud servers and servers in our office with backup of electricity and internet so that most of our staff can work back home, accessing the resources inside our office.”

“Technology has always helped to track hours, digital tickets and attend online meetings. However, technology has also kept the working class from returning to office buildings, which is affecting our trade.”

“New technologies make for better construction techniques and designs.”

Q15: In which direction do you feel the industry is moving: is it on an upturn or a downturn?

“After lockdown, there will be a big boom in our industry as far as I can see as customers are waiting and their money is ready with them.”

“It seems investment firms are realizing the margins in the VT industry are attractive. Dollars are being poured into the industry with consolidations and so-called ‘partnerships’ that will eventually create a balloon effect. That balloon will eventually pop, and the industry won’t have the resources to meet the demand, similar to the recession of 2009. Upturn for now, but downward in the next three to four years.”

“There will be fewer office buildings built and less business travel leading to fewer new hotels. Public transportation infrastructure will provide some opportunities.”

Q16: Do you see more work or product being sold for maintenance, modernization or new construction? Is this a shift from before the pandemic?

“Big buildings will see vacancies, which will affect new construction volume and existing maintenance pricing (light service discounts).”

“Our customers like what we have been doing for the last three years, and we keep getting better. We had good sales throughout the pandemic.”

“We have maintained approximately the same balance of all three phases of work, (maintenance, modernization and new construction) requests during this time frame.”

“We started selling more products for modernization during the pandemic, but the period is too short to have good statistics. Coming years will show us the real trend.”

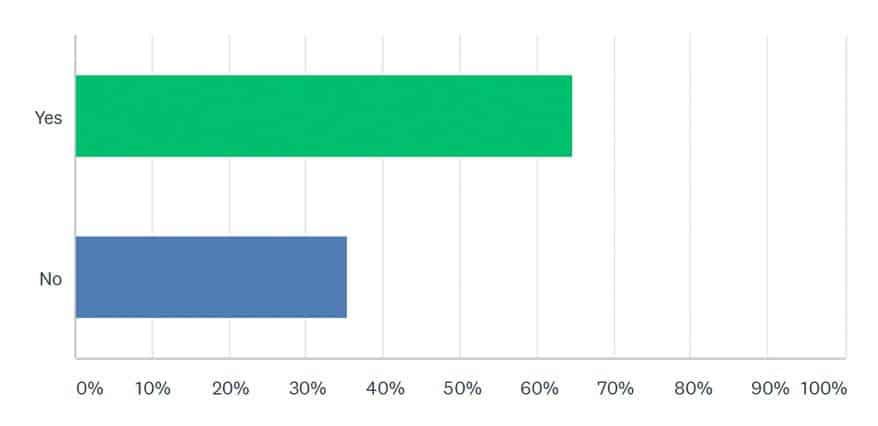

Q17: In your opinion, is the industry safer today than it was 24 months ago?

“With every passing day, the industry is becoming safer with more and more countries paying more attention or becoming aware of safety and applying required norms.”

“No, price increases have allowed our competition to offer inferior products to maintain margins. We won’t.”

“Safety is always a major concern, and we strive to improve with increased education and building a safer product.”

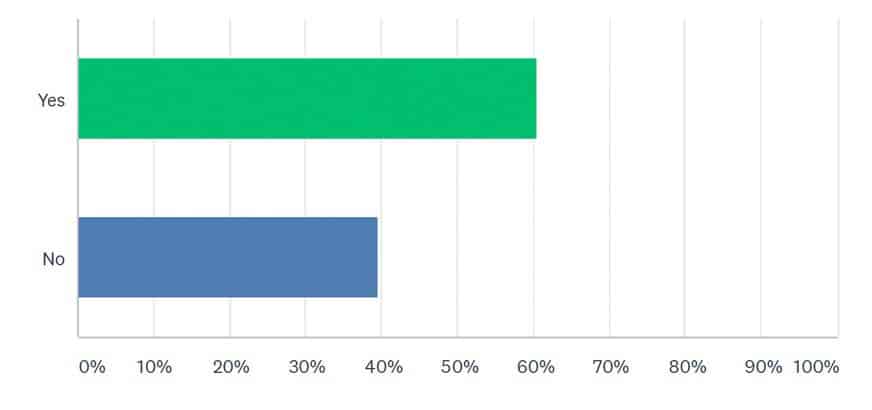

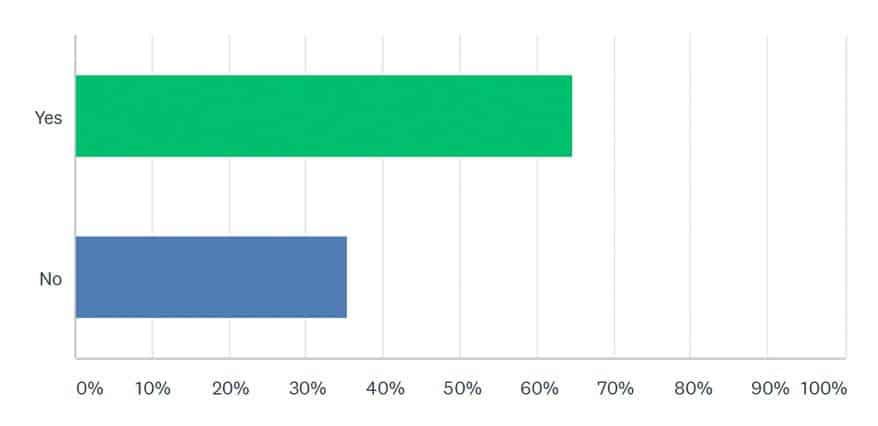

Q18: Is private equity investment good for the industry?

“An investment firm’s goal is to increase capital for the stockholders and investors. When the industry dips as it always does, firms will begin to cut acquisitions not performing well, and resources will not be available for those once independent elevator contractors. I can appreciate the volume of dollars being poured into our industry, but it is a slippery slope.”

“Too early to tell. If it’s just about squeezing out cash flow — leading to declines in maintenance, product life and safety — then no. But the publicly held OEMS were already doing this, so maybe private equity held companies will force the global OEMs to provide better service and product.”

“Not sure yet. Before I comment on this, I want to see how some of these companies do with a financial company basically running them and not an elevator industry experienced ownership.”

“We think it cuts both ways. Being a nepotistic industry means an overly insular brain trust. New blood demanding change could be very good. The downside could be that people who have no flipping idea what an elevator really is could drive change away from safety first to profitability first. Time will tell.”

“Yes, only because I have spoken to owners who have sold to them, and they were happy with the deals. It also provides opportunities for us as larger companies just can’t provide the service we can.”

“Any investment in the industry is good.”

Q19: What is the biggest challenge your business is facing today?

“Cost of equipment and being able to compete with the majors.”

“The lead time to train staff about the industry.”

“Educating new people fast enough. But it can’t be too fast and be safe.”

“I would say the longer lead times for certain parts and the increased cost of basic materials.”

“Good maintenance. If the elevator industry were to have to follow aviation maintenance guidelines, more people would be in jail!”

Q20: How have you changed your sales approach due to the pandemic?

“We are targeting larger customers that as a smaller company we would not have before.”

“Created additional procedures to help reassure clients we are doing everything we can to protect them.”

Q21: If you could improve or change one thing about the industry what would it be?

“Better collaboration between elevator contractors and suppliers like us.”

“Having technical schools be able to train new employees. The industry lacks qualified employees.”

“Allow union members to cross over and work with non-union shops without penalizing them. Especially after they have retired.”

“Increased participation in industry events from all businesses.”

“Have a uniform code for all the states, if possible.”

Get more of Elevator World. Sign up for our free e-newsletter.