Elevator Insurance

Sep 1, 2025

A collision between two industries leads to cooperation.

by Dr. Lee Gray, EW Correspondent

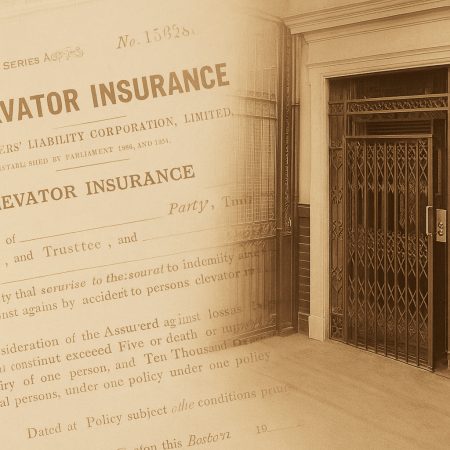

In the mid-1880s, the technological world of the vertical-transportation (VT) industry collided with the actuarial world of the insurance industry. The collision occurred as a direct result of the development of a new type of insurance that originated in the U.K. in 1880 and first appeared in the U.S. in 1886. In September 1880, the British Parliament passed the Employers’ Liability Act; in October, the Employers’ Liability Assurance Corp., Ltd. (ELAC) was established to “enable employers to protect themselves by means of insurance against the liability imposed upon them by the Employers’ Liability Act.”[1] In 1886, American companies – and British companies operating in the U.S. – “began selling liability insurance for personal injury accidents, primarily to cover business tort liability for employee accidents at work and nonemployee injuries occasioned by their business operations.”[2]

The expansion of policy coverage to include nonemployees led to the creation of a new type of liability insurance in early 1888:

“The Employers’ Liability Assurance Corp. has formulated a new branch of accident insurance known as ‘Elevator Insurance,’ for the purpose of indemnifying owners and lessees against loss by accident to persons in an elevator or elevator well. The premiums are not large and are based upon the carrying capacity of the elevator, the policy being drawn up with the usual liberality of the corporation. It limits its liability to US$5,000 in the case of an accident causing the death or injury of one person, and US$10,000 for several persons, and in no case will it be liable for more than US$10,000 under one policy. The corporation will also defend the assured in any suit for the recovery of damage.”[3]

George M. Endicott and Frank G. Macomber of Boston served as the company’s U.S. representatives and the elevator policy was drafted by John Lowell (also from Boston), who served as the company’s U.S. legal counsel. The fact that an American attorney was asked to draft the policy reflects the ELAC’s awareness of the differing legal and cultural contexts in the U.K. and the U.S. In fact, in 1896, a British insurance journal reported that, although “elevator or lift insurance is of very recent origin,” its application “pertains almost wholly to America.”[4]

The ELAC’s new offering received both positive and negative reviews. In December 1888, The Review published an enthusiastic endorsement:

“To the ELAC of London, we are indebted for that branch of insurance which protects the employer of labor from claims which may be brought against him for accidents incurred by those in his employ. Since the advent of this corporation in this country, something over two years ago, its experience has been one of marked enterprise and success … Thus, it is not strange that this progressive corporation should inaugurate a new class of ‘elevator insurance.’ … That the field for this class of insurance is an extended one, is too obvious to require demonstration. The rushing business world of the present era must have some rapid means of reaching the top of lofty structures, and that building which today is not equipped with an elevator is sadly lacking in its conveniences. ‘Accidents are bound to happen’ is a hackneyed phrase, but we realize that this is quite true in connection with elevators, as over 60 accidents of this character have been brought to our notice since last June, eighteen of which resulted fatally … rigid state laws, particularly those of Massachusetts, will hold a landlord liable for almost any accident upon his premises, and in case of suit it is well known that juries are predisposed in favor of the injured person. Landlords must realize that they need this kind of insurance, and, being a new thing, the enterprising agents throughout the country ought to be able to work it with great success.”[5]

In January 1889, The Insurance Age published a less enthusiastic response:

“It strikes us that elevator insurance would be cutting the thing rather fine. Doubtless, accidents will happen sometimes to elevators, but the actual risk must be much greater in streetcars, and if special hazards are to be covered by special policies, instead of in a policy of general accident, a man might ‘paper’ the walls of his house with policies and still not be fully insured.”[6]

This response may have been, in part, prompted by the fact that elevator insurance was only one of the numerous liability policies offered by the ELAC:

“In addition to its general accident policies, which … cover nearly every conceivable form of accident, this Corporation also issues policies indemnifying employers against liability for accidents to work people and policies indemnifying owners of buildings against loss arising from injuries caused to persons in an elevator owned by the insured. Under its accident policies are included accidents to football players, baseballists, cyclists, yachting or cricketer accidents, accident to voyagers at sea, etc.”[7]

The inclusion of elevators in the increasingly diverse range of policies offered by the ELAC (which, as is noted above, included baseballists, a common term for baseball players in the 1880s) may have contributed to critics’ willingness to downplay the importance of this new offering.

Another insurance journal that questioned the need for elevator insurance sought to do so in a somewhat humorous way when they reported: “A woman fell down an elevator shaft in El Paso. She landed on her bustle and was not hurt. Here is a hint to that elevator insurance company, the Employers’ Liability. Let insured elevators be equipped with an immense bustle.”[8] For ELEVATOR WORLD readers not familiar with 19th century women’s fashion: A bustle was a mass of fabric incorporated into a light wire frame that was placed under the rear of a dress; this feature accentuated the rear of the dress and allowed the skirt to hang more freely. Given this definition, it may seem reasonable to ask if the story printed by the insurance journal was, in fact, true. It was. On the evening of February 18, 1889, Mrs. Taylor of El Paso, Texas, fell from the second floor of the Clarendon Hotel in Memphis, Tennessee, to the bottom of the elevator shaft, a distance of approximately 20 ft. According to the Memphis Daily Appeal:

“How or why the accident should have occurred is a mystery to those in and connected with the hotel. Mrs. Taylor had been moving about the hotel all day (and) knew where the elevator was and how it worked. It was at an upper floor at the time, and one of the boys in charge heard the door on the second floor open and a moment later the fall. The place where she landed was dark, and just how she struck the floor is unknown, as she was in a sitting posture when found.”[9]

The Memphis Avalanche offered greater clarity, reporting that Mrs. Taylor “landed on her bustle and escaped with a few slight bruises and a sprained wrist.”[10] The fortunate (and unusual) outcome of this accident may have, in fact, encouraged the ELAC, and other companies, to offer elevator insurance policies.

The inclusion of elevators in the increasingly diverse range of policies offered by the ELAC (which, as is noted, included baseballists, a common term for baseball players in the 1880s) may have contributed to critics’ willingness to downplay the importance of this new offering.

In fact, in February 1889, the Fidelity and Casualty Co. of New York joined the ELAC and became the second company to offer elevator insurance in the U.S. Their success — and the public’s interest in this insurance — was recounted by The Weekly Underwriter in December 1889: “The Fidelity and Casualty Co. has issued a pamphlet on elevator insurance in which it is stated that in the first ten months of this year the company has insured 1,000 elevators and inspected 2,000, and of the latter, 600 were found to need repairs or alterations.”[11] Requiring elevator inspections as a feature of these policies, and the relationship between VT and insurance industry inspectors, had been highlighted in an article published in June 1889:

“The prosecution of this business necessitates an inspection of the elevator machinery by the insurer, and the rivalry between the inspectors employed by the insurance companies and those employed by the elevator companies has already become spirited. All of this benefits the public and makes travel in the average passenger elevator safer.”[12] Otis had launched an inspection and maintenance service in 1883, an effort that was soon followed by other VT companies.[13]

However, the “rivalry” between dueling inspectors may have been somewhat overstated. The ELAC reported that they employed their inspectors from “leading elevator manufacturers,” including “Otis, Hale, Crane, Whittier and others.”[14] In October 1890, the New York Insurance Journal provided a description of the inspection process:

“All the surroundings of an elevator are taken into account in determining the question of its insurability as well as the condition or pattern of the elevator itself. The method employed by a prominent company largely engaged in this business is, immediately after having insured the elevator, to have it thoroughly inspected by an elevator maker; the custom being where practicable to have each maker inspect his own elevators. After this each elevator is inspected at intervals of two or three months. Records are kept at the office of the company by which the present condition of the elevator can be seen at a glance. The recommendations of the inspectors are registered and if they have not been complied with, the reason why must be forthcoming. While this insurance promises indemnity to the owners of the property from loss by elevator accidents, the general public receives additional protection from the thorough and frequent inspections to which the elevators are subjected.”[15]

If an elevator were to be inspected every three months, it would seem reasonable to assume that a high level of safe operation could be easily obtained. Unfortunately, actual inspection records and confirmation that this pattern of inspection was followed (as well as how long this practice lasted) has yet to be discovered. A final feature of elevator use that attracted the attention of the insurance industry was the operator:

“How the insurance companies estimate the moral hazard reposing in the elevator boy we are not informed. It would seem that accidents oftener occur from the careless operation of an elevator than from any other single cause, consequently it would appear that a good share of the inspectors’ time should be devoted to the young men who manipulate the wire ropes.”[12]

By the mid-1890s, the insurance industry had devised a strategy to address the “moral hazard reposing in the elevator boy.”

The insurance industry’s response to the challenge of the elevator operator was imbedded in a comprehensive approach to elevator insurance that was developed between 1890 and 1896, when the leading companies established a cartel and agreed to fixed premium rates and sharing information on policy holder losses. In 1896, the leading liability insurers included ELAC, Fidelity and Casualty Co., the Standard Life and Accident Insurance Co. and Travelers Insurance Co. The Insurance Year Book for 1896-97 offered the following overall assessment of this industry sector:

“On the whole, elevator insurance has been profitable from the inception of this branch of liability insurance, and there would seem to be no logical reason why the loss ratio should not continue to be kept down, provided a careful and regular system of inspection is adopted and followed up. However, the recent introduction into our mercantile life of excessively high buildings, varying from 12 to 25 stories, has brought with it increased hazards from elevator accidents and presents new problems to underwriters which time alone can solve. The elevator policy covers the liability of the insured for accidental personal injuries suffered by any person or persons in the elevator, elevator well or while entering or alighting from the elevator, or accidents caused by the machinery, doors, hatches or safety devices connected with the elevator. A very important feature of the insurance is that the company will inspect once every three months during the term of the policy the elevators and their appliances and will furnish the policyholder with a copy of such inspection.”[16]

The companies in the cartel applied similar strategies when assessing elevator installations. General information collected included the number of floors, the number of landings, the number and kind of elevators (freight and passenger), the elevator manufacturer, the date of construction, a description of the hoisting machine (hydraulic, steam, electric or hand) and the elevator’s operating speed. Detailed information was also collected for the car. This included the size of platform, the capacity (in pounds or persons), as well as answers to the following questions: Is there a safety device? Is the top covered? Is there a counterweight? Is there a governor? If no operator is assigned, who runs the elevator? And, how many hours is it run during a typical day?

Hoistway questions included: How is the shaft enclosed (material, etc.)? How are the landings guarded? And, are the doors self-closing, self-locking or both? Additional questions included: Has any accident ever occurred? If so, how? And, are there automatic stops on the shipping rope? All of the cartel company’s policies also included a version of the following requirement: “This policy shall not be in force during such times as the elevator shall be operated by any female, or by a male under 15 years of age or while undergoing repairs or reconstruction.”[16] The assumption that a 15-year-old boy possessed the maturity to safely operate an elevator while a woman (apparently regardless of her age) did not, speaks to the inherent gender biases of the 19th century. In addition to setting assessment criteria, the cartel also established fixed insurance rates (Table One). For comparison purposes, a US$35 annual premium in 1896 equals approximately US$1,340 in 2025 dollars. Premium guidelines were as follows:

“The full rate for the several limits stated must be charged for each elevator written. One policy may be written to cover several elevators, but no reduction in the rate per elevator shall be made in such case. An elevator may not be written for limits less than US$5,000 and US$10,000. Insurance of Property Damage must not be written on elevators. Sidewalk elevators may be written for 66% percent of the rates provided in the rate schedule … One story Elevators – not sidewalk lifts – within the walls of a building, and not rising more than 15 ft, may be written for a premium of US$18.” [16]

| Limits | Premium |

| US$5,000 – US$10,000 | US$35 |

| US$5,000 – US$15,000 | US$40 |

| US$5,000 – US$20,000 | US$45 |

| US$5,000 – US$25,000 | US$50 |

| US$10,000 – US$20,000 | US$55 |

| US$10,000 – US$25,000 | US$65 |

The sophisticated rate table (in comparison to the simplicity of original rates) reflected the fact that buildings were steadily increasing in height and that elevator usage was also increasing dramatically with the rapid growth of American cities.

The collective effort of the cartel reveals that, by 1896, the insurance industry had developed a relatively sophisticated understanding of elevator systems and technology. This understanding would continue to grow throughout the remainder of the 19th century and into the 20th century. The insurance industry’s understanding of the VT industry also allowed it to play an important role in the development of the first A17.1 Code (published in 1921). Industry representatives from the Aetna Life Insurance Co., Fidelity and Casualty Co., Employers Liability Assurance Corp. and Travelers Insurance Co. participated in writing the Code. Thus, what began as a collision between two industries ended (more or less) in a spirit of cooperation.

References

1. “Employers’ Liability Assurance Corporation,” The Review (March 2, 1881).

2. Sachin S. Pandya, “The First Liability Insurance Cartel in America, 1896-1906,” Faculty Articles and Papers. 2 (2011).

3. “Elevator Insurance,” Post Magazine and Insurance Monitor (May 19, 1888).

4. “Minor Topics,” The Index (November 30, 1896).

5. “Elevator Insurance: A New Branch of Insurance Practiced by the Employers Liability Assurance Corporation,” The Review (December 19, 1888).

6. “Personal and Impersonal,” The Insurance Age (January 1889).

7. “Employers’ Liability,” The Indicator (February 15, 1889).

8. Untitled, The Coast Review (April 1889).

9. “Fell Through an Elevator,” Memphis Daily Appeal (February 19, 1889).

10. “Her Bustle Saved Her,” Memphis Avalanche (February 19, 1889).

11. Untitled, The Weekly Underwriter (December 7, 1889).

12. Untitled, The Chronicle (June 27, 1889).

13. Lee Gray, A History of the Passenger Elevator in the 19th Century, EW (2001).

14. Advertisement for Employers’ Liability Assurance Corp., Poor’s Manual (1889).

15. “Employers’ Liability and Accident Business,” New York Insurance Journal (October 20, 1890).

16. “Liability Insurance Explained,” The Insurance Year Book 1896-97, New York: The Spectator Co. (1896).

Get more of Elevator World. Sign up for our free e-newsletter.