Market Updates: Germany and Austria

Oct 1, 2021

A look at each country’s economic situation and the impact on their VT sectors

The German elevator industry has weathered the COVID-19 crisis well so far but is increasingly threatened by supply bottlenecks and rising prices. Sales revenues in the German construction industry increased in April for the first time in 2021; this industry is already struggling with supply bottlenecks. The German economy is growing, although expectations — just as in the elevator industry — have fallen in recent months. Your author also provides detailed information about Austria, which has a more positive outlook than Germany.

The Economic Situation in Germany

In June, the ifo Institute reduced its economic forecast for 2021 to +3.3%, down 0.4% from March, reporting:

“With the slowdown in infection incidence and progress in vaccination against COVID-19, existing economic constraints are likely to be gradually lifted. Nothing stands in the way of an economic recovery in trade and contact-intensive service sectors by the end of 2021. In the short term, bottlenecks in the supply of intermediate products will have a dampening effect, so that the industrial boom is likely to cool somewhat in the further course. Overall, gross domestic product (GDP) is expected to grow by 3.3% in 2021 and 4.3% in 2022.”[1]

The IW Economy Traffic Light from June 2021 shows how Germany compares with the eurozone, the U.S. and China in terms of production, orders, employment, demand, investments and exports.

Austrian Economic Data/Situation

The general economic situation in Austria is reflected in the economic data compiled by the Austrian Federal Economic Chamber (Wirtschaftskammer Österreich, WKO) on its website.[2] Just under 347,000 companies in production and services generated sales revenues of around EUR800 billion (US$943.7 billion) in 2018 with just over 3 million employees. The investment volume was just under EUR42 billion (US$49.6 billion).

Under the headline “Strong Upward Revision of Growth Forecast,” WKO stated in June 2021:

“The Austrian economic research institutes and the Austrian National Bank expect a strong recovery for 2021 and 2022. The economy gained momentum in the spring due to the opening moves, but it is expected to still have shrunk by 1.1% in the first quarter of 2021 compared to the previous quarter, according to Statistik Austria. The good international framework conditions are contributing to a potential strong catch-up process in Austria. Based on current forecasts, the pre-crisis level can probably be reached at the turn of the year 2021/22.”

As changes in percent compared to the previous year, depending on the institution surveyed, real Austrian GDP growth is forecast to be between +3.4% and +4.0% in 2021, and between +4.2% and +5.0% in 2022.

Construction Industry in Germany and Austria

At the end of June, Secretary General of the German Construction Industry Association (Zentralverband Deutsches Baugewerbe ZDB) Felix Pakleppa commented on the latest data from the Federal Statistical Office on the current development of the economy in the main construction industry:

“The sales revenues trend in April shows a positive sign for the first time this year. However, after the winter onset and the coronavirus-related slowdown compared to the previous year, there is still some to catch-up on. … Companies with 20 or more employees in the main construction sector achieved sales revenues of EUR7.94 billion (US$9.37 billion) in April (+2.3%). Thus, sales revenues reached ca. EUR24.4 billion (US$28.8 billion) (-5.9%) in the year to April. Orders received in April totaled approximately EUR7.9 billion (US$9.3 billion) (+7.0%).”[3]

Pakleppa takes a differentiated view of incoming orders:

“The 7% increase in orders in April compared with April 2020 is largely attributable to the collapse in demand in the previous year in residential construction and commercial building construction following the first lockdown. Demand in residential construction subsequently stabilized again and is also proving sustainable. By April, orders here had reached a volume of EUR7.3 billion (US$8.6 billion) (+13.4%). In commercial construction, we do not yet see any comparatively dynamic development. Orders up to April reached EUR7.1 billion (US$8.4 billion). Compared to the previous year, this represents an increase of 3.3%.“[3]

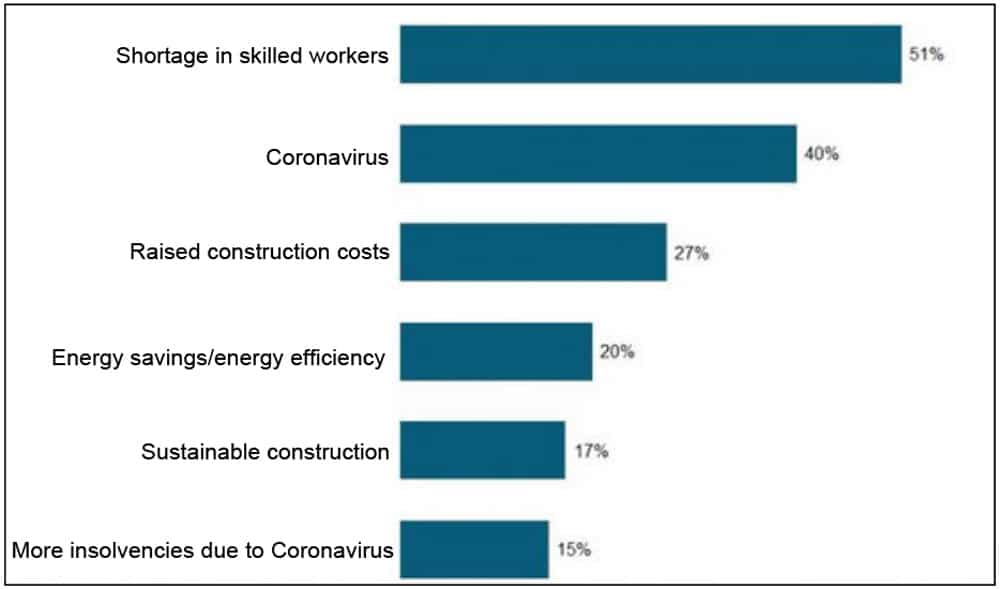

BauInfoConsult regularly identifies the defining construction trends among 600 professionals from the construction industry. Most recently, in May 2021, its industry study “Annual Analysis” looked at the shortage of skilled workers, price increases and COVID-19:

“German construction activity continues to develop positively even after more than 15 months of corona crisis. Nevertheless, industrial players are primarily observing developments and trends that are challenging their work in construction. Above all, the shortage of skilled labor is driving construction companies. Increased construction prices are also becoming increasingly noticeable. And, of course, the uncertainty factor of corona continues to overshadow future prospects.”[4]

In Austria, according to WKO statistics based on Statistik Austria updated in April 2021, the construction production values in 2020 total just under EUR40 million (US$47 million) in sold production with just over 196,000 employees.

Shortages in Materials and Price Increases Dominate the German Construction Activities — Including the Elevator Industry.

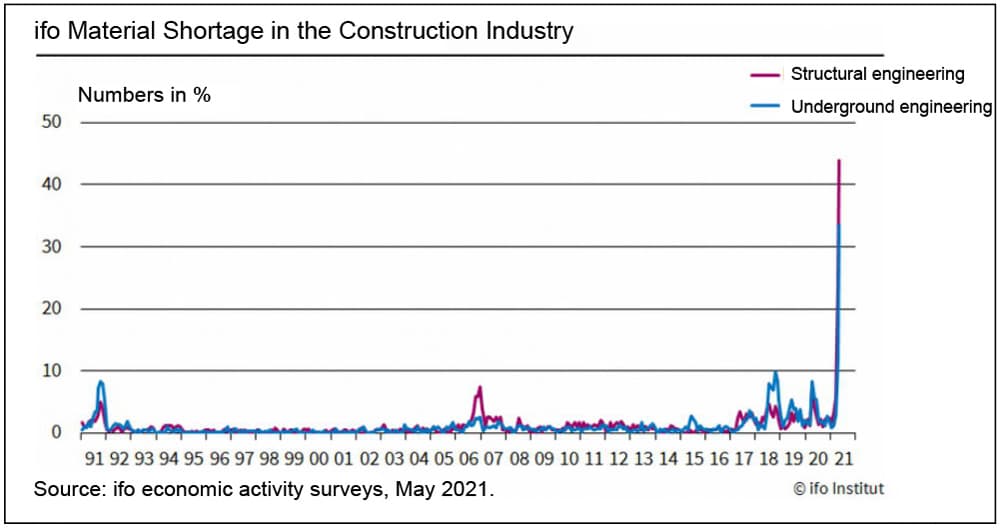

According to the ifo Institute, the shortage in materials on German construction sites worsened in June 2021: In building construction, 43.9% of companies reported in May that they were having problems procuring building materials in time.[5] This compares with 23.9% in April and only 5.6% in March.

Felix Leiss, survey expert at the ifo Institute, said:

“Rapidly rising raw material prices are causing problems for the industry. … Steel has also become considerably more expensive. … and various plastics are also in short supply, is what is being heard from the industry.”

Pakleppa agrees with this assessment:

“The continuing problems in the supply of building materials such as wood, steel and plastics represent a major challenge in this respect. … If demand and supply for globally traded building materials do not quickly return to equilibrium, however, construction site operations are in jeopardy in many cases. Projects become more difficult to calculate.”

Currently, the biggest problem of the industry — “supply bottlenecks and price increases” — is clarified for the elevator industry in the SafeLine Group’s direct mail and in an interview with its German Managing Director Michael Puttrus (See sidebar interview).

Markets and Trade Fairs for “Elevators and Escalators” in Germany are Under the Influence of COVID-19.

The elevator market in Germany — like the economy as a whole — has been dominated by the COVID-19 crisis over the last 15 months. According to the ifo Institute, the cost of the COVID-19 crisis for 2020 to 2022 amounts to EUR382 billion (US$451 billion). In the sidebar interview, Udo Niggemeier from the Federation of Medium-Sized Elevator Companies (Vereinigung mittelständischer Aufzugsunternehmen, VmA) explains the impact on the industry.

Puttrus also commented on the current COVID-19 situation for his company:

“In general, as a supplier of emergency call systems, we cannot complain about the economic situation despite COVID-19. We were not affected due to the end of the retrofit obligation. The construction of new elevators has also increased rather than decreased during this period. Except for one employee in the shipping department, everyone in Germany is still in the home office. Orders and support are running smoothly. I would describe the situation in the elevator industry as stable.”

The postponement of the interlift trade fair in Augsburg, which is held every two years, also had a signal effect. It moved from its regular date in October 2021 to spring 2022, sharing this with around 430 trade shows postponed in Germany in 2020, according to Deutscher Fachverlag (German specialist printer) (expocheck) based on Statista. Some 350 were canceled altogether and 37 changed to a virtual or hybrid format.

Puttrus also commented on the postponement of interlift:

“We had planned some new products for the interlift. The postponement of the trade show from fall 2021 to spring 2022 is convenient for us because we will then be finished with the redevelopment using the new chips due to the shortages of chips from China. Our LCD displays and THOR controls are not affected by the chip problems in China.”

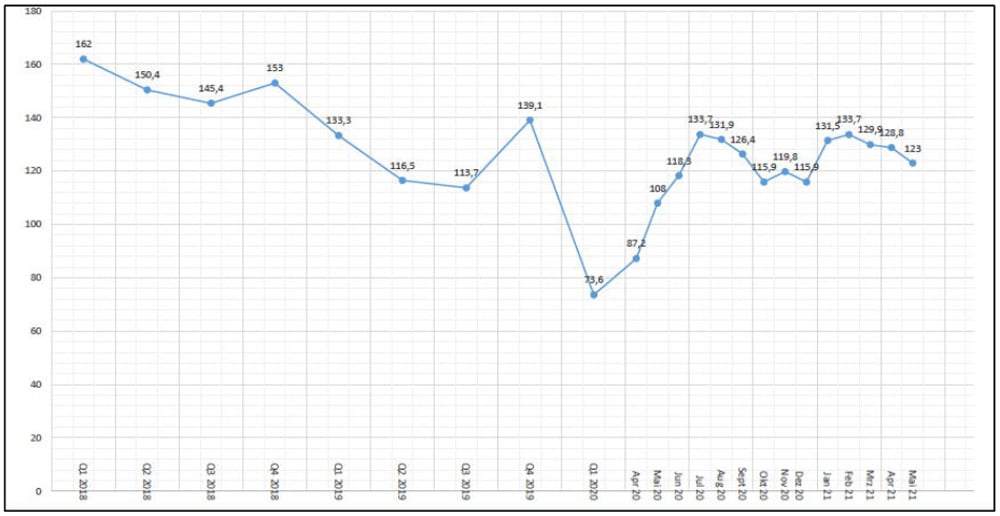

German association VDMA collects data on the business climate in the German elevator industry on a quarterly basis. The latest Lift Index was published by Ebru Gemici-Loukas, VDMA Lifts and Escalators Trade Association, in May 2021:

“The mood in the German elevator industry has darkened again in May 2021. The VDMA Lift Index fell to 123.0 points in May from 128.8 in April. This is due to both the assessment of the situation and the expectations. The current situation was assessed by the majority of the companies surveyed as only slightly worse than in the previous month. However, the outlook to the coming six months decreased even more. For the third time in a row, expectations for the coming six months show a clear downward trend.”

In contrast, the third global survey of the elevator industry by ELEVATOR WORLD, the German industry association VFA-Interlift and the trade fair organizer AFAG, together with Crédit Suisse, documents a continuing change for the better. In EW Europe March-April 2021, starting on p. 34, these results can be read in detail in the report “The Consequences of COVID-19, Prospects.”[6]

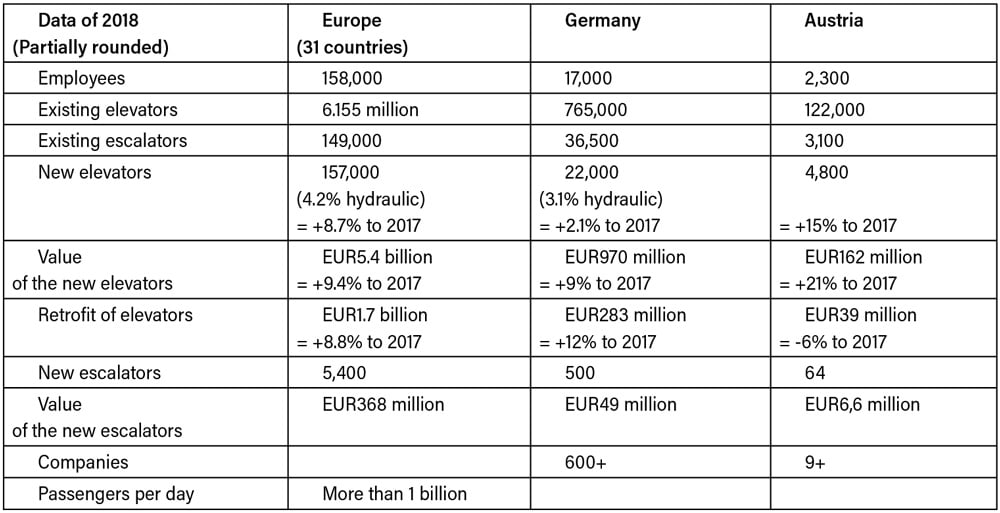

Elevator Market in Austria

Mag. Barbara Schicker of the trade association metal working industry (Fachverband Metalltechnische Industrie, FMTI) in Vienna, Austria, (www.metalltechnischeindustrie.at), in June 2021, compiled a list of nine industrial elevator manufacturers in the country. She points out, “However, there are additional suppliers who are members of the federal guild of metal workings (Bundesinnung der Metalltechnik).”

FMTI has not collected data on the elevator market for years. Elevators are also not recorded individually in the WKO statistics for Austria as a class of economic activity.

The data of the Statistical Committee of the European Lift Association (ELA) for 2018 do not yet incorporate the COVID-19 crisis, but they do serve as an orientation. They are unchanged from the 2020 report in EW Europe, as more recent data have not yet been published by ELA; Austria has been added to the table.

“Supply Bottlenecks Expected as Global Economy Picks Up Steam”

Under the above headline, Geert Maurissen, CEO of the SafeLine Group based in Tyresö, Sweden, sent out a direct mail to his customers in Europe and overseas in early June 2021. In it, he spoke “about the global shortage of electrical components and why you may need to expect longer lead times and changes to your SafeLine orders.” He continued:

“The global economy is recovering even quicker than expected and industries are catching up on the gaps that have been left behind with the ongoing health crisis.

“This backlog in combination with a booming economy is now resulting in shortages of components and delays in services at a global level. Looking at the market, we can now see shortages happening in many businesses, such as computer chips, containers, wood, plastics, palm oil, etc. The consequences are obvious, resulting in delays and prices going up. At SafeLine, we are facing the same challenges, and it is our responsibility to inform you and keep our promise to you as a customer, but with this global shortage, it is not in our hands to improve the situation on a short notice. SafeLine depends on the global supply chain, as do many others.

“Here follows the critical points we face today and that you will need to take into account:

- Longer delivery time – in some cases with unconfirmed delivery time – depending on the ordered product.

- We may limit the delivery of quantity for oversized orders.

- Prices can be reviewed monthly and will also be referenced to the actual delivery date.

- Freight costs will be adjusted to our actual cost of the freighters we use today.

- Count on two-three days extra transit time.”

In general, we also reserve the right to make any changes, even after confirmation of your orders, due to the current uncertainties.

Puttrus on SafeLine’s Direct Mail

Your author (USB) talked with Michael Puttrus (MP), managing director for SafeLine Germany, about the direct mail and its message.

USB: In this direct mail, you have externalized the biggest problem currently facing the elevator industry: “supply bottlenecks and price increases.”

MP: Unfortunately, we are in “good company” with our problem — Volkswagen has also already had to sign up for short-time work due to supply bottlenecks. We are working on solutions, above all to be able to roll back the price increases as quickly as possible, and to avoid disproportionate price increases.

USB: Would you like to speculate on the causes of the supply bottlenecks?

MP: According to my research, I see the bone of contention in the automotive industry. There, production was shut down due to COVID-19 because they feared a drop in sales. Instead, the computer chips went into video game consoles, which helped to pass the time at home. But now, despite COVID-19, more cars than expected are being bought again and are being produced accordingly. So, computer chips are being put back into these rolling computers by the millions — and the elevator industry, with its need for just some 10,000, still awaits.

USB: What exactly caused the problem in your company?

MP: Our parts are not in one of the tens of thousands of containers on the freighter that was detained in the Suez Canal in Egypt because of the average. Our chips did not even get off the ground from China. We ordered our usual quantities in May and received the order confirmation from China for delivery in 56 weeks — without any advance warning.

USB: What are the possible solutions?

MP: We will use other electronic components, so this will be only a temporary problem. For larger quantities, we are currently planning various appropriate alternatives. We need about five months for our own adaptive developments. For new developments, we have a little more time now due to the postponement of the interlift.

USB: And what comes next?

MP: Depending on demand, we see where things could get tight for a period of four weeks. By October 2021, we expect to

COVID-19 – With (Open) End?

Your author (USB) talked to Udo Niggemeier (UN), second chairman of the Federation of Medium-Sized Elevator Companies (Vereinigung mittelstaendischer Aufzugsunternehmen e.V., VmA) based in Bissendorf near Osnabrueck, Germany. His full-time job is managing the business of ASIB-Niggemeier GmbH in Weilerswist near Cologne, Germany, which is dedicated to occupational safety in elevator construction with all its facets.

USB: How has COVID-19 affected small and medium-sized enterprises (SMEs) in the elevator industry up to now?

UN: From an economic point of view, the last 12 months have been predominantly stable to pleasant, which is due to the great flexibility of SMEs. For some companies, the number of incoming orders increased at the beginning. For most SMEs, the order situation has not significantly deteriorated. Some customers have postponed new development projects; these gaps were filled quickly and completely with orders brought forward from the “waiting queue.” There have been delays in modernization projects in the area of the communities of properties, as meetings were not held or have been significantly delayed due to COVID-19.

USB: And what is the situation in existing buildings?

UN: In maintenance, there were delays at the beginning, because there was a ban on entering certain places, such as hospitals or homes for the elderly, for example — at least until the elevator stopped due to a malfunction and the building could no longer be operated regularly. Since elevators were used less overall — especially in office buildings due to mobile work — there were also fewer malfunctions than in pre-COVID-19 times.

USB: How will the situation develop in the coming months?

UN: At the moment, our members are concerned about the extreme price increase. There could also be severe supply shortages due to the congestion of goods, especially electronic components from China, which will have a much greater impact on our industry than COVID-19 has had so far.

USB: And what other effects do you expect from the COVID-19 crisis in the coming years?

UN: In new building projects, the market for residential elevators will continue to grow undisturbed. On the one hand, this is due to the rapidly and strongly aging population in Germany, which needs barrier-free housing. On the other hand, there is the unbroken request of Germans for more private ownership rather than rent, which is increasingly being met by more affordable condominiums rather than owner-occupied houses. How demand for office properties will develop is still unclear. There are initial forecasts predicting up to 25% less office space in the next 10 to 20 years due to the remaining home office portions. The need for building refurbishments stays high. My prediction: The near and more distant future of elevator construction looks also stable to pleasant.

USB: Finally, what is your current recommendation to elevator companies and component manufacturers as the most important COVID-19 mitigation measure?

UN: Companies must immediately prepare a COVID-19 risk assessment for their employees, deduce protective measures from it and implement them quickly; VmA has prepared a model risk assessment. Since April 2021, all employers are also obliged to offer their employees a free weekly COVID-19 test on site. For more up-to-date tips and contact details, visit the Federation’s website at www.vma.de.

References

1. https://www.ifo.de/prognosen/ifo-konjunkturprognose

2. www.wko.at/service/zahlen-daten-fakten/daten-oesterreich.html

3. www.zdb.de/meldungen/baukonjunktur-lieferschwierigkeiten-erschweren-weiterhin-baustellenbetrieb

4. bauinfoconsult.de/bautrends-2021-fachkraeftemangel-preisanstiege-und-immer-noch-corona/

Get more of Elevator World. Sign up for our free e-newsletter.